Justin Sullivan/Getty Images News

FedEx Corporation (NYSE:FDX) is feeling the heat of the slowdown in global business activity. From having to aggressively increase network availability in the last couple of years to cater to the surging demand for small package delivery, FedEx is now forced to cut costs, reduce its capacity, and prepare for a phase that will be characterized by low shipping rates, declining demand for package delivery, high energy costs, and shrinking profitability. A few months ago, a decline in freight rates would have been considered a positive development as rates went through the roof due to supply-chain disruptions caused by the pandemic, but today, declining shipping rates have more to do with weaker cargo movement resulting from weak global trade. These are early indications of what the near-term future holds for FedEx: challenges. That’s not a good enough reason to abandon FedEx just yet. Every business will face challenges as the economy moves through the business cycle, and investor focus should unwaveringly remain on the long-term prospects for a company. I am passing on FedEx stock today not because of recession risks, but because of several other challenges that are looming on the horizon.

Recession fears mask several other challenges for FedEx

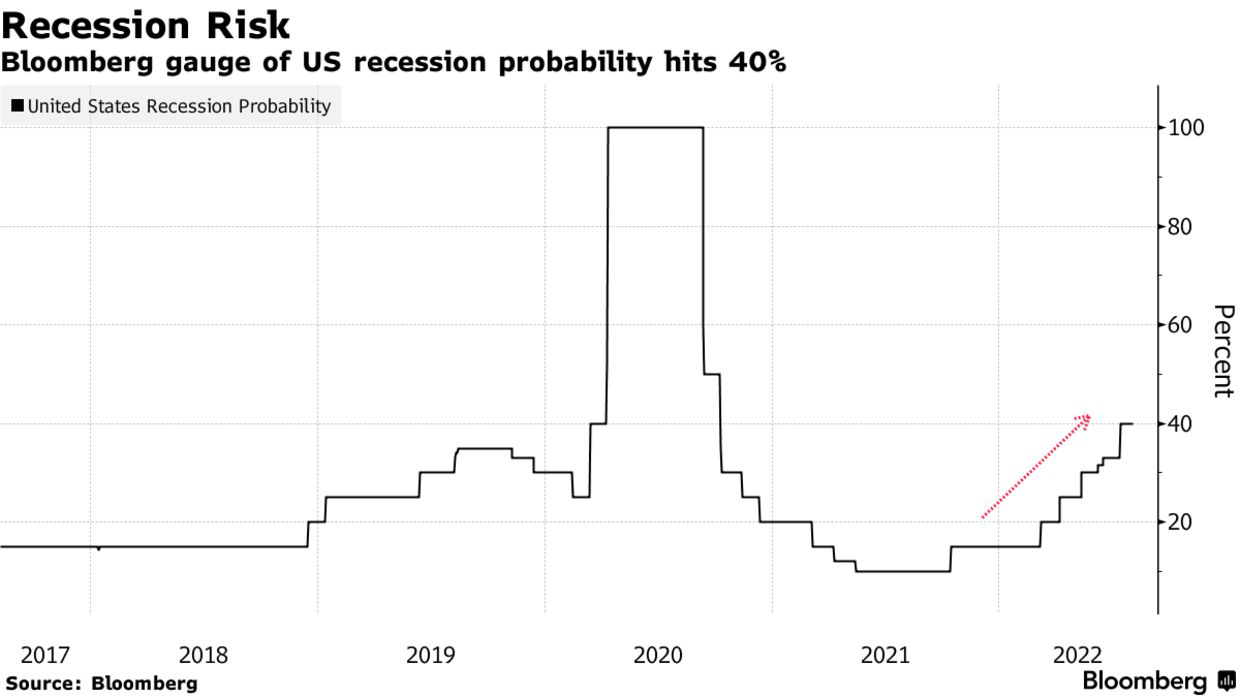

Today, the primary focus of investors has shifted to the recession predicted by almost all Wall Street firms. In a recessionary environment, business won’t be good for almost every industry, so it does not seem prudent to conclude that FedEx stock is a sell today because of recession risks. In that case, a better way to put it would be to say that stocks as an asset class are not attractive anymore because of recession risks. Investors, however, cannot hide or run away from recessions as these economic downturns are perfectly normal and should be accounted for when forming investment return forecasts.

Exhibit 1: Probability of a recession in the United States in the next 12 months

Bloomberg

Source: Bloomberg

If a recession is expected to result in lost revenue for FedEx, then the recovery that would follow should be expected to lead to new business for FedEx. This is true for almost every company. Therefore, I am not ready – nor do I find it prudent – to make investment decisions based on the probability of a recession. Unfortunately for FedEx, there is more to the story than just recession fears.

First, FedEx seems to be struggling to keep its Ground contractors satisfied. Before I present some numbers released by the Trade Association For Logistics Professionals (TALP) headed by Spencer Patton, let me remind you that Mr. Patton has been publicly campaigning to improve contractor terms since the beginning of this year and that he was ousted by FedEx as a contractor. According to TALP, its survey of FedEx Ground contractors was independently monitored by global advisory firm Stout. The data published by TALP suggest FedEx needs to work on its relationship with Ground contractors. Below are some of the findings of this survey (TALP gathered responses from 1,200 contractors).

- 97% of survey respondents do not have confidence in FedEx Ground CEO John Smith.

- 94% of survey respondents fear retaliation from FedEx if they voiced their concerns.

- 54% of survey respondents claim their business is not profitable.

- 93% of survey respondents are not satisfied with their financial relationship with FedEx.

Use this data with a grain of salt if you will, but there have been instances in the past where contractors complained about their pay, demanding for better business terms. At a time when the company is facing financial hurdles, FedEx cannot afford to see a deterioration of its relationship with contractors. This challenge, in my opinion, is worth monitoring closely to identify the possibility of a business disruption.

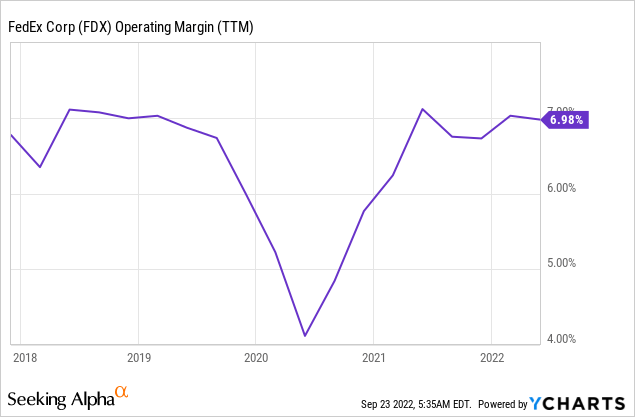

Second, the days when FedEx could hike shipping rates to increase margins are almost over. As illustrated below, FedEx’s operating margin has improved notably since the start of the pandemic, which was the result of the pricing power FedEx enjoyed over the last couple of years as a result of a surge in the demand for residential package deliveries. With e-commerce booming amid mobility restrictions, industry-wide network capacity was not sufficient to meet the demand for deliveries. This created a strong platform for the company to charge higher prices across its shipping categories. The party, however, has come to an end today.

Exhibit 2: Operating margin

With e-commerce volumes declining and global trade slowing down, FedEx no longer can rely on price hikes to drive margins and profitability. The company’s business, therefore, will be tested in the coming quarters.

FedEx yesterday announced a 6.9% general rate increase for 2023 except for FedEx Freight in a bid to negate the impact of declining volumes. This strategy, however, could cost the company customers and it’s too early to comment on the overall impact of this decision on profit margins.

Third, retailers are building their own logistics networks to improve the customer experience while gaining more control over last-mile delivery. According to data from Insider Intelligence, Costco Wholesale Corporation (COST) now delivers approximately 85% of U.S. shipments itself, and Amazon (AMZN) has been building its logistics infrastructure for a long period of time. This emerging trend in the retail sector could hurt FedEx and the existing shipping giants in the future.

Finally, FedEx’s new strategy focuses more on efficiency gains and less on real growth. Earnings growth resulting from efficiency gains is always welcome, but Mr. Market has a tendency to reward earnings growth coming through price and volume gains. The company’s updated strategy, therefore, might not bode well with investors in the short to medium run.

Cost-cutting: a double-edged sword

If FedEx gained any ground against its arch-rival United Parcel Service, Inc. (UPS) in the last few years, that was because of providing faster delivery times and a better customer experience. To do this, FedEx expanded its delivery network, hired more contractors, and used more aircraft. The company’s decision to cut costs and save at least $2.2 billion in the current fiscal year is good news for shareholders who are dealing with the sudden decline in business but on the other hand, these cost reductions could help UPS gain some lost ground in the last few years. The company will reduce the number of flights it operates and ground an undisclosed number of aircraft in its effort to reduce costs. Although these measures seem necessary to improve the efficiency of the business while adapting to a new demand environment, I believe these decisions could end up costing the progress it has made in recent years in its battle against UPS.

Takeaway

The recent crash has brought FedEx back into the fairly valued territory. Despite the magnitude of recent losses, I cannot categorize FedEx as undervalued because of the many challenges the company is facing today. Despite its best efforts, I believe FedEx will suffer from operating margin contraction in the foreseeable future, which could further deteriorate investor sentiment toward the company. I certainly believe FedEx has a long runway for growth given that e-commerce trends are positive for the long run, but in its current shape and form, FedEx could succumb to competitive pressures as well.

Be the first to comment