SolStock

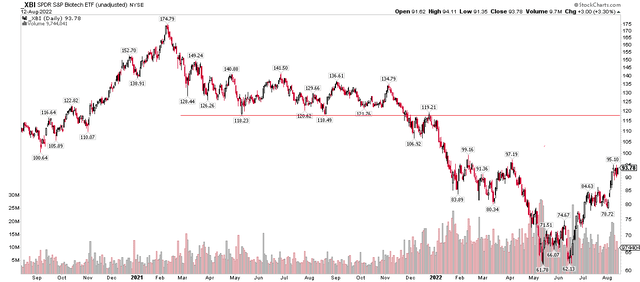

Biotech stocks have been on a tear lately. The equal-weight SPDR S&P Biotech ETF (XBI) is up more than 50% from its May and June lows. After forming a bullish double-bottom technical feature earlier this year, volume has come into the niche ETF as speculative price action returns to the broader market. Traders eye the $118 level on XBI – that was an important spot in 2021.

Biotech Stocks’ Summer Surge

Not all biotech stocks have participated, though. One diagnostics firm, known for the Cologuard colorectal cancer screening test, trades poorly and does not make a profit. Still, the bulls point to potentially high growth stemming from robust demand from doctors and patients. Much of that optimism is based on positive developments with Cologuard and Oncotype DX.

According to Bank of America Global Research, Exact Sciences (NASDAQ:EXAS) is a molecular diagnostics (MDx) company with a focus on cancer screening tests. Exact has commercialized a next-generation non-invasive colorectal cancer (‘CRC’) screening test, Cologuard, which received concomitant FDA approval and Medicare coverage in 2014. In 2019, Exact acquired Genomic Health, an MDx company best known for its Oncotype DX portfolio of tests to help optimize treatment decisions for cancer patients.

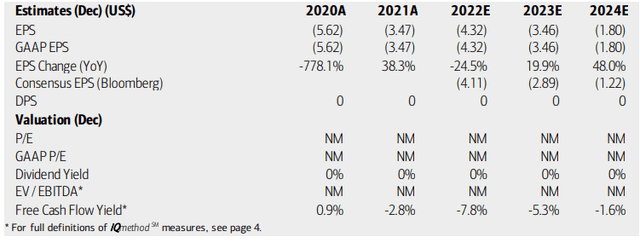

The Wisconsin-based $7.6 billion market cap Health Care sector company in the Biotechnology industry features negative earnings over the last year and does not pay a dividend, according to The Wall Street Journal. Analysts at BofA see earnings continuing to be in the red through 2024, though growing sharply in the years ahead. Still, the company does not pay a dividend and free cash flow is seen as negative for the foreseeable future.

EXAS: Earnings and Free Cash Flow Forecasts

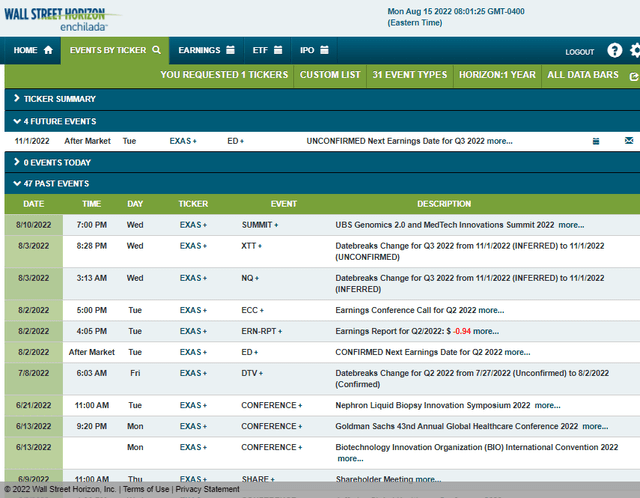

Exact Sciences’ corporate event calendar is light until its unconfirmed Q3 earnings date of Tuesday, November 1, AMC, according to Wall Street Horizon. The company presented last week at the UBS Genomic 2.0 and MedTech Innovations Summit 2022, but shares failed to rally during and after the event.

EXAS Corporate Event Calendar

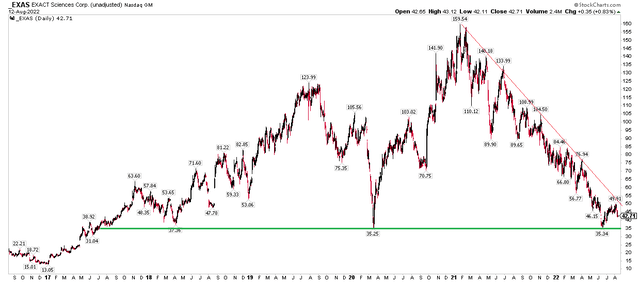

The Technical Take

EXAS shares have slid hard over the last year-and-a-half. The biotech stock participated in the industry’s upside during late 2020 and then in the bear market in 2021 and over the first half of 2022, but it has not been involved in XBI’s big bounce.

I see support on the chart of Exact near $35. That was a pivotal spot in early 2018, March 2020, and this past June. Based on recent price action, I think the stock has a date with that figure once again before long. With relative weakness lately, I think there is a good chance it will bust through it this time. I would avoid the stock from a technical perspective. I’d like to see the stock climb above $50 for some long-term bullish action to show signs of materializing.

EXAS: Another Date With $35 Support?

The Bottom Line

Exact Sciences has a bearish fundamental and earnings picture while its chart is ugly. Down more than 70% from its early 2021 high, there has been little relief despite a surge in the biotech industry ETF. I see EXAS going lower from here.

Be the first to comment