bjdlzx

(Note: This article appeared in the newsletter on September 27, 2022.)

There is a lot of fear about Exxon Mobil Corporation (NYSE:XOM) and the rest of the industry “getting hit” by lower oil prices. But the forward curve and industry price-earnings ratio had long indicated serious doubts that those great oil prices were going to last in the first place.

Now there is going to be a trader reaction to any oil price decline. But those of us who followed the industry watched the industry drop up to 90% by the time the 2020 downturn was over. The recovery has kept those low price-earnings ratios for the time being. What is likely to lead to a recovery is consistency that was clearly lacking (and led to the previous price-earnings ratio collapse). Inconsistency causes future doubts, which leads to a far larger discount factor. Of course, the pandemic did not help either. But that issue is fading from future consideration.

I follow the industry and have for many years. Insiders and those with experience are still getting in. Other insiders already in are buying. The latest purchases that I wrote about are by EQT (EQT) and Ring Energy (REI). As long as insiders are buying, then this is the time to follow them because they are usually more often right than wrong in decent numbers.

One of the most frequent glaring absences in a lot of the panic articles is the failure to mention where we are in the business cycle. The insider purchases and the “getting in” (through reverse mergers or other means) indicates that the recovery is underway. Therefore, there is still some time to go before worrying about a sale. Energy investments tend to be volatile (and therefore some eye-popping percentage changes), but anyone invested in energy needs to be prepared for the volatility before they invest.

Typically, the beginning of the end of a cycle is signaled by the arrival of speculative money that is also usually inexperienced. This money does deals that established sources would not touch. That money usually “loses its shirt” and actually stays out of the capital market at the time when business is actually pretty safe. Generally, insiders sell (sometimes the whole company) into a speculative market like that. Of course, it goes without saying that such an atmosphere usually allows production to exceed supply (and then you know what happens).

Counter-Cyclical Tendency

Exxon Mobil is far more than an oil company. It is, therefore, in position to take advantage of the situation. This kind of panic often leads to lower costs and, therefore, the capital budget goes further. That means more activity.

Anyone following this company knows that activity has been increasing for several years now. The company really did not flinch much when 2020 arrived and the losses appeared. The result was a lot of production added at rock-bottom prices combined with considerably cheap progress on several large projects. Despite a lot of market opinion to the contrary at the time, the extra debt powering that activity appears to have been well worth it as well.

Investors have quickly forgotten that the company told the President about $50 billion in investments over the last 5 years just in North America. As a result, the company grew and has continued to grow the business at low costs when much of the industry is cautious. The articles that were out about “too much debt” have gone because it has been more than adequately demonstrated that those debt levels are the dream of many companies in the business. All one has to do is look at the sky-high debt rating to confirm that.

Natural Gas

The result of the last five years is a lot of growth possibilities that will likely offset any price downturn. Compared to much of the stock market, the industry is cheap despite a very bright future ahead. Renewables so far cannot begin to compete with the industry yet, and there really is little to indicate that will change. As an analyst, I did those calculations for my employer many times, and it got checked and rechecked.

Even if it does change, the industry supplies many of the raw materials for renewables. That is likewise very unlikely to change. So, in the worst-case scenario, the demand changes from one source to another.

Exxon Mobil had acquired Interoil a few years back when the company discovered one of the largest natural gas deposits on record. Now the company is expanding that project. There is already a natural gas plant built that can be easily expanded.

The nice thing about all the current fears is the fact that many just put off major projects. That is just fine with this company because, when you are the only one putting out bids for more business, the bids coming back are often a pleasant surprise. So more gets done than the market initially expects.

Meanwhile, up in Alaska, the company is involved in a project that controls about 25% of the known gas reserves on the North Slope. There was an expansion project that the partners shelved because returns were deemed insufficient. Investors can just about bet that assessment will be under review in the current environment.

Oil

Oil has gotten a lot more coverage than has been the case with natural gas. Exxon Mobil explained to the President that they were one of the few companies GROWING production in the Permian over the last few years and that growth is expected to continue well into the future.

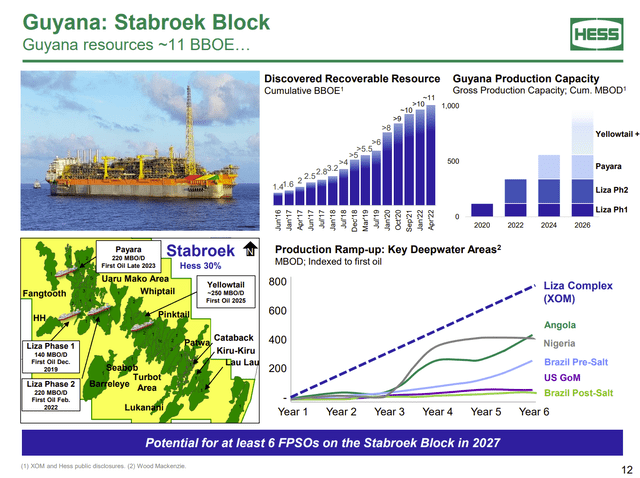

But, of course, the headlines have to go to Guyana which is one of the most significant oil discoveries in recent years.

Hess Presentation Of The Guyana Partnership Progress And Guidance (Hess Presentation At Barclays CEO Energy-Power Conference September 2022)

Even if something conspires to push the timing back from current guidance, that amount of production is significant to the operator, Exxon Mobil. Far more importantly, the company sees at least the possibility of 10 FPSO before (probably long before) the end of the decade. Left unstated is when cash flow gets to a certain level, then there will likely be two FPSOs added per year instead of one, with still faster growth down the road as this project progresses.

This project alone is really not coming close to being represented in the price of the stock. The reason I am hearing for such a situation is that the cash flow is not yet there. On the other hand, the cash flow has clearly started with two FPSOs producing and a third one on the way. The breakeven price estimated in the current presentation is so far below current oil prices (and the forward curve) that this project will likely continue development right through whatever is causing the oil price to drop right now.

By the end of the decade, about 50% of the current company production will be coming from this project alone. The company has more exploration projects (in Brazil for example) that can add to that rosy scenario.

Refining And Further Processing

This company has a chemicals division that either provides the raw materials for the “green revolution” or flat out makes the materials and sells them. This does not come close to getting the coverage it deserves. It is definitely a future growth area for the company.

Furthermore, some fuels like jet fuel are in no danger of being replaced by the green revolution. Airplanes right now have little to no hope of flying on solar energy. It is going to take some major advances to put that one even on the horizon.

The overall result is the industry has a slowly increasing amount of sales to renewable energy. Exxon Mobil also funds an experimental project to make oil from algae. That would make it renewable (a speculative future at best). But the future of oil and gas is so far one of growth and is likely to remain that way for a long time to come. We will likely at some point get to a different place. But right now, that place is oil and gas.

Stock Price

There is a lot of calls about a downturn and “get out now,” not to mention “keep going and don’t look back.”

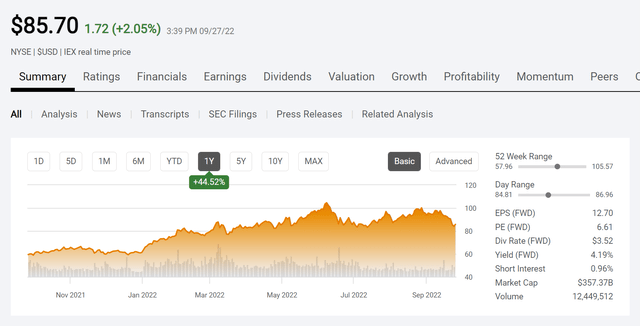

ExxonMobil Stock Price History And Key Valuation Measures (Seeking Alpha Website September 27, 2022)

The interesting thing about all those calls to sell now is the price-earnings ratio is at a whole 6 as shown above. Even if oil prices decline to $60 and stay there, this company is in a position to make a lot of money while growing production at some very profitable and significant ventures. The price to earnings ratio would likely remain relatively cheap compared to the rest of the market.

Therefore, the stock price shown above is not likely to remain there because Exxon Mobil is likely to be a significantly larger company in the future with some very low breakeven projects powering that larger earnings power.

Blast From The Past

The call to sell the stock and not look back is reminiscent of the past treatment of other cyclical stocks. History needs to be reviewed or it is likely to be repeated.

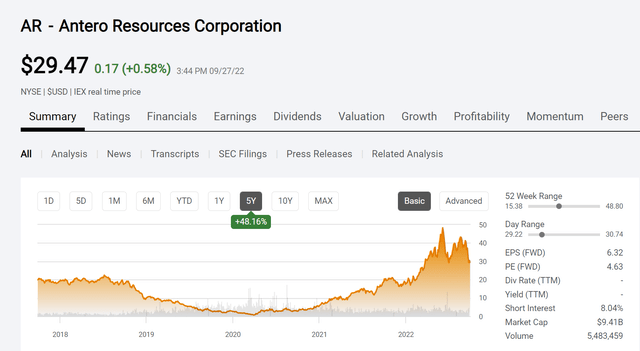

Antero Resources Common Stock Price History And Key Valuation Measures (Seeking Alpha Website September 27, 2022)

Some may remember that there were articles just about everywhere to sell Antero Resources (AR) beginning back in 2019, along with assertions by some that the company would go broke from high costs. This is typical downturn behavior that is repeated in many cyclical companies that I follow.

The key here is that the company is a rich gas producer with options to switch to lower-cost dry gas if that is indicated by market conditions. So, the breakeven price needed for natural gas is dependent upon the prices received for everything else produced. In the current environment, many rich gas producers need about $.50 MCF (give or take) to break even because the prices of everything else coming out of the well are sky high.

That was not the case back in 2019, when the breakeven was coming in closer to $2.40 MCF. But that high breakeven price led to a lot of calls for bankruptcy. Many did not realize that certain strategies are profitable at different times and really no one strategy is profitable all the time. Even more important is the stock price did decline below $1 with a warm winter (or two) aiding the cause at the time.

But there was clearly nothing wrong with the company, as the subsequent rally showed. Interestingly, a lot of these companies have had financial strength ratings increases after only suffering at most a warning during the downturn. The common stock price action for many of these companies was far worse than what actually happened.

The Future

It looks like the market is panicking because “earnings will be revised downward.” Anyone following this industry knows that such a forecast is probably good until “we get out of bed tomorrow” because any commodity industry moves fast. Conditions change quickly, as does market sentiment.

I will not dispute the obviously current selling pressure on the stock. But Exxon Mobil has growth projects underway that are likely to continue to lower the company breakeven price and increase the size of the company (even if slowly) over the long term.

Therefore, the currently well-covered dividend and low debt ratio would indicate that this is likely a buying opportunity for buy-and-hold investors. One of the things to note about Antero Resources is that very few of the sellers during the stock price downturn wrote an article on the recovery that followed. So, at least publicly, they missed a great stock price runup that likely far exceeded anything they made on the way down. That is one of the advantages of buy and hold.

Even in an extreme case where an investor purchased AR at $10 (or more) and saw the price head below $1 for a while, a buy and hold investor still did okay to the current time. That is why you buy strong balance sheets and good management. Exxon Mobil management is widely regarded as one of the best managements with one of the best balance sheets. This stock is likely to considerably surprise on the upside as more good news unfolds down the road.

Therefore, this one is “Game on” and it is why I own the company. Rarely do you get an opportunity for growth and income from a company of this quality and size. You can definitely trade it in the current bear market on the downside if you are agile. But I write for the buy and hold investor. This one is definitely a buy and hold right now (and likely for a long time with the growth projects Exxon Mobil currently has in the pipeline).

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment