Thinkhubstudio

Increasing global internet penetration and the number of connected devices such as IoT [Internet of Things] means web traffic is exploding. The number of Internet of Things [IoT] devices globally is forecast to nearly triple from 9.7 billion in 2020 to more than 29 billion devices by 2030. More connected devices mean a wider attack surface and thus more opportunities for hackers. Therefore it’s no surprise that the Cybersecurity market is forecasted to grow at a 13.33% compounded annual growth rate [CAGR] and reach over $298 billion by 2027. Companies are also going through a Digital Transformation to the cloud and that industry is expected to be worth over $1 trillion by 2028. F5, Inc. (NASDAQ:NASDAQ:FFIV) is a leading cybersecurity company that focuses on application performance and security. I forecast the company to benefit from the growth in the aforementioned trends across increasing web traffic, cybersecurity, and the cloud. The company recently generated strong financial results for Q3FY22, beating both revenue and earnings estimates. In this post, I’m going to break down the company’s business model, financials, and valuation. Let’s dive in.

Secure Business Model

F5 is a leading cybersecurity company that focuses on the security, performance, automation, and monitoring of applications.

F5 Networks (Official Website)

Slow applications with bottlenecks in bandwidth cause a poor customer experience. According to a Salesforce study, 61% of customers switched to a competitor product that delivered a better experience. In order to mitigate this, F5 provides an Application Delivery Controller [ADC], called BIG-IP Local Traffic Manager. This device “intelligently manages traffic” by balancing the load between servers. A simple analogy of how this works is to imagine a coffee shop with multiple cashiers, without a load balancer, the web traffic (customers) may all just line up at cash register one. This would cause a system slowdown, to prevent this a load balancer acts as a “concierge” that balances the traffic. This also helps with security by preventing what is called a “Slow Loris” attack. This basically involves an attacker initiating a web request before, going silent and delaying the system [TCP three-way handshake]. A simple analogy is to imagine a slow customer in a coffee shop that keeps changing their mind and holds up the entire line.

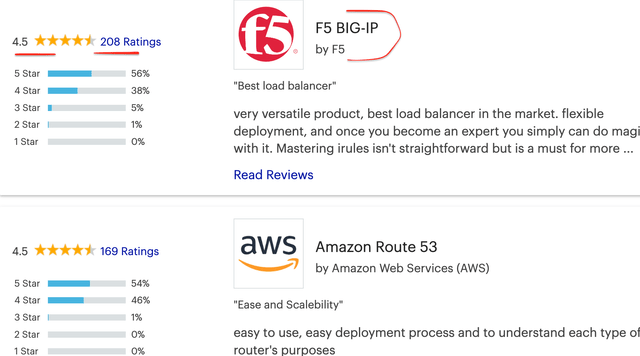

For Application Delivery Controllers [ADC], F5 has a 4.5 out of 5 star rating on Gartner and comes in second overall by the number of reviews. According to G2, F5 also has a 4.5/5 star rating and is on the first page of results. Smaller competitor A10 Networks (ATEN) which I have previously covered, offers a similar solution. They have the same 4.5/5 star rating but fewer reviews overall and thus are much lower down the list on Gartner. This doesn’t necessarily mean F5’s product is better, but if it higher up on the web page it is more likely to generate new business, leads and ultimately sales.

F5 sits above AWS Route 53 (Gartner Reviews for ADC)

F5 Networks also offers a variety of other products such as below:

The firewall products help stop cybersecurity attacks, such as a DDoS (Distributed Denial of Services) attack. For firewalls the company will compete with company’s such as Fortinet (FTNT) and Palo Alto Networks (PANW).

In addition, Carrier Grade NAT (Network Address Translation) provides businesses with IP addresses. This is because we have actually run out of IPv4 addresses and thus a “translation” must be done, but that is beyond the scope of this post. All you need to know here is the company provides a lot of essential services which are necessary in our ever-connected world.

Steady Financials

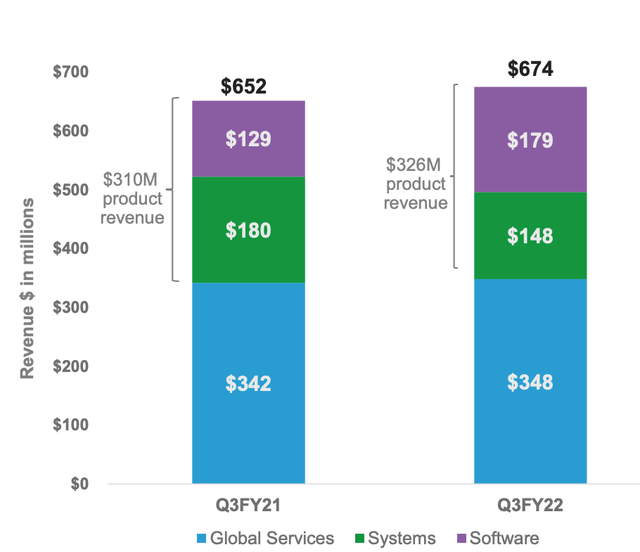

F5 generated solid financial results for the third quarter of FY22. Revenue grew by 4% to $674 million, up from $652 million in the prior year. This may not seem incredibly fast growth, but this still beat analyst expectations by $6.67 million. Revenue was driven by solid Product revenue growth of 5%, and a rapid 38% growth in its software revenue. This is part of the company’s ongoing transition, from a “hardware” focused business to a software-focused company. This transition has been a challenge for the business and has required a whole host of acquisitions to compete. For example, in 2019 the company acquired NGINX for $670 million in order to bolster its application delivery service across the multi-cloud infrastructure. The company also acquired Volterra in 2021, to take advantage of its “edge as a service” platform.

F5 saw its Systems revenue decline by 18% year over year, due to semiconductor shortages. In addition, Global services revenue popped by 2% year over year.

Revenue Split (Q3,22 Earnings Report)

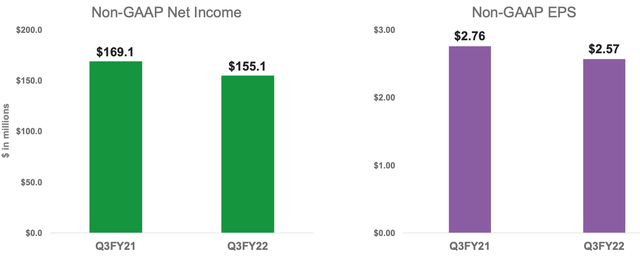

Earnings Per Share [GAAP] was $1.37 in the quarter, which beat analyst estimates by $0.19. Net Income on a GAAP basis was $83 million and $155.1 million on a Non-GAAP basis. Net Income did decline slightly year over year, as the company’s margins are getting squeezed by a rocky transition of its business model. I don’t deem this to be a major issue currently and expect the effects to be short-term in nature.

Income and EPS (Q3,22 Earnings Report)

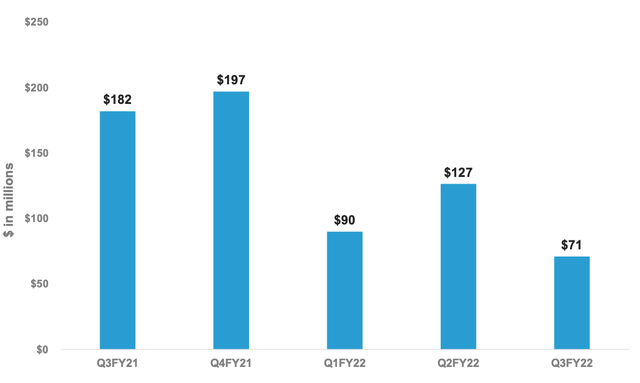

The company generated over $71 million in cash flow from operations. This was impacted by strong multi-year subscription sales which effectively spread out invoices annually, thus we see staggered results.

Cash Flow (Q3,22 Earnings presentation)

Despite the headwinds, management showed confidence and authorized an addition, $1 billion in share repurchases. During Q3FY22, the company bought back $250 million worth of stock at an average price of $171 per share.

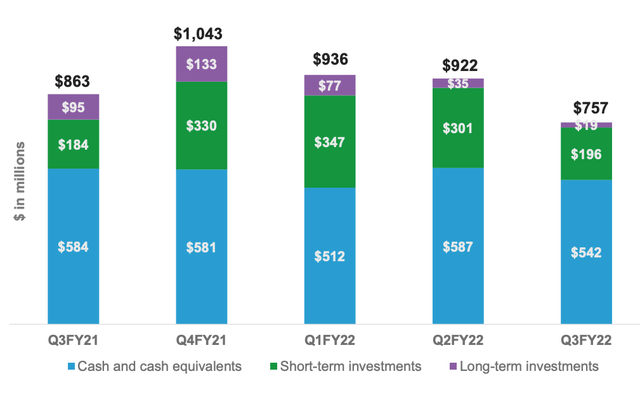

The company has a solid balance sheet with $542 million in cash and cash equivalents. In addition, to $196 million in short-term investments. Current debt stands at ~$355 million which is manageable given the solid cash flows.

Balance Sheet (Q3,22 Presentation)

For the fourth quarter of the fiscal year 2022, management expects revenue between $680 million and $700 million. With non-GAAP earnings between $2.45 and $2.57 per share. The company has a strong pipeline but management is “cognizant” of the “cautious environment”, which I will elaborate more on in the risk section.

Advanced Valuation

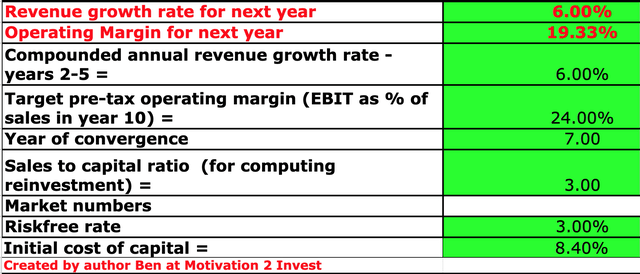

In order to value F5 Networks, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 6% revenue growth per year over the next 5 years. I expect this to be driven by secular tailwinds across increasing web traffic, cyber-attacks, and the need for Application Delivery Controllers.

F5 Networks stock valuation 1 (created by author Ben at Motivation 2 Invest)

I also expect the business’s operating margin to increase from 19.33% to 24% over the next 7 years, as it transitions to more of a software business. You may notice this base operating margin is higher than the figures the company has stated. This is because I have capitalized R&D expenses and made the necessary adjustments.

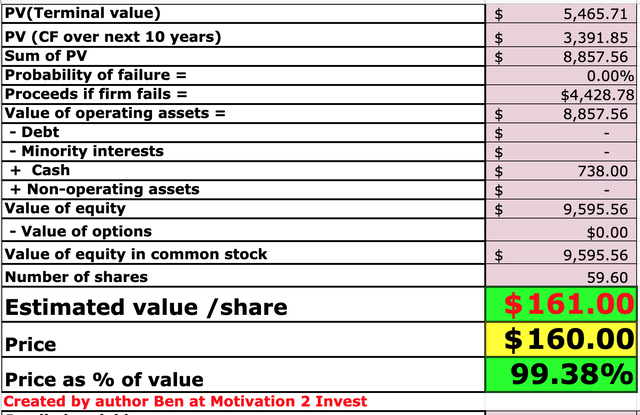

F5 Networks (created by author Ben at Motivation 2 Invest)

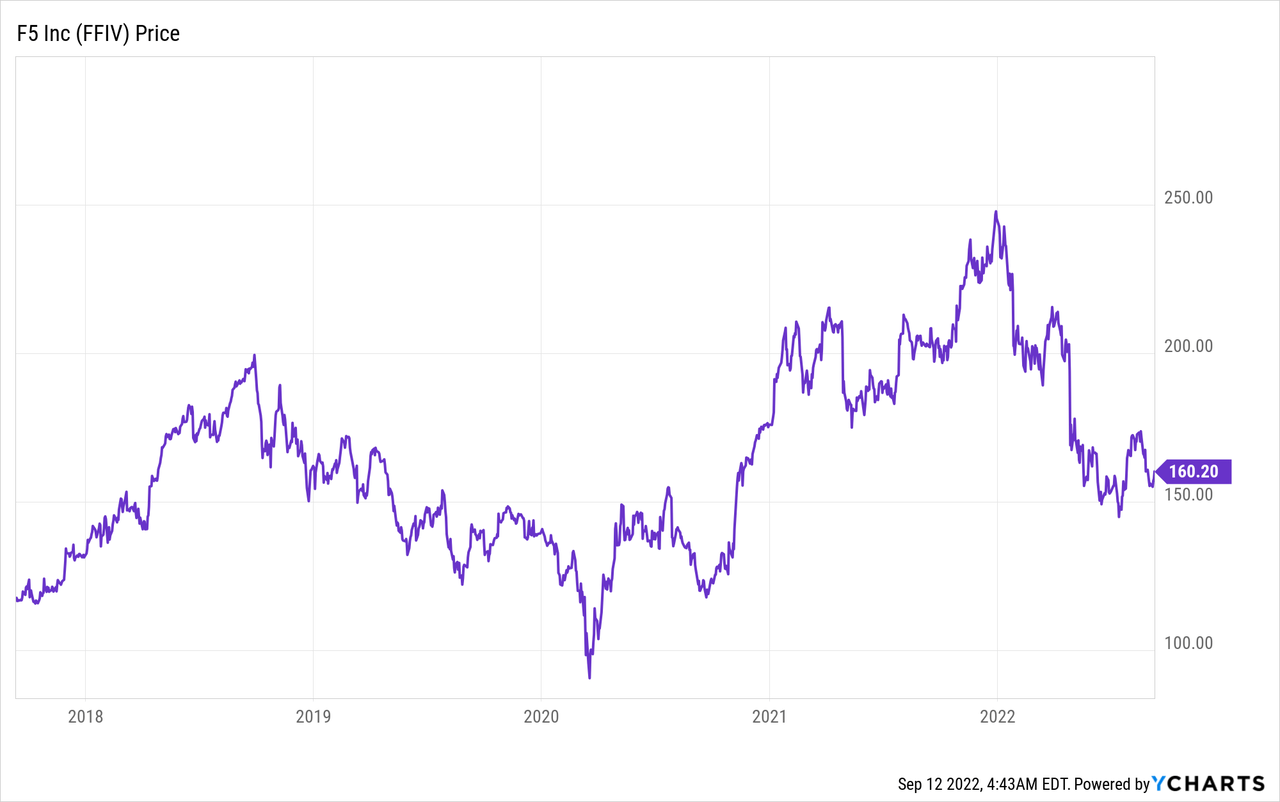

Given these factors, I get a fair value of $161 per share, the stock is trading at ~$160/share at the time of writing and thus is “fairly valued”.

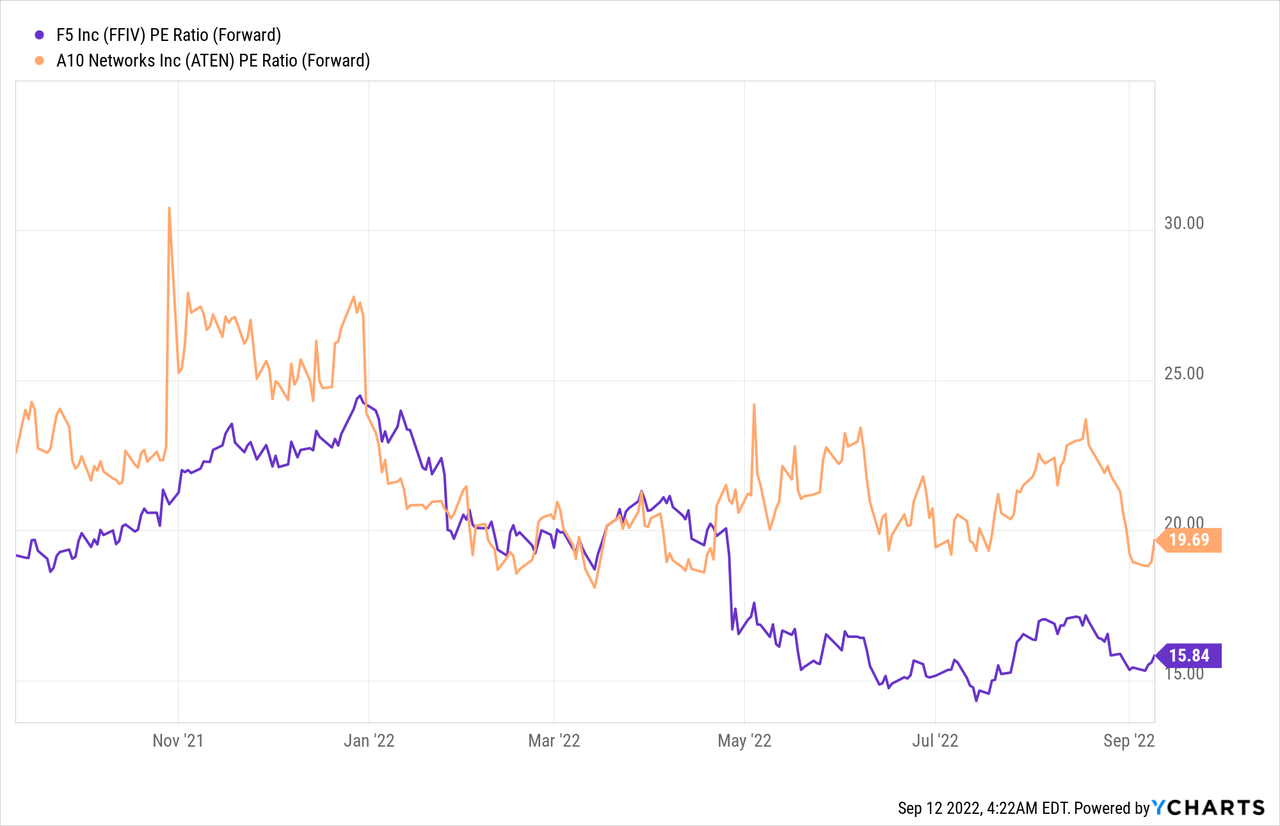

As an extra data point, F5 trades at a forward P/E ratio = 15.84, which is 2.7% cheaper than its 5-year average. In addition, the stock is trading at a cheaper valuation than competitor A10 Networks (orange line on chart) which trades at a P/E Ratio = 19.69.

Risks

Recession/Lower IT spending

Many analysts are forecasting a recession due to the high inflation and rising interest rate environment. Even if a “recession” does not occur the fear of a recession may cause decision makers to delay new IT spending and thus this may impact revenues in the short term. However, I do expect the secular tailwinds to grow in future years.

Final Thoughts

F5 Networks is an established cybersecurity company that is undergoing a transition to more of a software company. Now although the company has experienced some friction with this in the short term, the recent financial results look promising and could be a leading indicator of future success. The stock is fairly valued intrinsically and thus this looks to be a great long-term investment.

Be the first to comment