Mario Tama/Getty Images News

FedEx (NYSE:FDX) was soaring on Tuesday after it announced some notable changes to its capital allocation policies. Those changes included a sizable dividend increase and an apparent commitment to increase shareholder returns moving forward. These moves may be just what is needed to help the stock begin a sustained move higher – this is beginning to look like a secular growth story with an immediate catalyst to close the valuation gap with its closest comparable peer.

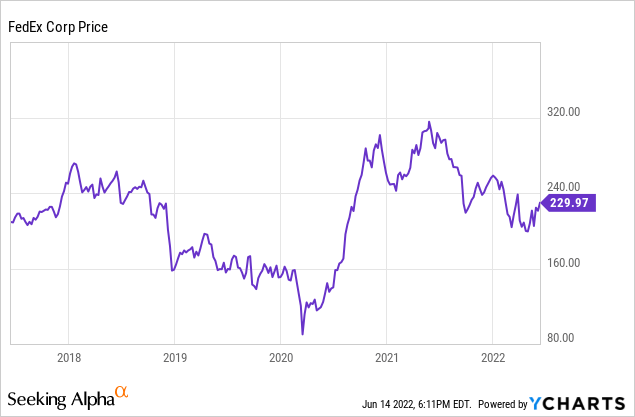

FDX Stock Price

FDX jumped double digits on Tuesday, but that did little to change the fact that the stock has been a disappointment over the past 5 years.

I last covered FDX in 2019 where I discussed why I had sold the stock on account of the elusive free cash flow. The stock is up 59% since then – but is now more buyable than ever as those reservations may soon come to pass.

Why did FedEx Stock Go Up?

There are two critical reasons why the stock soared. First, the company increased its quarterly dividend by 53% to $1.15 per share, stating:

“The increased dividend we announced today is the culmination of our Board’s thoughtful efforts over many months to ensure that our capital allocation strategy reflects our confidence in the trajectory of the business and increases returns for our stockholders. We look forward to sharing more detail on our strategy and long-term objectives at our investor day later this month.”

Second, and most importantly, the company announced changes to its compensation program which appeared to hint at lower capital expenditures over the long term:

The Company also announced that its cash-based long-term incentive (LTI) program for fiscal 2023 through 2025 includes an additional performance metric tied to FedEx’s total shareholder return (TSR) relative to a broad market index. The LTI program also includes a capital expenditures as a percentage of revenue (CapEx/Revenue) performance metric. The CapEx/Revenue target metric in the new LTI program is lower than in prior years to align with FedEx’s capital plans for fiscal years 2023 through 2025, and the Company expects to further lower its capital intensity in subsequent years. These changes are specifically designed to make management compensation more directly tied to delivering outstanding TSR and long-term value creation.

Is FDX Stock A Buy, Sell, or Hold?

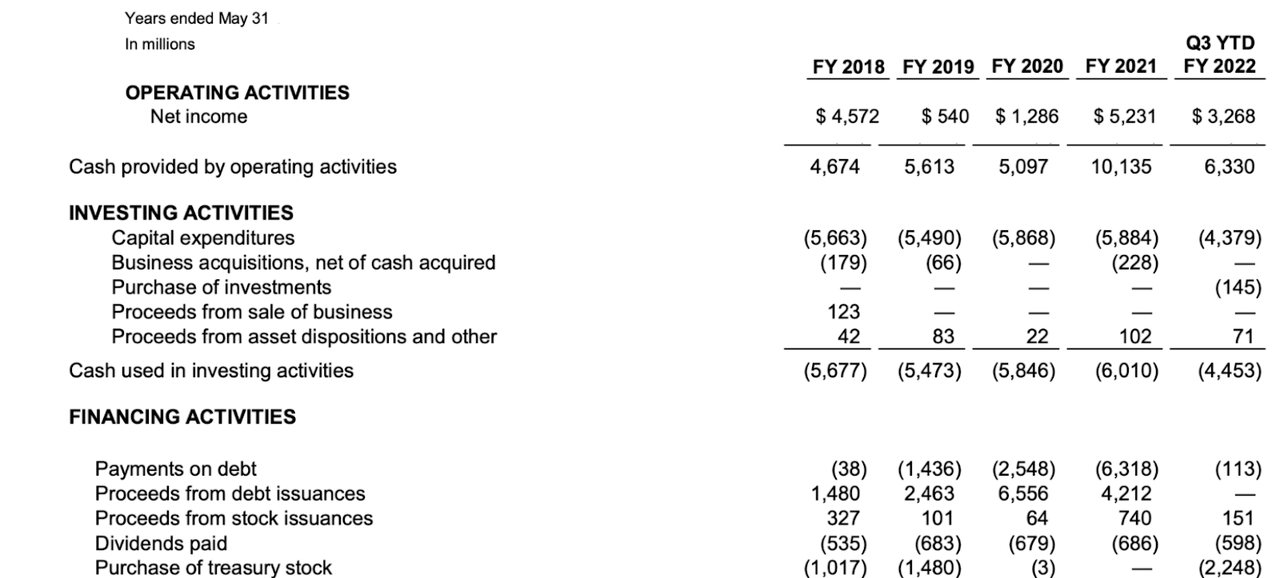

To those unfamiliar with FDX, such changes might not appear so important at first glance. After all, FDX is trading at around a 2% dividend yield following the recent rally. The key thing is understanding that FDX trades at a notable discount to UPS (UPS). FDX trades at 8x EV to EBITDA versus 10x at UPS. In my view, a large driver of that discount has been due to the historically different free cash flow profiles of the two companies. We can see below that FDX has rewarded shareholders with dividends and share repurchases over the past 4 years, making it seem like a cash flow machine. In reality, though, capital expenditures were quite elevated and thus the company was funding its shareholder returns using debt.

FedEx Stat Book

That trend did not change until last year, when the company finally realized operating leverage and was able to generate over $4 billion in free cash flow – which would have been more than sufficient to fully fund dividends and share repurchases. The latest announcements from the company appear to confirm that it will not seek to increase capital expenditures to use up the excess free cash flow but will instead return cash to shareholders through a growing dividend and share repurchases. This is a stock which is trading at only 10.7x forward earnings. Previously, investors might have viewed such a valuation with some doubt due to the low free cash flow conversion, but that has now all changed. We could see a narrowing of its discount to UPS – as well as potentially multiple expansion for both names. FDX remains a secular growth story as it stands to benefit from the ongoing growth of e-commerce. Sure, e-commerce growth should slow moving forward due to the great acceleration that took place during the pandemic, but the company still expects e-commerce to grow at a high single digit growth rate over the next 3-4 years, as stated on its conference call. I could see FDX re-rating to at least 15x earnings over time, which would represent a stock price of around $322 per share. There are some key risks to consider. First, while e-commerce is a long-term secular growth story, it could experience near term volatility on account of rising interest rates and inflation. FDX has slim operating margins and would likely see operating leverage work the opposite direction in a slowdown. Another risk is if the company actually needs to upgrade its fleet at a pace more aggressive than anticipated, which would lead to higher than expected capital expenditures and lower free cash flow. Such an event could send the stock back down to the high single-digit earnings multiple that it traded at before the pandemic – the stock could trade back down below $150 per share in that case. I rate the stock a buy as the stock is offering a generous earnings yield plus potential for multiple expansion.

Be the first to comment