Bet_Noire/iStock via Getty Images

In the world of central banks, it is often a “relative” world, rather than an absolute one.

Right now, the Federal Reserve System in the United States has been working overtime to convince business leaders and investors that it is serious about raising interest rates and reducing the securities portfolio.

More and more leaders within the Fed are now calling for rate increases of 50 basis points rather than 25 basis points, and we have a “clarified” picture of what the Fed plans to do in reducing the size of its securities portfolio.

The plan: the Fed now intends to oversee a reduction in its securities portfolio by $95 billion per month beginning very shortly. This reduction would include a decline of $60 billion per month in U.S. Treasury securities and a $35 billion per month in mortgage-backed securities.

So, the Federal Reserve seems to be working hard to convince markets that it is going to do what it has been talking about doing for several months now and it appears as if it is becoming convincing enough that markets are moving lower.

Not True Of Europe

This is not the path that the Europeans are following.

Inflation is soaring in Europe.

Last month, annual inflation hit a new eurozone record of 7.5 percent.

It is expected that the figure for March will be similar or even higher.

But, members of the European Central Bank are mixed.

The ECB has been buying bonds on a regular basis for nearly eight years.

Negative interest rates persist.

There is a group of policymakers, however, that are still arguing “for a ‘wait-and-see’ stance because of uncertainty over the economic impact of the eurozone of Russia’s invasion of Ukraine.

Others are pushing for “a firm end date” on its net bond purchases “to prepare the ground for raising interest rates in the third quarter.” They are afraid of “falling behind the curve” in the fight against inflation.

So, the ECB decided on a “balanced compromise: to scale back its bond purchases more quickly and to end them in the third quarter unless a sharp downturn occurs, while deferring the decision on potentially raising interest rates.”

The fear: tightening monetary policy too soon “would mean considerably lowering real activity and employment, knowing down wages and income.”

The result

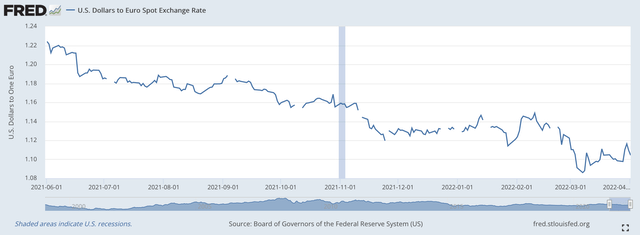

We see the consequences of this policy in the relative strengthening of the U.S. dollar against the value of the Euro.

Right now, it costs about $1.0865 to purchase one Euro.

It was later in the spring of 2021 that members of the Fed really began talking about tapering their monthly purchases of securities and moving to raise their policy rate of interest.

On June 1, 2021, it cost about $1.2250 to purchase one Euro.

The ECB, at that time, would not even entertain the idea of slowing down its purchase of securities or raising its interest rate.

Consequently, the value of the U.S. dollar strengthened from June 1 2021 to the current date.

Exchange rate: dollar?Euro (Federal Reserve)

If the Federal Reserve actually accelerates the pace at which it raises its policy rate of interest and sticks with its schedule for reducing the size of its securities portfolio, and the ECB follows the schedule outlined above, the value of the dollar should continue to rise against the Euro.

It is going to be interesting to see just how much longer this “relative” difference in monetary policies can continue to exist.

It does show, however, that the Federal Reserve’s actions so far are impacting markets, globally.

Federal Reserve Activity

The effective Federal Funds rate remained constant through the week at 0.33 percent.

The Fed’s portfolio of securities held outright rose by just $1.2 billion.

Reverse Repurchase agreements dropped by $65.2 billion.

As a consequence, Reserve Balances with Federal Reserve banks rose by $76.4 billion.

However, over the past month and since the beginning of the year Reserve Balances with Federal Reserve banks fell by $69.6 billion and $190.0 billion respectively.

Reserve Balances with Federal Reserve banks are a rough proxy for “excess reserves” in the banking system. So a decline in these Reserve Balances means that the Fed has “tightened up” a bit or reduced liquidity in the banking system and this is consistent with a rising Federal Funds rate.

Thus, since the start of the year, the Federal Reserve has overseen a modest decline in bank liquidity.

Since March 2, 2022, the Fed has only added $36.0 billion to its securities portfolio.

So, the Federal Reserve has produced some results that are consistent with the tapering in the outright purchases of securities.

Given that the Fed is planning to oversee the securities portfolio decline by $95 billion per month beginning by May, it seems as if they are positioning themselves to do just that.

Hold on, the tightening has just begun. Now we will see whether or not Chairman Powell and the other Fed leaders stick to their “guns.”

Be the first to comment