Khosrork/iStock via Getty Images

The Federal Reserve is sticking to its guns and is not backing off.

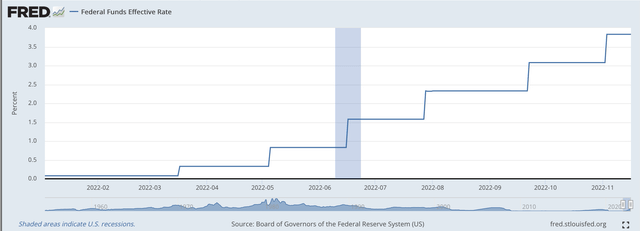

This we write as Federal Reserve leaders face another rise in the Fed’s policy rate of interest at its early December policy meeting of the Federal Open Market Committee.

The Fed began this round of tightening in the middle of March 2022.

The effective Federal Funds rate was 0.08 percent before the Fed began to step on the monetary brakes.

The timing of this move is related to the end of the banking week, March 16, 2022.

The policy rate is now at 3.83 percent, after five increases of 75 basis points.

Federal Funds Effective Rate (Federal Reserve)

Right now, the expectation is for a 50 basis point increase in the Federal Funds rate in early December.

At least three rate increases are expected in the first six months of 2023.

The thing is, if the inflation rate in the United States is over 5.0 percent, then the “real cost of money” is still negative.

This does not represent a “tight” cost of money.

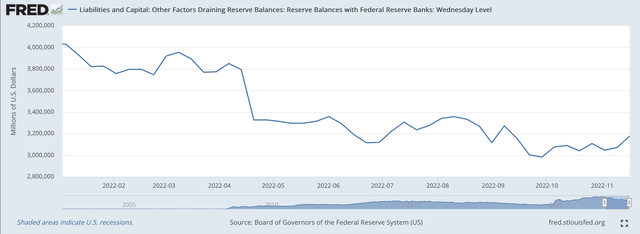

Reserve Balances With Federal Reserve Banks

The line item on the Federal Reserve’s balance sheet that represents the liquidity in the commercial banking system in the Fed’s H.4.1 statistical release is the one titled “Reserve Balances With Federal Reserve Banks.”

This account, at this time is closely tied to what is happening with the effective Federal Funds rate.

Since March 16, Reserve Balances with Commercial Banks have declined by $716.6 billion. Since March 9, 2022, reserve balances are down by $776.9 billion.

Reserve Balances With Federal Reserve Banks (Federal Reserves)

Note that I am using Wednesday-level statistics. These numbers represent the amount of money in this account at the end of the Wednesday business day, so it is not an average, and it represents the exact accounting number on the Fed’s balance sheet.

So, in order to tighten up the money markets, during this period of time the Fed has reduced the liquidity in the banking system so as to support the rising level of the Federal funds rate.

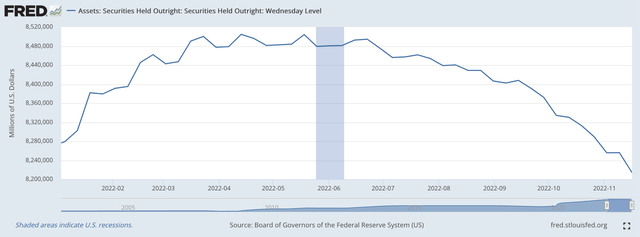

Securities Held Outright

In order to reduce the liquidity in the banking system, the Federal Reserve is letting the securities it holds outright mature off the balance sheet.

This is the basic tool that the Fed is using to reduce the liquidity of the banking system.

Since March 16, 2022, the securities portfolio of the Federal Reserve has fallen by $276.2 billion. Note that another $34.0 billion has left the Fed’s balance sheet as accounts are adjusted for the premiums and discounts associated with maturing securities.

Thus, securities maturing off the Fed’s balance sheet have contributed $310.2 billion to the reduction in the amount of securities held on the Feds’ balance sheet.

Securities Held Outright (Federal Reserve)

Notice that the Federal Reserve did not really begin to reduce the size of the securities portfolio until July. In the original plans of the Federal Reserve, it was noted that the reduction in the Fed’s securities portfolio was not going to begin right away in March or in the spring of 2022.

But, the Fed has been overseeing the drop in securities held outright since then.

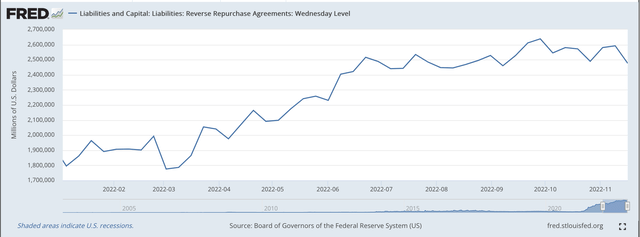

Reverse Repurchase Agreements

The Federal Reserve, as can be seen from the above chart, steadily reduced the size of its securities portfolio once it started the process.

The important thing here is the word “steady.”

The Fed does not want to disrupt the bond markets with a highly variable approach to its program. A highly variable program could hurt the overall effort more than it helped it.

So, the Federal Reserve has used reverse repurchase to “incrementally” manage the Fed’s position and allow the financial markets to adjust smoothly to the “tightening” that the Fed was pursuing.

Here we are talking about the Fed “selling” securities to “dealers” under an agreement to repurchase the securities after a very short period of time.

This vehicle seems to be where the Fed is “incrementally” allowing the financial markets adjust to the Fed’s tightening.

Note further that other items impact the liquidity position of the banking system. One major item is the movement of the funds managed by the Federal government as it, for example, collects taxes, brings the tax money into its General Account at the Fed, and then writes checks to pay for government activities.

For example, the General Account of the U.S. Treasury at the Fed fell by just under $150.0 since March 16, 2022. These monies flowing back into the banking system would supply quite a bit of liquidity to the commercial banking system.

In order to maintain stability of the short-term financial markets, the Fed would “sell” securities under a repurchase agreement to keep the money markets steady.

Furthermore, if the Fed needed to stabilize the money markets because the Fed had just raised its policy rate of interest and the Fed didn’t want to “permanently” the size of its securities portfolio just yet, it could “sell” securities under a repurchase agreement in order to manage the level of the Federal Funds rate in the market.

Overall, Reverse Repurchase Agreements on the Fed’s balance sheet rose by $611.5 billion since the start of the tightening program begun on March 16.

Reverse Repurchase Agreements (Federal Reserve)

Notice the aggressive rise in these reverse repos beginning in the middle of March. Obviously, the Federal Reserve had a lot of work to do to convince “market participants” that it was pushing the policy rate of interest upwards.

The Future

The one thing the use of reverse repos does for the Fed is to give it more flexibility in working with the money markets.

For example, if the Fed needs to inject a lot of liquidity into the banking system because of a “financial bump,” it could just allow these reverse repos to “run off” and supply the banking system with lots and lots of “cash.”

That is, the Fed would not have to to out into the market and “buy” lots and lots of securities to pump money back into the banking system.

Since the repurchase repos are of such short term nature, the “re-building” of market liquidity could happen quickly, and in quite substantial numbers.

Thus, this methodology allows for “downside protection” to the marketplace.

The Federal Reserve, I believe, will stick with its policy of monetary tightening” for quite some time.

Mr. Jerome Powell, Fed Chairman, wants to be remembered along with former Fed Chairman, Paul Volcker.

Mr. Powell, I believe, will not be remembered well for his leadership during the Covid-19 pandemic when the Fed pumped so much money into the banking system.

He does not want to be remembered for screwing up the current battle against inflation.

I don’t expect a “pivot” soon.

Be the first to comment