Dine Brands will look to leverage its two iconic chains, IHOP and Applebee’s, to further reward shareholders and help launch new virtual brands. Scott Olson/Getty Images News

Over the years we have traded in and out of Dine Brands Global (NYSE:DIN) as opportunities have presented themselves. The most opportunistic trading occurred during the onset of the COVID pandemic when we were able to purchase shares south of $20/share for client accounts, and in many cases still hold those positions to this day. We have a tendency to be drawn back to this name due to its structure of being asset light with a lot of the business risk offloaded to franchisees and a history of returning cash to shareholders; reasons that once again have grabbed our attention.

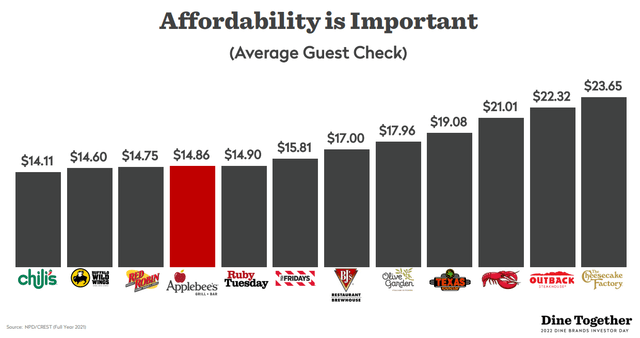

With inflation raging, the restaurant space may or may not be a good sector to be looking at, but if one believes that consumers will accept menu price increases without those increases impacting traffic and overall volume, then Dine Brands is a name to look at. With a low average guest check at their Applebee’s restaurants versus other national chain peers, the company does have some room to push through price increases. Couple that with the company rolling out new virtual brands and ghost kitchens and there is room for the company-owned stores, as well as the franchised locations, to offset some inflationary pressures while also creating new additional high margin revenues that should help drive overall company revenue and EBITDA growth in the years ahead.

Even if Dine Brands were to increase menu prices 5-10% across the board for the Applebee’s brand, Applebee’s would still offer an attractive price point for customers compared to other national brands. (Dine Brands Investor Day/NPD/CREST)

Virtual Brands/Ghost Kitchens Offer Hope

Consumer habits have changed since the pandemic, and so too have the ways in which restaurants interact and sell to their customers. Ghost kitchens and virtual brands came about out of a necessity for restaurants to generate revenue and keep the bills paid without necessarily destroying their customer facing brand during the COVID pandemic. Many restauranteurs (from local owners to national brands) recognized the opportunity when the success stories began to circulate and quickly realized that this could not only help them get through the pandemic but also create value-add brands to help drive growth once they emerged from the pandemic.

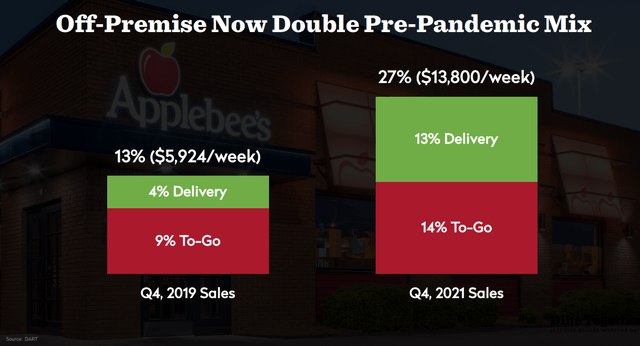

Applebee’s off-premise sales have doubled from pre-pandemic levels. (DART/Dine Brands Global Investor Day Presentation)

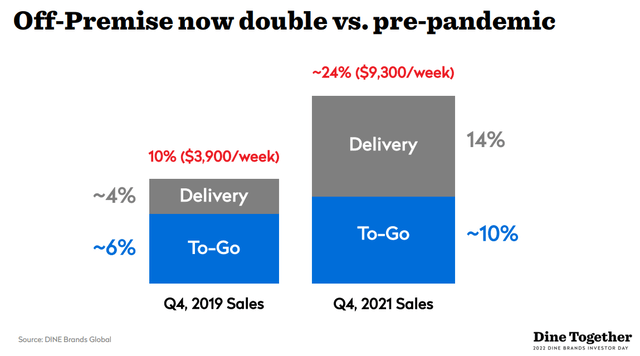

Dine Brands has seen off-premise revenues increase dramatically compared to pre-pandemic results at both Applebee’s and IHOP. Across the industry it appears that consumers have stuck with the delivery apps that they utilized during the pandemic and that this business is more “sticky” than some had anticipated. While this does have an impact on margins, in the current environment where almost every business is having staffing issues this does afford franchisees with some flexibility on hiring and staffing mix; essentially they can prioritize the kitchen and run light on front of house (known as FOH in the industry) staffing.

IHOP off-premise sales have dramatically increased due primarily to delivery orders. (Dine Brands Global Investor Day Presentation)

With inflation hitting everything from rent, labor and food costs, we think that the three virtual brands that Dine Brands has launched (some are technically still in the test phase) offer intriguing value-adds for franchisees and investors. Applebee’s launched the Cosmic Wings virtual brand last year with Uber Eats (UBER) and is now bringing on other delivery partners, such as GrubHub (OTC:JTKWY) in Q2 of 2022, and IHOP has expanded the offering of Thrilled Cheese (sandwiches) and Super Mega Dilla (quesadillas) from just a handful of locations to 50 as they continue to test out these concepts. Adding incremental revenues while utilizing the current real estate footprint and labor pool will help drive efficiencies and hopefully boost revenues and profits. Time will tell but we do think this is an intriguing growth path for the company to pursue as the start-up costs are minimal and the addressable markets still look promising, even with the economy opening back up.

Growth Plans To Impact Results Short-Term

Dine Brands plans to develop, on average, 50-60 net new restaurants and 40-50 ghost kitchens each year over the next five years in international markets. Domestically, Applebee’s will return to growth in 2023 utilizing a combination of traditional and ghost kitchens with IHOP targeting opening on average 100+ units per year over the next five years. We will note that IHOP will utilize all four of their concepts (traditional, non-traditional, small prototype and flip’d) to achieve this growth.

Management was very clear on the latest conference call (located here) that the expenses they are incurring on technology and other growth initiatives are going to be front loaded and impact results in 2022, but that 2023 will be a much better indicator of the business moving forward (as revenues will begin to flow from those earlier expenses).

Capital Allocation Strategy

We have always appreciated the company’s attention to the shareholders over the years via management’s focus on dividends and share repurchases. It was, in fact, one of the main drivers for our original bullishness years ago as the company transitioned towards the franchise model. Today investors collect a dividend paying over 2.50% while management continues to repurchase shares; now under a new $250 million share repurchase program (the old program which was terminated only had $66 million remaining under its terms).

So What Is The Trade?

We do think that Dine Brands will outperform relative to the industry, especially those who are operators of their brands, due to their asset light approach, franchise structure and potential growth via ghost kitchens and virtual brands. We also think that the industry as a whole faces stiff headwinds that concern us enough that we find ourselves lukewarm on the idea of adding exposure to even the companies we perceive as the best to own. That is not to say we are against owning the shares, as we do own Dine shares purchased at much lower prices in client accounts, but rather it is our opinion that a more intriguing trade is to instead sell the September 16, 2022 $70 Puts.

We like this trade because instead of having to invest $7,083 to purchase 100 shares now (this is the price as of the close on 4/12/2022), we only have to tie up $7,000 in one contract until September 16th and can collect a premium that should be about $8.90 (based on the midpoint of the closing bid/ask of $8.60/$9.20), or $890 total. The premium is 12.71% of the capital at-risk, and we only forego one dividend worth a total of $46 (based off of the most recently dividend which reflects the increased rate). Worst case, the company announces an ex-date before the 16th and we miss out on a second dividend, for a total of $92 in dividends. However, we would still prefer the cash flow of $890 at the start of this trade as a potential gain of 12%+ looks respectable in this current environment and should Dine’s stock fall below $70, we would have decent downside protection as the breakeven for this trade would be roughly $61.10/share. With 2022 looking like a set-up year for 2023’s results and economic headwinds facing Dine Brands and the industry as a whole, this trade does look like a decent way to minimize some downside risk on a stock that might not move too much higher through September 2022.

Be the first to comment