Mlenny

Main Thesis & Background

The purpose of this article is to evaluate the iShares MSCI Australia ETF (NYSEARCA:NYSEARCA:EWA) as an investment option at its current market price. This fund is managed by BlackRock (BLK), and its objective is to “track the investment results of an index composed of Australian equities”.

This is a fund I have recommended in 2022, and have owned since January. Looking back, the decision to buy it leaves me with a mixed feeling. On the one hand, it has beaten the S&P 500 – which makes up the bulk of my portfolio. Yet, the return was still negative since I initiated my position:

Fund Performance (Seeking Alpha)

Given this “out-performance”, it makes logical sense to stick with this position. However, I see some macro-headwinds brewing Down Under that make me more than willing to shed this position in favor of other opportunities. I see a challenging economic backdrop that will pressure both corporations and Australian households. Rising interest rates will pose a major problem for lenders, even if they will potentially benefit the Financials sector – which happens to be EWA’s biggest area of exposure. This is outweighed by the fact that I see heightened regulatory risks for this sector as it continues to grow in size. All of these factors suggest to me that moving on from EWA is the right play at this time.

Why Am I Concerned? Growth And Sentiment On The Decline

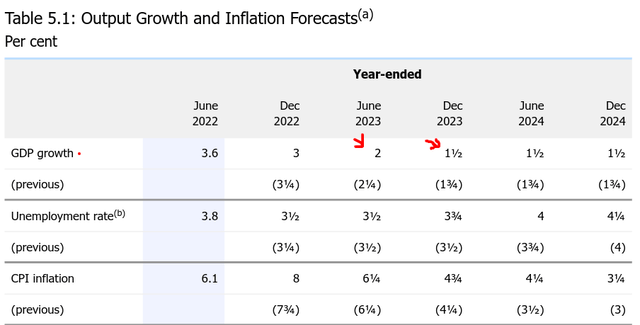

Let me start this with some of the primary concerns I have for Australia as a whole. The most important of which is the outlook for declining growth in 2023. While recessionary fears are a global concern – which would limit economic growth in most of the countries I follow – Australia’s central bank is working to avoid that scenario. Even so, the expectation is that growth is going to be weak for the next 12 – 24 months, with expectations falling since earlier in the year:

GDP Estimates (Reserve Bank of Australia)

As you can see, growth is expected to decline next year by a meaningful margin. This is compounded by the fact that growth estimates are even lower than they were in the previous meeting by the Reserve Bank of Australia (RBA). A downward shift in economic conditions is not the type of investment environment I look for. This alone helps to support my decision to start shedding my EWA position.

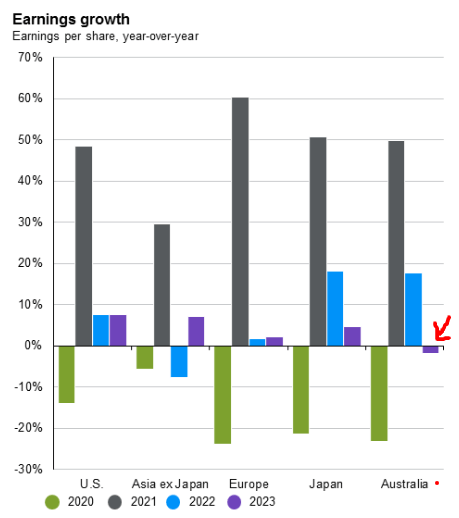

Also important is, this reality is going to make its way in to corporate earnings. While earnings growth was robust in Australia this year (estimated for Q4), that story is expected to shift in 2023 in a big way:

Earnings Growth (By Region) (JPMorgan Asset Management)

I have two concerns with this graphic. One, the sharp drop in earnings growth is far and away a pressuring concern for equity valuations. Two, the relative performance of Australian companies is worrisome. While growth is likely to drop across the developed world, the chart shows only Australia is expected to see a decline (rather than lower rates of growth).

The takeaway for me is that there are better opportunities out there. While EWA has offered me some “alpha” in 2022 in the form of smaller losses, I don’t see that continuing next year. This tells me to look elsewhere for now.

Rates Going Up – Will It Ultimately Hurt The Banks?

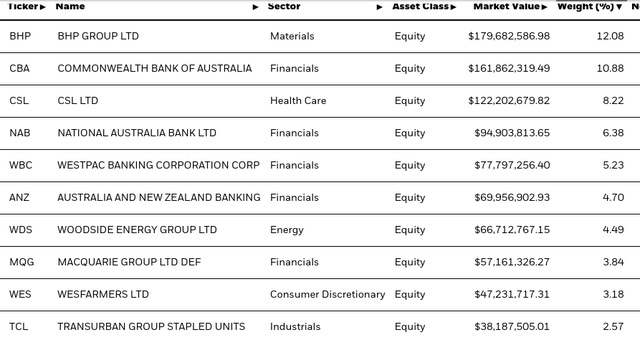

My next focus is on the interest rate environment and how this may impact the major Australian banks. Known as the “Big 4”, these top lending institutions have a big impact on the Australian economy, the top holdings in EWA, and, ultimately, EWA’s total return performance.

To understand how important this is, let us look at EWA’s portfolio. The Financials sector makes up over 35% of total fund assets and the major banks all rest in the top holdings list:

Top Holdings (‘EWA’) (iShares)

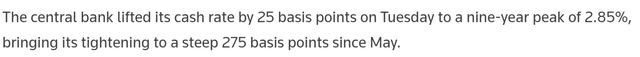

Similar to the U.S., Canada, Europe, and elsewhere, Australia’s RBA has embarked on an interest rate hiking cycle. Just this past week, the central bank raised rates by another .25 basis points, as reported by Reuters:

RBA Rate Hike (Reuters)

With this in mind, EWA could be a big beneficiary of this action. As rates go up, banks and other lenders tend to increase their margins, along with net profit. This begs the question – why not be bullish on EWA in this environment?

The problem is that higher interest rates are great if borrowers continue to make good on their obligations. But that isn’t always the case. Sometimes borrowers default. In other instances, loan applications dry up because of the higher rate environment. This can lead to lower profitability even with higher rates because fewer loans are being made (or being repaid). So it isn’t as easy as saying “higher rates are good for banks” and leaving it at that.

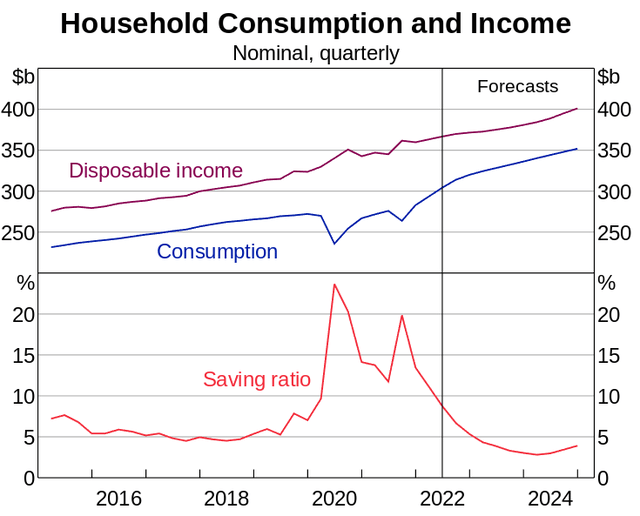

The challenge I see is within Australian households. Just like everywhere else in the world, Australians are grappling with high inflation rates and wage increases that are not keeping up. This has led to a declining savings ratio, meaning Australian households are not as ready for higher borrowing costs than they otherwise should be:

Household Metrics (‘RBA’)

This leads to lower net household wealth. This will weigh on consumption and sentiment and can also wind up seeing delinquency rates increase and households cannot keep up with the higher borrowing costs.

This is a global concern to be fair. But it is particularly relevant for Australia, and EWA by extension, because more borrowers there use variable rate mortgages. While U.S. households use fixed rate mortgages at a very high rate (around 90% of U.S. mortgages are fixed rate), Australia is almost a complete opposite. According to Fitch Ratings, nearly 60% of Australian households use variable rate mortgages. These are typically fixed for a few years, then reset at the prevailing rates. In this rising rate environment, that means as variable rates start to kick in, households are going to be on the hook for higher interest payments.

To me, this couldn’t come at a worse time with inflation soaring, wages not keeping up, and energy costs remaining elevated. Australian households have already been dipping into savings to pay for the inflation impact in 2022. As mortgage costs go up, we could start to see real immense pressure. This will limit discretionary spend and also cloud a bank’s ability to collect timely and complete mortgage payments. While I am not predicting a mass of foreclosures in Australia by any means, EWA’s heavy reliance on the Financials sector means there is quite a bit of risk here.

Banks Keep Getting Bigger – Potential For Regulatory Scrutiny Rises

Beyond interest rate risk, I have other concerns about Australia’s banking sector. This has long been considered an oligopoly, with smaller banks and lenders struggling to compete with the Big 4. While this means the sector offers benefits in terms of scale and pricing power, it is not without cost. This brings increased regulatory scrutiny and the potential to make the sector a political target of convenience. We have already seen this across the country in recent years with “inquiries” designed to respond to public anger and, most likely, to solicit fines.

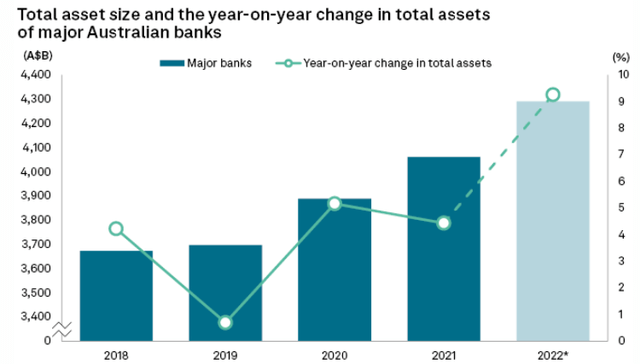

The problem is that even under a tight regulatory environment, the big keep on getting bigger. In fact, growth in 2021 and 2022 was quite substantial across the Big 4 in the sector. This year is still an estimate, but readers will surely get the point:

Growth of Australia’s Major Banks (S&P Global)

My conclusion here is that the banks are ripe for being targeted if the economy turns and public pressure increases. Higher borrowing costs on households while the sector is enjoying strong profits does not make for great headlines. This could lead to more intense regulatory pressure, calls to break up the banks, and probably calls for banks not to pass on all of the RBA’s rate increases to the consumer. While that may be a good strategy for getting paid in full, it would limit the benefit of a higher rate environment if the lender is not able to capture all of that higher rate.

This is speculation at this point, but again points to some under-the-surface risk brewing in this space. With EWA so heavily tilted towards the performance of these banks, I view any headwind as important. For now, I see it as a sign to steer clear.

Consumer Sentiment Dropping Sharply

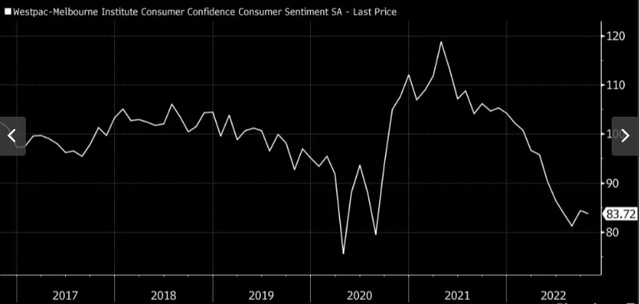

I will now shift away from the banking sector and talk about Australia more broadly. I have mentioned the inflationary environment and the RBA’s attempts to limit it just as the Fed has done in America. The impact of this remains to be seen, but it is taking its toll on consumer/household sentiment across the country. With prices of just about everything elevated, it is no surprise Australians’ confidence has been dropping sharply:

Consumer Confidence (Australia) (Westpac Bank)

This will most likely lead to depressed levels of spending across the country. While EWA is not too exposed to Consumer-oriented sectors, it still doesn’t bode well for Australia investment plays as a whole. This is another supporting factor in my decision to move on.

We Are Entering A Historically Bullish Period For U.S. Stocks

My last point just touches on the relative value. I looked to EWA (and other developed markets) as a hedge against the S&P 500. This has worked out to some degree, albeit not as well as I would have hoped. But I was concerned about the macro-outlook in America and really wanted to diversify. There is plenty of merit to that theory still, but less so in my view. My developed markets’ funds have generally done better than the S&P 500 and that is not going to continue forever.

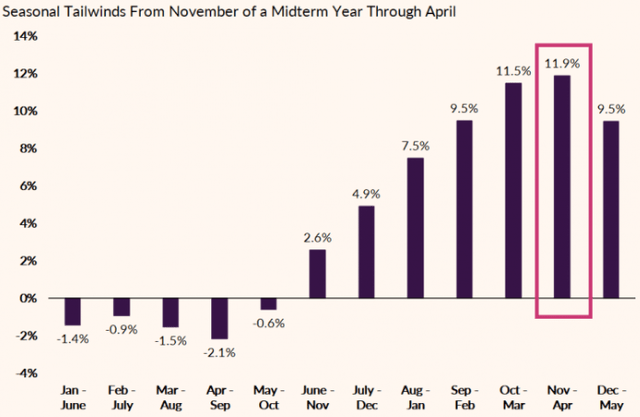

I think buying in to U.S. markets on weakness makes a lot of sense here and one of the reasons has to do with historical performance. During mid-term election cycles, U.S. stocks typically perform well. This is especially true when we get a split Congress or a different party holding majorities in both the House and Senate that is opposite of the President’s party. Looking back over the past century, the time period of November – April following mid-term elections is one of the strongest period for stocks, on average:

S&P 500 Historical Performance (Ally Bank)

This is relevant now because I do expect Republicans to take control of the House and quite possibly the Senate. This will result in a divided government. Post a mid-term election with a divided government, we see that the S&P 500 often posts double-digit returns. This history lesson is telling me to up my exposure to my U.S.-focused large-cap funds, and pulling my money out of EWA will allow me to do so.

Bottom Line

Australia has not been immune to global challenges. While EWA has held up better than the S&P 500 this year, I am going to rotate out of that alpha-play to hopefully find new alpha elsewhere. With inflation and interest rate hikes Down Under, the expectation is this will cut into profits in the first half of the 2023 calendar year, and to a higher degree than other developed markets. Sentiment has also taken a beating, and the banking sector is heavily exposed to a housing market that is looking fragile. All this suggests the prudent move for me is to rotate out of EWA, and I would urge readers to approach this fund cautiously going forward.

Be the first to comment