nicomenijes

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Based on the concept that 60/40 Equity/Fixed Income allocations make sense for a segment of the passive investors out there, the idea of Balanced funds was created. I suggested my non-investment-oriented nieces and nephew Roth IRAs use the Fidelity Balanced Fund (FBALX), which dates back to 1986 and holds almost $40b in assets. Today, one can own allocation ETFs with varying equity/bond ratios based on the risk they want to take on.

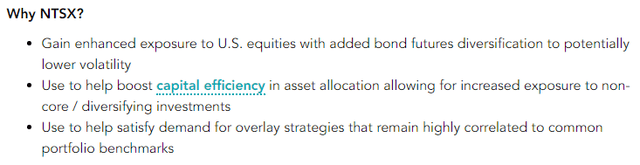

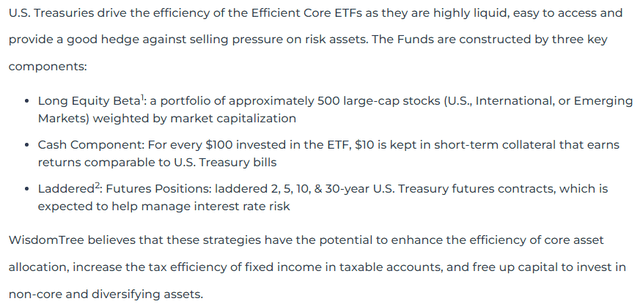

In May 2021, WisdomTree renamed the WisdomTree 90/60 U.S. Balanced Fund to the WisdomTree U.S. Efficient Core Fund (NYSEARCA:NTSX). Despite the name change, the 90/60 ratio is still in play and is achieved by using futures to gain the Fixed Income exposure, underwritten by short-term collateral, usually US T-Bills. In the press release announcing the creation of the WisdomTree Efficient Core Suite of Funds (there are three), they provided this explanation:

Historically, a balanced portfolio (60% equities, 40% bonds) served as the bedrock (and benchmark) for asset allocation decisions. WisdomTree believes this same intuition can be used for creating core strategies in the U.S., international and emerging markets. However, instead of allocating to a portfolio of stocks and bonds, they provide stock exposure to the U.S., international, and emerging equity markets with a capital efficient exposure to fixed income. This exposure is created by investing 90% of the Fund’s assets in equities and 10% in short-term fixed income. The 60% bond exposure is attained through investment in laddered U.S. Treasury futures contracts.

Jeremy Schwartz, WisdomTree Global Head of Research, said, “High valuations in equities and bonds present a challenge and headwinds for traditional portfolio approaches in achieving investor goals. The WisdomTree Efficient Core ETFs are designed to help investors create capital efficient equity and bond portfolio blends that have lower volatility or similar volatility as a standalone 100% equities allocation.”

Source: www.globenewswire.com/news-release

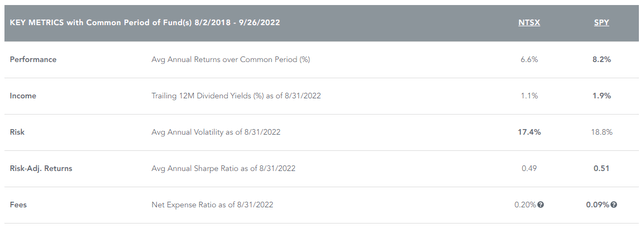

Since the equity portion is mostly invested in and benchmarked against the S&P 500 Index, considering it as a substitute for an ETF like SPDR S&P 500 ETF (NYSEARCA:SPY) seems like a logical conclusion. The results show that could be considered a viable switch.

WisdomTree U.S. Efficient Core Fund review

Seeking Alpha describes this ETF as:

The fund invests in growth and value stocks of large-cap companies. For its fixed income portion, it invests through derivatives in U.S. treasury securities with maturities between 2 to 30 years. The fund uses derivatives such as futures to create its portfolio. It seeks to benchmark the performance of its portfolio against the S&P 500 Index and a composite index comprising of 60% of the S&P 500 Index and 40% of the Bloomberg Barclays U.S. Aggregate Index Composite. NTSX was formed in 2018.

Source: seekingalpha.com NTSX

NTSX has $743m in assets and provides a 1.5% yield. The managers charge a reasonable 20bps for an actively managed ETF. Normally at this point when reviewing an ETF, I cover the index used, or in this case two, but since they only measure themselves against the blended benchmark, I will skip that, especially since most readers are familiar with both. WisdomTree provides the strategy and reasons behind NTSX, plus a list of several benefits from adding NTSX to an investor’s allocation.

The WisdomTree U.S. Efficient Core Fund takes a unique approach to balanced fund investing. The Fund offers investors a risk profile that is similar to the traditional 60/40 portfolio with the potential for enhanced returns and increased tax efficiency. The 90/60 strategy has the potential to enhance total returns while also helping dampen volatility by combining 90% equities, 10% short-term fixed income plus a 60% Treasury futures overlay to help boost capital efficiency.

Source: wisdomtree.com NTSX

NTSX holdings review

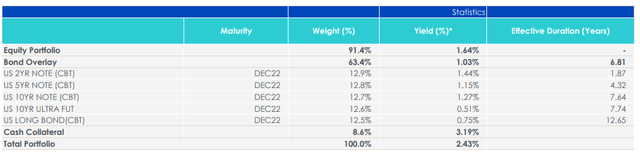

Of the 500 stocks held by NTSX, 424 are S&P 500 index stocks. The non-index stocks account for only 4% of the of NTSX’s weight. It also holds US T-Bills, and several UST futures. They are structure this way, as WisdomTree outlines, for these reasons:

A high level look at the holdings reveals:

As rate increase, the income generated by the cash collateral and futures should improve. Note that while the futures are laddered to across the yield curve in order to limit reinvestment risk, they all expire on the same date.

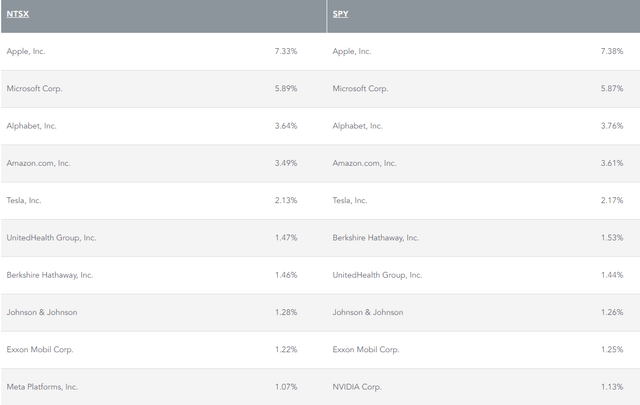

As mentioned above, NTSX only owns 424 of the stocks in SPY but they account for 97% of SPY’s weight. Both overlaps are critical if one is thinking of replacing SPY with NTSX. The top holdings are listed later in the Compare section of this article.

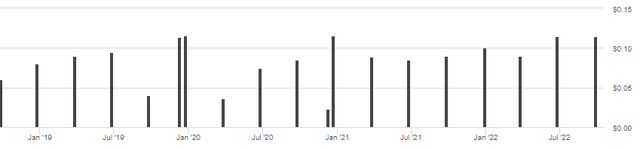

NTSX distribution review

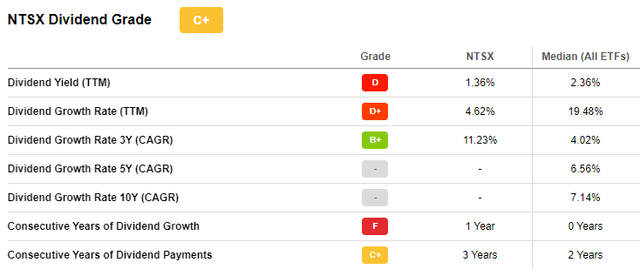

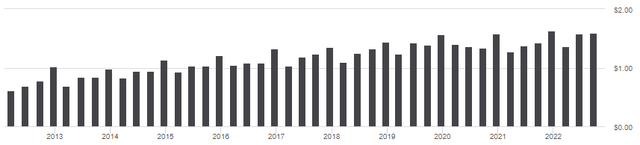

Payouts occur quarterly, with an occasional bonus payment. It might be too early to tell if higher interest rates will results in larger payouts. NTSX only earns a C+ grade for its distribution history from Seeking Alpha.

seekingalpha.com NTSX scorecard

SPDR S&P 500 ETF review

Seeking Alpha describes this popular ETF as:

The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index. SPY started in 1993.

Source: seekingalpha.com SPY

SPY has $358b in AUM, making it one, if not, largest ETFs in the world. SPY yields 1.7% and the managers are still getting 9bps to run a passive index ETF. With the exception of the Dow Jones Index, the S&P 500 Index is the best known and is preferred by investment professionals as a better representation of the US equity market, especially Large-Cap stocks.

SPY holdings review

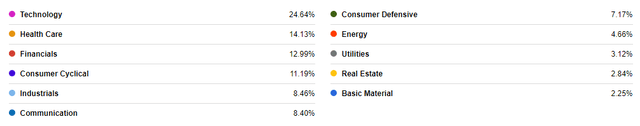

The sector allocation is such:

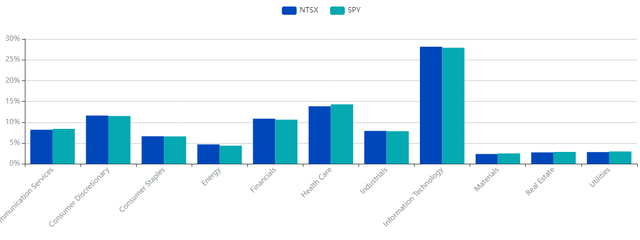

Technology stocks are 25% of the largest 20 holdings, and along with the next three sectors, account for 63% of the portfolio. These are compared against NTSX later.

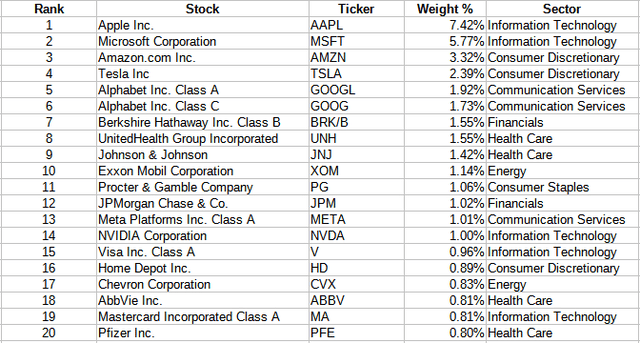

The Top 20 stocks are just over 37% of the ETF’s total weight.

SPY distribution review

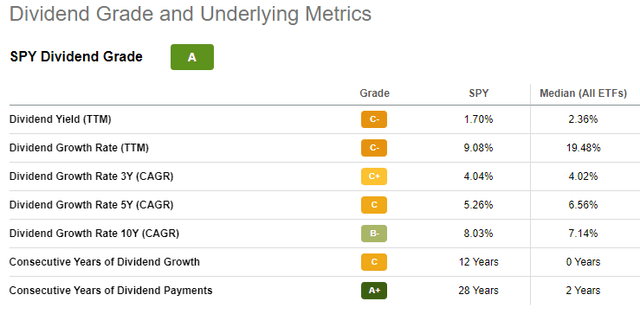

SPY shows higher growth rates for its distributions than NTSX.

seekingalpha.com SPY scorecard

Thanks to its long history of payments, Seeking Alpha gives SPY a “A” rating.

Comparing ETFs

The above data gives a good perspective on how adding futures effects NTSX relative to SPY. In a little surprise to me, NTSX currently has a lower yield, though this could change as interest rates keep rising. One area of concern when considering SPY substitutes is sector drift; that is not an issue between these two ETFs.

The Top 9 holdings are the same, though some differ in placement.

When comparing ETFs in the search for the better “mouse trap”, I look at certain factors to decide if the switch makes sense and how close are they really to being equivalent substitutes. Important questions to ask are:

- What is the correlation between the returns, not just which currently has better history?

- Am I taking on more risk to achieve the perceived return bump? How do their StdDev, Sharpe, and Sortino data compare?

- Is the asset mix the same or am I taking on extra risk associated with the sectors owned (equities) or credit risk (fixed income)?

- Are there other factors that differ, as could bond fund durations, or country exposure for international funds?

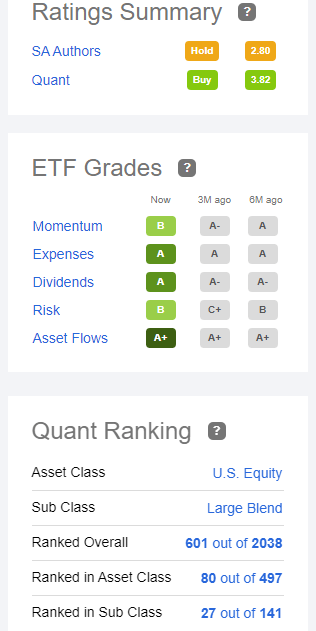

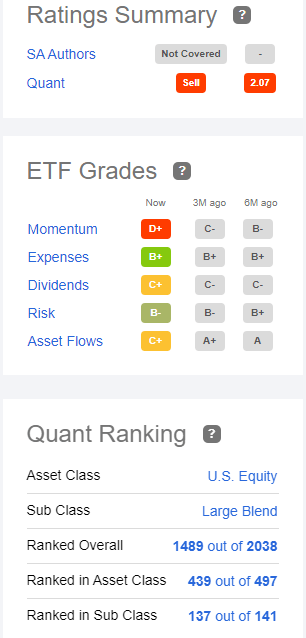

Here is how Seeking Alpha grades and rates each ETF on multiple factors.

seekingalpha.com SPY seekingalpha.com NTSX

The Seeking Alpha Quant rating system ranks SPY very well but NTSX almost at the bottom of its sub-class, Large Blend.

Portfolio strategy

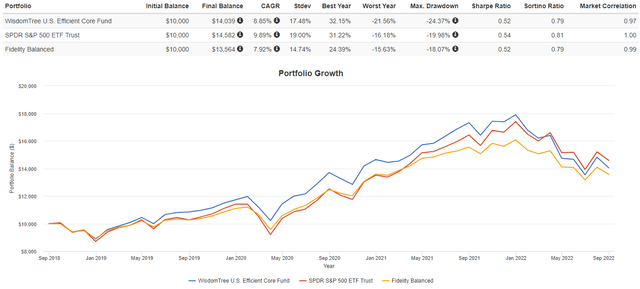

As with many non-pure equity ETFs that might be viewed as substitutes for SPY, NTSX comes up short on performance, but that currently is due to poor 2022 results. Since I mentioned FBALX at the start of the article, I included it here.

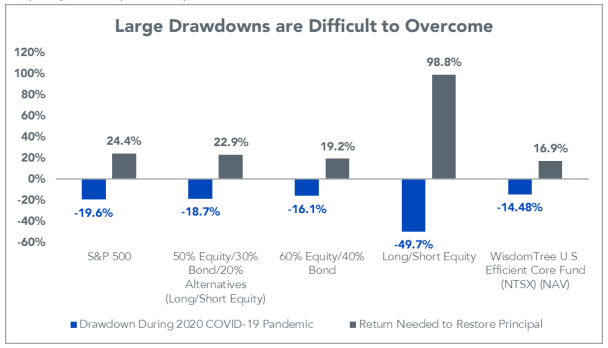

But one of the points WisdomTree expounds is NTSX has lower risk. As measure by StdDev, this has been the case. During COVID, that factor proved to have benefited NTSX investors.

wisdomtree.com

That said, the current long downturn has NTSX showing a deeper drawdown than SPY has experienced.

Final thoughts

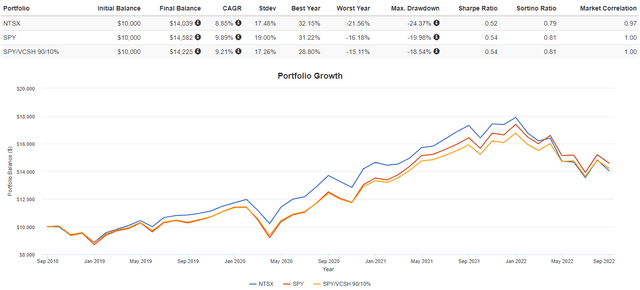

When looking at new ETF like NTSX with unique strategies, I then like to see if a combination of ETFs executes a closely-aligned process that has better results. Without much effort, I found one. Since NTSX is basically 90% equity, by building a portfolio of 90% SPY and 10% Vanguard Short-Term Corporate Bond ETF (VCSH), I see better return and risk data.

Owning ETFs like SPY means you should match market performance, maybe under by the bps charged. Most studies show active managers fail to beat their benchmark up to 75% of the time over long periods. Even if based on a unique index, ETFs like NTSX fall into what I consider ‘actively managed”. That said, one needs to ask themselves about how much time do they want to spend looking for that better “mouse trap”?

Be the first to comment