Mario Tama/Getty Images News

By Brian Nelson, CFA

During the past several weeks, we’ve grown increasingly concerned about the health of consumer-tied entities across the consumer staples and consumer discretionary spaces. Many consumer staples entities, while raising prices, aren’t raising them fast enough to drive operating-income and bottom-line expansion. Consumer discretionary companies may be facing higher freight and logistics costs and weaker performance in Greater China, as that exposed in Nike’s (NKE) most recently-reported quarter, where inventory advanced 23%.

The tell-tale sign about the health of the consumer may be Amazon Prime Day, which is coming up on July 12-13, but based on many of the reports we’ve monitored this past earnings season, consumers may be willing to spend a bit more to help business revenue, but businesses are having a difficult time leveraging the price increases into operating income and earnings-per-share expansion. Perhaps we were somewhat in denial that pressure on S&P 500 earnings growth might materialize when Walmart (WMT) and Target (TGT) disappointed a number of weeks ago, but the Nike report, released June 27, all but sealed the deal that the probability of a recession in the U.S. is material.

When we look at Walmart and Target, the story was similar. Top-line growth ensued but consolidated gross margins faced pressure, and operating income tumbled. Full-year earnings per share at Walmart is now expected to be down about 1%, as the company’s top-line growth just isn’t enough to keep earnings moving in the right direction. For Target, the company originally guided its second quarter operating income margin rate well below consensus estimates at the time, to 5.3%, due to pressure on gross margins from higher freight and transportation costs and measures to reduce inventory. However, just a few weeks later, Target reduced that second-quarter operating margin target again to just 2% as it is being forced to work through excess inventory with aggressive markdowns.

What does all this mean for FedEx Corporation’s (NYSE:FDX) trajectory? Well, it all depends. Clearly, consumer-tied businesses, whether consumer staples or discretionary, are facing tremendous cost pressures. However, some of those cost pressures are freight and logistics costs, which might play into the hands of FedEx and rival UPS (UPS). For example, for its fiscal 2023 (ends May 2023), FedEx issued guidance for diluted earnings per share to the range of $22.45-$24.45, which when issued June 24, was above the consensus estimate of $22.40 at the time. FedEx was able to drive its fiscal fourth-quarter 2022 operating income higher due to a “favorable net impact of fuel,” but it did note that it experienced “lower shipment demand due to slower economic growth and supply chain disruptions.”

We think FedEx is better positioned to pass along costs than many of the retailers. For that reason, we think it will hold up better should the U.S. enter a recession. The same rings true for rival UPS, which reported first-quarter 2022 results on April 26. In UPS’ first quarter, consolidated revenues jumped 6.4% from the same period last year, while it grew consolidated operating profit 17.6% (12.1% on an adjusted basis). We think transportation stocks such as FedEx and UPS, which are able to pass along price increases in the form of surcharges for higher fuel costs, are much better positioned than the broader retailer landscape, which may face continued earnings pressure as they deal with higher input costs and larger inventory balances.

We value FedEx at $295 per share, well above where shares are trading at the moment (~$240), and while the company is not immune to recessionary characteristics, its flexible pricing surcharges mean it can handle cost adversity better than most S&P 500 entities, in our view. Shares of FedEx yield ~1.9% at the moment, and while the company’s Dividend Cushion ratio could be stronger, we give it high marks for both dividend strength and dividend growth potential.

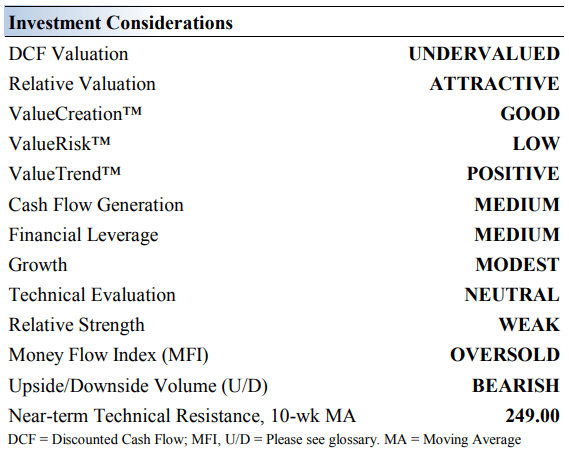

FedEx’s Key Investment Considerations

FedEx provides customers and businesses worldwide with a broad portfolio of transportation, e-commerce and business services. The proliferation of e-commerce supports its growth outlook. FedEx operates under various segments including: FedEx Express, FedEx Ground, FedEx Freight, and FedEx Services. It was founded in 1971 and is based in Memphis.

FedEx’s acquisition of TNT Express gives it access to TNT’s European distribution network. Integration costs have come in higher than projected, but it is on track to achieve material pre-tax synergies, which will help drive incremental operating profit.

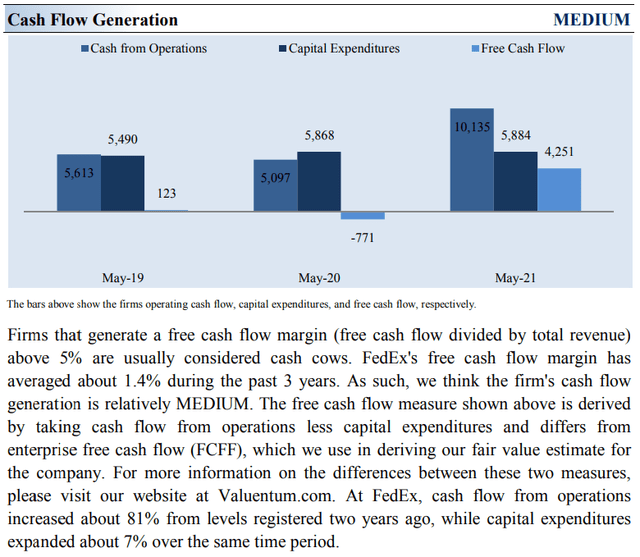

FedEx’s operations are capital intensive, characterized by significant investments in aircraft, vehicles, technology, facilities, and equipment. Capital expenditures are generally 7%-9% of sales. Though FedEx is a tremendous generator of operating cash flow, its free cash flow performance is rather volatile, and the firm has a large net debt load.

FedEx has several pricing mechanisms across its business. The company can raise list prices, implement temporary surcharges, and is able to pass along rising fuel costs through indexed fuel surcharges, adjusted weekly. Here’s more about FedEx’s ability to price effectively to grow earnings from its 10-K:

FedEx Express has an indexed fuel surcharge for U.S. domestic and U.S. outbound shipments and for shipments originating internationally, where legally and contractually possible. FedEx Express fuel surcharges are adjusted on a weekly basis. The fuel surcharge is based on a weekly fuel price from two weeks prior to the week in which it is assessed. Some FedEx Express international fuel surcharges incorporate a timing lag of approximately six to eight weeks.

As noted above, FedEx’s outlook is supported by its impressive pricing strength, and future price increases should be expected. However, FedEx is also contending with major inflationary pressures, with an eye towards rising labor and fuel expenses. It will take time for recent pricing increases to be fully reflected in its financials, but we view this as more a lagging mechanism than anything that will permanently impact operating income and earnings.

FedEx has significantly grown its dividend in recent years, and we’re expecting more dividend increases to come. Management remains committed to rewarding shareholders. During the COVID-19 pandemic, FedEx’s business model has proven to be resilient even in the face of serious operational hurdles. Shares yield ~1.9% at the time of this writing.

FedEx’s Economic Profit Analysis

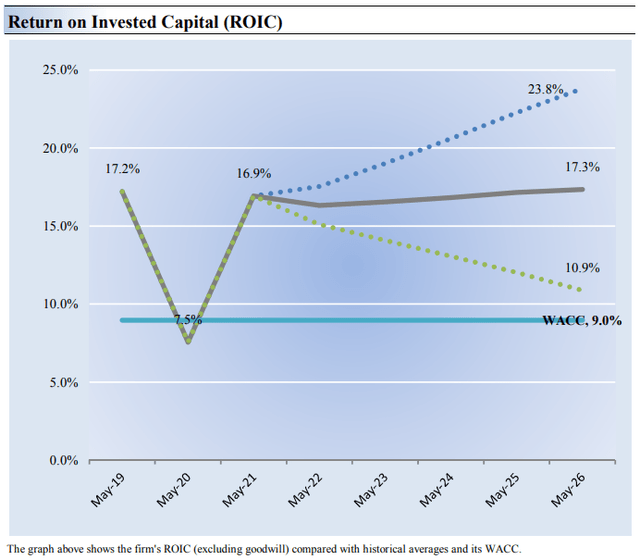

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. FedEx’s 3-year historical return on invested capital (without goodwill) is 13.9%, which is above the estimate of its cost of capital of 9%.

As such, we assign FedEx a ValueCreation™ rating of GOOD. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. FedEx’s ability to raise prices should help prop up performance should the U.S. enter recession.

FedEx’s Cash Flow Valuation Analysis

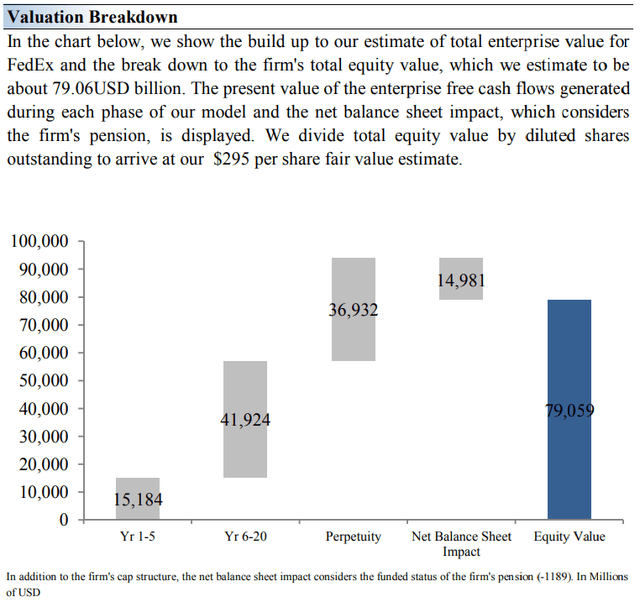

We think FedEx is worth $295 per share with a fair value range of $236-$354.00. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

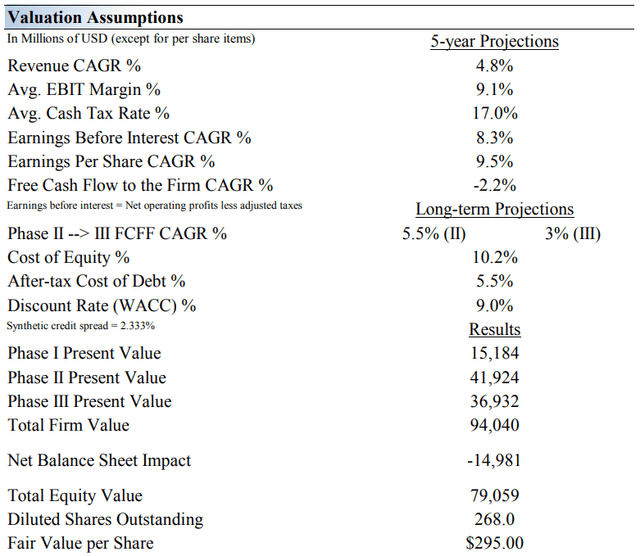

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 4.8% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 8.7%.

Our valuation model reflects a 5-year projected average operating margin of 9.1%, which is above FedEx’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 5.5% for the next 15 years and 3% in perpetuity. For FedEx, we use a 9% weighted average cost of capital to discount future free cash flows.

FedEx’s Margin of Safety Analysis

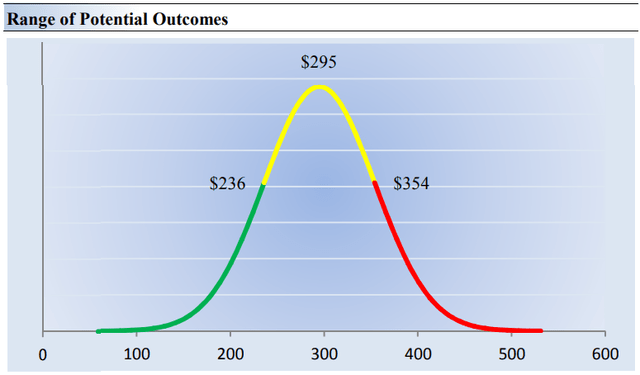

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate FedEx’s fair value at about $295 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

This is an important way to view the markets as an iterative function of future expectations. As future expectations change, so should the company’s value and its stock price. Stock prices are not a function of fixed historical data but rather act in such a way to capture future expectations within the enterprise valuation construct.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for FedEx. We think the firm is attractive below $236 per share (the green line), but quite expensive above $354 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

FedEx provides customers and businesses worldwide with a broad portfolio of transportation, e-commerce and business services. The firm’s pricing strength supports its outlook, as does the proliferation of e-commerce and the growing global middle class. FedEx is investing heavily in automation and route optimization technology to support its FedEx Ground division while continuing to integrate its air freight business in Europe, activities that should support its financial performance over the long haul by generating meaningful operating efficiencies. We expect management will push through decent dividend increases over the coming fiscal years.

That said, FedEx’s business requires substantial capital investments (capital expenditures as a percentage of revenues generally are in the 7%-9% range), but it typically generates significant amounts of operating cash flow. The company aims to offset inflationary pressures, such as rising labor and fuel expenses, with its pricing power though it will take time for pricing increases to be fully reflected in its financial performance. FedEx has a sizable net debt load which weighs negatively on its Dividend Cushion ratio, though the company generally maintains a nice total cash position on hand to manage its various near term financing needs. We think shares are trading at a discount to intrinsic value and like its ~1.9% dividend yield.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment