Bim/iStock via Getty Images

Introduction

Federal Agricultural Mortgage Corp (NYSE:AGM) is a federally chartered bank focusing on the agricultural sector in the USA with a mandate from Congress to provide a secondary market for loans in rural America. As the bank is backed by the US federal government, it’s able to borrow money at a lower cost resulting in a strong earnings profile as the loan loss provisions remain rather low as well. I last discussed the company in June when it issued a new series of preferred shares.

A strong set of results in 2021 as the default ratio remains very low

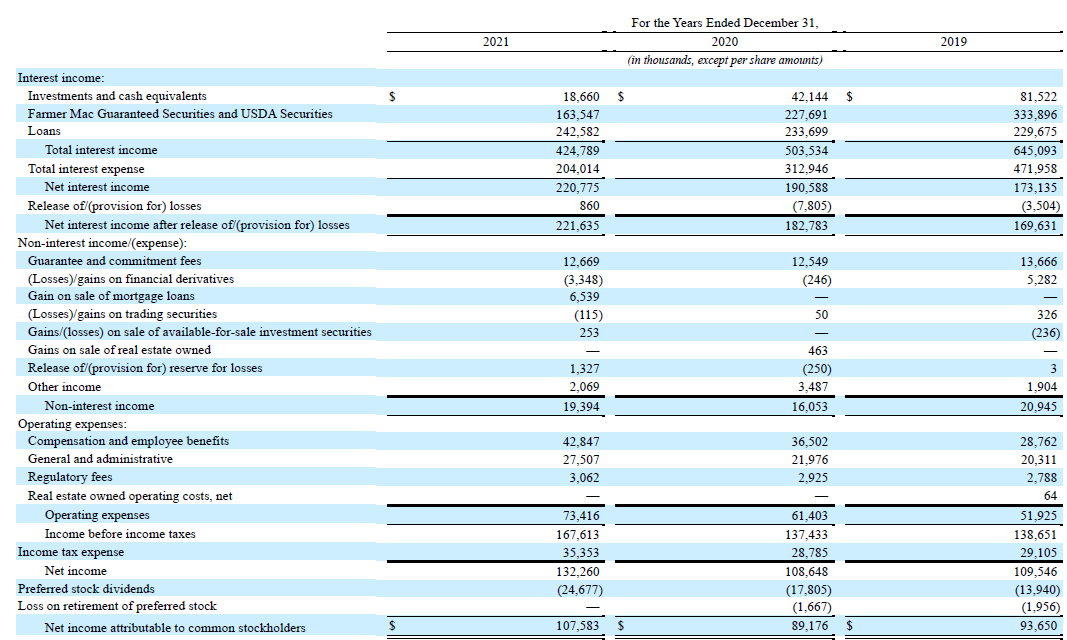

As Farmer Mac continues to grow its loan book and as its net interest margin remains stable (but relatively low as AGM has access to cheap capital but also invests in low-risk loans where the returns are lower as well), the bank’s net interest income continues to expand.

In 2021, the bank recorded a lower total interest income but an even sharper decrease in the interest expenses and the net interest income increased by in excess of 15% to just under $221M. Not only is that a clear improvement compared to FY 2020, the almost $221M in net interest income is also almost 30% higher than the result in 2019, so AGM can be pretty happy with its net interest performance.

AGM Investor Relations

The bank obviously also has some non-interest income and expenses, and the net non-interest expense in FY 2021 was approximately $54M. This resulted in a pre-tax and pre loan loss provision result of approximately $167M. This was subsequently slightly boosted by the reversal of historical loan loss provisions, resulting in a pre-tax income of $167.6M and a net income of $107.6M. As there are approximately 10.8 million shares outstanding (in all categories), the EPS was $10.00 per share.

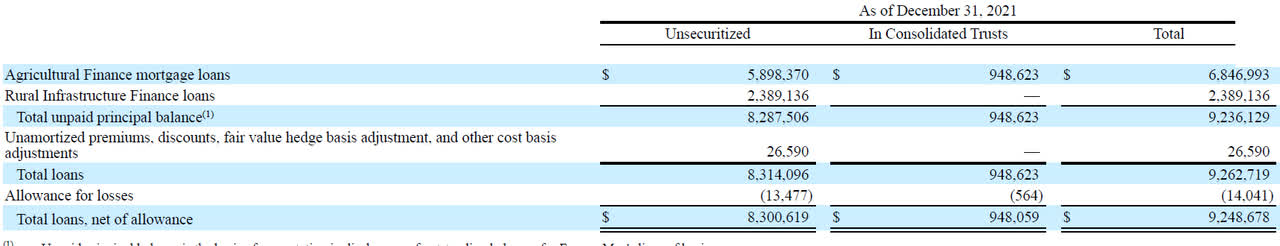

The low loan loss provisions in the past few years have been low and even in 2020 the total amount of loan loss provisions came in below $8M. Considering the bank has a total balance sheet of in excess of $25B, keeping the loan loss provisions this low is a spectacular performance and further confirms the quality of the assets in the bank’s loan book. The agri related loans total approximately $8.3B (the remainder of the balance sheet consists of cash and investment securities) and as you can see below, the bank has recorded a total loan loss allowance of almost $13.5M.

AGM Investor Relations

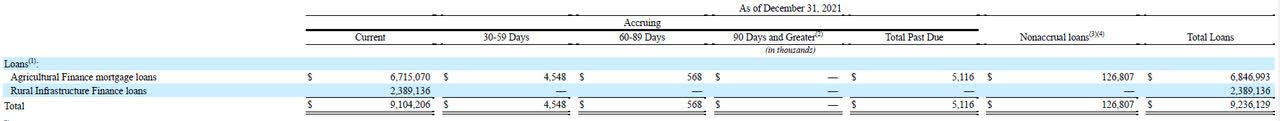

And while these provisions, totaling just under 0.2% of the total loan book size appear to be low, the delinquency status of the loans explains why Farmer Mac doesn’t have to increase the loan loss provisions. As of the end of 2021, only $5.1M of the loans were past due, of which about 90% was past due by less than two months.

AGM Investor Relations

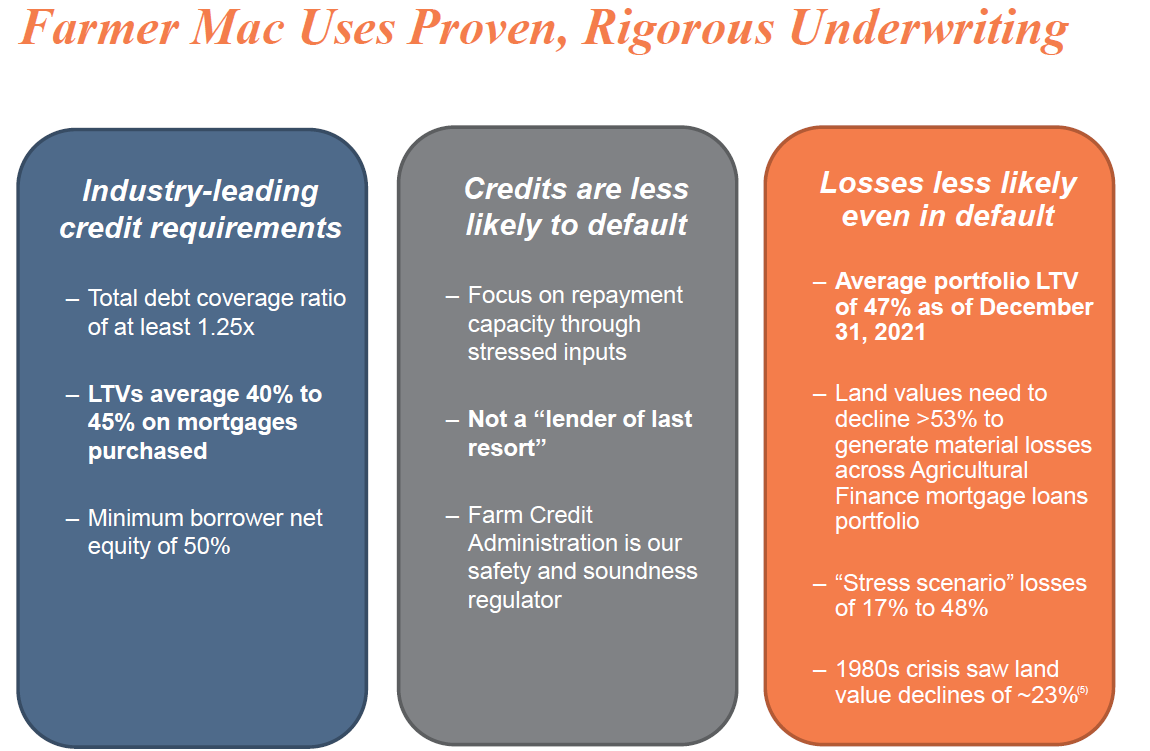

There also was a total of $127M in non-accrual loans. That’s substantially higher than the loan loss allowance but keep in mind the average LTV ratio of the loan book is just around 47%. This means that based on the $126M in non-accrual loans, there should be over $250M in collateral available so the odds of Farmer Mac being able to avoid a haircut on non-accrual loans appears to be rather low. According to AGM’s own internal stress test, the value of the collateral would decrease by 17% to 48% so even in the worst circumstances of the stress test, the collateral should be sufficient. Of course, both the stress test and LTV ratios are based on averages and some loans will have a higher LTV ratio than others. I’m not saying AGM will be able to avoid all losses, but I do think the bank will be able to keep the potential losses very low.

AGM Investor Relations

The dividend was just hiked

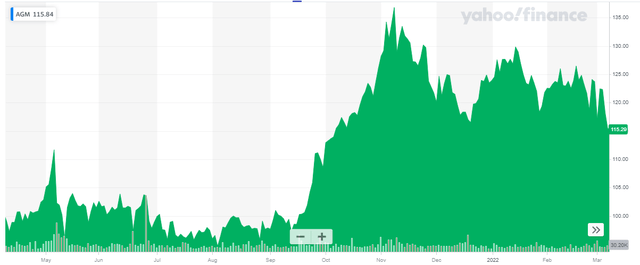

Thanks to the strong results, AGM was able to hike its dividend once again and the bank has now declared quarterly dividends of $0.95 per share. That’s an increase of approximately 8% from the $0.88 per share it previously paid out and based on the current share price of approximately $115, the current dividend yield of Federal Agricultural Mortgage is approximately 3.3%.

While that obviously isn’t the highest in the banking sector, it’s important to know it’s a very safe dividend as the payout ratio is less than 40% and the bank itself is running its business in a very conservative way. And as the bank retains a substantial portion of its earnings on the balance sheet, it will be able to further grow its loan book which will result in stronger earnings going forward and the potential to further increase the dividend.

AGM Investor Relations

Investment thesis

I currently have no position in Farmer Mac’s common shares, but I do own preferred shares in my income portfolio as I like the asset coverage ratio and the safety of the preferred dividend as the preferred dividend requires less than 20% of the net income on a pre-preferred dividend basis.

While the preferred shares are a useful component of the portfolio, I think AGM offers excellent potential for capital gains as the bank retains in excess of 60% of its earnings on the balance sheet which allows it to further expand its balance sheet for an even higher net interest income. Over the past twelve months, I have been writing put options on AGM but all options expired out of the money. I will likely continue to use this strategy in an attempt to establish a long position in the common shares of Farmer Mac.

Be the first to comment