HarriesAD/E+ via Getty Images

Written by George Spritzer, co-produced by Alpha Gen Capital

Author’s note: This article was released to Yield Hunting members on Sept. 20, 2022. Please check latest data before investing.

The First Trust Dynamic Europe Equity Income Fund (NYSE:FDEU) is a diversified closed-end fund whose objective is to provide a high level of current income along with some capital appreciation. It invests at least 80% of its managed assets in European equities of any market cap including common and preferred stock and REITs. The fund currently writes covered calls against 32% of the portfolio.

(Data below is sourced from the First Trust fund website unless otherwise stated.)

FDEU does not hedge its currency exposure, so by owning the fund you are taking on some currency exposure to the Euro. By investing in an ETF like UUP (or a short position in FXE), you can hedge some of this currency risk. But I like to keep it simple and remain unhedged, since I believe the currency aspect tends to evens out over the long term.

An interesting feature of the Europe stock market is the spread of the equity dividend yield over the 10 year government bond yields. In German the 10-year government bond yield 1.76% and in France it is 2.30%.

SPDR Portfolio Europe ETF (SPEU), a broad based Europe ETF, has a dividend yield of 3.89%. The equity dividend yield spread is several hundred basis points. Compare that to US broad based ETFs, where the equity dividend spread is negative or close to flat. FDEU has a distribution yield of 6.89% which has even a bigger spread because it enhance its yield via covered call writing.

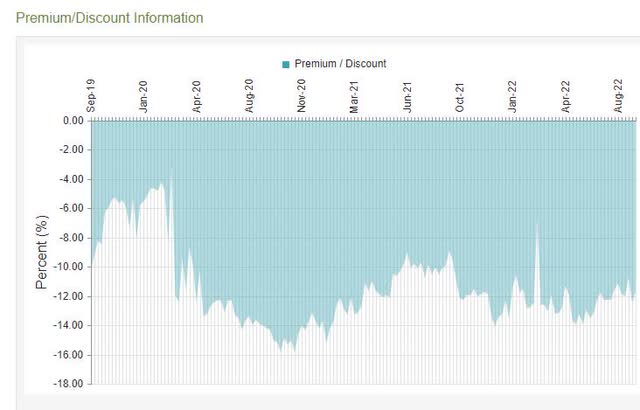

At Monday’s close, FDEU traded at a -11.85% discount to its net asset value. This is close to its 52-week average discount of -12.23%. But the discount still seems quite high because of the upcoming contingent conversion feature of the fund.

FDEU is a well-diversified fund where the top ten holdings are about 27% of the portfolio. Here are the top ten FDEU portfolio holdings as of August 31, 2022 taken from the fund’s web site:

Top 10 FDEU Holdings (as of 08/31/2022)

|

Nestle SA- CHF |

3.43% |

|

Sanofi- EUR |

3.27% |

|

BHP Group Ltd.- GBP |

2.76% |

|

Imperial Brands PLC- GBP |

2.67% |

|

Roche Holding AG- CHF |

2.66% |

|

Novartis AG- CHF |

2.54% |

|

Astra Zeneca PLC- GBP |

2.52% |

|

Shell PLC- EUR |

2.47% |

|

Unilever PLC- EUR |

2.45% |

|

Total Energies SE- EUR |

2.40% |

The top 10 holdings are all strong global companies. The fund’s top two sectors are Financials and Healthcare. This is the top ten sector breakdown as of August 31 from the fund web site.

Industry Sector Allocation (as of August 31, 2022)

|

Financials |

17.01% |

|

Health Care |

14.05% |

|

Consumer Staples |

11.94% |

|

Consumer Discretionary |

11.28% |

|

Industrials |

11.17% |

|

Energy |

8.76% |

|

Communication Services |

7.25% |

|

Materials |

6.46% |

|

Utilities |

6.46% |

|

Information Technology |

2.99% |

|

Real Estate |

2.63% |

It is worth noting that the weighting to the Information Technology sector is quite low at 2.99%.

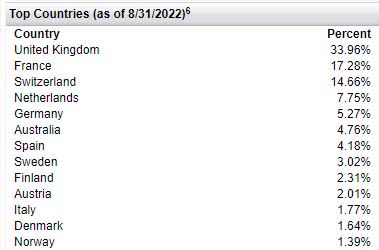

FDEU Country Breakdown (First Trust web site)

FDEU has an annual baseline expense ratio of 1.65%, which is on the high side, but that is not unusual for CEFs that own foreign stocks. For equity CEFs, I like to see the discount of at least ten times the expense ratio. FDEU does not qualify using this standard. But, the contingent conversion feature helps to overcome that.

FDEU Three-Year Discount History

FDEU Discount History (cefconnect)

FDEU Historical NAV Performance Record

Total Return% FDEU (NAV) Europe Stock

|

5 Years |

-2.73% |

-1.30% |

|

3 Years |

-1.70% |

-0.32% |

|

1 Year |

-15.16% |

-20.36% |

|

YTD |

-18.64% |

-22.45% |

|

3-Month |

– 5.19% |

– 4.02% |

(Source: Morningstar)

Here are some other summary statistics for FDEU:

First Trust Dynamic Europe Equity Income Fund (FDEU)

- Total Assets: 277 Million

- Common Assets: 205 Million

- Inception Date: Sept. 24, 2015

- Inception Share Price= $20.00

- Last Monthly Distribution= $0.06

- Annual Distribution= $0.72

- Distribution Yield= 6.86%

- Fund Expense Ratio: 1.65%

- Discount to NAV= -11.85%

- 6-Month average Discount= -12.38%

- 1-Year Z-stat for Discount= +0.38

- Portfolio Turnover rate: 33%

- Leverage: 26%

- Average Three Month Daily Volume (shares)= 47,000

- Average Dollar Volume = $490,000

Contingent Conversion Feature

One of the main reasons why I like FDEU here is because of its contingent conversion feature. When the fund was first marketed back in 2015, this feature was often used by fund sponsors to help raise funding for the closed-end fund IPO.

The feature provides that during calendar year 2023, the Fund will call a shareholder meeting for the purpose of voting to determine whether the Fund should convert to an open-end management investment company. But the meeting may be adjourned or postponed in accordance with the By-Laws of the Fund to a date in calendar year 2024.

The conversion vote requires approval by a majority of the Fund’s outstanding voting securities as defined under the 1940 Act. As defined in the 1940 Act, a “majority of the outstanding voting securities” requires one of the following:

- 67% or more of the shares present at a meeting, if the holders of more than 50% of the shares are present or represented by proxy. OR

- More than 50% of the shares, whichever is less.

If approved by shareholders, the Fund will seek to convert to an open-end management investment company within 12 months of such approval. If the requisite number of votes to convert the Fund to an open-end management investment company is not obtained on the Conversion Vote Date, the Fund will continue in operation as a closed-end management investment company.

What are the chances the Fund will actually convert in 2024?

I believe the fund management probably does not want the fund to convert to an open end fund. They could lose a good portion of their future stream of management fee income if enough investors decided to sell the open-end mutual fund at NAV. Because of this, the contingent conversion feature is not promoted on the First Trust home page or the fund fact sheet. If you didn’t read the prospectus carefully, you might not even know that this feature existed.

Because many investors do not vote on shareholder proposals, it can be very difficult to obtain the majority vote needed for the conversion to an open-end fund. There are usually two conditions required:

-

The discount should be large enough to encourage shareholders to vote for the conversion.

-

A good portion of the share ownership should be active investors who vote on shareholder proposals. Ownership by institutions or fund activists make the required vote easier to obtain, especially when the discount is wide enough.

In the case of FDEU, I think the contingent conversion vote has a good chance of passing if the discount remains near 10% next year. Institutional investors own 62% of the shares outstanding. These are the largest shareholders as of June 30, 2022:

Shareholder Name $ Value (MM)

|

Allspring Global Investments |

$39.7 |

|

City of London |

$17.8 |

|

1607 Capital Partners |

$13.9 |

|

SIT Investment Associates |

$9.1 |

|

Morgan Stanley |

$5.3 |

Some other activist investors such as Bulldog Investors have smaller positions in FDEU right now, but may very well add to their holdings in 2023 if the FDEU discount remains high. I also think the shareholder base may attract more active investors, who tend to vote, as more people learn about the contingent conversion feature for this fund.

FDEU is a reasonable buy here for a longer term investor who is willing to hold the fund with a good possibility that the discount may narrow in 2023. If the discount narrows enough, you will likely earn a nice profit. If the discount does not narrow below 7% or so, I believe there is a good chance the fund could be converted to an open-end mutual fund in 2024.

A reasonable alternative is the SPEU, which has a much lower expense ratio of 0.09%. But I still prefer FDEU, if you can buy it at a 12% discount versus paying full price for SPEU.

Be the first to comment