SeventyFour/iStock via Getty Images

Introduction

In June, I wrote an article titled “Extra Space Storage – Top Tier Dividend Growth At A Great Price”. Since then, the stock has added 25%. That’s fantastic as it confirms my bull case. Yet, I’m looking for another dip as I decided that I want Extra Space Storage (NYSE:EXR) in my portfolio. This company goes well with my existing position in Public Storage (PSA), the company’s much larger peer. In this article, I will walk you through my thoughts and explain why EXR might be the right fit for your portfolio, regardless of whether you’re an income-focused investor or a dividend-growth-focused investor like myself.

So, let’s look at the details!

EXR Is An Outperformer

I have covered EXR for many years. Hence, I guess that most of my readers know that I’ve often made the case that EXR would make so much sense in my portfolio. I actually owned the stock in early 2020, but it didn’t make the cut when I restructured my portfolio. I decided to go with its larger peer Public Storage.

While I do not regret buying Public Storage, I do regret that I did not buy Extra Space Storage – or keep it, depending on how you look at it.

I do like self-storage. If I had to buy physical real estate myself, I would probably be in self-storage as well. I like the simplicity of it and the long-term secular trend fueled by people moving into smaller homes, and the ever-increasing need for storage. Moreover, storage facilities often have prime locations, which makes self-storage suitable for mini-warehousing tasks and related final-mile logistics, which I believe will be a huge bull case in the decades going forward.

With that said, Extra Space Storage has a market cap of $28.0 billion, which makes it the second-largest REIT operator in the industry.

The company is an S&P 500 member operating 2,130 properties. 995 of these properties are wholly owned. 847 properties are third-party managed. 288 properties are part of joint ventures.

Founded in 1977, EXR has grown into a company operating in 41 states, renting 1.5 million units operated by more than 4,000 employees.

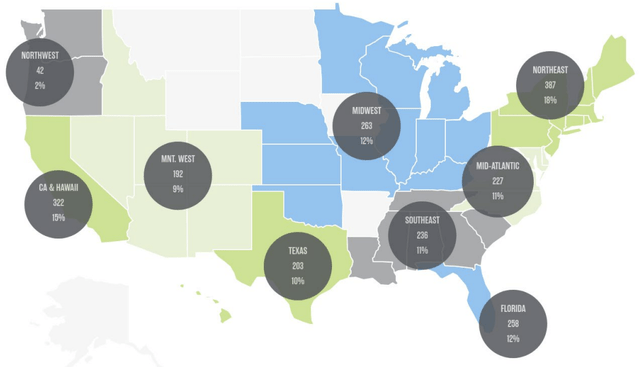

Extra Space Storage 2022 Investor Presentation

As the map above suggests, the company is well-diversified. Its largest markets are the greater Los Angeles area and NY/NJ. These two areas account for 12% of total revenue each.

Moreover, with 2,100 stores, no property is worth more than 1% of EXR’s portfolio while 60% of properties are located in primary locations.

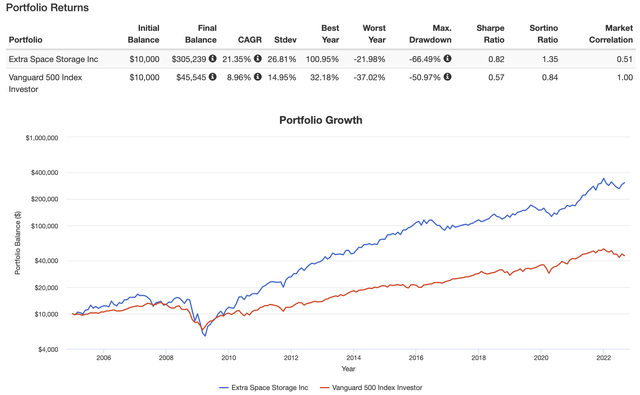

Going back to the company’s IPO in 2004, EXR shares have returned 21.4% per year including dividends. This beats the S&P 500 by a mile. Moreover, despite a standard deviation of 26.8% (versus 15.0% for the S&P 500), the volatility-adjusted performance (Sharpe/Sortino ratios) is much higher. Also, the market correlation is just barely above 50% as high-quality yields tend to protect investors in certain recessions – not all, as the Great Financial Crisis showed.

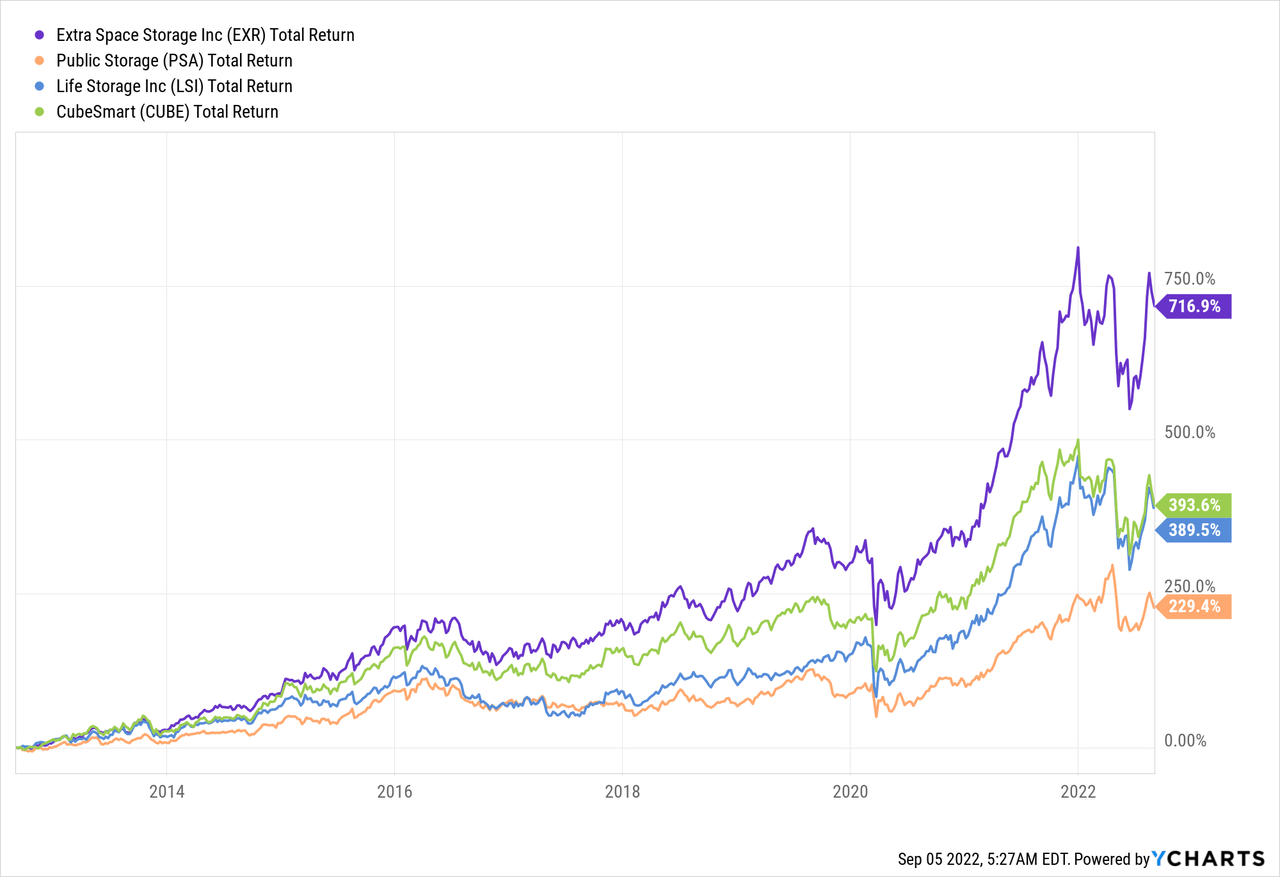

Moreover, over the past 10 years, EXR has consistently outperformed its peers on a total return basis.

On top of that, the company has a fantastic dividend yield.

The EXR Stock Dividend

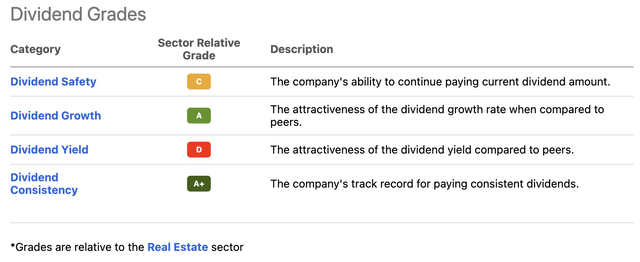

Using Seeking Alpha’s dividend scorecard for EXR, we see a very mixed card showing high scores for dividend growth and consistency. Yet, both safety and dividend yield score rather low – relative to the real estate sector.

With that said, let me elaborate as the numbers are much better than the relative scores suggest.

First of all, dividend safety isn’t bad. The company has a cash payout ratio of 66.0%, which is just 200 basis points above the sector media, according to Seeking Alpha data. The AFFO (adjusted funds from operations) payout ratio is 73%. The peer median is just 100 basis points lower.

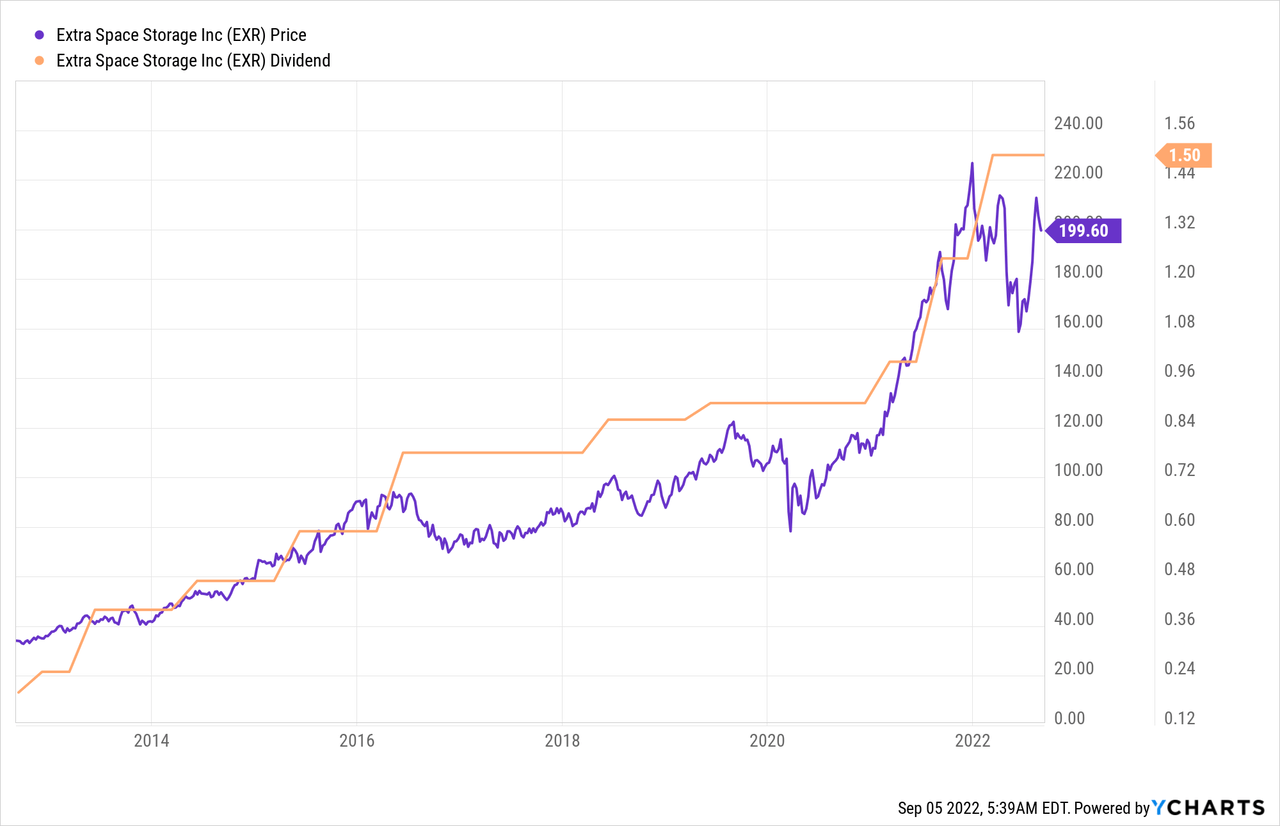

On top of that, dividend growth is consistent and quite aggressive as the chart below suggests.

As visualization isn’t enough, let me give you some numbers.

Over the past 10 years, the average annual dividend growth rate is 23.3%. This number has come down to 16.5% over the past three years.

These are the most “recent” hikes:

- February 2022: 20.0%

- August 2021: 25.0%

- February 2021: 11.1%

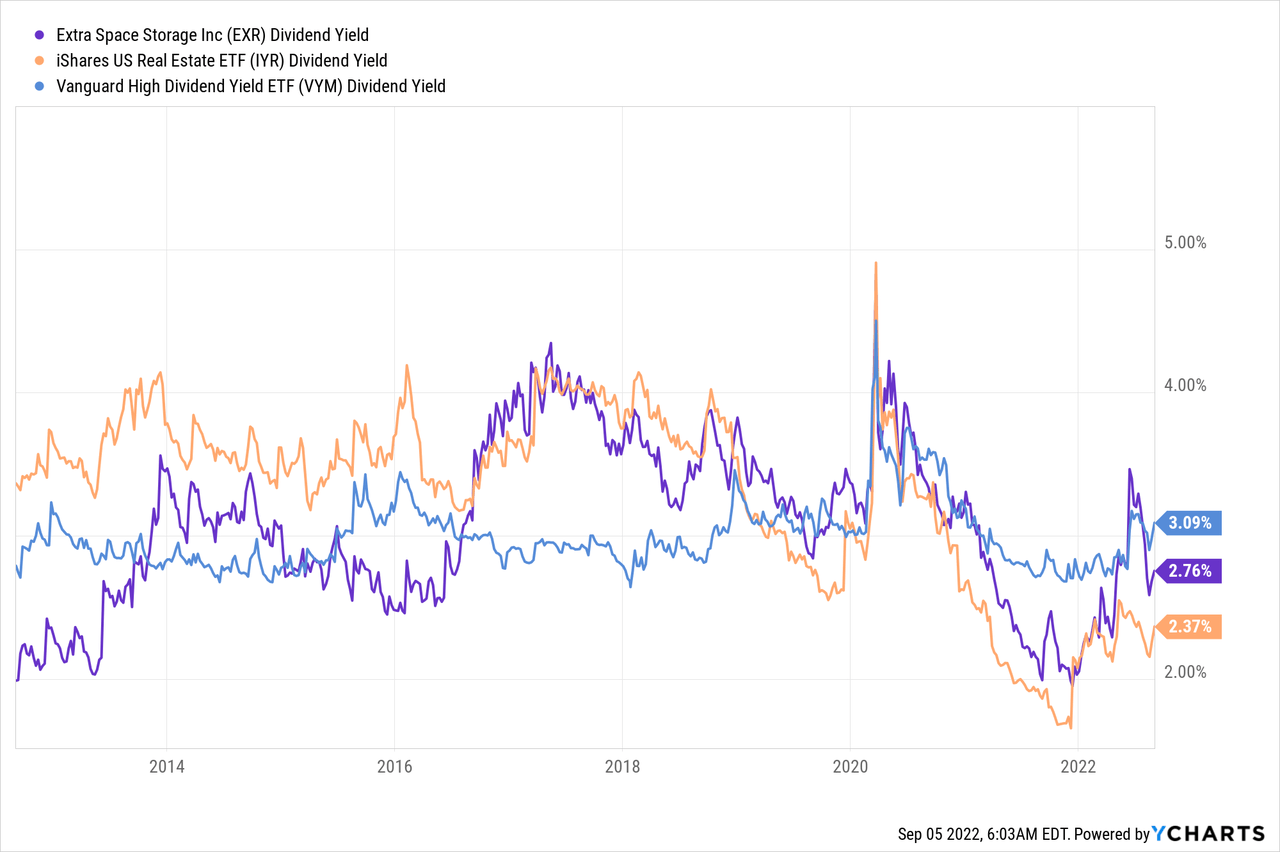

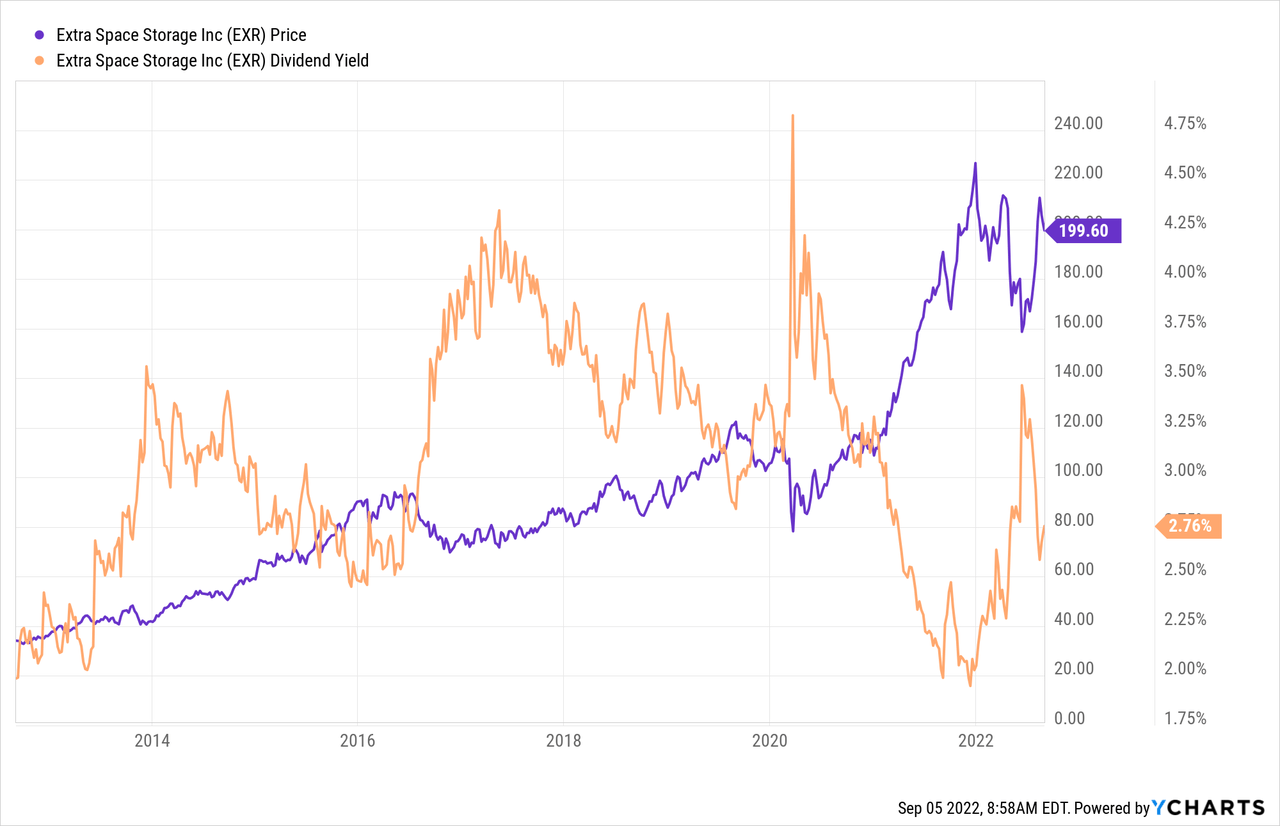

- May 2019: 4.7%

The current yield is 3.0% based on a $1.50 quarterly dividend per share and a $200 stock price. Please note that the yield in the YCharts graph has NOT been updated. Hence, I calculated the yield myself. What we’re dealing with here is a yield that comes close to the “high-yield” definition (currently 3.10%) and a yield that beats the weighted real estate average by roughly 60 basis points, using the iShares U.S. Real Estate ETF (IYR) as a benchmark.

The most important thing is that the EXR dividend is safe and backed by more than just a “large” business. EXR is highly efficient and backed by a stellar balance sheet. It also helps that industry fundamentals remain favorable, which we will discuss next.

Favorable Industry Fundamentals

Housing is weakening. Rates are rising, an increasing number of homes are being sold below the asking price, and people are less optimistic about their home value going forward.

Yet, self-storage remains in a good spot according to a report, I discussed in a Public Storage article at the end of August.

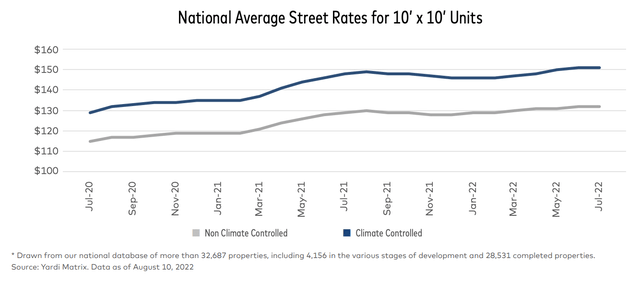

According to the most recent Yardi Matrix national self-storage report, fundamentals remain strong, backed by high demand.

Essentially, while growth has moderated after a rapid pandemic-fueled expansion, demand is maintaining steady growth in rates according to the report:

As street rates have leveled at record highs, year-over-year growth has decelerated. The slowdown in growth was to be expected, as much of the industry’s anticipated gains in 2022 were unlikely to match the above-trend increases posted last year. Nationwide, the overall average street rate, which includes all unit sizes and types, grew 2.1% year-over-year in July, a 210-basis-point drop compared to June’s annual rate growth.

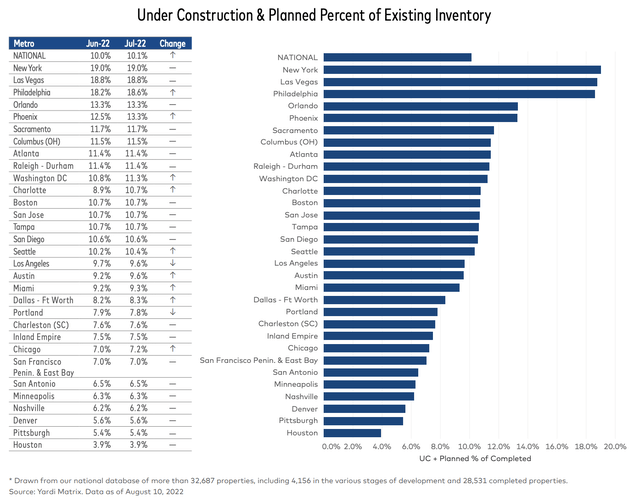

Adding to that, new supply is one of the biggest issues. After all, self-storage has low entry barriers. Everyone with access to capital can buy storage facilities.

As of July 2022, new supply under construction and planned is at 10.1% of the national existing inventory. Growth is especially high in New York, Las Vegas, and Philadelphia.

As I wrote in my August article:

The good news for operators is that rapidly rising construction costs will likely prevent any major surges in new supply over the coming years.

According to the latest Yardi Matrix forecast, the amount of new supply delivered across the nation in 2022 will be equal to 3.2% of existing stock and annual deliveries will moderate to 2.5% of total stock by 2027.

That’s terrific news for large operators who not only have a large footprint already but also better “value-adding” assets that most no-name operators cannot compete with. After all, the long-term surge in storage demand also comes with a demand for high-quality storage including safety, self-service support, climate control, and whatnot.

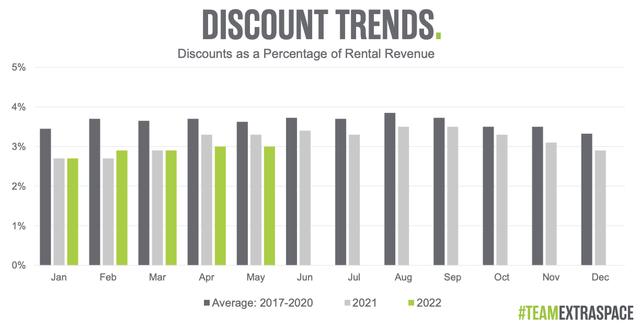

In light of these numbers, it’s important to mention that EXR is able to keep discounts low. Discounts are a great indicator to track how competitive a company is. After all, building storage is “easy”, but offering a good service while making money is far from easy.

Extra Space Storage 2022 Investor Presentation

EXR’s Results Are Great, So Is Its Balance Sheet

As industry fundamentals remain favorable, EXR remains in a great spot to capitalize on this.

First of all, the company is maintaining a high occupancy rate despite declines in the industry. Same-store occupancy was at 95.9% in 2Q22. That was down 100 basis points versus 2Q21.

In 2Q22, the company increased same-store revenue by 21.7% with 26.0% growth in same-store net operating income. EXR benefited from underperforming same-store operating expenses of “just” 9.3%, versus 21.7% same-store revenue growth.

According to CEO Joseph Margolis:

With manageable new supply and durable customer demand, we continue to operate at high occupancy with strong rates. Despite inflation and the potential effects of recession, we believe we are well positioned to continue to produce strong results due to our resilient need-based asset class, diversified portfolio, strong balance sheet and best-in-class team and platform.

Moreover, going into this year, more than 66% of customers stayed longer than 12 months. That’s an all-time high and well above the longer-term average close to 60.0%. 47.6% of customers stayed longer than 24 months. That’s up from less than 45.0% prior to the pandemic.

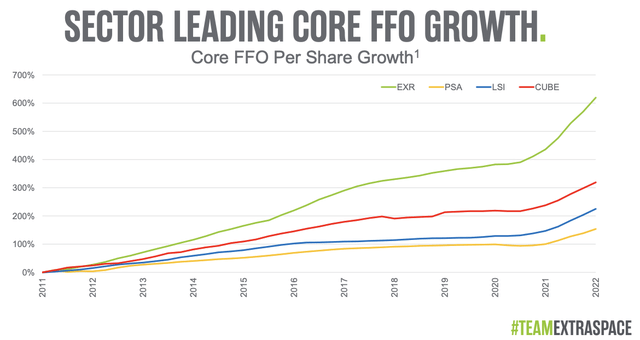

What’s interesting is that the company has grown its net operating income by 7.5% per year over the past five years. This beats every single competitor by at least 70 basis points. Going back to 2011, the company has also outperformed using funds from operations as a metric. This paved the way for the aforementioned total return outperformance.

Extra Space Storage 2022 Investor Presentation

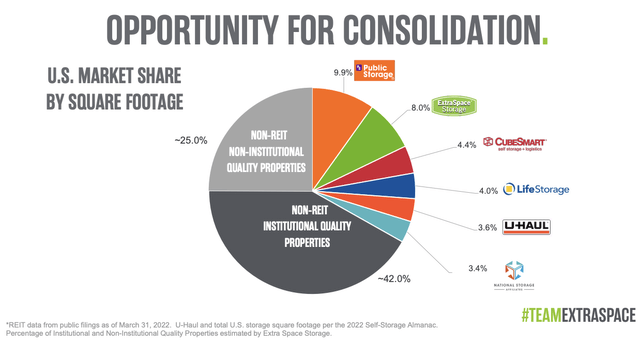

These numbers aren’t just great in general, but they help EXR to penetrate a highly fragmented market where the largest REITs and storage providers own just roughly one-third of the market.

Extra Space Storage 2022 Investor Presentation

Moreover, it helps that EXR has a healthy balance sheet. Especially in light of the current surge in rates.

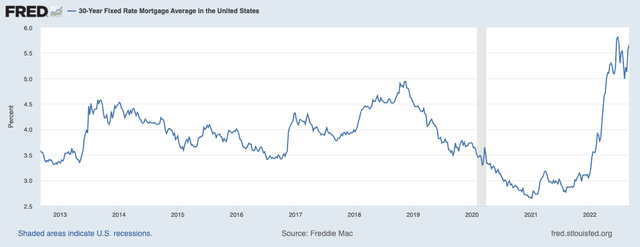

Using eurodollar futures, the three-month LIBOR rate is at 3.36%. The average 30-year mortgage rate in the United States is 5.7%.

As of June 30, 2022, EXR’s percentage of fixed-rate debt was 74.8%. The weighted average interest rates of the Company’s fixed and variable-rate debt were 3.1% and 2.9%, respectively. The combined weighted average interest rate was 3.1% with a weighted average maturity of 5.5 years.

Moreover, net debt to EBITDA has come down significantly from 6.2x in 2020 to 4.5x in 2022. The interest coverage ratio has risen to 7.9%.

This stellar balance sheet is also the reason why common stock dilution has only been 1.1% per year since 2017, which helps to create per-share value.

So, what about the valuation?

EXR Stock Valuation

The company expects to generate between $8.30 and $8.50 in core FFO this year. This is based on at least 16% same-store revenue growth, 7.5% same-store expenses growth, and at least 18.5% same-store net operating income growth.

This FFO outlook puts the valuation between 23.5 and 24.1x (Price/FFO).

The longer-term median is close to 23x, which makes this valuation “fair”.

The same can be said about the dividend yield of 3.0%, which is close to the longer-term median as well. Again, note that the yield in the chart below has not been updated by YCharts yet.

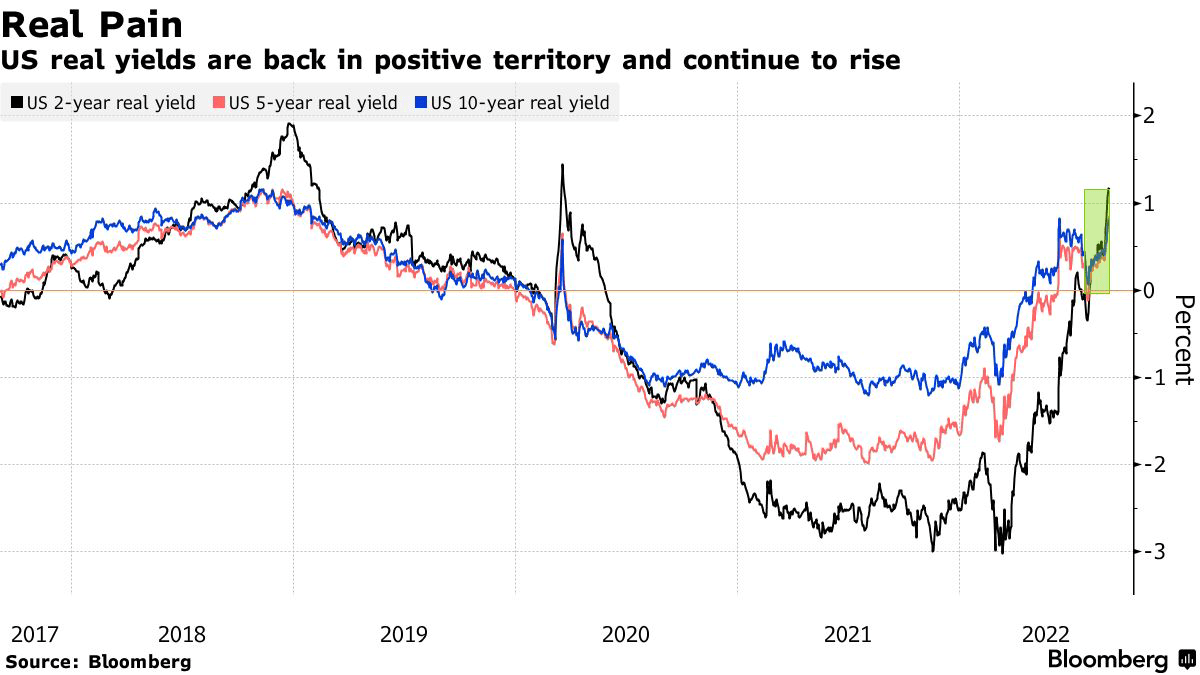

With that said, real rates have entered positive territory, which is rather bad for risk assets like stocks.

Bloomberg

According to Bloomberg:

“It is likely that any push to new multiyear highs in real yields would likely correspond with a new leg down in stocks,” said Charlie McElligott, a cross-asset strategist at Nomura Holdings Inc.

Rising inflation-adjusted yields are putting pressure on the likes of tech shares because the latter’s long-term earnings prospects now have to be discounted at higher rates. At the same time assets bereft of income streams like gold and cryptocurrencies look less appealing given the greater opportunity costs to hold them compared to a Treasury bond that pays out a real return.

Given that the Fed is eager to aggressively hike into economic weakness to harm demand – in order to fight inflation – I wouldn’t bet against some downside in EXR and the market, in general.

It’s also the reason why the rating for this article is “neutral”.

Yet, that’s a good thing. If EXR declines, I will start a position if I have the funds available to do so – as I have other stocks on my list that I have discussed on Seeking Alpha that I want to buy as well.

Takeaway

Extra Space Storage is one of my all-time favorite REITs and dividend stocks in general. The company has a fantastic business portfolio of high-quality self-storage assets, the ability to expand and withstand higher rates thanks to a stable balance sheet as well as the willingness to let shareholders benefit through consistent and high dividend hikes.

The company’s 3.0% yield is very decent, the valuation is fair, and I have little doubt that the stock can continue long-term outperformance versus its peers, various real estate ETFs, and the market in general.

While I like the current valuation, I would not bet against some short-term declines. The stock has rallied more than 25% since my most recent article while real rates have entered positive territory.

So, long story short, if you are an income-oriented investor or a dividend growth investor, put EXR on your watchlist. I believe it’s one of the best dividend investments money can buy and I honestly regret not keeping my shares in 2020.

(Dis)agree? Let me know in the comments!

Be the first to comment