DNY59/E+ via Getty Images

Article Thesis

The Fed is on an aggressive hiking path in order to bring down inflation that is currently running at a four-decade high. Rising interest rates are a headwind for equity markets in general, although not all companies are hit equally. Value stocks should outperform in the current environment, whereas growth stocks are hit harder by a rising discount rate due to the fact that a larger portion of their future profits lies in the distant future. There are also individual industries where interest rate changes have a more pronounced impact, such as homebuilding.

Why The Fed Is Hiking Interest Rates

Up until very recently, interest rates in the US and many other economies were near record lows. Inflation wasn’t a problem, and the fact that economies were hit hard by the global pandemic made central bankers decide that a very accommodating monetary policy was the correct choice.

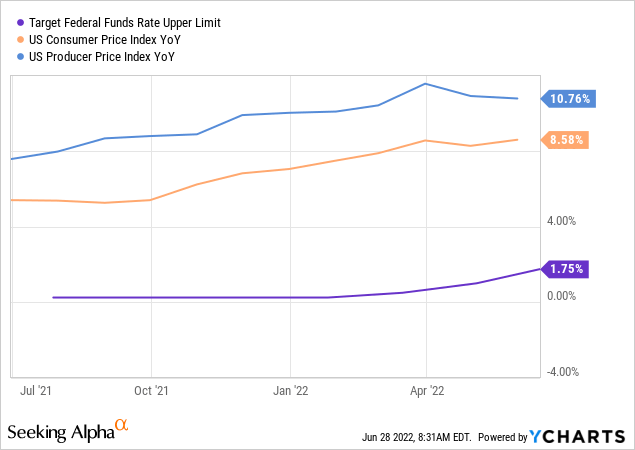

Over the last year, we have seen inflation run to highs that we have not seen for decades, however:

Inflation, oftentimes measured by the change in the consumer price index, is currently running at an 8.6% rate. The producer price index is even higher, at close to 11%. Since higher producer prices are oftentimes pushed through to consumers eventually, one could argue that we may not yet have seen the CPI peak. In the above chart, we see that PPI increases have been leading the CPI index by a couple of months, so CPI might rise further. On the other hand, PPI increases seem to have peaked and are not rising any further, which is good news as it means that CPI increases might also peak in the not-too-distant future.

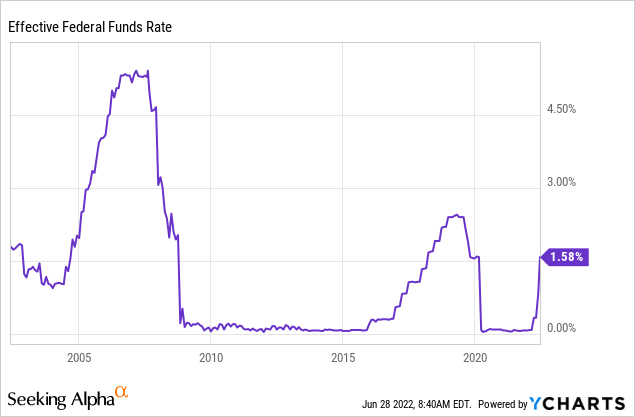

No matter what, interest rates are well below the rate of inflation — everyone that puts money to work at 1%-2% while said money loses 8%+ per year in value is locking in hefty losses in real terms. It’s thus not too surprising that most central bankers are forecasting further interest rate increases in the coming months, with the market anticipating another 75 base point hike in July. By the end of the year, the Fed Funds rate will likely be north of 3%. That’s still considerably below the current rate of inflation, but at the same time, a 3%+ interest rate is high relative to the interest rates we have seen in the recent past:

Prior to the Great Recession, the Fed Funds rate rose to as much as 5%. But since then, the Fed Funds rate hasn’t breached 3% again. The current hiking path is thus far from usual, but due to the persistently high inflation, it is necessary.

The Impact On Growth And Value Stocks

All else equal, rising interest rates result in lower equity prices (and lower bond prices). There are several reasons for that. First, higher interest rates mean putting money into bonds, CDs, etc. becomes more attractive, which is why some equity investors may switch to fixed-rate investments when interest rates rise. While putting money into fixed income with interest rates near zero isn’t attractive, the calculation may be different with interest rates at 3% or more — which is more than the average equity’s dividend yield.

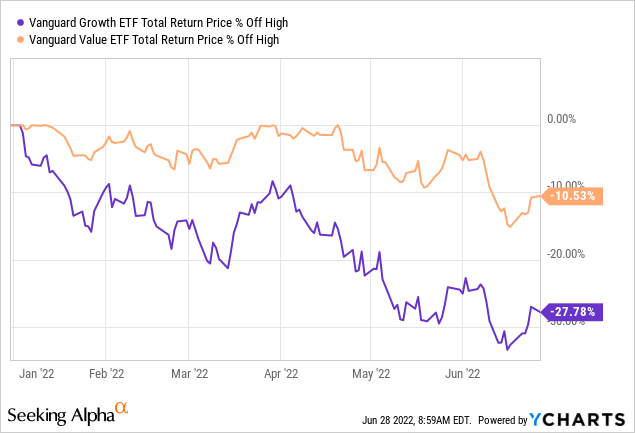

Another reason for pressure on equity prices is that the discounted value of future cash flows declines. Higher interest rates result in a higher discount rate, which is why a stock’s fair value, according to the discounted cash flow method, declines when interest rates rise. Not all stocks are impacted to the same degree, however. Instead, a lot depends on whether a company generates the majority of future profits in the near term, as is the case with value stocks, or whether most or all future profits lie in the future. Growth stocks, especially unprofitable growth stocks where it may take years for them to generate meaningful profits, are thus more heavily impacted when interest rates rise. Not surprisingly, this is visible when we look at the performance of Growth versus Value in the recent past:

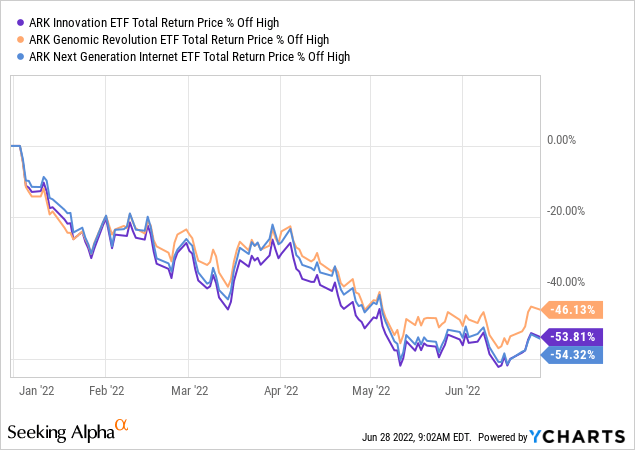

This year, the Vanguard Growth ETF (VUG) has dropped by 28%, while the Vanguard Value ETF (VTV) is only down 11% over the same time frame. In other words, Value has outperformed Growth by a hefty 17% percentage points so far this year, due to the aforementioned connection of growth stock underperformance during times of rising interest rates. When we look at expensive growth stocks that are oftentimes not profitable yet, such as those held by the different ARK Innovation funds (ARKK)(ARKG)(ARKW), the underperformance is even more pronounced:

To date, these funds have dropped between 46% and 54%, essentially destroying half of investors’ wealth in a couple of months. A 117% return from current levels would be needed for the main fund, ARKK, just to climb back to where it was at the beginning of the year. Holding expensive growth stocks during times of rising interest rates and high inflation is thus very dangerous. Since inflation may not have peaked yet, and since interest rates will continue to get hiked going forward, owning these types of stocks is still risky, despite the fact that they have become considerably cheaper in recent months.

Industries That Perform Well

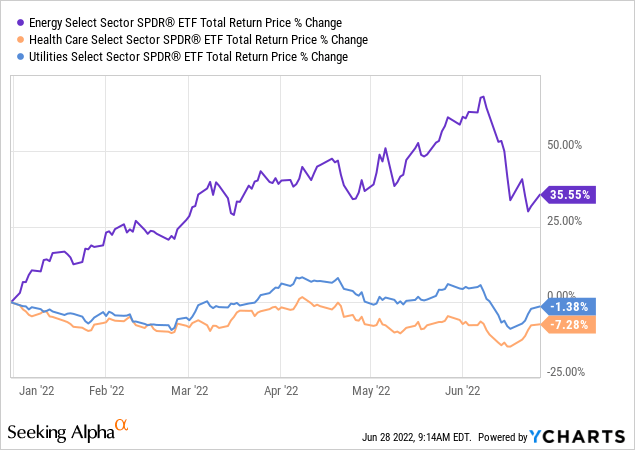

The value outperformance can also be seen in the strong relative performance of typical value sectors such as energy, health care, and utilities.

Utilities are essentially flat this year, while health care stocks are down 7%, slightly less than the overall value universe and outperforming the growth universe by 20%+.

Energy stocks, which are both an absolute value play due to their ultra-low valuations and an inflation play as they benefit from rising oil and natural gas prices, have offered a very compelling 36% so far this year. Oil supermajors such as Exxon Mobil (XOM) and Chevron (CVX) are still pretty inexpensive, as both stocks are valued at just 8.5x this year’s profits while returning billions of dollars in cash to their respective owners. Other energy stocks that are not as diversified as these supermajors, such as many E&P players, are even cheaper. Diamondback Energy (FANG) and Devon Energy (DVN), for example, trade at 5x and 7x net profits, respectively.

The Impact On Banks And Lenders

Banks and the broader financial industry have not performed too well in recent months. The Financial Sector Select ETF (XLF) has dropped by 17% on a year to date basis, underperforming other value sectors, although XLF still easily beat the growth universe so far this year.

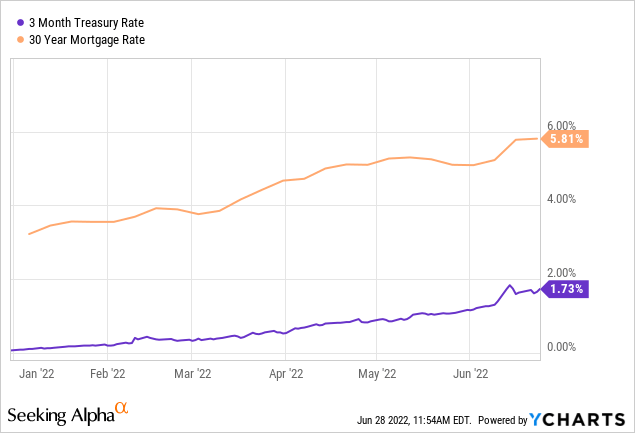

In general, times of rising rates are positive for banks and other financial companies, as their net interest margins generally increase in those times. They have to pay more when they borrow money, but that is more than offset by them receiving higher interest rates when they lend out money. In the current environment, short-term rates have risen more than long-term rates on a relative basis:

The 3-month treasury rate as a proxy for short-term rates has risen by hundreds of percent in relative terms, but from an ultra-low level. In absolute terms, the rate has expanded by around 150 base points. Meanwhile, the 30-year mortgage rate has risen by around 260 base points so far this year. It thus looks like banks were able to expand their net interest margin, which should be a positive for their revenue generation. This is partially offset by some other items, however. Less deal activity due to higher cost of capital hurts investment banking fees, and a potential recession means that credit losses could climb in the coming quarters. This is why Wells Fargo (WFC), Bank of America (BAC), JPMorgan (JPM), and other major banks have pulled back significantly in recent months. Still, their near-term outlooks are not bad, and they are now trading at pretty low valuations of around 10x this year’s profits.

Takeaway

The Fed has to hike rates aggressively in order to prevent inflation from running up further and further. This hurts equity valuations, with growth stocks being hit significantly harder than value stocks. Positioning one’s portfolio accordingly seems like an opportune choice. Stocks that have value characteristics and that tend to do well in high-inflation environments, such as energy stocks, could continue to outperform, while unprofitable growth stocks could continue to underperform in a higher-rates, quantitative tightening environment.

Be the first to comment