onurdongel

By now, it has become relatively clear that the world is tilting toward some form of a recession: the only question is how deep it will be. Discretionary spending categories, especially on things like luxury goods, have already started to see sharp quarter-over-quarter declines, and many of the hottest consumer internet/e-commerce stocks during the pandemic have become huge eyesores in our portfolios.

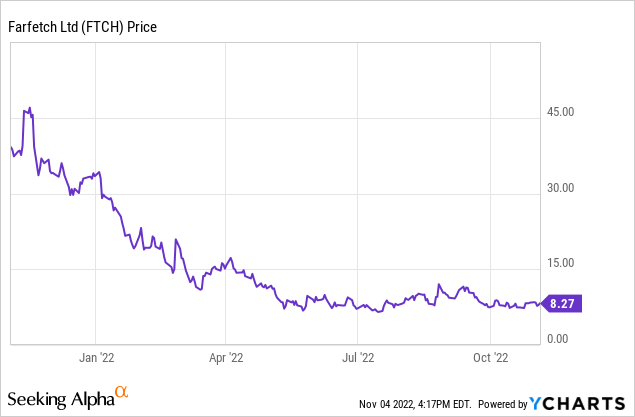

Farfetch (NYSE:FTCH) is one clear example here. This luxury e-commerce company has lost a whopping 75% of its value since the start of the year, as the company continues to issue a dollop of bad news with each passing quarterly earnings release. The company next reports earnings in mid-November, and to say the least, confidence in the stock is quite low.

Despite the recent downtrends in the stock, as well as the near certainty that the last two quarters of FY22 will likely prove to be quite dismal for Farfetch, I think most of the risks are now well-known and priced into the stock, and I am shifting my rating on Farfetch to neutral. I’m simply of the mind that investors will soon tire of indiscriminately selling off e-commerce stocks, and with both valuations and fundamental expectations for these stocks sitting at multi-year lows, I think companies like Farfetch have the potential to rebound on the slightest whiff of good news.

Of course, there are major red flags here and risks to consider:

- China may be front-running the world’s recession. Consumer confidence is down in the world’s largest economy (which is an outsized buyer of luxury goods, needless to say), and renewed COVID resurgences won’t be friendly to Farfetch either.

- Major FX headwinds. A good chunk of Farfetch’s revenue is international, which leads to major FX translation losses on a dollar basis.

- How long will the luxury category take to recover? If a global economic recession is protracted, it may take the luxury category a long time to rebound. If anything, post-pandemic trends have shifted toward more casual and relaxed attire, and a more penny-pinched global population may have lower proclivity to spend on unneeded luxuries.

That being said, I don’t think it’s all bad for Farfetch; in particular, I think investors should consider a few “saving graces”:

- Farfetch is quite well capitalized for a turndown. The company has $1.47 billion of cash on its most recent books, and even after we take out $515 million of debt, it still has nearly $1 billion of net cash left. That’s plenty of financial flexibility to withstand a downturn, especially as the company isn’t printing huge losses (its adjusted EBITDA margin is roughly flat).

- Gross margins are holding up. Due to the fact that Farfetch has reduced its reliance on demand generation and promotional activity, the company has managed to hold up its gross margin profile – even in this inflationary environment.

The bottom line on Farfetch: this isn’t my first choice of investment in a very choppy market. I’d rather buy into an enterprise software company that is similarly beaten down but has contractual recurring revenue. At the same time, considering Farfetch’s considerable net cash position (which is roughly a third of its current market value), its proven niche in the luxury e-commerce market which even Amazon (AMZN) has failed to penetrate, and a relatively healthy margin/EBITDA profile, I’d put this one on a watchlist.

Q2 download

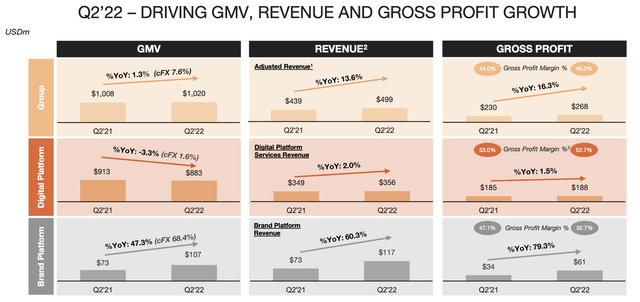

Let’s now briefly go through the highlights of Farfetch’s most recent quarter. Though investors picked up very well to the risks in the top line, there are also some positive callouts worth mentioning. The Q2 earnings summary is shown below:

Farfetch Q2 key metrics (Farfetch Q2 earnings presentation)

As shown above, Farfetch’s GMV – the most closely-watched metric for the company, as is the same for every other e-commerce business – grew at a measly 1% y/y pace, decelerating slightly over Q1’s 2% y/y growth rate. This is driven by both a reduction in consumer spending as well as heavy FX impacts. On a constant-currency basis, the company would have seen stronger 8% y/y growth. The company’s third-party digital platform saw as-reported growth decline, while the company’s own brands saw rapid 47% y/y growth, due to strong customer reception of the company’s Off White and Palm Angel brands. Growth here was also partially driven by a catch-up and recovery from a Q1 warehouse issue. In-store revenue also grew 39% y/y.

The offsetting good news to total GMV deceleration here is that revenue grew 14% y/y, actually accelerating over Q1’s 7% y/y pace. This is driven by the greater weight of the faster-growing brand platform revenue as well as higher take rates of the digital marketplace. The company also maintained its active customer base flat to Q1 and up 13% y/y to 3.8 million.

Margins were another major win for the quarter. The company’s overall gross margins actually rose 220bps to 46.2%. This was primarily driven by an improvement in brand platform margins (up six points versus the prior year), which also had a greater contribution to revenue this quarter.

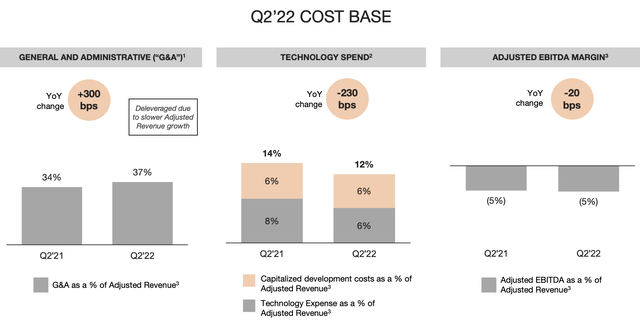

And while Farfetch also saw opex inflation alongside many other companies, the three-point increase in G&A costs was almost entirely offset by a two-point reduction in technology spending. As a result, adjusted EBITDA margins were flat at -5% for the quarter:

Farfetch adjusted EBITDA profile (Farfetch Q2 earnings presentation)

Key takeaways

In my view, it’s not a pure doom-and-gloom story for Farfetch. I think the health of the company’s first-party brands, its relatively stable margin profile, and its ample cash balances will help it get through the current recession. At the same time, the recovery timeline of the luxury market plus the fact that Farfetch’s revenue is heavily concentrated in China and Europe (whose currencies have depreciated dramatically against the dollar) are major risks. I’d say stay on the sidelines here, but at the same time Farfetch doesn’t have much more room on the downside.

Be the first to comment