pinstock

Description

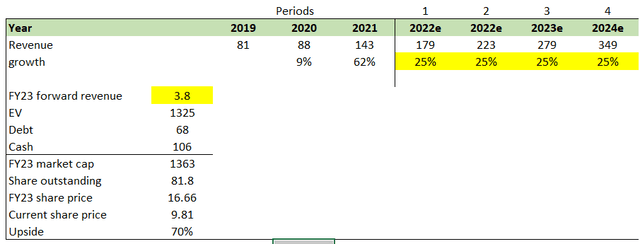

I believe Expensify (NASDAQ:EXFY) is worth $16.66/share, representing 70% upside from the date of writing. What EXFY does is provide SMBs a better way to manage their finances. Their primary focus is on SMBs, which research has shown contribute significantly to the global economy. As long as EXFY keeps offering great services, more SMBs enroll in their platform, and as such, EXFY should continue to scale higher and make more profit.

Company overview

EXFY is a company that basically helps various types of organizations and businesses worldwide manage their money in a less complicated and easier way. With EXFY, these businesses and associations are able to scan and reimburse receipts from different places or things that they have spent their money on.

EXFY core target is the SMBs, which is a large TAM

The makeup of the global economy consists of a majority of small and medium-scale businesses, and the OECD reports that these businesses contribute about 99% of all businesses and about 70% in the 36 OECD countries. I believe that SMBs are always going to be a major part of global economic development, and as such, they will have a need for new and emerging technologies that can further help them to provide better customer services, improve productivity, increase employee engagement, and also achieve cost-conscious growth. Although COVID-19 affected SMBs to an extent, it also brought about the need for the adoption and use of technology because these businesses needed to look for new means to connect with their customers and also deal with working remotely.

Because of their size, small and medium-sized businesses most often have just one person that combines the major job function with the monitoring and implementation of new systems.

SMBs need simple tools to manage their processes

Administrative processes are crucial to every SMB. However, they are outdated and inept. Functions like HR, accounting, and expense management are activities that are prevalent and essential to all businesses of every size and industry. The first accounting function of any business is Expense Management. Way before a business generates income, it will have incurred expenses first. In the same vein, way before the services of an accountant are needed, the business will have developed some way to monitor their expenses.

Regardless of the fact that these activities are crucial, these SMBs still choose to use ineffective, outdated, and mechanical processes to carry out most of the back office functions. While expense management no longer takes the form of paperwork and more digitized processes have been embraced, the digitized processes are merely the digitized representation of batch paper processes; they don’t possess the true characteristics of real-time, mobile-first, and digital-first processes. To meet today’s increasingly technological demands, I believe SMBs must employ modern and technologically inclined solutions that can automate the mechanically defined and time-consuming back-office functions.

The truth remains that most businesses manage expenses manually. While technological innovation, like cloud-based accounting platforms, has improved accounting activities, much still needs to be done in the crucial aspect of data-gathering processes that precedes the accounting workflow. Expense Management is, in fact, one of the most technical pre-accounting processes.

The mechanisms employed by most SMBs are mechanical and time-consuming; they take the form of employees physically filing expense claims, handing in receipts, and scanning and attaching receipts to emails. Unlike accounting and payroll, which are well managed by people who are held accountable for the successful execution of the functions associated with them, expense management has several managers but no owners. For expense management processing to work well, it must also work well with other internal systems like enterprise resource planning, human resources, etc., as well as with consumer applications like Uber.

In short, manual processing of expense management is detrimental to productivity and job satisfaction.

Growth strategy fits well to tackle the SMB industry

Employees, having used EXFY for the first time, came to the realization that the platform has helped to improve their productivity and save time. Because of this, they recommended EXFY to other businesses. EXFY has an effective and self-service business model that is facilitated by the viral, bottom-up adoption of their platform by employees. Traditional enterprise sales focuse on a small number of decision makers, whereas EXFY focuses on the employee, which allows for zero marginal cost for new leads, numerous entry points for each customer, and, most importantly, the ability to sell a large portion of the market profitably from a single person to the world’s largest organizations.

Since EXFY’s members are responsible for spreading the use of Expensify within their organizations, the company’s platform and business model are laser-focused on enhancing the quality of life for those members. This produces enthusiastic word-of-mouth, which in turn leads to organic growth in both customer base and revenue. Because there are so many more workers than managers in any given company, EXFY doesn’t feel the need to narrow its marketing to specifically qualified decision makers; instead, it treats every employee in every company as a potential customer. As a result, EXFY has a tremendous advantage over more conventional sales channels and can reach a much wider audience with its advertising efforts

Q3 earnings

EXFY’s third-quarter results were weaker than I expected, with revenue and non-GAAP earnings per share falling short of expectations and EBITDA margins contracting by 6 percentage points from the previous quarter. Pay-per-use volatility also contributed to a sequential slowdown in EXFY’s average paid member growth and a quarterly decline in ARPU. To improve predictability, management is attempting to convert pay-as-you-go users to annual plans.

Despite the negative developments, management announced a $6 million share repurchase and revealed preliminary October numbers that indicated 4Q top-line acceleration. In addition, EXFY saw an 115% increase in their interchange amount (the benefit from card services). Due to the terms of the current contract with Marqeta, this is a deduction from earnings. Management intends to restructure the contract in the coming quarters in order to count the interchange as revenue.

Valuation

I believe EXFY is worth USD16.66/share in FY23, representing 70% upside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue growth will follow the lower end of management’s long-term guidance of 25 to 35%. It would be nice to see 30%, but just for modeling sake, I assumed 25%.

- Since EXFY is still a high growth company with no meaningful profits, I used a revenue multiple to value it. Given that consensus growth over the next few years is relatively in line with long-term guidance, I assumed the same EXFY to trade at the same level 1 year from now in FY23.

KEY RISKS

Awareness in the SMBs space is not easy to build

A major obstacle is thrown in the way of EXFY by do-it-yourself methods and organizations that offer traditional horizontal platform solutions with expense management features, corporate card providers, and niche expense management solutions. Many businesses that take this traditional approach are completely unaware that EXFY can provide them with a single platform that will cater to their needs, rather than fragmented and costly services.

Recession

Big corporate businesses have a solid balance sheet, unlike SMBs, which can totally go out of business in an economic downturn because of a lack of funding and business. This will invariably affect EXFY because their major users are SMBs.

Conclusion

EXFY’s major aim is to cater for SMBs to ensure better productivity and great user experience. Instead of going through the traditional method of managing their accounting processes, EXFY is offering SMBs a single platform that will be of great benefit to these businesses. You know what they say, if you can make the customer happy, you can make their money easily.

Be the first to comment