onurdongel/iStock via Getty Images

Thesis

Given the current market environment short-ideas are in high-demand, yet not in short supply. In this article I would present one of my high-conviction sell recommendations: Farfetch (NYSE:FTCH). The company appears structurally unprofitable in a highly competitive environment (1), the company dilutes shareholders (2) management’s investment/M&A strategy questionable (3). Despite liking Farfetch as a platform, I just don’t see how investors are possibly going to be rewarded buying the company’s equity at a $2.5 billion valuation.

About Farfetch

Farfetch operates one of the world’s most popular online shopping platforms for premium fashion clothing, shoes and jewellery. The company operates a business model whereby Farfetch mainly serves as a match-maker of premium fashion boutiques (sellers) and shoppers (buyers), and takes a commission fee on the transaction. As of Q1 2022, the Farfetch marketplace offered more than 1 million products from over 1,400 sellers, including both brand partners and multi-brand retailers. Farfetch was founded in 2007 and first sold shares to the public in 2018.

Many red flags, one positive

Personally, I like Farfetch and I regularly shop on the platform. That said, my issues with the company do not relate to the company’s products or services, but to the company’s valuation, which I think is too high. In my opinion, Farfetch’s business operations appear structurally unprofitable. This argument is supported by an empirical observation that the company has recorded negative EBITDA ever since the company’s inception. The problem with online fashion retailing is, in my opinion, that the business is almost entirely price driven. A Balenciaga shirt on Farfetch is the same as a Balenciaga shirt on MyTheresa, LuisaviaRoma, Net-A-Porter, Moda-Operandi, SSense, etc–to name just a few of Farfetch’s competitors. Moreover, most boutiques that sell on Farfetch also operate their own e-commerce shop.

In 2021, Farfetch generated a negative operating income of -$462million. Cash provided by operation was even worse: -$282 million. As for other growth tech/internet firms, this loss is not due to significant R&D expensing, which were only $132 million for Farfetch in 2021, but due to elevated SG&A costs equal to $1,096 million. Reflecting on a highly competitive market environment and low margins for Farfetch as a buyer/seller match-maker, it is very hard to see how Farfetch can grow into considerable profitability–if ever.

In addition, Farfetch is diluting shareholders through share-based compensation programs which jumped from $53 million in 2018 to $219 million in 2021. For a company that is writing such considerable losses, what is justifying management to support a 7% – 8% of market capitalization dilution through stock awards? As the company is struggling with profitability and cash flow, the company is pushing a considerable expense out to shareholders.

Another aspect that I do not like relates to Farfetch’s CAPEX/investment strategy. For a structurally unprofitable company, depended on capital markets, Farfetch is arguably doing way too much M&A as the company has spent over $900 million on 6 acquisitions: New Guards Group, Stadium Goods, Style.com, Curiosity China, Luxclusif and Palm Angels. Moreover, the company’s CEO has confirmed interest in buying a minority stake in Richemont’s YOOX Net-A-Porter. But with CAPEX and OPEX deeply negative, who/what is holding the balance?

In the past, Farfetch’s operating loss and CAPEX deficit was no market concern, as money was cheap and Farfetch could support its business operations through access to capital markets. This has been the strategy that many unprofitable, yet glamorous companies, such as Uber (UBER), DoorDash (DASH) and WeWork (WE) operates. Now, however, as the market is turning risk-averse and equity valuation depress on rising interest rates, Farfetch is likely going to have a hard time to support its business operations as is.

That said, Farfetch’s cash balance is only $938 million as of Q1 2022. Given the company’s negative operating and investing cash flow for the past 12 months of 724 million cumulatively, I do not see how Farfetch can continue without significant share-holder dilution through an equity issuance. Given the company’s low market cap, this will imply a significant dilution. Of course, a debt issuance is possible as well. But given Farfetch’s financials and rising interest rates, the cost for debt will likely be equally high.

Furthermore, Farfetch’s operating loss has been and is company-specific and independent of macro-economic challenges. Again, this is an empirical observation as the company has not managed to turn a profit during the recent economic upswing. Now, investors must also consider decade-low consumer sentiment, rising freight costs and inflationary pressures in general, geopolitical tensions. In 2021 Farfetch had >15% combined revenue exposure to Russia and China. The following snippets are from Farfetch’s analyst call Q1 2022 (emphasize my own).

…by the end of 2021, Russia has grown to become our third largest marketplace market, representing 6% of total GMV and an even higher share of the marketplace where it posted more than 70% year-on-year growth. Naturally, we expected the continuation of robust growth from this market and our stoppage in Russia considerably impeded GMV growth. We also believe the conflict had a spillover effect in Europe and CIS countries where we have seen less buoyant demand than expected. Based on the current status of this conflict, we have no expectations of reinitiating operations in Russia for the foreseeable future.

Moving to China, our second largest market, the rise of COVID-19 cases against the backdrop of a zero COVID policy increasingly impacted our growth trajectory. The majority of our Mainland China business consists of cross border sales from Europe to Tier 1 cities, such as Shanghai which serves as a major cross border hub, and as such we experienced significant disruptions in our delivery operations for the China market.

On the positive site, Farfetch’s business ex-China and ex-Russia is growing strongly. According to Bain-Altagamma, the online luxury market will grow at a CAGR of approximately 7% from 2021 to 2025, reaching a market size of $108 billion (equal to approximately 30% of the total luxury market size of $370 billion). Moreover, Farfetch is expanding attractively in China, with a $1.15 billion joint-venture with Alibaba’s Tmall. But again, as a shareholder I would not be concerned with Farfetch’s topline growth, but with the company’s profitability, business model and strategy. Specifically, I would like to see how Farfetch is planning/able to capture economic returns from growth.

Risks To My Thesis

The major risk to my thesis is, in my opinion, that the market re-discovers its appetite for loss-making companies and the decade-long bull-market continues. If this were to be the case, Farfetch could easily continue to fund negative operating cash-flow with financing from the capital markets.

Secondly, investors might also consider that the online fashion retail industry could consolidate–or grow to become a monopoly similar to Amazon. If Farfetch would claim this market, the company could enforce stronger bargaining power against consumers and partners. This would support Farfetch’s operating margins–and could nudge the company to profitability.

Personally, however, I see both arguments — the continuation of the bull-market and industry consolidation — as unlikely. Or at least, I don’t see these scenarios playing out within the next 6 – 12 months.

Valuation

Farfetch currently trades at a $2.5 billion equity valuation (market capitalization) and I argue this valuation is way too high, as I cannot see any visibility for operating profitability. I am not alone with this assessment. In fact, analyst consensus estimates a $257 million operating loss even in 2025–despite $4.4 billion of revenues (Source: Bloomberg Terminal as of 15th July). For reference, earnings and EBITDA are negative, operating profitability remains elusive until at least 2025, and BVPS is only $2.25, of which most are intangible assets. Thus, where should an analyst anchor his/her valuation? In case Farfetch can prove operating profitability, I will write a follow up and anchor a valuation on the updated facts. But for now, I will not attach a price target to Farfetch stock at this point.

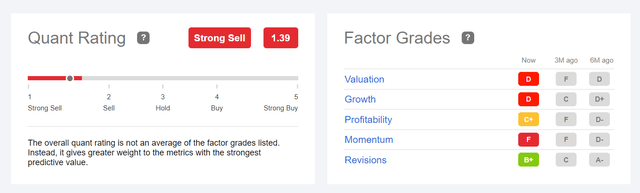

As an alternative to a valuation, investors might consider Seeking Alpha’s Quant Rating for Farfetch. Notably, Seeking Alpha’s rating strongly agrees with my assessment.

I advise to be careful with investments in Farfetch. Even though the stock is down about 80% YTD, the company is still highly speculative and I believe the stock could potentially go much lower. Initiate with a Sell recommendation.

Be the first to comment