SeanPavonePhoto/iStock via Getty Images

Investment Thesis

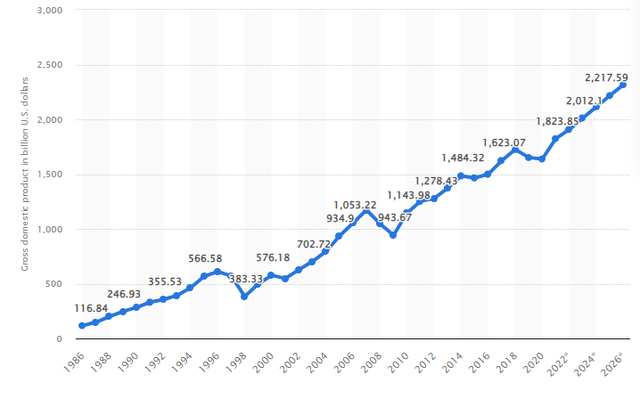

South Korea’s economy is a sophisticated mixed economy, mainly composed of family-owned companies called chaebols. In terms of nominal GDP, it has the fourth-largest economy in Asia and the tenth-largest economy in the world. Going forward, the economy is expected to grow at a ~4% annual growth rate up until 2026, which is relatively good compared to other developed markets that struggle with growth such as France or Japan.

The unemployment rate remains low with levels staying in the range of 2.5 to 4%, which should boost domestic spending. Yet, there are a number of challenges that South Korea needs to tackle going forward, including an aging population and a heavy reliance on exports, which could become a drag on future growth. In this report, I will review the iShares MSCI South Korea ETF (NYSEARCA:EWY) which provides exposure to a basket of South Korean equities.

Strategy Details

The iShares MSCI South Korea ETF tracks the MSCI Korea 25/50 Index composed of South Korean equities. This ETF can be used to express a single country view (long/short) or as part of a broader portfolio strategy to get exposure to large and mid-sized companies in South Korea.

If you want to learn more about the strategy, please click here.

Portfolio Composition

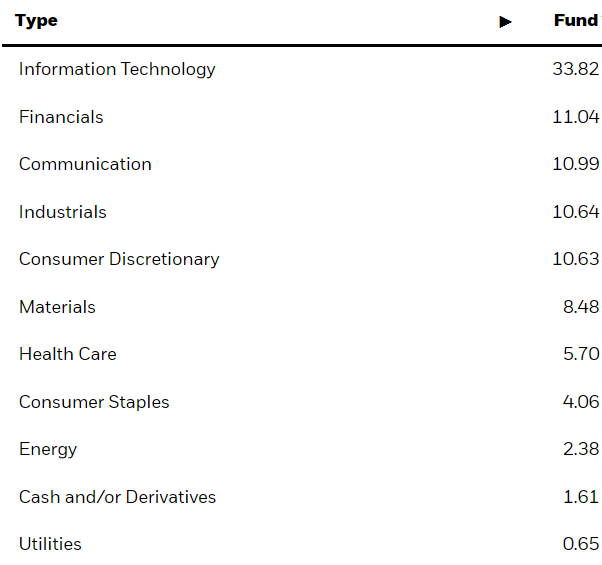

From the sector allocation chart below, we can see the index places a high weight on the Information Technology sector (representing around 34% of the index), followed by Financials (accounting for 11% of the index) and Communications (representing around 11% of the fund). The largest three sectors have a combined allocation of approximately 56%. In terms of geographical allocation, EWY is investing exclusively in South Korea.

iShares

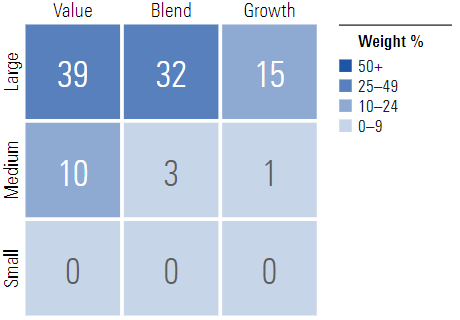

EWY invests over 39% of the funds into large-cap value issuers, defined as large-sized companies where value characteristics predominate. Large-cap issuers generally have a market capitalization exceeding $8 billion. The second-largest allocation is large-cap blend equities, with a 32% allocation. This ETF mostly invests in household names such as Samsung or Hyundai, which are large and stable corporations. It is interesting to note that EWY doesn’t allocate any amount to small-caps, which tend to outperform large-caps over a long period of time.

Morningstar

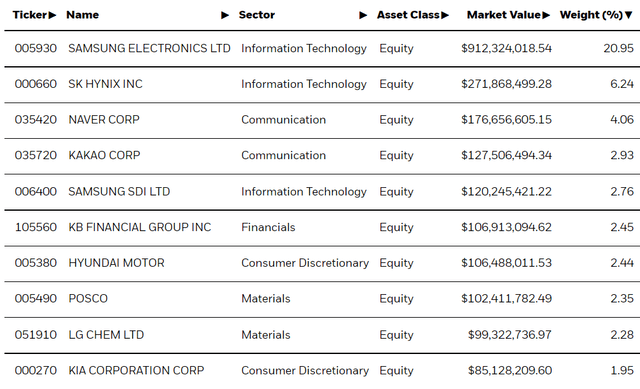

The fund is currently invested in 112 different stocks. The top ten holdings account for 48% of the portfolio. The largest position in the portfolio is Samsung Electronics with a 21% allocation, which gives an idea of the massive size of this company relative to other South Korean corporations. Given the high allocation to this stock, I think it is important to be comfortable with a concentrated portfolio when buying EWY.

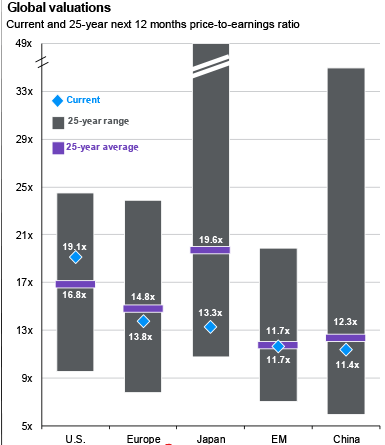

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to iShares, the fund currently trades at an average price-to-book ratio of ~1 and at an average price-to-earnings ratio of ~8.5. If we compare it to other developed markets throughout the world, it seems that South Korea is one of the cheapest places to invest at the moment.

JPM Guide to the Markets

Is This ETF Right For Me?

I have compared below EWY’s price performance against the performance of the Vanguard FTSE Developed Markets ETF (VEA) and the Vanguard Total World Stock ETF (VT) over the last 5 years to assess which one was a better investment. Over that period, VT clearly outperformed EWY and VEA thanks to the strong performance of the US equity market. EWY’s performance was pretty much in line with that of other developed markets ex-US. To put EWY’s performance into perspective, a $100 investment 5 years ago into this ETF would now be worth ~$114.3. This represents a compound annual growth rate of ~2.7% excluding dividends, which is a disappointing absolute return.

If we take a step back and look at the performance from a 10-year perspective, the results don’t change much. Both VT and VEA came on top once again, outperforming EWY since early 2013. I personally believe that South Korea is one of the best investment choices when it comes to developed markets given the economy’s above-average expected performance. On top of that, South Korean equities are trading at a discount relative to other developed market equities, which should provide a larger margin of safety. That said, I expect some volatility in the short term as some parts of the economy – such as real estate – are in bubble territory for some time now and are likely to start cooling off over the next couple of months.

Key Takeaways

EWY provides exposure to a basket of South Korean equities. The fund has a 21% allocation to Samsung Electronics, which makes the portfolio pretty concentrated around one position. Investors purchasing ETFs for their diversification benefits should assess if they are comfortable with a 20%+ allocation to a single stock prior to buying EWY. In terms of valuation, South Korea is cheaper than most developed equity markets at the moment, despite a solid economy and above-average growth prospects. I personally think EWY will do well over the long term, although some volatility should be expected in the short term.

Be the first to comment