Trevor Williams/DigitalVision via Getty Images

From 1 YouTube Subscriber to A Quarter Billion Dollar Company

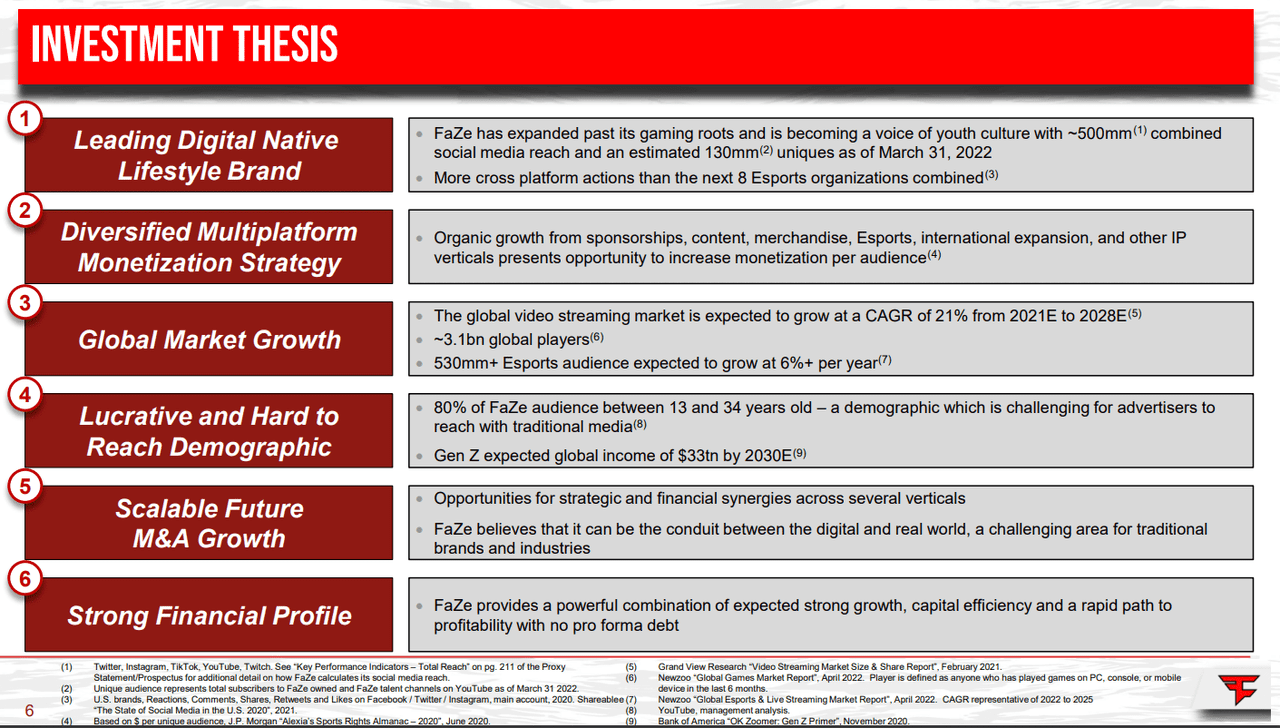

On the surface, if you are familiar with FaZe Clan, now FaZe Holdings (NASDAQ:FAZE), it is likely either because of negative publicity or you and your friends/family are familiar with the world of competitive video gaming. However, winning tournaments and having popular gamers amongst the ranks is not enough to establish a hundred-million-dollar-plus company. As such, the company is becoming far more complex in order to drive some form of stable and predictable financials into the future. I will discuss these opportunities.

FaZe Presentation

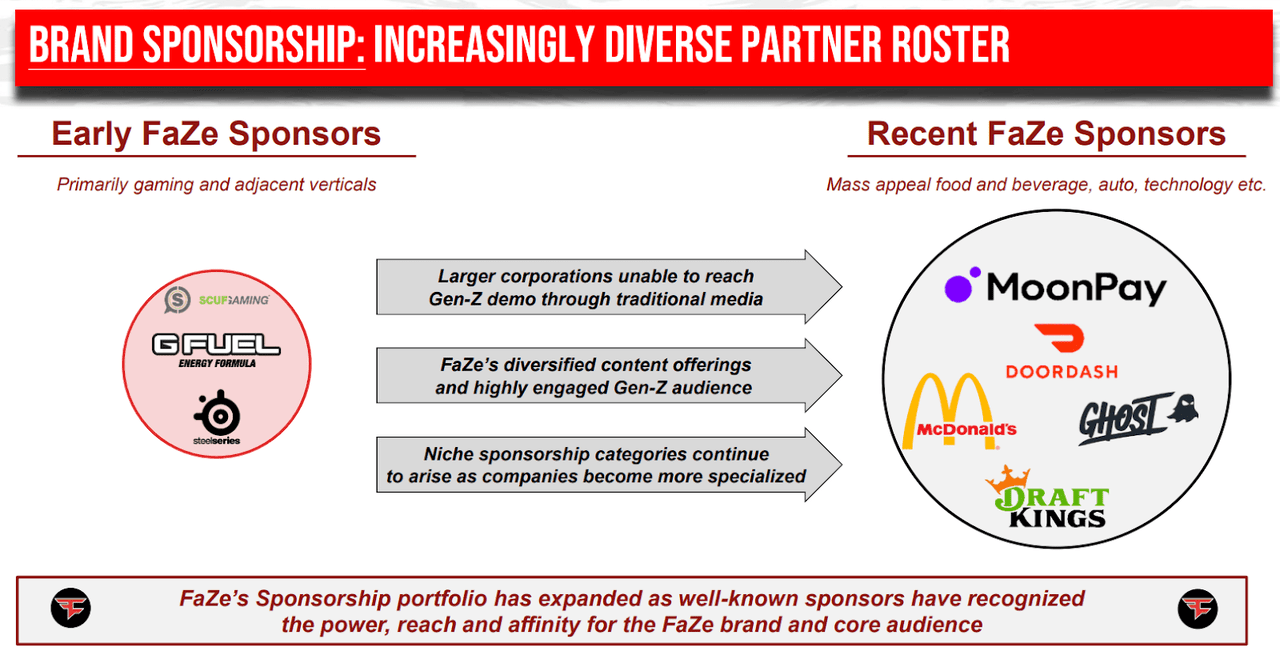

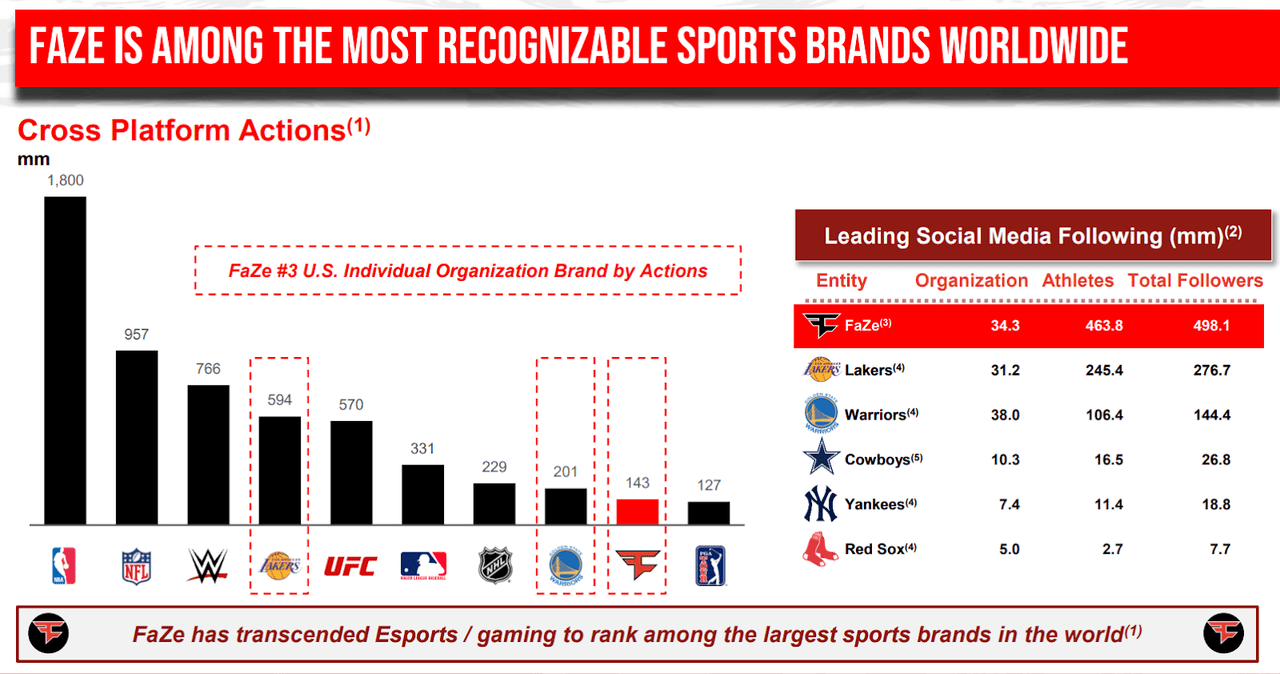

The key to understanding the new FaZe is through media and sponsorship. In this modern, click-based society, the more eyeballs an entity receives, the better. At least at the beginning, as the problem is how to monetize these views. FaZe is certainly good at gaining viewership, they have over 500 million combined followers across all platforms, but now they are working on earning revenues thanks to their large following. I’ll give you some examples.

-

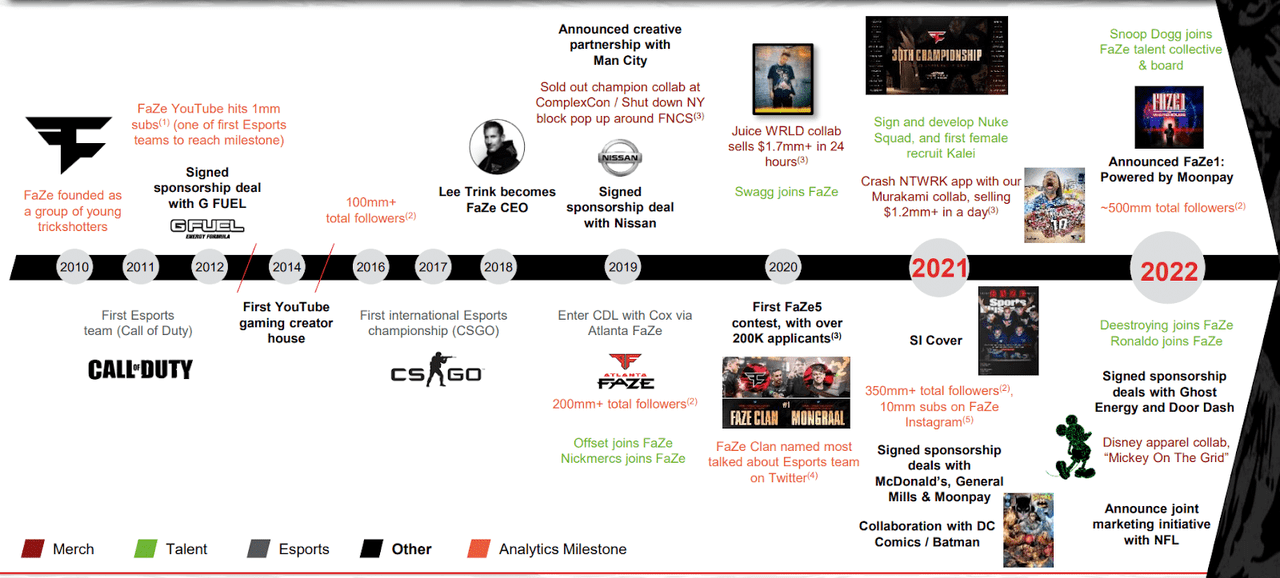

A collaboration with McDonald’s (MCD) for driving “diversity and inclusion”, mostly through specials and interactive media content.

-

Various plugs by celebrities and organizations, such as Snoop Dogg wearing a FaZe chain at the Super Bowl, a FaZe/Batman DC universe mash-up,

-

Merchandise deals, including with famous artist Murakami, rapper Juice WRLD, and even Disney (DIS).

-

Other various sponsors/partners include Manchester City FC, the NFL, Nissan (OTCPK:NSANY), and General Mills (GIS).

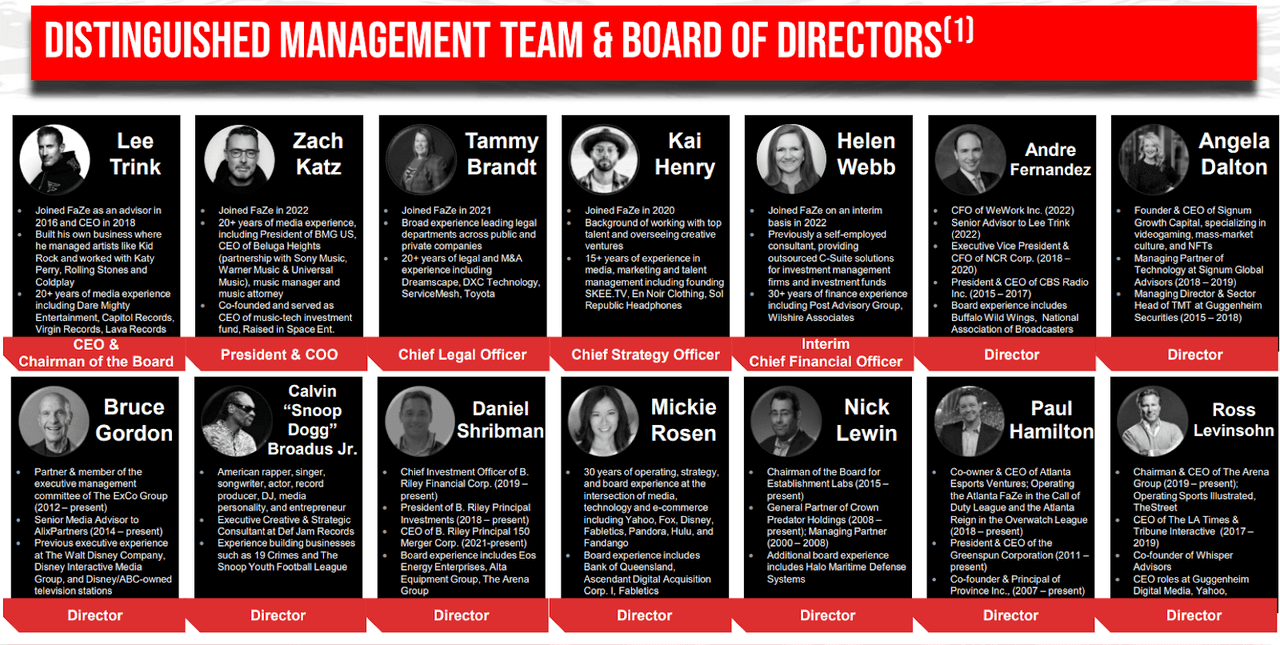

Now that FaZe has moved on from being a band of teens making videos to a mature company with management and board full of media industry stalwarts, I am sure there is actually a viable financial case that one can make. If Roblox (RBLX) can do it, I am sure FaZe can as well. Unfortunately, it is far too early to make any determination about the full financial opportunities. The company has outlined plenty of trillion dollar market outlook data points, along with a highlight of the age difference between FaZe fans and traditional sports media fans, but I will wait to dive into the financials until some sort of pattern emerges. First, I want to highlight the major risk points of the platform.

FaZe Presentation FaZe Presentation

Gaming Rosters Rely on Results

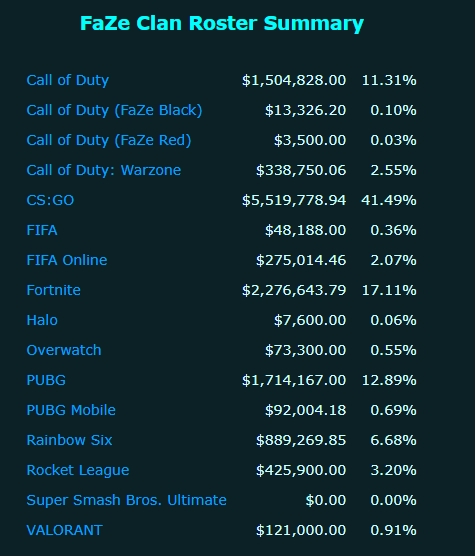

FaZe rides and dies on the back of their talent roster, at least for the time being. With that, some believe that the major revenue segment for FaZe will be via competitive gaming earnings. Unfortunately, as a new industry, Esports earnings are far lower than what would be expected at other tournaments, although payouts are increasing each year. Also, these earnings are unpredictable, risky, and variable as constant performance is required. Further, as evident by numerous bouts of poor-publicity, favorable sentiment may quickly fade if talent says or does something wrong.

Thankfully, FaZe is still a popular leader across multiple Esports, particularly thanks to its roots in Call of Duty and Counter-Strike: Global Offensive. According to Esports Earnings, the FaZe CoD team has earned over $1.5 million USD, mostly thanks to entering over numerous competitions and with multiple teams. The star child, at 40% of total winnings, is CS:GO. According to CSGO database Liquipedia, FaZe has won $5.5 million USD for wins over their lifespan, including three recent $500,000 prizes for winning IEM Cologne 2022 and the PGL Antwerp Major, and $400,000 for IEM Katowice 2022. However, this is just not enough money. Combining all Esports, including the fact that these results are for the better part of the past decade and thousands of competitions, these earnings are scraps for a publicly listed company.

Esports Earnings

Therefore, do not even think about investing in FaZe if you think they will be carried by their gaming leadership. No, investors must rely on the ability of the company to manage sponsorship deals and merchandise sales. While the number of new sponsors has increased rapidly over the past few years, I would look to see many more after the company becomes public. Further, sponsorships only earn so much money (one of the main reasons why there are not many public media entities), and it is unknown what revenues can be seen with time. I think speculators who are in it for the long-run should still wait to see how the monetization of the large fan base unfolds.

FaZe Presentation

FaZe Presentation

Investment Conclusion

Considering the day 1 performance of FaZe, down 25%, I am sure there is plenty of time to be patient and consider the investment. Take the chart above for example, all other entities listed above are private. While there are regulations and rules against teams going public, there are also financial risks that have prevented the practice from being widespread (remember when the Cleveland Indians and Boston Celtics were publicly traded?). According to Stephen Dodson, a portfolio manager for the San Francisco-based Bretton Fund:

‘A sports team is almost always worth more to a very rich person than it is to a company who only cares about its cash flows,’…

… ‘Sports teams are a bit of a vanity asset, like owning a Picasso, and the highest bidder is going to be a very rich person who wants to own the team so they (can) call themselves an owner of a sports team.’

Although, the data is cloudy. Another way to look at is with these two contradictory fun facts by TheScore:

Consider that Apple, the most valuable North American company, produced $123 billion in fourth-quarter revenue. That’s more than all revenue MLB reported for 18 years combined from 2003 to 2020 ($120 billion)…

…All that said, the Celtics and Indians were good investments for Wall Street and fans as publicly traded companies. They weren’t just souvenirs; they both beat the market, which runs contrary to Manfred’s claim last week that the stock market is a better investment than owning an MLB club.

To combat the risk, and fund growth for the future, FaZe has listed on the market to gain necessary cash. At the moment, FaZe should have raised enough funds to hire new talent and pay the large management team a decent salary to motivate them in forming partnerships across multiple industries. Especially since the company only had $50,000 in cash prior to the SPAC listing. Along with that, the company’s business structure is that of a “black check”, and so we are not given any revenue history. The only financial metric I could find was a loss of $7 million last year, so it is unknown how revenues and expenses will balance out after IPO.

Altogether, I find it is far too soon to determine the financial capabilities of FaZe. While certainly an entertaining and speculative opportunity, I would recommend that investors remain on the sidelines, at least for a while. However, if growth is strong, the balance sheet remains healthy, and the valuation becomes reasonable, I will write another article to let readers know of the opportunity. This may end up unlikely.

Thanks for reading.

Be the first to comment