Joey Ingelhart/E+ via Getty Images

Introduction

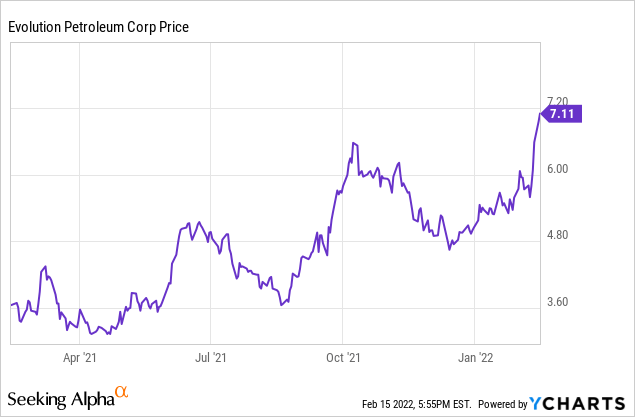

Back in December, I was charmed by Evolution Petroleum’s (EPM) hands-on balance sheet management. The company was debt free, paid an attractive 6% dividend and was benefiting from high natural gas prices. Since that previous article, Evolution has reported on its financial results for its second quarter. Thanks to the strong commodity prices, that quarter was exceptionally strong and Evolution was able to hike its quarterly dividend by a third without jeopardizing the strength of its balance sheet. It’s hardly a surprise to see the company pop up in the list of “top rated stocks” with Quant Rating of 4.97. I think that’s well deserved and I’ll fine-tune my investment thesis in this article.

The Q2 results were strong, thanks to the high natural gas price

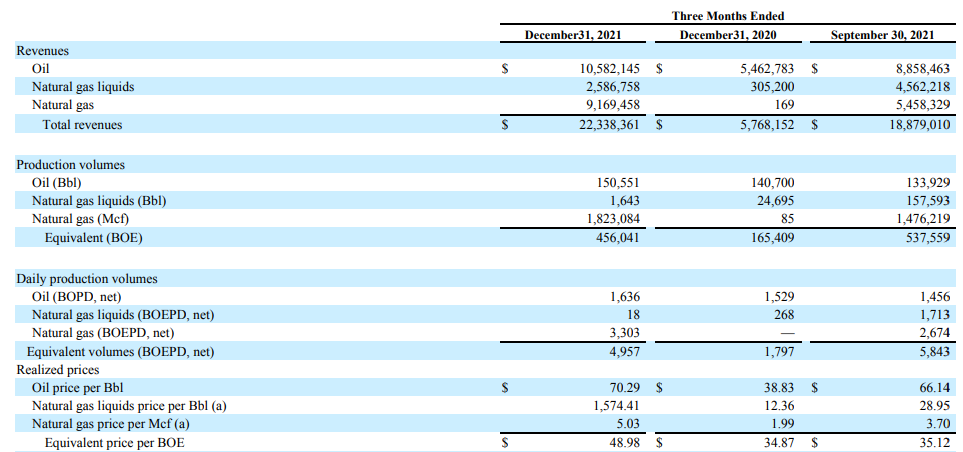

Evolution’s financial year ends in June which means the company recently reported on its second quarter of FY 2022, and that quarter ended in December. The company produced a total of just under 5,000 barrels of oil-equivalent per day and approximately 65% of the oil-equivalent production rate consisted of natural gas. Evolution Petroleum benefited from the high natural gas prices as the average received price was just over $5/Mcf.

Evolution Petroleum Investor Relations

As you can see above, Evolution saw its NGL production drop to almost nothing but this is related to the rejection of ethane in the Barnett Shale. This had a negative impact on the NGL production but boosted the natural gas production by about 20% as the operator of the field wanted to maximize the natural gas production rate.

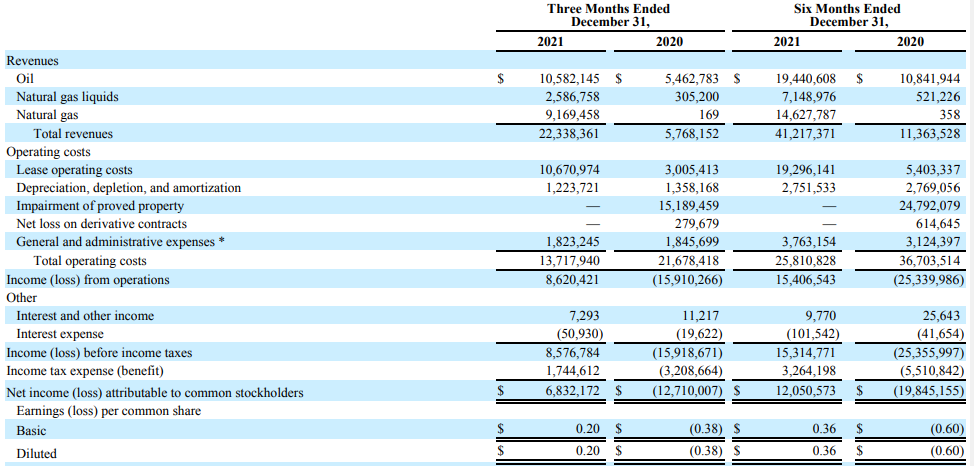

The total revenue in the second quarter came in at $22.3M and after deducting the operating expenses and overhead expenses, Evolution reported a pre-tax income of $8.6M and a net income of $6.8M which is the equivalent of $0.20 per share. That’s an EPS increase of approximately 25% thanks to the higher commodity prices.

Evolution Petroleum Investor Relations

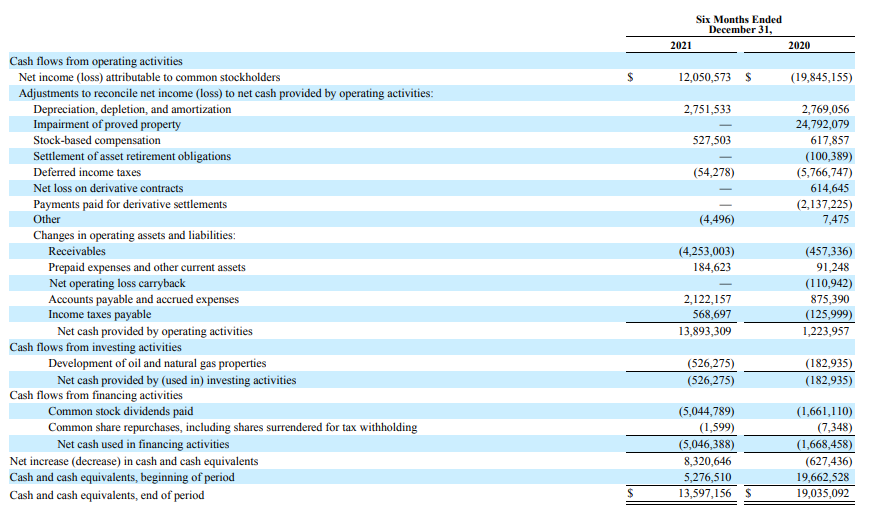

Evolution Petroleum’s free cash flow also shows a similar increase. The company did not provide a detailed Q2 cash flow statement but it’s easy enough to compare the H1 statement with the Q1 statement.

In the first six months of its financial year, Evolution Petroleum reported an operating cash flow of $13.9M and after adding back the investment in the working capital position, the adjusted operating cash flow was approximately $15.4M. The total capex was just $0.5M resulting in a positive free cash flow result of $14.9M.

Evolution Petroleum Investor Relations

As Evolution Petroleum generated an adjusted operating cash flow of $6.8M and recorded a capex of $0.4M in the first quarter of the year, it generated an operating cash flow of $8.8M in the December quarter resulting in a free cash flow of just over $8.6M. Divided over 33.7M shares outstanding, the adjusted free cash flow per share generated in the December quarter was just over $0.25/share.

This makes it rather easy to understand why the company decided to hike its dividend. The quarterly dividend of $0.075 per share was increased to 10 cents per share on a quarterly basis and this still represents a payout ratio of less than 50% based on the normalized production results.

As of the end of December, Evolution’s balance sheet contained $13.6M in cash while it only had $4M of debt resulting in a net cash position of $9.6M or approximately 30 cents per share.

The incoming cash flows enable the company to pursue acquisitions and to increase the dividend

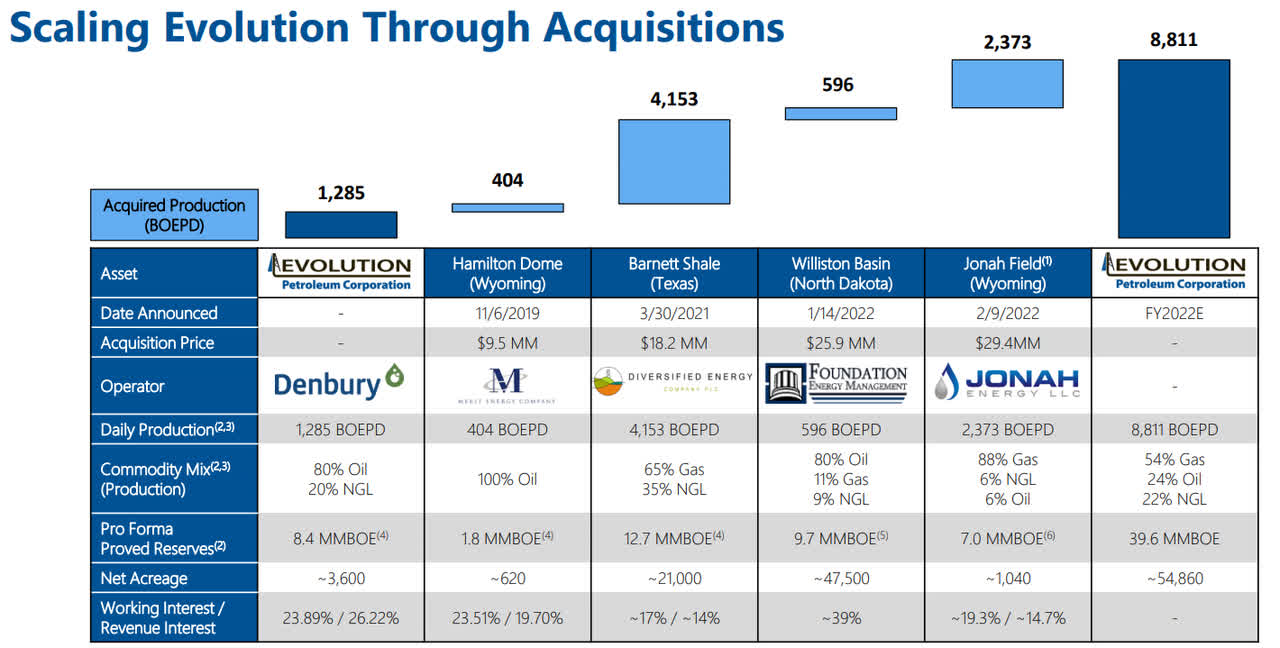

Evolution still sees a lot of potential to grow at an affordable cost. The company will be paying US$55M to acquire two separate assets which will increase the oil-equivalent production rate by more than 60%. As you can see below, the acquisitions will also add about 17 million barrels of oil-equivalent to the reserve estimate while more aggressively increasing the exposure to gas as the Jonah Field acquisition is very gas-heavy.

Evolution Petroleum Investor Relations

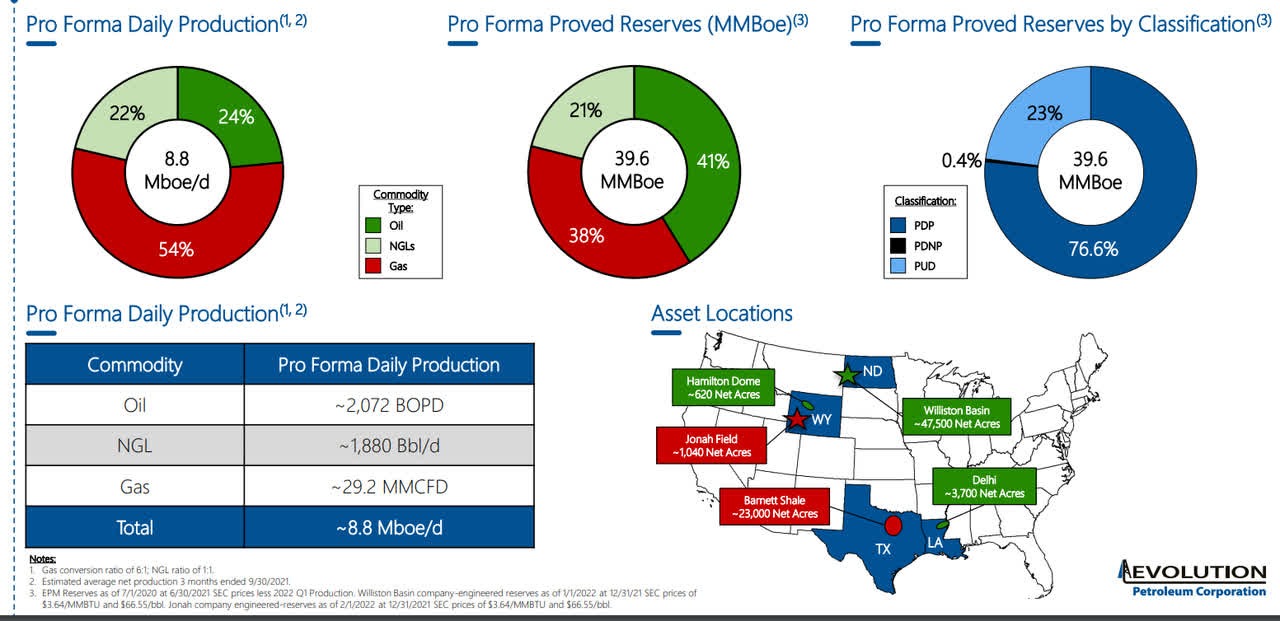

After completing the acquisitions, Evolution Petroleum will still be a gas producer but oil and NGLs will continue to play an important role.

The transactions are fully funded using the credit facility and existing cash, and Evolution Petroleum confirmed the debt ratio will remain below 1X the anticipated pro-forma EBITDA. That’s easy to believe as the EBITDA in Q2 FY 2022 was already almost $10M before including the impact of the new acquisitions.

Evolution Petroleum Investor Relations

Investment thesis

I still like the financial discipline of Evolution Petroleum and although the two new acquisitions are rather sizeable, the strong oil and gas price will likely allow Evolution to rapidly reduce the net debt again. Despite spending $55M on acquisitions, I think the net debt will come in below $40M as of the end of the March quarter.

Meanwhile, the operating cash flow and free cash flow will increase thanks to the bump in the total production rate. The capex will likely increase as well as Evolution is planning to spend approximately $2M on the existing assets and the Williston Basin acquisition, and we can likely expect some capex to be spent on the Jonah field as well. Using an average natural gas price of $4, I expect Evolution Petroleum to generate in excess of $10M per quarter in free cash flow (the interest expenses and slightly higher H2 capex will reduce the impact of the higher production rate) and I expect the company to end the financial year with a net debt position of less than $25M.

The current dividend is costing the company just under $3.5M per quarter and is not at risk. That being said, I’d prefer Evolution Petroleum to hold off on additional dividend increases as I’d prefer the company to deploy its capital on similar small-scale acquisitions.

I have a long position in Evolution Petroleum and I’m very happy to hold this position. If the natural gas price continues to cooperate, Evolution could easily be a $10 stock as that would still represent a market cap of less than $350M.

Be the first to comment