MicroStockHub/iStock via Getty Images

Introduction

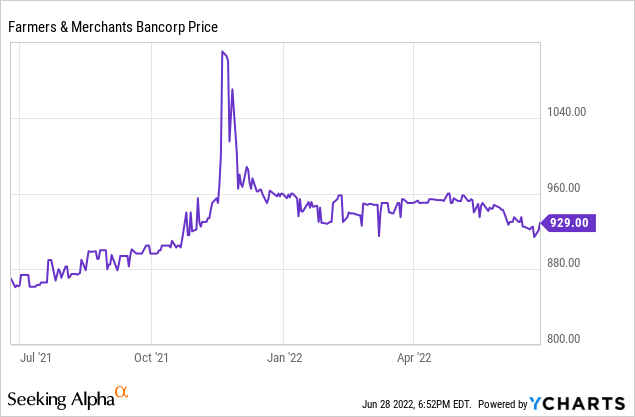

In an article published in December 2021, I expected Farmers & Merchants Bancorp (OTCQX:FMCB) to increase its book value by about $60 per share per year. Unfortunately I no longer think this will happen. Not because the bank’s earnings profile is deteriorating, but because the higher interest rates are reducing the unrealized gains and increasing the unrealized losses on the securities portfolio. We already saw a noticeable impact in the first quarter and I don’t expect to see a stabilization in Q2. Notwithstanding this, I still think FMCB is trading at an interesting level.

A strong result in the first quarter leads to another dividend hike

FMCB is active in California and investors are cautioned not to confuse FMCB with other banks carrying the same name. ‘Farmers & Merchants’ is quite a generic name for a bank and there are several regional and local banks with that name listed on the exchange. To avoid any doubt, this article is focusing on FMCB.

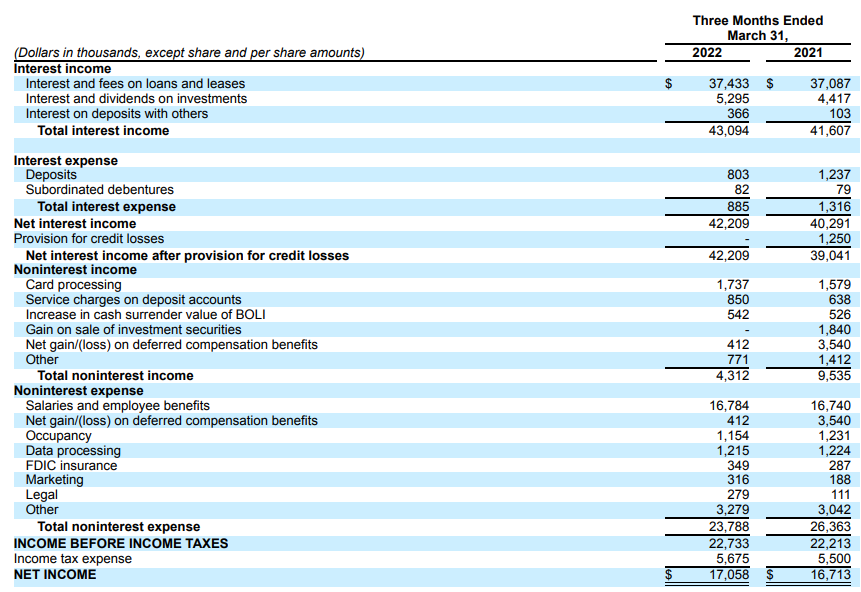

In the first quarter of the current financial year, Farmers & Merchants should be pretty satisfied with its net interest income as the combination of a decreasing interest expense with increasing interest income resulted in a 5% increase in the net interest income, which jumped to $42.2M.

FMCB Investor Relations

Meanwhile, the net non-interest expenses increased from less than $17M to just over $19M mainly because the bank could not replicate some of the non-recurring gains on the sale of investment securities. Notwithstanding this slightly worse result, the pre-tax income increased by almost 3% although this is entirely due to the lack of loan loss provisions. Whereas FMCB recorded $1.25M in provisions in the first quarter of 2021, it didn’t (have to) record any provision in Q1 2022. The higher pre-tax income also boosted the net income which came in at $17.06M for an EPS of $21.70. The EPS increased faster than the net income did as FMCB repurchased a few thousand shares which reduced the share count by about half a percent to 786,000 shares. That was just the average share count during the quarter and the total amount of shares outstanding was further reduced and as of April 30, the net existing share count was just under 784,000 shares.

The bank does pay a dividend, not on a quarterly basis but on a semi-annual basis and recently hiked its semi-annual payment to $7.85 and this marks the 57th consecutive year this local bank has increased its dividend. The full-year dividend came in at $14.75 in 2020 and $15.30 in 2021 and this year’s dividend will likely come in closer to $16/share.

A portion of its earnings is used to buy back stock and in the first quarter of this year, the bank spent $4.25M on buying back exactly 4,500 shares, indicating it paid an average price of approximately $945/share.

The book value per share barely increased due to the higher interest rates

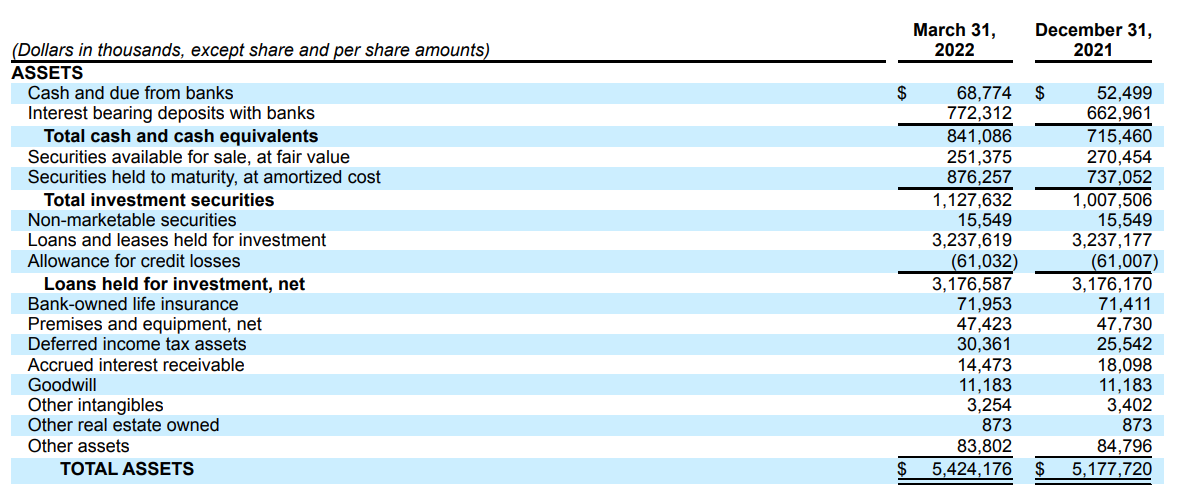

My expectation to see the book value increase by about $60/share on an annual basis was based on pretty straightforward assumptions. The bank is generating $80-85/share in earnings and is paying out a dividend of just over $15/share so the remainder of the earnings were supposed to be retained on the balance sheet and after knocking off some dollars for the buyback plans, the BVPS should increase at a rate of approximately $60/year, further reducing FMCB’s premium to the book value.

But that likely won’t materialize this year, and I think shareholders should already be happy if we only see half of the $60 being added to the book value. The main ‘issue’ is related to the securities on the asset side of the balance sheet.

FMCB Investor Relations

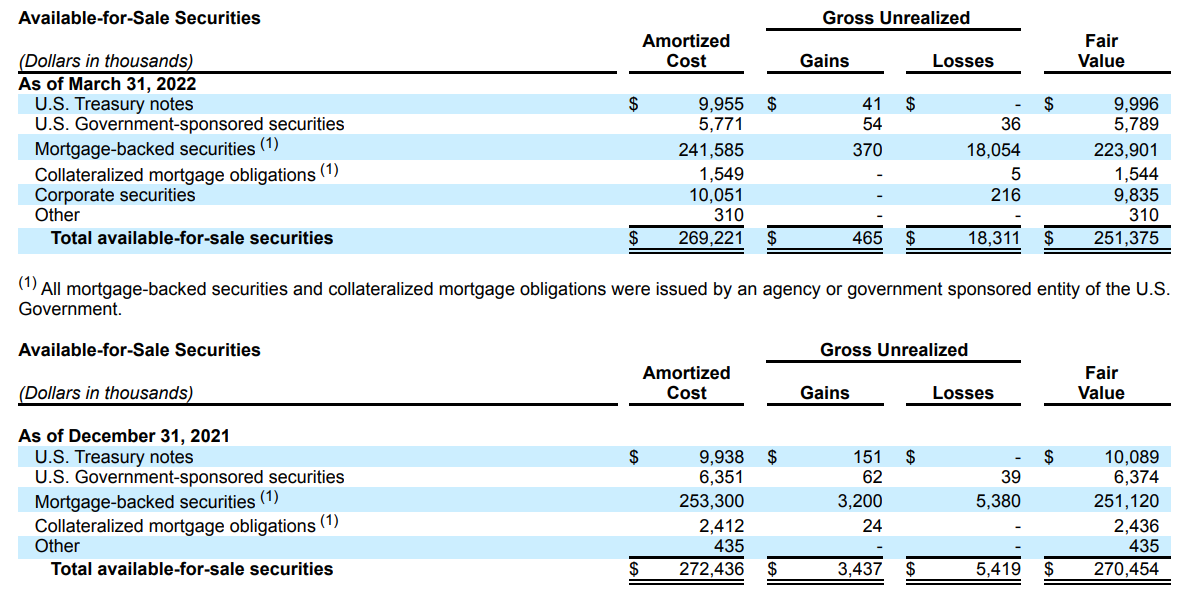

While I certainly appreciate FMCB running a conservative balance sheet which consists for in excess of 35% of cash and securities, owning in excess of $1.1B in securities also has a downside. The higher market interest rates reduce the fair value of the securities and the securities classified as ‘available for sale’ had to be marked down. The image below shows how the total amount of unrealized losses has increased while the total amount of unrealized gains has decreased.

FMCB Investor Relations

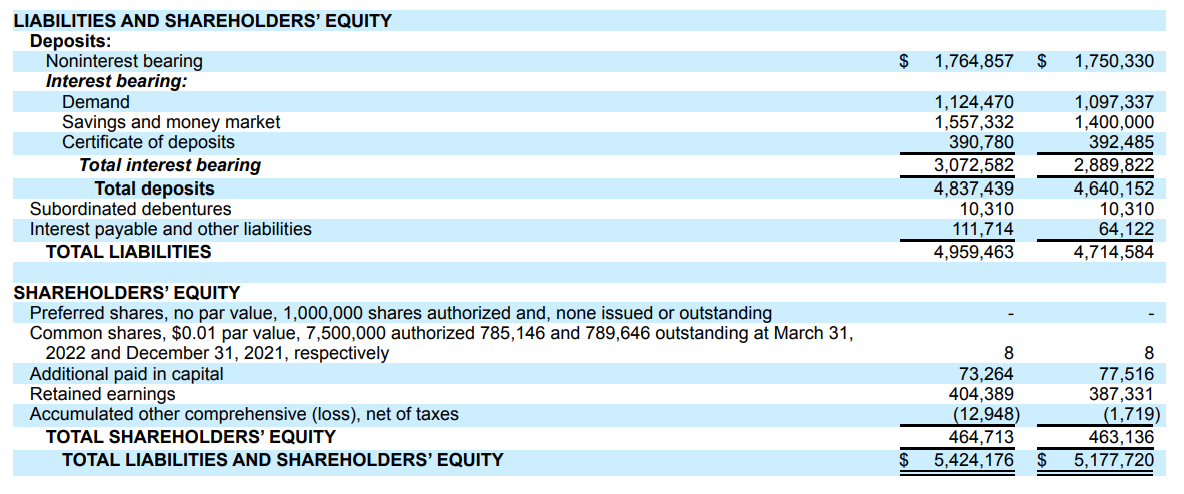

This means that the impact of these fluctuations in the fair value in combination with buying back shares has strongly mitigated the impact from the earnings in the first quarter. As you can see below, the equity value has increased by just $1M.

FMCB Investor Relations

Investment thesis

The book value per share came in at approximately $592 as of the end of March and while this was still an improvement from the $586/share as of the end of 2021, it means Farmers is now unlikely to indeed grow its book value per share by $60 towards $650 this year despite the strong financial results and strong loan book (less than 0.1% of the loans is classified as ‘past due’).

The tangible book value was approximately $560/share and I’m also not expecting a meaningful increase here. This means the current premium to the book value of 60-65% is perhaps a little bit rich but I still like the earnings multiple of just 11 as well as the very strong loan book with virtually no loans past due.

I have no position in FMCB and although this bank clearly isn’t the cheapest or highest yielding bank, it does offer another important element: peace of mind. And that’s also worth something.

Be the first to comment