Brandon Bell/Getty Images News

Exxon Mobil (NYSE:XOM) is one of the largest crude oil companies in the world with market capitalization of more than $300 billion. However, over the past several years, it has struggled with investor concern over its ties to global warming and the potential impact on its business. As we’ll see throughout this article, the company’s moves into low carbon help reinforce its value for shareholders.

Climate Change

At this point, climate change and its human-caused impacts are fairly well understood scientifically. In tandem, despite a continued anti-science push, most myths related to climate change not being real have been disproven, and most bodies, including large energy companies, acknowledge it’s a fact of life that must be mitigated.

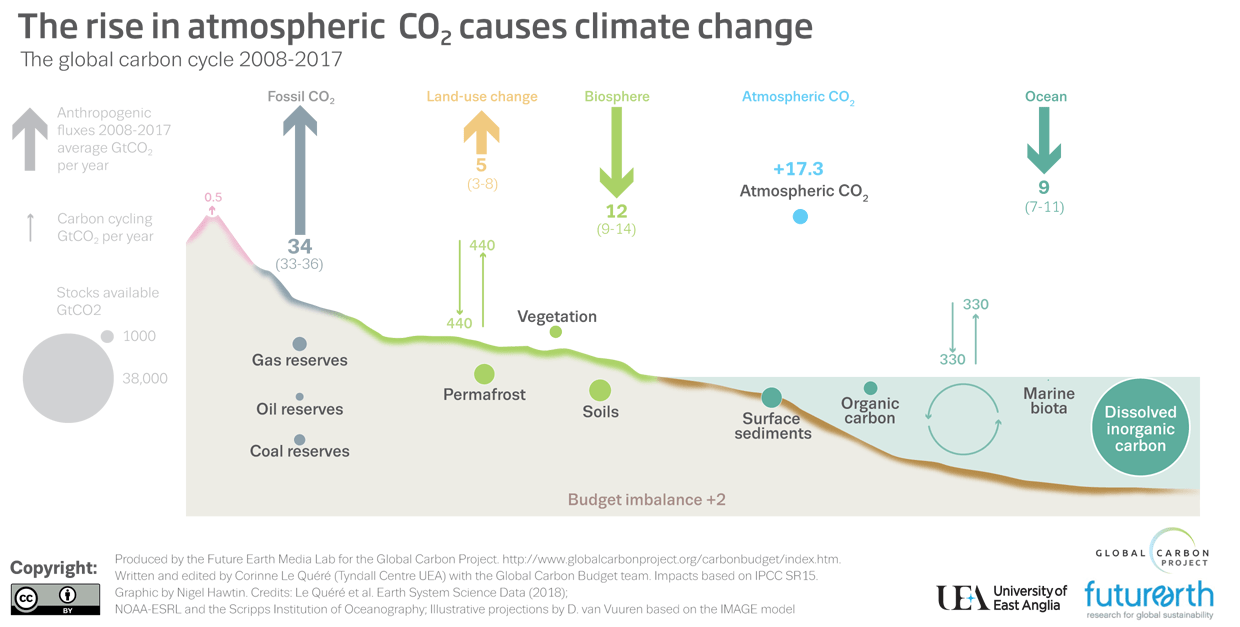

Climate Change (Carbon Dioxide – Climate Feedback)

Current atmospheric CO2 is increasing at 17.3 GtCO2 per year. While that’s a small part of the amount of CO2 moving through the system, it’s a substantial imbalance. However, with global Co2 emissions at almost 40 GtCO2 per year, it means that emissions don’t need to move to 0, but they can have a substantial decline.

Currently, we expect that process to happen in three steps.

- Easy reductions. Reduce flaring, increase recycling, decrease waste. Increase efficiency. Look for ways that not only reduce emissions but save money because they reduce cost.

- Transition fuels. Coal has numerous other harmful pollutants and in many regions of the world is more expensive than natural gas. Renewables are cheaper than fossil fuels in areas that have them plentifully available (i.e. solar in high sun areas).

- Large scale reduction. Carbon capture and sequestering projects. Battery technology improvements to move the grid towards renewables, a dramatic drop-off in fossil fuel consumption.

Exxon Mobil, in our view, has the unique market positioning to benefit from all three stages of the transition.

Exxon Mobil Low Carbon

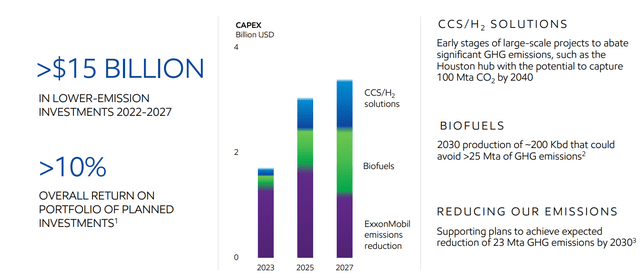

Exxon Mobil is investing >$15 billion in building a growing low carbon business than can support billions in deployed capital.

Exxon Mobil Low Carbon (Exxon Mobil Investor Presentation)

The first thing worth pointing out is that low-carbon technology and improvement initiatives, even with “freebies” such as reduced flaring, are growing rapidly. For less than $2 billion a year, Exxon Mobil can comfortably reduce its emissions (targeting net-zero Permian Basin emissions by 2030) while continuing to increase earnings.

XOM is also planning to invest in carbon capture and biofuels with investments growing to almost $4 billion by 2027. From this, it expects a >10% return on its portfolio of planned investments here, strong returns from a business that helps Exxon Mobil hedge its future oil and gas business and earnings.

This low carbon business is an exciting and growing part of Exxon Mobil’s business.

In our view we see a three step adoption path for the future of Exxon Mobil’s low-carbon business.

(1) Emission reduction. The company will take advantage of cheap opportunities to reduce emissions. It’s spending roughly $1.5 billion annually in order to do this. This will enable the company to offset some of the true cost of its emissions; however, any benefits will come in the form of lower regulatory restrictions versus true benefits.

(2) Carbon capture. Carbon capture, especially in easy to capture locations, such as the Houston Shipping Channel, represents a cheap way to remove carbon from the atmosphere and move towards climate goals. Government support here to the tune of $50-$100 / tonne could make this very profitable.

The market is expected to grow rapidly and Exxon Mobil is the current #1 in the world.

(3) Renewables. Oil majors already have strong capital execution and connections to customers. Natural gas represents a major transition fuel. Many majors are rapidly ramping up their natural gas and power delivery networks, and Exxon Mobil could do the same, providing increased earnings and shareholder return potential.

Through these 3 phases, Exxon Mobil is not only increasing earnings, but de-risking the remainder of its business, helping to highlight the company’s shareholder return potential.

Based on projected returns, the company’s 2022-2027 investments are expected to generate more than $1.5 billion in annual profits. By 2028, the company should be able to deploy more than $4 billion annually in this business, generating hundreds of millions in additional annualized profits for the company.

Additionally, this doesn’t count for new unexpected opportunities such as large-scale government support for carbon sequestration projects.

Exxon Mobil Core Businesses

Exxon Mobil has one of the best asset portfolios in the business and the Permian Basin is an example of that.

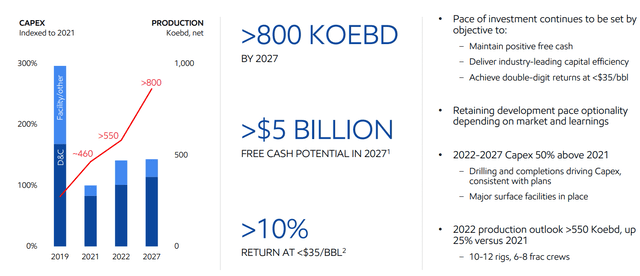

Exxon Mobil Permian Basin (Exxon Mobil Investor Presentation)

Exxon Mobil has the largest contiguous development in the Permian Basin with more than 65,000 contiguous acres. The company slowed down production as a result of COVID-19; however, it’s still anticipating >800 thousand barrels / day by 2027 with the potential for more than $5 billion in annualized cash flow.

Exxon Mobil’s unique integrated asset portfolio here has double-digit returns at <$35 / barrel showing the strength of the company’s assets. The company has been slowly increasing the number of rigs here and we believe it can do that even faster given the rapid decline rate of the wells and the strong current pricing.

Exxon Mobil’s other segment of increasing upstream potential is the company’s Guyana assets.

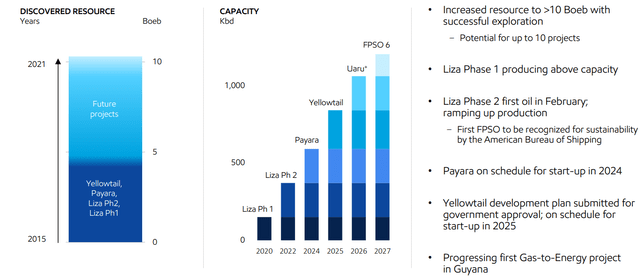

Exxon Mobil Guyana – (Exxon Mobil Investor Presentation)

Exxon Mobil has discovered 10 billion barrels of reserves, and the first 4 developments are expected to utilize roughly 4 billion barrels of reserves and produce 800 thousand barrels / year. The company’s initial developments and producing above capacity and the company is investigating gas-to-energy projects to increase production further.

XOM has numerous other growing assets. Its LNG supply is expected to hit >27 million tonnes per annum by 2027, providing >$7 billion in operating cash flow. Overall, the company’s upstream earnings are expected to double going into 2027, enabling the company to substantially increase shareholder rewards.

Exxon Mobil Financials and Returns

The company has an impressive financial portfolio that will enable substantial shareholder rewards.

Exxon Mobil Financial Targets – Exxon Mobil Investor Presentation

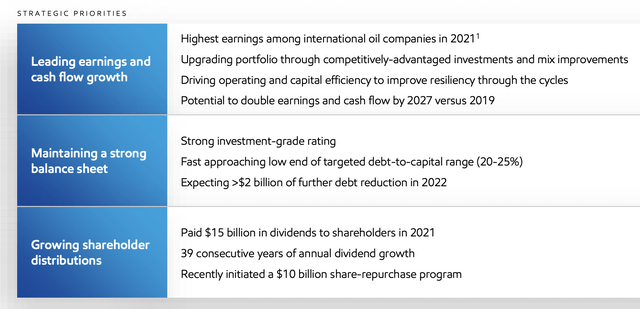

Exxon Mobil had the highest earnings among international oil companies and it is continuing to focus on upgrading its portfolio. The company has a strong investment-grade credit rating and its debt has already hit its target. It is expecting a >$2 billion further debt reduction in 2022 showing its financial strength.

XOM paid $15 billion in shareholder rewards in 2021, which should continue into 2022, providing mid-single-digit shareholder rewards to a company with 39 consecutive years of annual dividend growth. The company’s recent $10 billion share repurchase program shows its financial strength and will help support additional shareholder rewards.

If Exxon Mobil finishes that in 2022, which it can comfortably afford, that’d push shareholder rewards to the high single-digits.

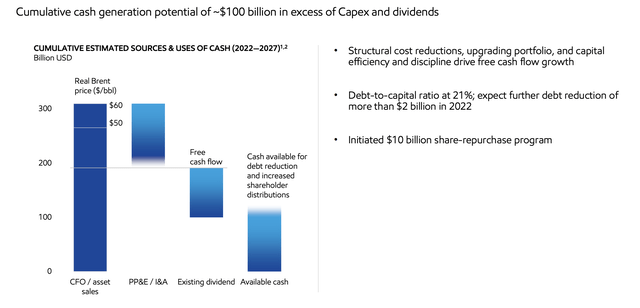

Exxon Mobil Cash Generation – Exxon Mobil Investor Presentation

Exxon Mobil is a cash generation machine. For the 6-year period from 2022-2027, the company is expecting to generate $300 billion at $60 Brent. At $110 Brent, that number becomes closer to $500 billion. It is investing heavily in capital spending to the tune of almost $100 billion and its existing dividend will also cost the company $100 billion.

That $100 billion will leave it with mid-single-digit returns. After that, there’s still $100 billion to spend. That’s at $60 Brent, which is well below current prices. With roughly $40 billion in long-term debt, Exxon Mobil can comfortably become debt free, but in a low interest rate environment it might not be inclined to do so.

So far, it’s announced $10 billion in share repurchases; however, we expect that to expand significantly. Exxon Mobil with this cash flow can buy back close to 10% of its shares, if not more, annually. Overall, this shows the company’s ability to generate comfortable double-digit shareholder rewards, making it a valuable investment.

Exxon Mobil Thesis Risk

The risk to Exxon Mobil’s thesis is crude oil prices. At $60 / barrel, XOM can generate low double-digit rewards. It has already committed to substantial share buybacks that we expect to continue. At <$60 / barrel, that drops off significantly; but at >$60 / barrel, it increases significantly. Paying attention to those crude prices is important for XOM’s returns.

Exxon Mobil’s other thesis risk is the multi-billion investments in its low-carbon business. That’s a double-digit % of its capital investment, and one that needs to pay off. While the company had done a great job of that so far, there’s no guarantee that that scales up long-term, which presents a risk to the company’s ability to drive continued shareholder returns.

Conclusion

Exxon Mobil has a unique and impressive portfolio of assets. It is substantially increasing its upstream production through both Guyana and the Permian Basin and the two regions have the potential to add a substantial amount of crude oil. In the downstream segment, the company is also growing rapidly and improving margins.

Exxon Mobil has the ability to generate massive FCF. It can comfortably generate double-digit shareholder returns at $60 / barrel. At more than $60 / barrel, those shareholder returns increase dramatically. XOM is susceptible to crude oil prices, but overall, this strength helps highlight how the company is a valuable investment.

Be the first to comment