DNY59/E+ via Getty Images

As data and key figures point to a hurricane coming to the economy, investors should prepare for more volatility by moving towards defensive strategies and adding recession-resistant ETFs like the First Trust Morningstar Dividend Leaders Index ETF (NYSEARCA:FDL). In the current bear market, FDL has the potential to outperform the market indices due to its portfolio concentration on large-cap dividend stocks from sectors that are benefiting from inflation and higher consumer prices. Moreover, its solid dividend yield, high dividend safety, and steady share price upside make it a great long-term investment.

Embrace Defensive Strategies To Beat Recession

In today’s market environment, portfolio risk management has become increasingly important because both tail event and volatility risks are wiping out trillions of dollars from stock and bond markets. NASDAQ and S&P 500 are already in a bear market, with expectations that economic uncertainty will heighten in 6-12 months. A 75-basis-point increase coupled with Chairman Jerome Powell’s statement that the Federal Reserve is committed to boosting rates high enough to contain inflation has raised concerns that the economy will head into recession. Investors must therefore adopt defensive strategies to protect their portfolios.

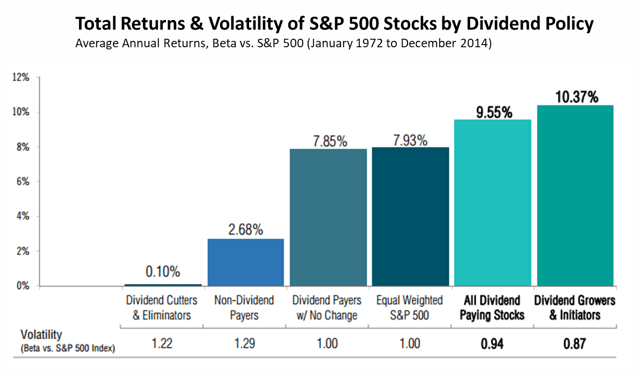

Dividend-Focused ETFs: How They Performed In Bull And Bear Markets (Seeking Alpha )

As shown in the above chart, the best way to beat stock market indices during extreme volatility is to adopt defensive strategies, such as investing in dividend grower stocks and ETFs. In every down year since 2000, dividend payers have outperformed the S&P 500. While historical data suggests dividend stocks are a good investment in high volatility, investors should always take caution when selecting them. This is because several high dividend-paying companies are vulnerable to rate hikes, economic slowdown, and high inflation. For instance, REITs, which offer one of the highest dividend yields, are currently struggling to maintain their dividends. Similarly, a looming recession and rising rates are also threatening the performance of the financials, technology, and industrial sectors. Nonetheless, dividend-paying ETFs like FDL seem like a solid bet to outperform economic uncertainty and bearish stock market conditions.

How Is FDL Recession Resistant?

With a diversified portfolio that focuses on dividend leaders in defensive sectors like health care, consumer defensive, utilities, and communications, FDL is one of the best recession-proof ETFs. Companies operating in these sectors thrive in any market condition, since they offer daily use products that people buy no matter what the economic conditions are.

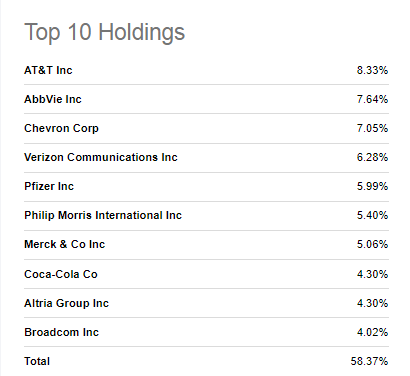

FDL’s top 10 stock holdings (Seeking Alpha)

The top 10 stocks in its portfolio, representing more than 58% of the entire portfolio, are among the most reliable names on Wall Street. In addition, five of the company’s top ten holdings are dividend aristocrats. The other five also have a long history of dividend growth. AT&T (T), for instance, raised dividends for 35 consecutive years before making the first cut due to the WarnerMedia division spinoff. Despite the dividend cut, the company currently offers a dividend yield of over 5% and its shares surged close to 6% year to date, outperforming the S&P 500’s slide of more than 20%. Likewise, AbbVie (ABBV), its second-largest holding, is also among the best dividend growers, with average annual dividend growth of 17.5% in the past five years. We can also describe AbbVie as recession- and inflation-resistant, given its share price increase of more than 7% this year. Similarly, Pfizer (PFE) and Merck & Co. (MRK), two of its top health care holdings, have generated double-digit share price returns in the last 12 months. Furthermore, both companies are well-known dividend growers and currently offer dividend yields above 3.30%. Additionally, consumer defensive stocks like Coca-Cola (KO), Altria Group (MO), and Philip Morris (PM) have also outperformed the broader market since the beginning of this year.

FDL Could Enhance Portfolio Stability Over The Long Term

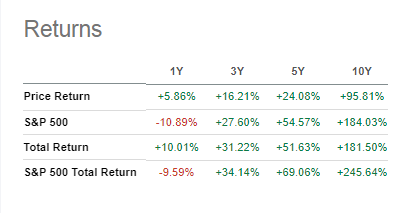

FDL vs. S&P 500 returns (Seeking Alpha)

FDL’s total return of around 10% over the last twelve months supports the notion that dividend growers within defensive sectors perform well in tough economic times. Besides that, the table above suggests that FDL has the potential to generate steady returns over the long run. Though the fund does not have a large number of growth stocks that can make significant gains in times of high economic growth, its dividend yield of 3.74% mitigates the impact of a slower price appreciation when compared to the S&P 500.

For instance, FDL has returned 184% over the past decade, of which 95% are price returns and nearly 90% are dividend returns. In the same time frame, a large chunk of the S&P 500’s 245% return was due to price increases, with the bulk of the price increases occurring in the past two years as growth stocks rallied amid easy money policies. Dividends contributed only a quarter of S&P 500 returns over the past ten years. However, in the quarters ahead, the spread between S&P 500 and FDL’s price return is likely to narrow as growth stocks tend to underperform in times of high-interest rates and slowing economic growth.

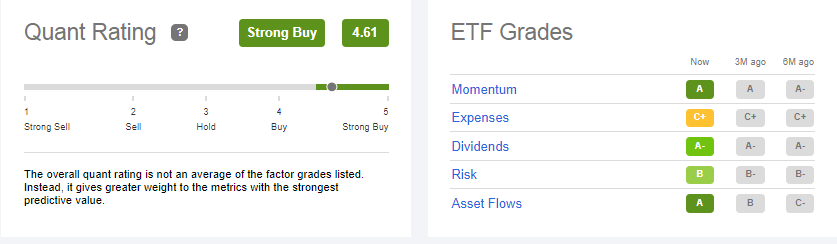

Quant grades (Seeking Alpha)

Based on the Seeking Alpha Quant grading system, which includes five factors such as momentum, dividend, expense, risk, and asset flow, FDL received a strong buy rating with a score of quant score of 4.61. With an A grade for momentum, FDL’s price is likely to accelerate the upside momentum, while high asset flows indicate that investors are confident and putting money into the funds. In addition, it has strong quant grades for dividend and risk factors, which make it a good buy-and-hold choice ahead of a potential recession.

In Conclusion

Boosting portfolio stability ahead of a possible recession and rate hikes seems prudent. In my view, a better way to manage the risk and increase the chances of success is to use exchange-traded funds like FDL instead of buying consumer staples or health care stocks. FDL is better positioned to beat bearish market trends due to its well-diversified stock portfolio that focuses heavily on defensive sectors. Additionally, its high dividend yield, dividend consistency, and steady share price appreciation make it a good long-term investment.

Be the first to comment