RyanKing999/iStock via Getty Images

Investment Thesis

Earlier this year, two investigational reports from the New York Times and the WSJ turned the gene testing market upside down, prompting the FDA to take steps to rein in the market. An industry-broad sell-off ensued, exacerbated by the Fed’s monetary tightening. However, I believe Exact Sciences (NASDAQ:EXAS) is mostly immune from these regulatory disturbances because of one historical incident that seemed detrimental at the time but today justifies this optimistic assessment, as discussed in more detail below.

Regulatory Change

To understand the regulatory landscape of EXAS and the historical events that have shaped its current market position, readers may find it helpful to start at the end, beginning with Congress’ decision not to pass the VALID Act last week. The Act would have satisfied the FDA’s demands for more regulatory authority over the thousands of Laboratory Developed Tests (LDTs) currently in use, which have been plagued by scandals this year as a result of multiple investigative reports by mainstream media revealing inaccuracies, improper use, and misinterpretation of various tests, sparking public outrage, class action lawsuits and renewing the FDA’s resolve to extending its regulatory arm over the market. The Congress’ decision provided temporary relief to gene testing companies. Still, the bill is far from dead, and I believe that it will pass sooner or later, given the bipartisan support and the FDA’s determination to end the self-regulatory status of LDTs.

How would this expected regulatory change impact EXAS’s revenue? Well, I believe not so much. Until 2008, EXAS and Labcorp (LH) had a licensing agreement where EXAS outsourced all marketing activities of its flagship colorectal cancer screening product, Cologuard, to LH in return for high-teens percent royalties. The arrangement meant that EXAS would sell its product as an LDT, thanks to Labcorp’s CLIA-waived laboratories.

In 2008, the FDA sent a warning letter to EXAS, causing considerable trade volatility to its ticker, cautioning that it would take regulatory action if EXAS didn’t acquire a 501K or a PMA for its test (despite being sold indirectly via LH.) This meant tens of millions of dollars in clinical trials, a significant amount for the then-fledgling biotech startup with a market cap of around $60 million. Nonetheless, with hard work, determination, and tens of millions on R&D spent, the company introduced an improved version of its screening test, Cologuard, in 2014, and the product now constitutes one of the few FDA-approved gene screening tests on the market and the only stool-DNA screening test for colorectal cancer.

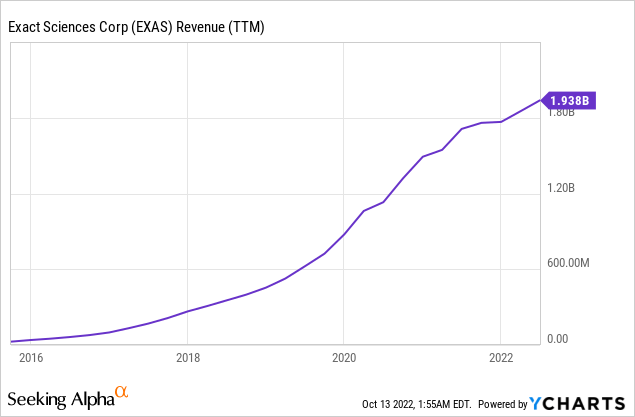

Revenue Trends

EXAS’s growth over the years has stemmed from three primary sources: First, the company registered numerous diagnostic tests with the FDA in recent years, thereby expanding its distribution reach and increasing its potential customer base. Second, the company has been acquiring other diagnostics companies, such as PreventionGenetics, Ashion, Thrive, and, most recently, OmicEra Diagnostics. And third, EXAS has been using celebrity endorsers in its marketing campaigns to increase awareness among the target demographic, in particular baby boomers such as Katie Couric and Harry Connick Jr, perhaps inspired by The “Angelina Jolie” Effect, when the pop culture icon revealed she was high-risk for breast cancer, causing a spike in gene testing. These efforts have paid off, as evidenced by the strong growth in revenue.

Future growth could come from gaining further market share from its two main offerings – Cologuard and Oncotype Dx tests. The company recently secured favorable guidance and recommendation from the American Society of Clinical Oncology “ASCO” for the use of its Oncotype DX for Breast Cancer patients. In July 2022, the CMS proposed a regulatory change that intends to remove barriers to colorectal cancer screening by eliminating Medicare colonoscopy co-payments for patients who have undergone a Cologuard test. The Medicare coverage change will likely take effect in January 2023, offering a potential catalyst for higher revenue. The company is also expanding its clinical trials program, enhancing reimbursement pathways which could provide another source of revenue in the future.

Management also attributed the growth to continued market adoption of Cologuard, which contributed to roughly two-thirds of overall revenues in Q2. EXAS reported sales of $522 million during the quarter, an increase of 20% from last year. Excluding the negative impact of weakening COVID-test demand, screening services (mainly consisting of Cologuard) increased 34% compared to the same period the previous year, 4% of which is attributed to the PreventionGenetics acquisition in Q4 2021, mirroring solid organic growth.

Operations, Competition, and Growth Drivers

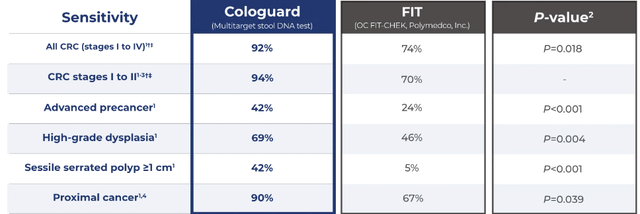

The US market for colorectal cancer screening is sizable, with about 100 million people aged 45 or older, the recommended age range for periodic CRC screening. As a result, various industry participants have their eyes on this lucrative market. All of the existing CRC screening technologies currently in use are limited by low sensitivity, inconvenience to patients, or high costs. Colonoscopy is invasive, FIT tests require annual screening (as opposed to Cologuard’s 3-year interval), and is also less sensitive than Cologuard. At the same time, Epigenomics’ (OTCQX:EPGNF) Epi proColon has a low sensitivity ratio and is not included in the CDC’s recommended list of CRC screening tests. Most non-invasive tests (excluding FIT and gFOBT) developed over the years, including Medtronic’s (MDT) PillCam, and Epi proColon, failed to create traction with providers or key opinion leaders (professional associations and standard-setting bodies).

We suggest that the Septin9 serum assay (Epigenomics, Seattle, Wash) not be used for screening – U.S. Multisociety Task Force on Colorectal Cancer.

For now, Cologuard seems to be the most accurate non-invasive CRC screening test on the market, but it does face commercialization challenges.

For example, Premera Blue Cross favors FIT tests based on an in-house value/cost analysis. FIT tests cost around $30 compared to $500-$600 for Cologuard. Even when considering the testing frequency (3-year interval for Cologuard vs. one year for the FIT test), the latter is still less expensive. For this reason, some insurance companies (such as Premera Blue Cross) encourage healthcare providers to consider the cost difference when prescribing screening tests for their patients.

Summary

EXAS’s growth has been phenomenal, driven by portfolio expansion, awareness campaigns, and clinical trials that established insurance reimbursement pathways. The company is largely immune from current regulatory risks, manifested in the FDA’s intent to regulate the LDT market, given that Cologuard, which represents two-thirds of EXAS’s revenue, is an FDA-approved diagnostic device. The company is scheduled to release Q3 earnings on November 3, 2022, after the market close. The market expects revenue of $503 million, a modest 10% YoY growth forecast. As EXAS starts shifting its business models from “growth at all costs” to “profitable growth” in response to rising capital costs, its sales will expand slower than historical averages. Still, given the market’s current disposition to reward value over growth, EXAS shares could potentially deliver contrarian capital gains as margins improve.

Be the first to comment