naphtalina/iStock via Getty Images

Thesis: Cyclical Downturn Presents Buy-The-Dip Opportunity

Evercore (NYSE:EVR) is an independent investment bank that offers advisory and underwriting services, wealth management, and research & analysis through its ISI division. The bulk of EVR’s revenue comes from advisory services such as advising on mergers & acquisitions as well as other capital markets activities.

Generally speaking, EVR performs best when the stock market is hot and bond yields are low. When stock prices are high, companies are more likely to use their own shares as currency to engage in M&A, and when bond yields are low, they are more likely to hire the services of EVR to lock in those low rates with hedging contracts. Also, to a lesser extent, higher stock prices equate to higher assets under management fees for the wealth management segment.

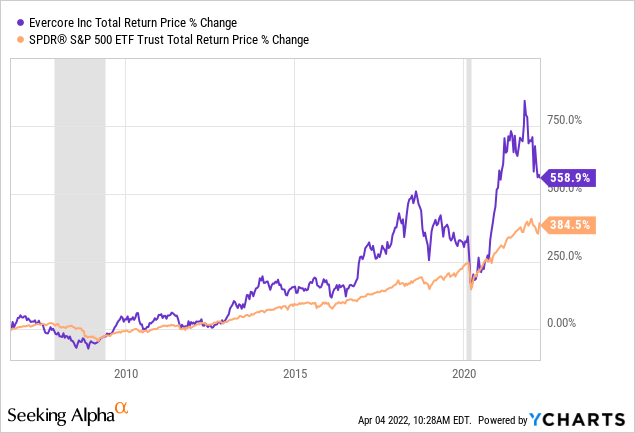

As such, EVR outperformed during the 2010s bull market, but began to struggle as the economy faltered in the years leading up to COVID-19. Then the pandemic struck, caused a ~35% stock market selloff, and EVR sold off as well.

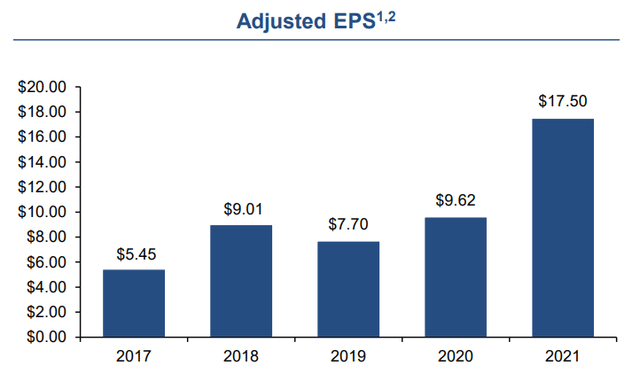

But then, as you can see above, EVR soared in late 2020 and through most of 2021 along with stocks. The M&A market was hot in 2021, giving EVR ample opportunities to win advising deals. EVR’s earnings nearly doubled from 2020 to 2021 – and that was after a year of record earnings in 2020!

This year, however, has been about as opposite of 2021 as possible. Interest rates are surging higher, and stocks have struggled so far. M&A has dried up, and EVR’s stock price has been dropping.

My thesis is that the economic environment will not stay this unfriendly to capital markets forever. Good times will return, eventually. M&A fervor will come back. And in the meantime, EVR’s management has authorization to buy back up to $1.4 billion of shares, which should provide a huge backstop to earnings per share.

I’m buying the dip on EVR.

Overview of Evercore

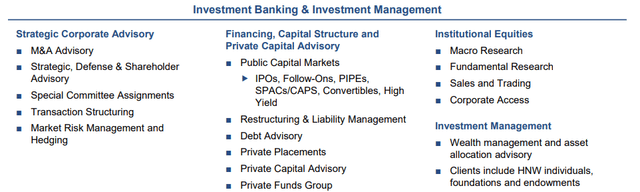

EVR offers a range of services related to capital market activity and corporate actions, as well as a growing Investment Management segment.

Evercore Q4 2021 Presentation

Most investment banks are divisions of larger, diversified banks like Bank of America (BAC) or J.P. Morgan Chase (JPM). EVR is not. That’s what makes it “independent.” Without non-investment banking segments to fall back on, independent investment banks tend to rise and fall with the broader stock and bond markets (mainly the stock market).

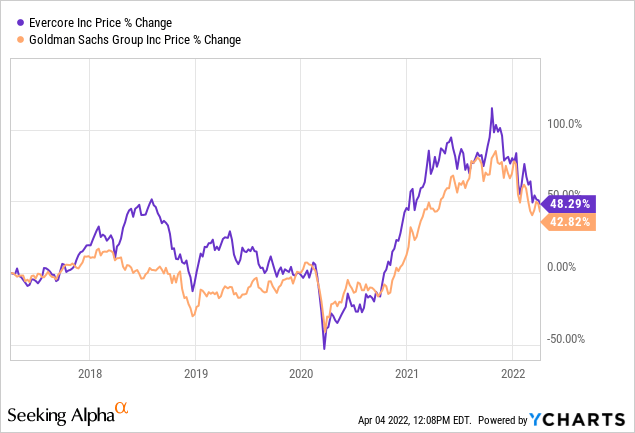

EVR’s stock price tends to track very closely with fellow independent investment bank Goldman Sachs (GS):

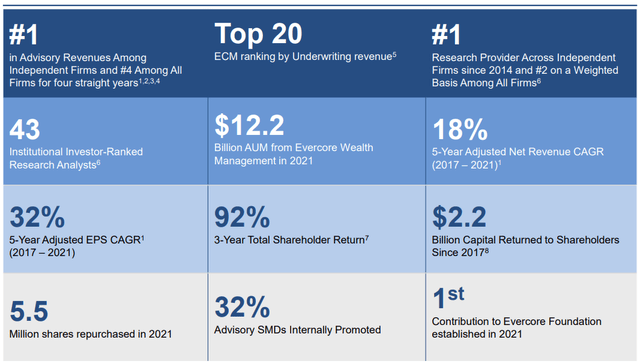

GS also looks attractive on the dip, so why buy EVR instead of the market leader in GS? For one thing, EVR is smaller, which makes growth a little bit easier because of the lower base off of which to grow. Also, EVR boasts its status as the #1 independent bank for advisory revenues as well as the #1 research provider since 2014.

EVR Q4 2021 Presentation

Among independent investment banks, EVR has the broadest range of capabilities in terms of the kinds of services it can provide to clients. This allows it to perform more complicated or specialty deals and appeal to a broader clientele.

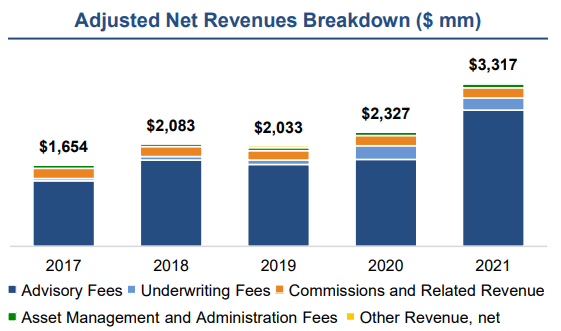

Full year 2021 revenues rose a remarkable 43% over 2020’s number, with the bulk of the increase coming unsurprisingly from advisory fees.

EVR 2021 Fact Sheet

In 2021, EVR earned $2.7 billion in advisory fees, up 57% over 2020. In fact, EVR advised on three of the top ten largest M&A deals of 2021.

But the asset management segment posted a big gain of 21% YoY in 2021 as well, though the effect was barely noticeable because of how much smaller it is than the advisory business.

On the back of a strong M&A and equity raising environment last year, EVR’s earnings per share soared 82%.

EVR Q4 2021 Presentation

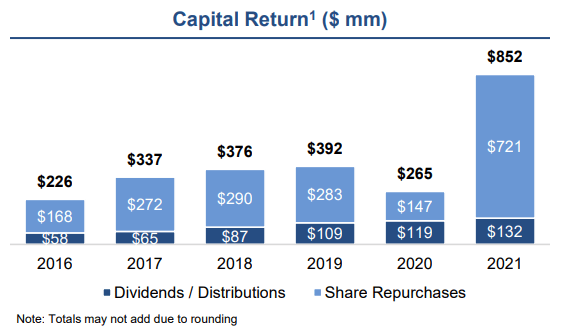

What did the company do with all this cash? Aside from expanding the business’s scope and reach across the globe, management also returned ample cash to shareholders in the form of a dividend hike and massive share repurchases.

EVR 2021 Fact Sheet

The $721 million worth of buybacks had an average share price of $132.10, which is about 18% above the current share price of ~$111. As such, it seems only reasonable that management is now using its $1.4 billion of buyback authorization to repurchase shares at the current price. This should help to offset the weaker equity market environment this year.

The dividend, currently sitting at $2.72 annualized, yields 2.4% and has been growing at a double-digit pace in the last decade. The last dividend hike in May 2021 represented 11.5% growth over the previous payout. Management has stated that they plan to continue raising the dividend over time as earnings per share rise.

Bottom Line

This year hasn’t been very strong so far for EVR. The capital markets have not been friendly to growth. But then again, a year of consolidation would be understandable after a blowout year like 2021.

Analysts still expect EVR to earn $13.70 in EPS this year, 42% more than in 2020 and 78% more than in 2019. If you ask me, that is pretty impressive growth. It also means that the dividend payout ratio is a mere ~20%, leaving plenty of room for big hikes in the future.

I’m buying EVR as a long-term dividend growth investment.

Be the first to comment