AsianDream

Thesis

Aberdeen Asia-Pacific Income Fund (NYSE:FAX) is a closed-end fund (“CEF”) focused on emerging markets fixed income. The fund has a high 32% leverage ratio and a high concentration in Indian, Chinese, and Indonesian bonds. The fund runs a high local currency exposure (over 60% of the fund) and has been pummeled as the dollar has soared this year.

The fund is down an astounding -25% year to date on a total return basis, but more importantly is down -21% on a 10-year basis on a total return basis. This means that an investor who would have put in $100 ten years ago would only have $79 now, not accounting for inflation! Needless to say the fund has a negative Sharpe ratio and no upside. A savvy investor needs to ask themselves when enough is enough and if there are any prospects in the asset class / investment that warrant to continue holding. We are of the opinion that a high inflationary environment is set to persist, with large amounts of accumulated government debt in the emerging market (“EM”) economies going to be long term headwinds, and that FAX is going to continue to do what it does best – lose investors’ money.

In our view, the factors that are going to continue to represent a headwind for FAX:

1) Global Rates tightening environment

- Canada just raised rates by 100 bps

- South Korea just raised its interest rates by 50 bps, its first-ever half percentage point interest rate hike to fight inflation that is rising at its fastest pace in since 1998

- India had an off-cycle surprise rate hike on May 4

- Malaysia had an unexpected decision to hike policy rates on May 11 followed by another rate hike in the beginning of July

- The Philippine central bank raised its key interest rates by 75 basis points in a surprise move today

2) High Probability of Default for many EM countries

3) Continued dollar strength

We are going to discuss below in more detail each of these factors, but suffice to say there are headwinds in the space. Unlike other markets where well-defined drawdowns are followed by rallies and recoveries, we have not seen this for EM and FAX. Just because you have owned something for a long time does not mean it will ever come back. It is time to think a bit more strategically and understand that we are currently in a bear market across asset classes and while we cannot call a bottom we are pretty certain it will eventually end.

We feel that 2023 is going to be a decent year for returns in U.S. high yield and U.S. equities, but do not feel the same for EM debt. An investor needs to asses their opportunity cost, and in our opinion sticking with FAX will not provide the same level of return in 2023 as the above-mentioned asset classes. In our opinion, it is time to get rid of FAX and never look back.

Performance

FAX is down -25% year to date on a total return basis:

YTD Performance (Seeking Alpha)

The fund has managed to “outperform” the S&P 500 and is close to the Nasdaq loss for the year, although it does not have the gains in prior years that the equity indices expose.

More worryingly, FAX is deeply, deeply negative on a decade-long basis:

10-Year total return (seeking alpha)

An investment that does not deliver over the long term during multiple monetary cycles is not an investment you want to own. Ultimately, one can talk about various risk factors, good/bad entry points, etc., but a good vehicle makes money over a 10-year time frame. Full stop. FAX has failed to do so, and in our view it will fail in the future as well.

Holdings

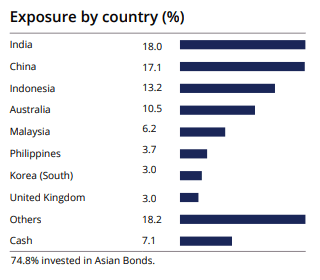

The fund has a high exposure to India, China, Indonesia and Australia:

Country Exposure (Fact Sheet)

The top four countries account for over 58% of the fund exposure. FAX also runs a high local currency exposure:

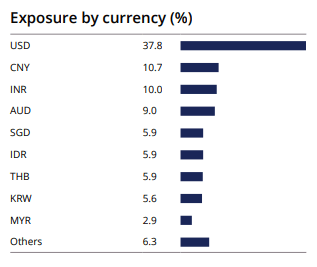

Currency Exposure (Fund Fact Sheet)

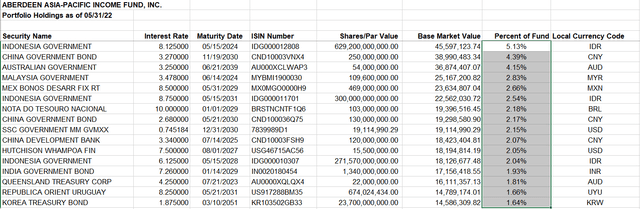

This means that as the dollar has strengthened, the fund has lost in NAV value due to local currency depreciation. We can see that the top holdings in the fund are denominated in local currency:

Risk factors

1) Global Rates tightening environment

– basically as central banks raise rates, bond prices go down. Since the fund holds a lot of local currency debt the price of the respective bonds is going to decrease as local rates go up. This is a negative for the fund

– we are in an environment of rampant global inflation with a Russia/Ukraine conflict which has exacerbated commodity prices

– we expect inflation to persist and local governments to keep raising rates

2) High Probability of Default for many EM countries

– as we have seen with Sri Lanka, political mismanagement can lead to default

– we do not think the FAX portfolio is prone to an outright default, but credit spreads will continue to widen for the underlying names, which will be a negative for the fund

3) Continued dollar strength

– we feel the USD will continue to show strength, although close to peaking

What does the fund have going for itself

The fund does have a couple of items on the positive side:

* a wide discount to NAV of -17%

* a current dividend yield of 12%

While these numbers are appealing, let us take a bit of a deeper dive. For the fund discount – this can never be realized unless the fund buys back some of its shares. CEFs trade at a discount when people do not see the value proposition for the vehicle. This is the case here. The current dividend yield will need to be cut as the vehicle continues to underperform. Do not be lured in by a high yield.

Conclusion

FAX is a emerging markets focused closed-end fund. The vehicle is down -25% year to date due to EM underperformance and high leverage in the vehicle. We feel some of the risk factors that have contributed to the negative performance are going to continue to do so, namely local central banks raising rates, dollar strength and the risk of local EM defaults. FAX has failed to produce positive returns in the past decade, and a savvy investor needs to question themselves if 2023 might offer more appealing return opportunities in other asset classes. We feel that is the case. Sell FAX and do not look back.

Be the first to comment