Exact Sciences (EXAS) is definitely one of the hardest-hit healthcare stocks in this COVID-19 pandemic. The stock fell from $95.58 on January 2 to $47.19 on March 23. While the stock is back to $74.65 on April 17, it still remains down by 19.28% YTD (year-to-date). And this leading cancer diagnostic player definitely deserves better.

Exact Sciences is a leading player in the field of minimally invasive tests for the prevention and detection of cancer. Investors are anticipating a decline in demand for the company’s products due to the social distancing requirements and wide-spread lockdowns across multiple countries in the world. However, we must remember that the demand will spurt back again once the pandemic is over. Cancer is very much here to stay and we are going to require minimally invasive molecular diagnostic tests to prevent and control this disease. And even during the pandemic, a significant number of physicians and patients will go ahead with screening, considering that majority of cancers have high mortality rates. Finally, the company has also secured FDA EUA (emergency use authorization) for a COVID-19 diagnostic test. Hence, the recent decline in share price can be an attractive entry point for retail investors to pick up this stock.

Exact Sciences is a top-notch player in the cancer diagnostics segment

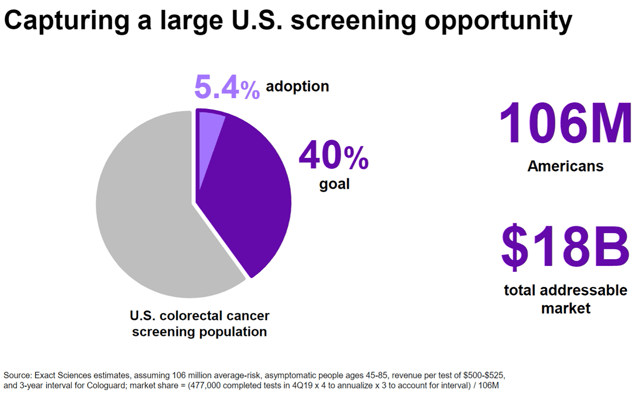

Exact Sciences’ flagship product, Cologuard, is used to detect precancerous and early-stage cases of colorectal cancer, a market opportunity worth $18 billion in the U.S. alone. The company is expected to emerge as a major player in this segment. According to the American Cancer Society, Cancer Facts and Figures 2020, colorectal cancer is the second deadliest cancer in the U.S.

At end of 2019, Cologuard was used by 5.4% of the total 106 million, average-risk, asymptomatic people aged 45 – 85 in the U.S. The company is targeting an adoption rate of 40% in this market. This is achievable, considering that Cologuard offers a non-invasive alternative to colonoscopy, a procedure that requires anesthesia. The expansion in Cologuard’s FDA label to include patients as young as 45 years of age, lower than the prior approval which targeted patients starting 50 years and above, has expanded Cologuard’s addressable market opportunity by 19 million patients. The company aims for earlier detection of colorectal cancer, which in turn can allow earlier treatment and better outcomes.

Besides Cologuard, Exact Sciences is also working on developing innovative diagnostic tests for other types of cancers. These tests can emerge as major growth drivers in the future. The company secured FDA’s breakthrough device designation for blood-based liquid biopsy test for hepatocellular carcinoma, which is the most common type of liver cancer in 2019.

In November 2019, the company demonstrated 80% sensitivity at 90% specificity from a new study of 443 patients evaluating this liquid biopsy test in HCC patients. The study also demonstrated 71% sensitivity for early-stage HCC at 90% specificity, much higher than the most commonly used blood-based AFP (alpha-fetoprotein) test, which has 45% sensitivity at 90% specificity for early-stage HCC. This data was presented at the 2019 annual meeting for the American Association for the Study of Liver Diseases. The company expects FDA approval for this test in late 2020.

Exact Sciences’ $2.9 billion acquisition of Genomic Health completed in November 2019, has also strengthened the company’s cancer diagnostic portfolio and pipeline. The acquired precision oncology portfolio seems mostly resilient to the pandemic, considering that breast cancer and prostate cancer patients will require testing to determine appropriate treatment plans. The deal expanded Exact Sciences’ product offering by adding Oncotype DX, which includes four diagnostic tests for breast and prostate cancers. Of these tests, three are tissue-based, while the fourth one is a liquid-based test for prostate cancer. Genomic Health’s tissue-based Oncotype DX diagnostic test, used to predict the probability of breast cancer recurrence in previously diagnosed women, is already well-adopted by the medical community. Many physicians opt for this test to determine the optimal treatment plan for their patients.

Exact Sciences plans to further expand the use of the Oncotype DX platform for other types of cancers. Besides reducing Exact Sciences’ over-reliance on the colorectal cancer segment, the deal has also strengthened the company’s oncology-focused sales force. Exact Sciences will also benefit from Genomic Health’s collaboration with Belgian-based Biocartis, which enables the Oncotype DX test to be performed at a local laboratory or hospital using Biocartis sample cartridge and analyzer. This allows for much faster turnaround times for the tests.

Exact Sciences also announced the acquisition of two privately held cancer diagnostic companies, Paradigm Diagnostics and Viomics, in March 2020. The acquisition of Paradigm Diagnostics has added a genomic profiling test for patients with advanced, refractory, or recurrent cancer. This will help physicians determine targeted therapies or clinical trials for the patients based on the tumor profile. Paradigm Diagnostics has already secured Medicare coverage for the test. Exact Sciences expects this test to make its mark in the molecular diagnostics space due to the smaller sample requirements and faster outcomes. Exact Sciences has also gained access to Viomics’ DNA sequencing capabilities and expertise related to identifying cancer biomarkers. The company can deploy these capabilities in its breast and prostate cancer test offerings, obtained through the acquisition of Genomic Health.

Although the COVID-19 pandemic is a cause of concern for Exact Sciences, the company also stands a chance to benefit from this global crisis. On March 18, CMS (Centers for Medicare & Medicaid Services) announced that all elective surgeries, non-essential medical, surgical, and dental procedures be delayed during the COVID-19 pandemic. This implies that the number of colonoscopies for cancer screening will also be suspended. Since early-stage cancer detection is a matter of life and death for these patients, physicians may switch to the alternative at home Cologuard molecular diagnostic test, which is based on the patient’s stool sample. This, in turn, can bolster the company’s revenues and earnings.

The company has a robust financial profile

In 2019, Exact Sciences’ revenues rose YoY by 93% to $876 million. This was partly driven by the rapid uptake of Cologuard molecular diagnostic tests and partly by the acquisition of Genomic Health.

In the fourth quarter, the company’s revenues jumped YoY by 60% to $296 million. Again, while most of the revenues were attributable to Cologuard sales, a small portion also came from sales of Biomatrica products. Exact Sciences reported a 63% YoY spike in Cologuard test volume which reached in the fourth quarter. The company also earned $66 million from Genomic Health’s precision oncology business from Nov. 8, 2019, to Dec. 31, 2019. Exact Sciences has earned $119 million from Genomic Health’s business on a Pro-forma basis in the fourth quarter.

The company also reported a profit of $0.54 per share in the fourth quarter. However, in the absence of a one-time tax benefit, the company would have reported significant loss.

On February 24, Exact Sciences also announced an increase in the size of the underwritten public offering of 0.3750% convertible senior notes due 2028 from $850 million to $1.0 billion aggregate principal amount. This is an exceptionally smart move by the company, especially when interest rates are dirt cheap. The company has managed to raise capital at a very low-interest rate without immediate equity dilution. It also highlighted robust demand for the company’s debt by institutional investors, despite the very low-interest rate. Investors are confident not only about the company’s capability to repay the debt but also about the stock reaching the rather high conversion price of approximately $121.84.

At the end of 2019, the company had cash worth $323.65 million. This coupled with recent capital raise and robust revenue trajectory is sufficient to sustain the company’s operations. I do not see any challenge to the company continuing as a going concern for many more years.

Investors should consider these risks

Exact Sciences is a loss-making company on a full-year basis and may not report profits for a few more years. Although innovative healthcare companies can take a number of years to break even, this may not be what investors want in such dire times. The company reported a net profit of $77.9 million in the fourth quarter. However, that performance was attributable to a one-time income tax benefit of $184.6 million. In absence of the tax benefit, the company’s fourth-quarter loss would be $106.7 million, almost 100% deterioration on a YoY basis.

On March 19, Exact Sciences withdrew its fiscal 2020 financial guidance in the face of increasing COVID-19 challenges. The company has backed off from its fiscal 2020 revenues of more than $1.60 billion, with 20% in the first quarter. In the short-term, patients are expected to delay their PCP (primary care practitioner) visits and screening appointments. This expectation is reasonable, considering the Exact Sciences’ testing business has previously suffered during bad flu seasons.

Shareholders were also displeased with the company’s $1.0 billion senior convertible note offering considering that it can lead to equity dilution in future years.

What price is right here?

According to finviz, the 12-month consensus target price of Exact Sciences is $107.60, 44.14% higher than the previous close. The company is currently trading at a forward P/S (price-to-sales) multiple of 11.79x, which is not very cheap. However, I believe that the stock can climb much higher considering the high growth opportunity available for Cologuard in the CRC screening segment and the company’s targeted focus on the broader cancer diagnostics market. The company is also set to benefit from increasing preference for minimally invasive liquid biopsy tests. Physicians and patients are also demanding more accurate and less time-consuming tests, and Exact Sciences is well-positioned to leverage this demand. Here, I will recommend only patient retail investors to go for the stock, since there are definitely some bumps the company may face in 2020.

While the majority of the analysts have reduced the target price for the stock, they have maintained the Buy rating. On April 17, Craig-Hallum analyst Alex Nowak lowered to $99 from $127 but has rated the company as Buy. On April 2, Evercore ISI initiated coverage of the company with an Outperform rating and $70 price target. On March 20, Baird analyst Catherine Ramsey Schulte reduced target price from $125 to $100 but reiterated Outperform rating. I believe that the target price of $100 is a realistic reflection of the true growth potential of the stock in the face of the ongoing pandemic.

I recommend investors to wait till Exact Sciences’ first-quarter earnings call scheduled on May 6. A significant impact on first-quarter earnings and a large reduction in fiscal 2020 guidance can lead to some emotional selling. This can offer a better entry point to retail investors. Therefore, retail investors with above-average risk appetite and investment tenure of at least one year can start considering this stock as a reliable pick for 2020.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment