DaveAlan/iStock Unreleased via Getty Images

Investment Thesis

- Despite the fact that FedEx (NYSE:NYSE:FDX) shares jumped about 14% on June 14 (the biggest one-day gain since 1986), the company remains an appealing investment for long-term investors.

- According to the HQC Scorecard, FedEx is rated as very attractive in the categories of Valuation (96 out of 100 points) and Expected Return (80 out of 100).

- In the categories of Economic Moat (74 out of 100) and Profitability (70 out of 100), the company is rated as attractive according to the HQC Scorecard.

- FedEx is rated as moderately attractive in the categories of Growth (52 out of 100) and Financial Strength (58 out of 100).

- I rate FedEx as a buy. The company has strong competitive advantages: its brand image, its wide global network as well as having cost advantages over smaller competitors due to its enormous size. These competitive advantages make FedEx an appealing investment for long-term investors. Furthermore, FedEx is currently undervalued according to my DCF Model.

FedEx’s Competitive Advantages

FedEx Corporation is the umbrella organization which covers the following independent operating companies: FedEx Express, FedEx Services, FedEx Ground, FedEx Freight, FedEx Office and FedEx Logistics. In 2021, FedEx Corporation generated a revenue of $83,959 million. This is an increase of 21.3% in comparison to the previous year, where the company generated a revenue of $69,217 million.

FedEx has a delivery fleet of more than 210,000 motorized vehicles. At the same time, the company is in possession of 697 aircrafts. FedEx has an average daily package volume of 16.5 million packages (based on 255 operating days per year) and it serves more than 650 airports in over 220 countries.

Due to the company’s enormous size (FedEx has more than 600,000 team members) and its extremely high daily package volume, it has cost advantages over smaller competitors. FedEx owns more than 4,200 facilities (including hub and regional sort facilities as well as freight service centers, airport hangars, business offices, and FedEx Office stores). This global network, as well as its cost advantages, provide the company with an edge over its competitors.

Additionally, FedEx has managed to establish a strong and worldwide well-recognized brand. According to Brand Finance, FedEx was ranked as the 68th most valuable brand in the world in 2022, estimating the brand value to be around $26,012 million. This is an increase of about 10.5% in comparison to the previous year. Competitor UPS (NYSE:UPS) was ranked at position 38 with a brand value of $38,533 million.

All of these competitive advantages for FedEx mentioned above contribute to my buy rating on FedEx stock.

FedEx’s Valuation

Discounted Cash Flow (DCF)-Model

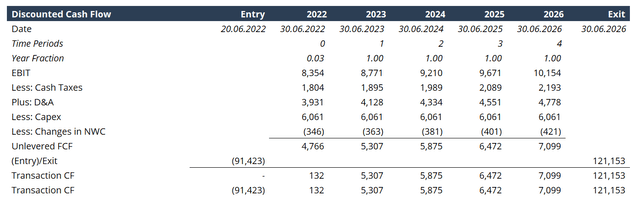

In terms of valuation, I have used the DCF Model to determine the intrinsic value of FedEx. The method calculates a fair value of $297 for the company. At the current stock price, this results in an upside of 28.1%.

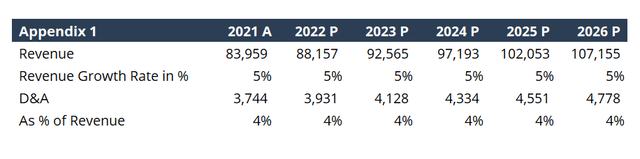

According to Seeking Alpha, FedEx’s Average Revenue Growth Rate (FWD) of the last 5 years is 7.45%. The company’s Average EBIT Growth Rate (FWD) of the same time period is 10.16%. However, I will make more conservative assumptions. Therefore, I assume a Revenue Growth Rate and EBIT Growth Rate of 5% for FedEx over the next 5 years. The GDP Growth Rate of the United States is about 3% per year on average. Therefore, I assume a Perpetual Growth Rate of 3%.

I have used FedEx’s current discount rate (WACC) of 8.25%. Furthermore, I calculated using an EV/EBITDA Multiple of 6.9x, which is the company’s latest twelve months EV/EBITDA.

My calculations are based on the following assumptions as presented below (in $ millions except per share items):

|

Company Ticker |

FDX |

|

Revenue Growth Rate for the next 5 years |

5% |

|

EBIT Growth Rate for the next 5 Years |

5% |

|

Tax Rate |

21.6% |

|

Discount Rate (WACC) |

8.25% |

|

Perpetual Growth Rate |

3% |

|

EV/EBITDA Multiple |

6.9x |

|

Transaction Date |

20.06.2022 |

|

Fiscal Year End |

31.05.2022 |

|

Current Price / Share |

$232 |

|

Shares Outstanding |

259.2 |

|

Debt |

$37,354 |

|

Cash |

$6,065 |

|

Capex |

$6,061 |

Source: The Author

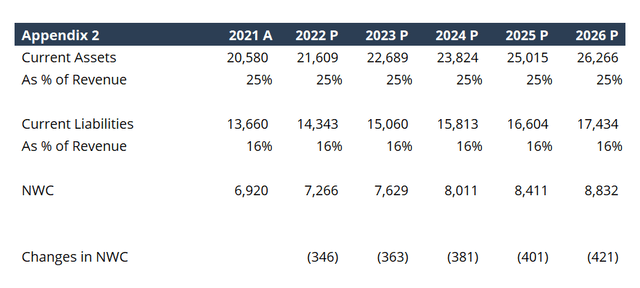

Based on the above assumptions, I calculated the following results (in $ millions except per share items):

Source: The Author Source: The Author Source: The Author

Terminal Value

|

Perpetual Growth |

$139,271 |

|

EV/EBITDA |

$103,034 |

|

Average |

$121,153 |

Source: The Author

Market Value

|

Market Cap |

$60,134 |

|

Plus: Debt |

$37,354 |

|

Less: Cash |

$6,065 |

|

= Enterprise Value |

$91,423 |

|

Equity Value/Share |

$232.00 |

Source: The Author

Intrinsic Value

|

Enterprise Value |

$108,294 |

|

Plus: Cash |

$6,065 |

|

Less: Debt |

$37,354 |

|

= Equity Value |

$77,005 |

|

Equity Value/Share |

$297.09 |

Source: The Author

Market Value vs. Intrinsic Value

|

Market Value |

$232 |

|

Upside |

28.1% |

|

Intrinsic Value |

$297.09 |

Source: The Author

Relative Valuation Models

FedEx’s P/E (FWD) Ratio

FedEx’s P/E Ratio is currently 12.38. This is 16.92% below its average P/E Ratio from the last five years, which is 14.91. It is also 25.30% below the sector median (16.58). These are additional indicators that FedEx is currently undervalued.

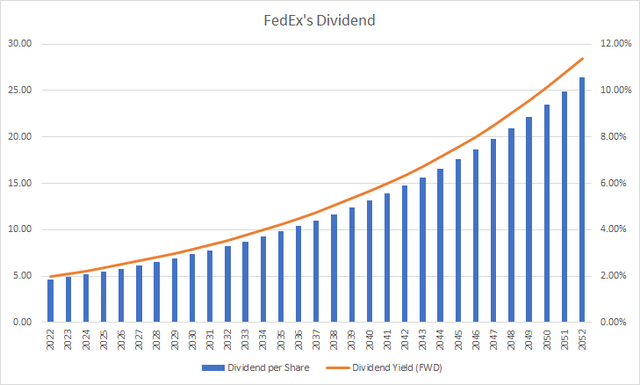

FedEx’s Dividend

The average growth rate over the last five years of FedEx’s dividend has been 13.4%. Here again, I will make more conservative assumptions. Therefore, I assume an average future growth rate for FedEx’s dividend of about 6% per year. Due to its low dividend Payout Ratio of only 15.96%, which still offers significant scope for dividend enhancements in the future, and the company’s strong competitive advantages, I assume that FedEx will be able to raise its dividend by approximately 6% per year. If you were to assume that FedEx was able to increase dividends by an average of 6% per year over the next 30 years and you would buy the FedEx stock at the current price of $232 per share, you would get the following results for the company’s dividend shown in the graphic below.

If FedEx was able to raise its dividend by 6% per year over the next 30 years, after 30 years you would get back 168% of your investment from receiving dividend payments (no tax on dividend has been included in this calculation):

|

Year |

Dividend per Share |

Dividend Yield (FWD) |

Accumulated Dividend |

|

2022 |

4.60 |

1.98% |

1.98% |

|

2032 |

8.24 |

3.55% |

29.69% |

|

2042 |

14.75 |

6.36% |

79.30% |

|

2052 |

26.42 |

11.39% |

168.14% |

The High-Quality Company (HQC) Scorecard for Long-Term Investors

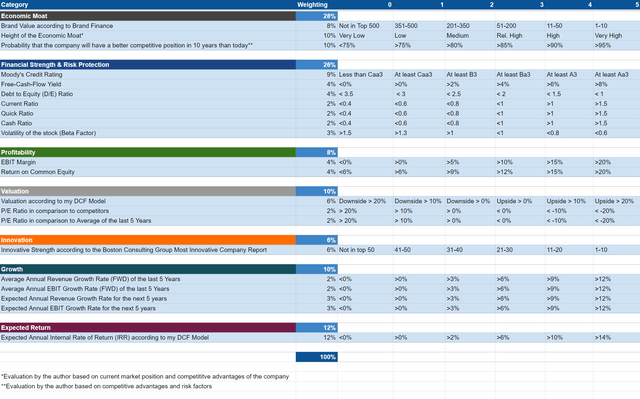

“The aim of the HQC Scorecard for Long-Term Investors that I have developed is to help investors to identify companies which are attractive long-term investments (investment with a horizon of at least seven years) in terms of risk and expected compound annual rate of return.” Here you can find a detailed description about how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard for Long-Term Investors

“In the graphic below you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item. Furthermore, you can see the conditions that must be met for each point of every item that is rated.”

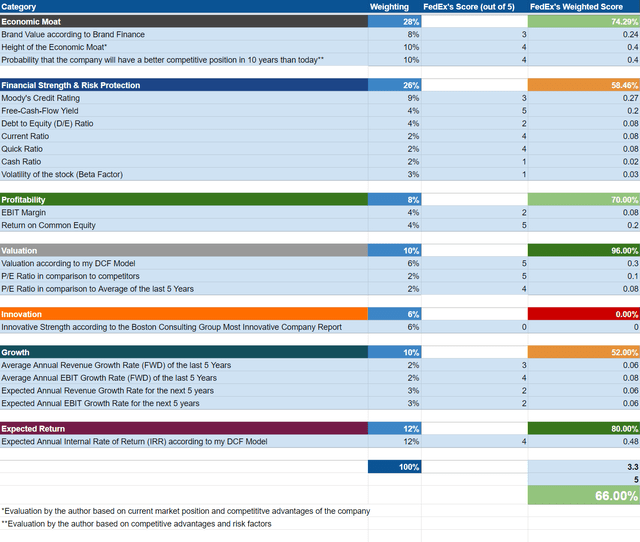

FedEx According to the HQC Scorecard for Long-Term Investors

According to the HQC Scorecard I have developed, the overall score of FedEx is 66 out of 100 points. Therefore, FedEx can currently be classified as an attractive long-term investment in terms of risk and expected compound annual rate of return.

The HQC Scorecard for Long-Term Investors indicates that FedEx is rated as very attractive in the categories of Valuation (96 out of 100) and Expected Return (80 out of 100) (calculated as the Expected Annual Internal Rate of Return (IRR) with my DCF Model).

Furthermore, FedEx is rated as attractive in the categories of Economic Moat (74 out of 100) and Profitability (70 out of 100).

However, in terms of Financial Strength (58 out of 100) and Growth (52 out of 100), FedEx is rated as moderately attractive according to the HQC Scorecard.

The HQC Scorecard demonstrates that FedEx has a currently very attractive valuation and also indicates a very attractive expected return (according to my DCF Model) for the company. Furthermore, it shows that FedEx is attractive in terms of Economic Moat and Profitability. This attractive scoring according to the HQC Scorecard strengthens my belief that the FedEx stock is currently appealing as a long-term investment.

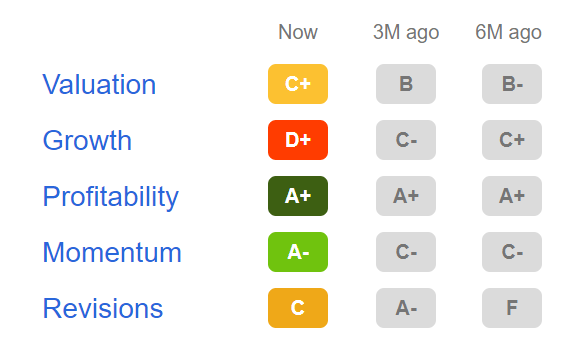

FedEx According to Seeking Alpha’s Factor Grades

According to Seeking Alpha’s Factor Grades, FedEx is rated with a C+ in terms of Valuation. In terms of Profitability, FedEx is rated with an A+ according to the Seeking Alpha Factor Grades. In terms of Growth, FedEx is rated with a D+ according to the Seeking Alpha Factor Grades. In the graphic below you can find the overview of the Seeking Alpha Factor Grades for FedEx:

Source: Seeking Alpha

Risks

One of the main risk factors for FedEx is the fact that the express package and freight markets are highly competitive. These markets are sensitive to price and service, even more so in times of little macroeconomic growth. Within the U.S., competitors of FedEx are other package delivery companies, especially UPS and the USPS, but also passenger airlines that offer express package services and regional delivery companies.

Internationally, FedEx competes particularly with DHL (OTCPK:DPSTF, DPSGY) and UPS as well as foreign postal authorities and passenger airlines. Due to the fact that some of these international competitors are government owned or controlled, they can have greater resources as well as lower costs or even better operating conditions than FedEx. This high competition in the markets that FedEx operates in, could result in declining profit margins for the company in the years to come.

One of the main risks for FedEx that I see, is the growing competition with Amazon (NASDAQ:AMZN). Amazon is developing and implementing in-house delivery capabilities and investing heavily in order to establish a network of hubs, aircrafts and vehicles. In comparison to other smaller companies who have fewer financial capabilities to compete with FedEx, Amazon does have the financial strength to become a very strong competitor. Furthermore, Amazon is already shipping cargo for third-party customers and doing so, directly competing with FedEx and UPS. From my point of view, Amazon is one of the main threats for FedEx in the future.

Due to competitive advantages such as its strong brand, its global networks and the enormous size of the company as well as its strong global presence, I expect FedEx to stand out against smaller competitors in the long-term. But in the future, it should be observed and analyzed as to what extent Amazon will continue to enter into the logistics and transport sector in order to be able to deliver for outside customers.

The Bottom Line

My Discounted Cash Flow Model indicates that FedEx is currently still undervalued with an upside of 28.1%, despite its shares jumping about 14% on June 14. The DCF Model calculates a fair value of $297 for the company.

According to the High-Quality Company (HQC) Scorecard for Long-Term Investors, which I have developed, FedEx scores 66 out of 100 points. The HQC Scorecard demonstrates that FedEx can currently be classified as attractive in terms of risk and expected compound annual rate of return.

The HQC Scorecard expresses FedEx’s currently very attractive valuation as well as its very attractive expected rate of return according to my DCF Model.

With an average dividend growth per year of 13.4% in the last 5 years and a dividend payout ratio of only 15.96%, the company still has enormous scope for future dividend enhancements.

I rate FedEx as a buy. From my point of view, FedEx has strong competitive advantages (such as its strong brand image, its worldwide network and its cost advantages over smaller competitors) which should help the company to stand out against its competitors. However, due to the fact that Amazon could become a direct and strong competitor in the future by delivering more and more for outside customers, I would not overweight a FedEx position in my long-term investment portfolio.

Thank you for reading and I would appreciate any feedback on this analysis!

Be the first to comment