lixuyao/iStock via Getty Images

Eaton Vance Tax-Managed Global Diversified Equity Income Fund (NYSE:EXG) is a closed-ended equity mutual fund launched and managed by Eaton Vance Management. Tax-managed funds are specifically designed to reduce taxes on investments, by either avoiding dividend-paying stocks or selling some stocks at a loss to offset other gains. Taxes can also be reduced by avoiding capital gain, i.e. holding on to stocks rather than selling those.

EXG, though, targets dividend paying stocks and writes call options on one or more U.S. and foreign indices. This enables it to fulfill its primary investment objective to provide current income and gains. EXG has written call options on 48 percent of its portfolio to generate cash flow from the options premium received. The Fund evaluates returns on an after tax basis and seeks to minimize and defer federal income taxes incurred by shareholders in connection with their investment in the Fund.

As the name suggests EXG has diversified investments over public equity markets across the globe. The majority of its investments are in secondary and tertiary sectors. Information technology & Communication (31 percent), financials (11 percent), healthcare (15 percent), industrial (14 percent) and consumer discretionary (12 percent) sectors, together account for more than 83 percent of EXG’s portfolio. Remaining funds are invested in companies in materials, real estate, energy, utilities, and consumer staples sectors.

EXG has been paying steady monthly dividends since 2013. Prior to that this close ended income fund used to pay quarterly dividends. EXGs current yield is 7.75 percent, and it has recorded an average yield close to 10 percent over the past ten years. Throughout its average annual yield has ranged between seven percent to twelve percent. This yield is exceptionally high, higher than even the total return of many funds.

“Exemplary service, timely innovation and attractive returns across market cycles have been hallmarks of Eaton Vance since 1924”. Eaton Vance Management is a part of Morgan Stanley Investment Management, the asset management division of Morgan Stanley. Eaton Vance Tax-Managed Global Diversified Equity Income Fund was formed on February 27, 2007 and has an asset under management (AUM) over $3.18 billion. The fund benchmarks the performance of its portfolio against the MSCI World Index.

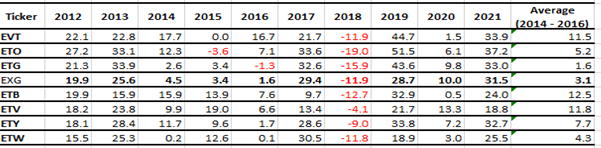

Besides EXG, Eaton Vance Management has launched and managed various Tax-Managed and Tax-Advantaged dividend income funds such as Eaton Vance Tax-Managed Buy-Write Income Fund (ETB), Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV), Eaton Vance Tax-Managed Diversified Equity Income Fund (ETY), Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (ETW), Eaton Vance Tax-Advantaged Dividend Income Fund (EVT), and Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (ETO) and Eaton Vance Tax-Advantaged Global Dividend Income Fund (ETG). All these dividend income funds of Eaton Vance Management have been very consistent in their price growth. This signifies the managerial efficiency of Eaton Vance Management. EXG’s price returns have been strong too. Over the past 10 years, EXG successfully mimicked its benchmark index – MSCI World Index, an unmanaged index of equity securities in the developed markets. During this period, EXG’s market return was very healthy at 13 percent. Over the past 3 years and 5 years, EXG recorded an average market price growth of 23 percent and 16 percent respectively. In 2021 EXG recorded a price growth of 31.5 percent. During the past 10 years, EXG has recorded growth of 20 percent or more five times.

Moreover, it has been able to record close to double digit growth in 2020, successfully overcoming the pandemic related market crash. It suffered a significant loss only in 2018, when the US stock market took a major hit due to higher tariff, interest rate hikes, and tax cuts. Between 2014 and 2016, there was an average growth of 3.14 percent only; but this seems to have been an outlier period.

Eaton Vance Funds (Eaton Vance)

A detailed analysis of the top 60 percent of EXG’s equity investments reveals that it is almost as same as that of ETG, which I covered recently. One third of EXG’s top 60 percent investment is in information technology & Communication (ITC) sector, compared to 21.3 percent of that of ETG. Only 11.7 percent of such investments are in basic industries – Materials, Utilities, Energy, Real Estate and Consumer Staples. In ETG’s case it is 11 percent. Although there are significant investments of both ETG (17 percent) and EXG (11 percent) in the financial sector, none of those investments are more than 1.2 percent of the entire portfolio. This may be the prime reason behind both ETG and EXG delivering high growth despite the financial sector performing poorly. Besides ITC, both ETG and EXG have significant exposure in healthcare and consumer discretionary. In brief, both the funds have followed the same investment pattern, and followed the same benchmark index.

However, EXG is a tax managed dividend income fund while ETG is a tax advantaged dividend income fund. As a result of this, EXG has a higher distribution rate, as it aims for better dividend paying stocks and premium realization through writing call options. On the other hand, ETG has generated higher returns through successful utilization of its borrowings (17.5 percent of its total holdings) and used income from bonds for payment of steady dividends. A closer look at the past 10 years’ return (shown in the above table) reveals that, during bull runs, ETG performed better than EXG, and during bear runs, EXG outperformed ETG. In other words, in the high growth years (2012, 2013, 2017, 2019 & 2021), ETG’s return is higher, while during the years of low or negative growth (2014, 2015, 2016, 2018, 2020) EXG’s return is relatively higher. This is because in high growth years, EXG is suffering losses from the call options it has written, whereas in bearish markets, call options remain unexercised.

Going forward, global stock markets are expected to perform better, and I expect a series of small bull runs. Overseas developed economies triumphed over the twin headwinds of the virus and inflation. The pandemic hit the US market hard in march 2020, however the impact was not as severe as people would have expected. Strong upward movements will surely have some negative impacts on EXG’s exposure on call options. However, this fund will gain much more from its equity investments. And in case the market witnesses some downward movement, EXG will gain from the unexercised call options. Thus, EXG will always be in a win-win situation unless investors stay away from the stock market for a longer period of time, as happened in 2018.

EXG will always have a steadier return than ETG. In other words, this close ended diversified income mutual fund is less volatile. Call options add another degree of diversification to this fund. I can invest in EXG just for its exceptionally high close to double-digit dividend yield. However, the price growth is also exceptionally good. Price growth between 13 percent to 23 percent, in the medium and longer term is good enough to attract any investor. Moreover, this close ended tax-managed income fund is anyway more diversified and less volatile. Unlike ETG, this fund is also available at a discount. EXG is trading at 14 percent discount to its 52-week high, and the 10-day simple moving average (9.68) is placed over the 50-day simple moving average (9.46), indicating possible upward movement. Thus, in my opinion it is the right time to get hold of Eaton Vance Tax-Managed Global Diversified Equity Income Fund, and stay invested in it for a longer time horizon.

Be the first to comment