Design Cells/iStock via Getty Images

Nektar Therapeutics (NASDAQ:NKTR) is now facing the unenviable challenge of picking up the pieces and rebuilding investor confidence in the company and the stock after the disappointing failure of the company’s pivotal combo study in melanoma. Although there are still additional studies of bempegaldesleukin (or “bempeg”) that have yet to read out, it seems unlikely that there will be winners here, leaving Nektar as a more development-stage biotech with three early-stage lead compounds.

I was completely wrong about the likelihood of bempeg succeeding in melanoma, and that was what I believed to be the program with the highest likelihood of success given the established use of IL-2 as a last-ditch therapy. I can’t completely write-off the remaining bempeg studies, but I think it would be highly surprising if any of them showed efficacy to warrant an NDA submission, and the three remaining lead compounds (NKTR-358, NKTR-255, and NKTR-262) are too early in their development to support a strong share price today.

PIVOT Fails

On March 14, Nektar and Bristol Myers (BMY) announced that the first analysis of the phase III PIVOT IO-001 study of bempeg and nivolumab (Opdivo) in first-line melanoma showed that the study failed. With these results, the companies decided to unblind the study, perform no additional analyses for the overall survival endpoint, and end the PIVOT-12 study of the combo as an adjuvant therapy in melanoma.

Instead of the hoped-for improvement in progression-free survival, the combo showed a 1.09 hazard ratio (meaning that patients on the combo fared worse than those getting just nivolumab), with nivolumab monotherapy showing a 5-month PFS that was inline with prior studies (the companies used a PFS of 6.9 from the CheckMate-067 study to power PIVOT).

Combo studies of bempeg and nivo are continuing in renal cell carcinoma (or RCC) and bladder cancer, with an update on RCC expected within a month or so and bladder a month or so after that. Given the established history of using IL-2 therapy in melanoma (bemeg is a modified form of IL-2), I believe this was the best clinical opportunity for bempeg, and coupled with earlier-stage clinical data, I don’t see much likelihood of success in RCC or bladder.

Likewise in lung cancer. The Phase I/II PROPEL results produced back in December of 2021 don’t provide much basis for confidence, particularly as the only patient subgroup to show differentiation versus monotherapy was in patients with PD-L1 below 1%, and there’s really no biological rationale that I’m aware of to drive a higher response there (so it could well be an artifact of the small number of patients in the study). There will be data coming later this year from a PROPEL triplet study (bempeg + Merck’s (MRK) pembrolizumab + chemo), but again I don’t see an argument for how/why bempeg would outperform here.

A Brief M&M On Bempeg In Melanoma

It’s commonplace for hospitals, teaching hospitals in particular, to have regular meetings called M&M’s (morbidity and mortality) where severe complications, adverse outcomes, and/or patient deaths are reviewed, with the idea being to scrutinize the decisions that were made and determine whether the outcome was preventable. While the process can be very uncomfortable, even for veteran clinicians, M&M’s are seen as invaluable teaching tools, and I think the principle can and should be applied to investing as well.

I had valued Nektar with a 66% chance of success in the PIVOT study, but I definitely didn’t take proper account of warning signs that were visible in Phase II development and before.

One of the indicators I dismissed was the lack of monotherapy efficacy for bempeg. This was an issue pointed out with Incyte’s (INCY) epacadosat after its Phase III failure (after promising Phase II results), but this one is difficult to assess in an age where combo therapies are becoming more important. There are certain drug classes like MEK inhibitors that don’t show much single-agent efficacy (outside of some less common melanoma sub-types) but do seem to lead to improved results in combination with other agents (BRAF inhibitors in the case of MEK inhibitors). At best, this is a mixed indicator – you’d like to see monotherapy efficacy, but it’s not necessarily disqualifying in all cases.

There were also issues in the PIVOT-02 study design and results that I should have paid closer attention to when assessing the likelihood of Phase III success. PIVOT-02 was not only modest in size as far as enrolled patients went, but it also included a higher mix of patients with a better prognosis (normal LDH scores, M1a/M1b stage disease, et al) and no active comparator arm.

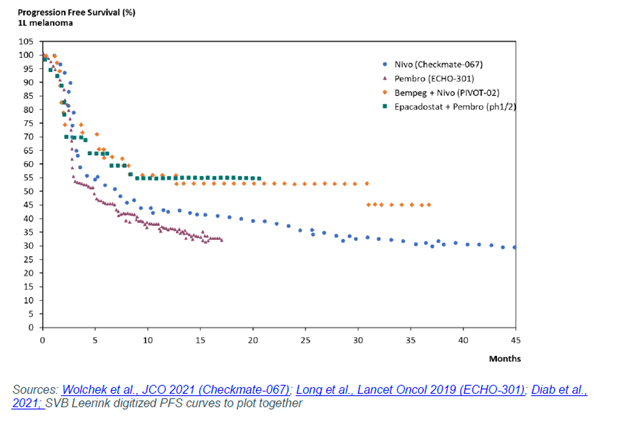

The study also showed higher complete response rates without meaningfully higher ORR, and if you compare the PFS results of the Phase I/II epacadosat study to PIVOT-02, as SVB Leerink analyst Daina Graybosch did, you see an eerie similarity.

SVBLeerink

Last and not least is a personal factor. I may get lashed for this in the comments, but so be it. Given that my wife died from metastatic melanoma at age 41, I won’t discount the risk that I was unconsciously rooting for this drug combo to succeed, and let that lead me toward a higher estimation of its odds of success.

At a minimum, I should have used a more conservative success estimate given the small size of the Phase II study, the lack of an active comparator arm, and the healthier mix of enrolled patients. That said, even a more conservative estimate of success (33% to 50%) would have still overestimated the value of the melanoma opportunity and the overall bempeg opportunity.

What’s Next For Nektar

As I said above, I’m not very bullish on the prospects for bempeg in its remaining indications. While all of these diseases are different, the reality is that PIVOT IO-001 is the most rigorous study done to date on bempeg and the results weren’t even close. As I found the earlier-stage results from RCC, bladder, and lung cancer less compelling than the melanoma data, I can’t say I see much chance of success here now.

Nektar does have three other compounds worth watching today, but all are early stage now. NKTR-358 is the most advanced, with partner Lilly (LLY) set to provide more data on Phase I studies in atopic dermatitis and psoriasis in a few months and Phase II data in lupus in the second half of the year. Data thus far, including preliminary Phase 1b data in moderate-to-severe atopic dermatitis, have been encouraging, but I think the atopic dermatitis results will have to improve for the drug to be a serious competitor to Sanofi (SNY) / Regeneron’s (REGN) Dupixent.

There has also been some early-stage data on NKTR-255 in relapsed/refractory multiple myeloma, non-Hodgkin lymphoma, colorectal, and head & neck cancer. At the December ASH meeting, the company presented early Phase I data from 15 evaluable rrMM and NHL patients, with 53% showing stable disease and some evidence that NKTR-255 could enhance the efficacy of CAR-T therapy. While this is enough to continue studying the drug, it’s worth remembering that only about 5% to 10% of Phase I oncology drugs make it to approval and there’s nothing extraordinary about the data here so far.

Less information is available on NKTR-262 at this point, and it’s unclear to me what the development path will be here given the challenges with the bempeg programs (NKTR-262 has largely been developed as a part of bempeg combo therapies thus far).

The Outlook

I use token odds of success for bempeg in its remaining indications today. Success in any one of RCC, bladder, or lung cancer would certainly support a higher share price, but I view that as a very low-probability outcome.

Based on past success rates for Phase II autoimmune disease drug candidates, I believe NKTR-358 is worth about $5/share today given multibillion-dollar revenue opportunities in lupus, atopic dermatitis, and psoriasis, but odds of success of less than 15%. This is the primary value driver now, as although NKTR-255 and NKTR-262 could become considerably more valuable if clinical data warrant more bullishness, they’re worth less than $2/share today given the low odds for Phase I oncology drugs.

Nektar does have over $4/share in cash and investments on the balance sheet, and that’s a decent short-term floor for the company, but the company will likely burn that cash developing NKTR-255, NKTR-262 and other pipeline candidates, so it will be a shrinking backstop.

The Bottom Line

All told, I think $7 is a reasonable fair value for Nektar today given the low likelihood of success of the remaining bempeg trials and the early-stage nature of the other pipeline compounds. Over $4/share in cash gives Nektar breathing room to further develop its pipeline, and I can understand investors wanting to stick around and see if there’s any salvage value in bempeg to go with future updates from these early programs. While there just aren’t the data in hand today for NKTR-358 or NKTR-255 to support a higher fair value relative to typical pipeline success rates, both could well prove far more valuable down the line if clinical studies prove out their efficacy.

Be the first to comment