uschools/E+ via Getty Images

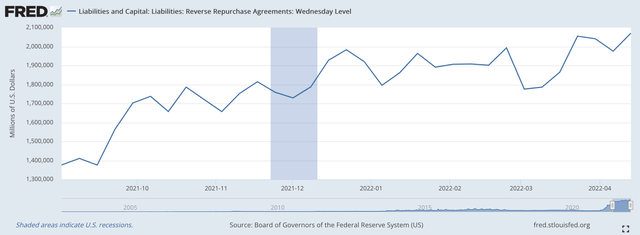

On Wednesday, April 13, the total amount of reverse repurchase agreements on the balance sheet of the Federal Reserve hit an all-time high of $2,070.3 billion.

Reverse repurchase agreements, or, reverse repos, represent sales of securities held by the Federal Reserve under an agreement to repurchase them after a very short period of time.

Reverse repos remove reserves from the banking system and offset any purchases of securities, outright, that the Fed adds to its assets.

In a real sense, when the Fed buys securities, it adds reserves to the banking system.

When the Fed sells securities, it removes reserves from the banking system.

Over the past year, the Federal Reserve has been very active in the use of reverse repos.

In April, we notice that reverse repos began to rise modestly, rising from around $200.0 billion in the first quarter of 2021. On March 31, reverse repos on the Fed’s balance sheet had risen to about $350.0 billion.

The Fed entered into more and more repurchase agreements following that date.

After September 1, 2021, we find that reverse repos really grew on the Fed’s balance sheet.

Note the growth in the following chart.

Reverse Repurchase Agreements (Federal Reserve)

Federal Reserve Tapers Security Purchases

All through 2021, Federal Reserve officials were experiencing a growing concern with the rising rate of inflation and the need for the Federal Reserve to go into a stance that would combat this threat.

During the early part of the year, the Fed was accommodating the banking system by purchasing, outright, $120.0 billion in securities to add to its balance sheet.

By the end of the summer, Federal Reserve officials had grown very concerned that its policy rate of interest would drop into negative territory.

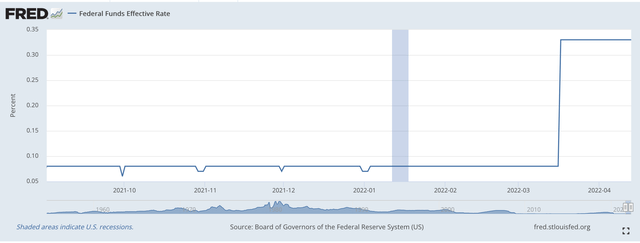

On September 1, 2021, the Fed began to keep the effective Federal Funds rate constant at 0.08 percent. It was very successful.

Federal Funds (effective) Rate (Federal Reserve)

The question is, how did the Fed keep the effective Federal Funds rate so constant if it was still buying $120.0 billion of securities every month, putting more and more liquidity into the financial system.

Well, we note that the reverse repos on the Fed’s balance sheet began to rise. (Check the first chart above.)

On September 1, 2021, reverse repos on the Fed’s balance sheet totaled $1,376.3 billion. The trend, since that date, has been up. Up to the point that these repos topped $2.0 trillion on April 13, 2022.

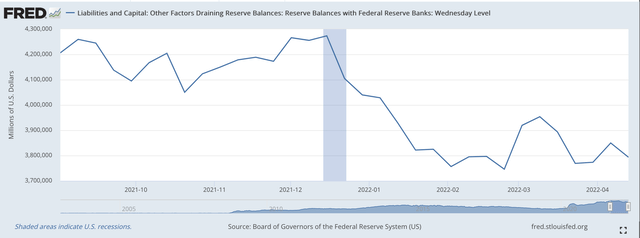

As a consequence, commercial bank liquidity declined, which helped the Federal Reserve keep the effective Federal Funds rate positive and constant at 0.08 percent.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

Note, however, as the Fed did begin to taper its outright purchases of securities for its portfolio, the rise in reverse repos on the balance sheet also reduced commercial bank liquidity so that it could move, in the middle of March, to actually raise its policy rate of interest, as can be seen in the second chart above.

Significant Points

In this history, there are some significant points that were achieved that should be noted.

So, first, we begin the tale on September 1, 2021, the date the Fed moved to keep its policy rate of interest constant at 0.08 percent.

On that date, the Fed carried, on its balance sheet, $1,376.3 billion in reverse repos.

On that date, the amount of reserve balances at Federal Reserve banks, a measure of the liquidity in the banking system, was at $4,206.4 billion.

The next significant date I would like to point out is the day that the price of Bitcoin (BTC-USD) hit its peak. The date was November 9, 2021. The peak price I have recorded for that date was $67,415.

On November 10, 2021, the amount of reverse repos showing up on the Fed’s balance sheet was $1,753.0 billion, almost a $400.0 billion increase from the earlier date.

Reserve balances at Federal Reserve banks had dropped to $4,178.6 billion.

The “tightening” was taking place. The Bitcoin price topped out.

My third significant point is January 3, 2022. This was the date that the S&P 500 Stock Index hit its last historic high. Since that date, the S&P 500 has closed at a lower level. The stock market topped out.

Reverse repos were at $1,795.6 billion on January 5, about the same they were on November 10, but the Reserve Balances at Federal Reserve banks were down to $4,028.5 billion. So, the commercial banking system was dealing with less liquidity than it had on the previous date.

On March 16, 2022, the Federal Reserve raised its policy rate of interest.

As can be seen in the second chart above, the effective Federal Funds rate jumped to 0.33 percent, up from 0.08 percent.

The amount of reverse repos on the Fed’s balance sheet rose to $1,864.6 billion on March 16, while the Reserve Balances at Federal Reserve banks fell to $3,890 billion.

Thus, the tightening continued.

The Current Position

The data just released this week showed that the liquidity position of the commercial banking system had fallen even more.

On April 13, 2022, reverse repos on the Federal Reserve balance sheet hit an all-time high of $2,070.3 billion.

Reserve balances with Federal Reserve banks dropped to $3,793.3 billion.

And, so the Federal Reserve is, seemingly, keeping the foot on the brake.

But, the Federal Reserve is still adding securities, purchased outright, to its balance sheet.

In the past banking week, the Fed added just under $26.0 billion in securities purchased outright to its securities portfolio.

Since March 2, 2022, the Fed has added just about $62.0 billion to its securities portfolio.

And, since December 29, 2021, the Fed has added almost $235.0 billion to its securities portfolio.

The timing of when the securities go onto the balance sheet depends upon the settlement date connected with the actual purchases, so this timing is not tightly controlled.

I go into all this detail because it helps to picture what Federal Reserve policymakers have to face and what they have to work with.

Going Forward

The important thing is how the Federal Reserve leadership will go forward.

Federal Reserve officials are committed this year to four or five more increases in the Fed’s policy rate of interest. More and more of the leadership are talking about making some of the changes 50 basis points rather than just 25 basis points.

We’ll see.

The interesting thing is going to be how the Fed manages its balance sheet.

Fed officials have stated that they will stop buying securities outright and reduce the securities maturing off the balance sheet and not be replaced.

But, will the Fed actually begin to sell securities in order to support the interest rate increases it has signaled will take place this year?

And, how will the Fed deal with all the reverse repos, more than $2.0 trillion of them, on its balance sheet?

There remains a lot of work to do along with all the many, many things that are taking place in our world these days.

Be the first to comment