iambuff/iStock via Getty Images

Thesis

It is no secret that early-stage growth tech stocks have suffered major losses during the market rotation that started in late 2021. Fastly, Inc. (NYSE:FSLY), an edge cloud platform provider, is one of the companies that have lost the most as investors have grown skeptical about slowing growth potential and lack of profits. In this analysis, I look into the current financial state of the company, as well as whether a valuation case could be made, given the tremendous stock price retreat the company has seen over the past few months.

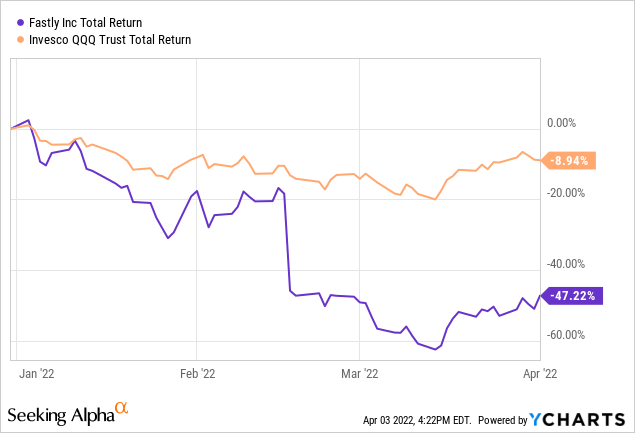

Stock price performance

Over the past six months Fastly’s has marked a massive retreat in stock price. Down more than -47% YTD and -80% from 52-week highs, many investors are losing hope. While the broader market has seen some momentous turmoil, Fastly is significantly underperforming as retail and institutional investors turn away from the pandemic-hyped stocks to seek shelter in established, cash-flow generating companies. Currently, Fastly trades at $13 per share, with a $2.25B market cap.

The business

Formerly known as Skycache, the company changed its name to Fastly, Inc. in May 2012. Fastly operates an edge cloud infrastructure platform that enables developers to build secure and deliver digital experiences with speed. The company uses the functionality of the Content Delivery Network, a geographically distributed network of proxy centers and data centers that essentially decentralizes data availability and performance, closer to the end-user. Serving customers in digital publishing, online retail, entertainment, hospitality, financial services and other sectors the company, Fastly is a highly regarded vendor of CDN technology.

In recent news, the company has completed the acquisition of Fanout, a platform that enables the real-time building and scaling of APIs such as live chat support, eCommerce, video streaming, gaming, collaborative editing, and more of APIs on March 20, 2022. Through the transaction, the company looks to broaden its growth strategy to identify and deploy technologies that increase performance, security and innovation for customers.

Financial performance

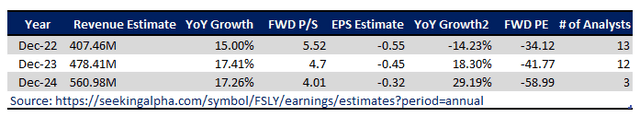

Fastly has posted a respectable growth record over the last few years. Revenue has grown at a 4-year CAGR of 35%, from $105M in 2017 to $354M in 2020, with the company maintaining strong gross margins, above 50%. Over the last year, however, growth seems to be slowing, as Fastly increased revenue from 2020 to 2021 at a 22% YoY rate. The lack of overall profitability only adds to the list of concerns, with the company posting bigger losses in 2021 compared to the previous year, and not expecting to reach a positive net result any time soon.

The slowdown in revenue growth is also apparent when examining analysts’ outlooks over the next few years. Expected to grow at a CAGR of 16% through 2024, forecasted revenue increases seem unimpressive, considering the pressing need the company has to generate profits. With $561M in sales projected for the 2024 fiscal year, Fastly will still be short of reaching a positive net result, as the EPS estimate for the same years currently looks for -$0.32 per share.

Even though someone could argue that a 16% CAGR near-term growth outlook cannot be possibly considered a bearish sign, I would counter that an early growth-stage, disruptive company in the cloud services industry should display better potential. After all, the technology sector, heavily weighted towards mature and established companies like Apple (AAPL), Microsoft (MSFT) and Google (GOOG). Fastly has grown more aggressively, at higher rates, and is expected to continue to do so.

Dilution is another threat facing stockholders. Fastly has aggressively increased its share count from 23M in 2017 to 116M at the end of 2021, looking to cover mounting losses. Shareholders fear further dilution is approaching, questioning the management’s strategy, hurting their returns and ownership claims.

Balance sheet

More concerns seem to arise when taking a closer look at the company’s balance sheet. Fastly’s long-term debt balance has significantly increased, amounting now to 900M or 40% of the company’s market cap. While at this level of leverage many investors are not particularly concerned, comparable companies in the technology sector are known for borrowing considerably less. Coupled with aggressive shareholder dilution, it is becoming clear that the struggle to become profitable is severely impacting long-term survivability. Liquidity on the other hand appears strong as Fastly carries a comfortable 4.74 current ratio and a 4.49 quick ratio.

Valuation

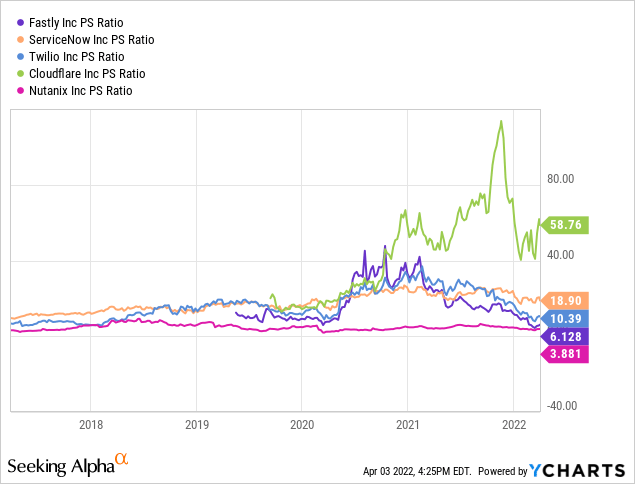

With the stock recording a massive pullback over the past months, stockholders looking for a silver lining to encourage them to hold on to their position, along with potential investors examining the attractiveness of a long position at current price levels, could rotate their focus towards valuation. Despite the price retreat, however, with the company still at a 6x P/S multiple, it is hard to see how Fastly could present a value opportunity unless the company’s growth outlook drastically changes and profitability struggles fade. While a P/B ratio of 1.92x might indicate that the stock is reasonably valued, it is important to note that this particular metric is ineffective in valuing companies in the cloud service industry that are notoriously asset-light.

On the other hand, when taking a look at P/S multiples across different companies operating in the cloud space, at 6x sales it could even be argued that Fastly is trading at a reasonable valuation. However, most of the comparable companies portrayed in this analysis maintain stronger growth outlooks or improving profitability metrics and encourage investors in that sense to pay a higher premium.

Final Thoughts

After all things are considered, I still find it hard to embrace a bullish outlook for Fastly, despite the significant drop in the stock price, which should in theory make the stock more attractive, at least on a valuation basis. Profitability struggles, increasing leverage, shareholder dilution, and an underwhelming growth outlook should keep a more conservative investor from considering adding Fastly to a portfolio.

Be the first to comment