Joe Raedle/Getty Images News

Launched in 2001, Expedia (NASDAQ:EXPE) is one of the most widely used travel comparators worldwide and allows you to book flights, hotels, cruises, holiday packages and car rentals all over the world. Just to mention a few numbers taken from the Expedia 2020 Annual Report we note 2.9m lodging properties available, more than 800 thousand hotels, 500 airline companies as well as activities in more than 200 countries. Registration is optional and it is accessible in over thirty languages. Each user can write reviews on any accommodation only if in possession of a valid reservation. Currently, Expedia is one of the world’s largest online travel agencies. The Company also offers specific services for business travel and manages numerous brands including Hotels.com, trivago and many others displayed below:

Why are we confident?

- Despite being one of the largest online travel agencies, Expedia’s gross booking represents a single fraction of the total worldwide travel market;

- Our internal team is confident that Expedia is very well positioned to increase its market penetration after the COVID-19 outbreak and the cyclical recovery;

- Expedia is mainly focused on the US market, and we believe that macroeconomics are more supportive in the States than in Continental Europe; FX might play in favour of US holiday travelling in the EU.

- During the pandemic, the Company has been transforming itself by unifying brands and communication strategies. This will bring significant shareholder value over the medium-long term. In terms of M&A and simplifying Expedia structure, the Egencia brand was sold to Amex GBT (American Express Global Business Travel). As part of the transaction, Expedia will own 14% of the combined entity and more importantly it has secured a 10-year contract that will generate almost $60 million in EBITDA.

- Over the years, Expedia has been launching important cost-saving initiatives. Having centralised back-end operations, tech, marketing & communication, and after the brand consolidation as already mentioned in point four, Expedia will be able to generate more efficiencies. We forecast a cost improvement of almost $900 million.

- Other cost-saving includes real estate, total headcount, and software. Automation will play a crucial role in Expedia’s future and the company will fully benefit from these trends that the pandemic has accelerated.

Despite the saving initiatives, Expedia has promoted various campaigns aimed to capitalise on consumer awareness on travel.

Q4 results, valuation and associated risks

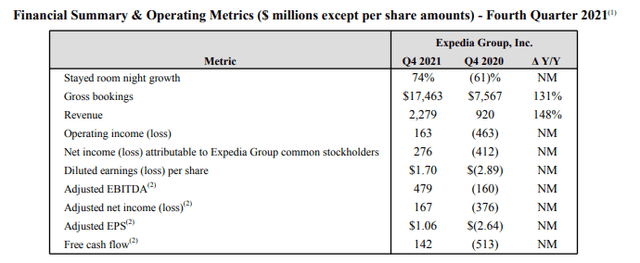

It goes without saying that the COVID-19 pandemic has severely restricted Expedia’s business model. While results in Q4 were once again negatively affected by the Omicron variant, management emphasised that clients are continuing to travel and noted the fact that each new variant has been shorter and less severe.

Having said that and having analysed the key highlights in the Q4, we see that revenue and total gross bookings are down by 17% and 25% respectively compared to pre-COVID-19 results in 2019.

Concerning the valuation, we use a DCF methodology with a long-term growth rate of 3% and a WACC of 10%. Based on our internal forecast, the EBITDA figure for 2023 is estimated to be $2.7bn suggesting a base case valuation reaching $230 per share versus the $186 per share at the time of writing. We still highlight 1) marketing leverage and cost improvement 2) travel recovery and incremental bookings 3) higher productivity thanks to a full transition to the cloud.

Major risks that could negatively impact Expedia’s stock price:

- Macroeconomic events;

- Worsening conditions from the current health crisis;

- Higher competition;

- Changes in consumer preferences.

Previous coverage in the travel and leisure industry:

- easyJet: Short Turbulences, Long Upside

- Ryanair: Our Bet On Travel Recovery

Be the first to comment