Douglas Rissing/iStock via Getty Images

Investors are still battling to determine what the Federal Reserve is going to do going forward.

Will the Federal Reserve stay firm and keep its foot on the brake?

Or, will Chairman Powell and the others back off and take the easy road through the next six months?

So, the yield on the 10-year U.S. Treasury bonds closed down on Thursday.

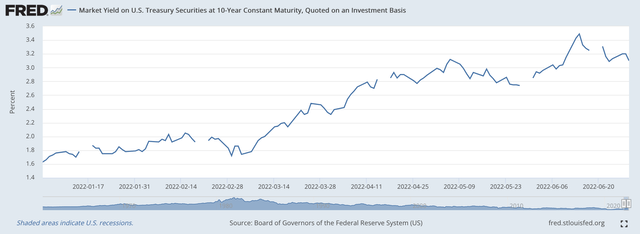

Yield on 10-year U.S. Treasury security (Federal Reserve)

Matt Grossman writes in the Wall Street Journal,

“Fears of an economic downturn have drawn more investors toward the guaranteed returns offered by ultrasafe Treasury bonds, reversing some of the rapid gains yields saw earlier this year.”

“After mounting one of its fastest increases in history to start 2022, the 10-year yield has in recent weeks retreated from an end-of-day high of 3.482 reached on June 14, a reflection of traders’ dimming views about the economy’s path.”

And, investors, who were enthused about the Fed following up its 75 basis point rise in its policy rate of interest in June with another 75 basis point rise in July are now cooling off.

“A week ago, bets in future markets showed traders thought there was a 93 percent chance the Fed would decide on another 0.75 percentage-point next month.”

“That probability has now fallen to about 81 percent.”

This uncertainty has been observed in stock prices as well.

On Monday and Tuesday, the Dow Jones Industrial Average closed down for the day, but then closed up on Wednesday.

Yesterday, the DJIA was down again.

And, there are articles all over the place questioning whether or not Fed Chairman Jerome Powell can be a Paul Volcker in this situation, or will he disappoint the inflation-fighters and turn more into an Arthur Burns.

For the time being, this debate will rage on.

Value Of The U.S. Dollar

if one looks at the foreign exchange market, it seems as if investors are more sure that the Federal Reserve will keep its monetary policy “tight,” at least relative to the monetary policies of other major countries.

In the past week, many other central banks have raised their policy rates of interest, or, at least, have indicated that they were moving to raise their policy rates in the near future.

But, investors don’t seem to believe that these movements will be as “tight” as what the Federal Reserve is expected to do.

For example, the U.S. Dollar Index (DXY) moved to a yearly high of around 105.50 at the market opening on Friday morning.

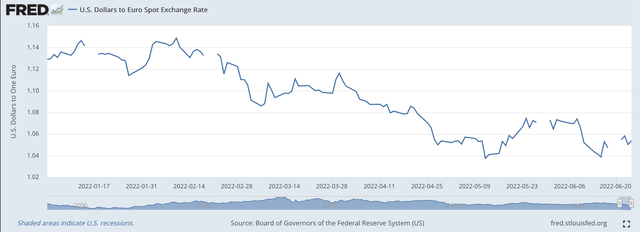

The price of one Euro dropped to around $1.0400 on Friday morning.

U.S. dollar/Euro exchange rate (Federal Reserve)

The value of the U.S. dollar remains very strong, with the U.S. benefiting from the “safe haven” space for risk-averse international investors that the dollar continues to maintain.

International investors believe that the value of the U.S. dollar will continue to remain strong in the near future with the Federal Reserve maintaining its lead in the world fight to combat inflation.

Federal Reserve Tightening

In the past few weeks, the Federal Reserve has tightened up the reserve position of the commercial banking system, but very modestly.

The measure used here is titled “Reserve Balances With Federal Reserve Banks.”

Last week, Reserve Balances actually rose. They rose by $3.0 billion.

Over the past month, Reserve Balances With Federal Reserve Banks declined by almost $240.0 billion.

This represents the Fed’s effort to reduce liquidity in the commercial banking system.

Note, however, that little or nothing has changed with respect to the size of the Fed’s portfolio of securities held outright.

Although the amount of securities held outright on the Fed’s balance sheet actually did decline over this four-week period, the decline was only $5.0 billion.

The reduction in Reserve Balances, therefore, did not come from the asset side of the Federal Reserve’s balance sheet.

The reduction in Reserve Balances came from the liability side, and this has been true of what has happened to the Fed’s balance sheet since the Fed began to raise its policy rate of interest in March 2022.

Since March 16, the day the Fed first raised its policy rate of interest this year, Reserve Balances with Federal Reserve Banks have declined by $777.8 billion.

Note, though, that the securities portfolio rose by only $4.0 billion during the time period since then.

Factors absorbing reserve funds, primarily reverse repurchase agreements and the General Account of the U.S. Treasury Department, accounted for almost all of the decline in Reserve Balances.

July, Moving Forward

We should begin to see more things happening to the Fed’s balance sheet as we move forward into July.

This is where investors in financial markets are going to have to look for signals that the Federal Reserve is sticking “on course” to seriously battle inflation.

The amount of securities held outright by the Federal Reserve is going to have to begin to decline.

The Fed’s plan is to allow the securities portfolio to decline in value through securities maturing off the balance sheet.

So, what we need to watch is the size of the portfolio.

On June 29, 2022, the Federal Reserve held $8,475.6 billion in securities purchased outright.

The Fed’s plans indicate that over the next two years or so, this portfolio should be a little more than $2,000.0 billion lower.

We’ll see.

Then there is the question about what the Fed will do to its policy rate of interest at its July FOMC meeting.

Will the Fed move the policy rate by 75 basis points? Or, 50 basis points? Or, some other number?

Radical Uncertainty

I am still of the opinion that we are in a period of radical uncertainty.

We just don’t know of all the possible outcomes that could take place over the next six- to twelve-month period.

Not only are there questions about what is going to happen in Ukraine, there are questions about what kind of a recession we might see… if a recession does take place?

And, what is going to happen if the United States gets a Republican-controlled Congress in November 2022?

Lots and lots of unknowns, and many of these unknowns are unknown, unknowns.

Then there is the pandemic, an existence that is generating changes that we will not really know about for several years.

To have all this uncertainty connected to the Fed at this time is really frustrating.

Be the first to comment