Sundry Photography/iStock Editorial via Getty Images

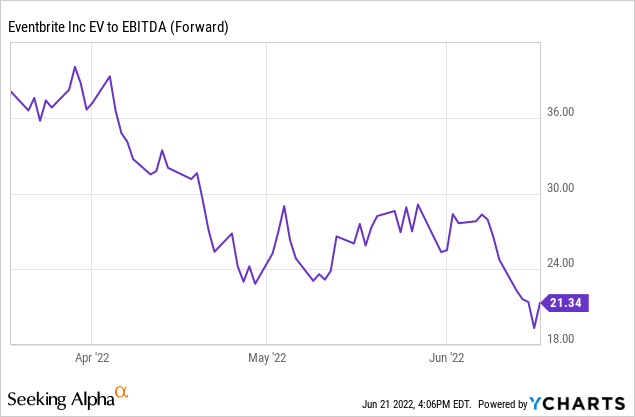

Ticketing platform Eventbrite (NYSE:EB) has made significant strides to reposition its business coming out of the pandemic – not only has the company shown early progress in streamlining its cost base, but it has also refocused on self-serve and frequent creators to drive more profitable long-term growth. That said, the post-COVID recovery looks set to be a gradual process, and it remains unclear if consumer behaviors have undergone a structural shift. Difficulty in scaling the expense base, in particular, and managing stock-based compensation growth and marketing intensity in a rising rate environment, also support the case for a more gradual operating leverage scenario. Thus, I would be cautious at the current ~22x EV/EBITDA valuation pending signs of an accelerating post-COVID recovery and a more profitable growth outlook.

Setting A Lofty Bar With Updated Revenue Growth Targets

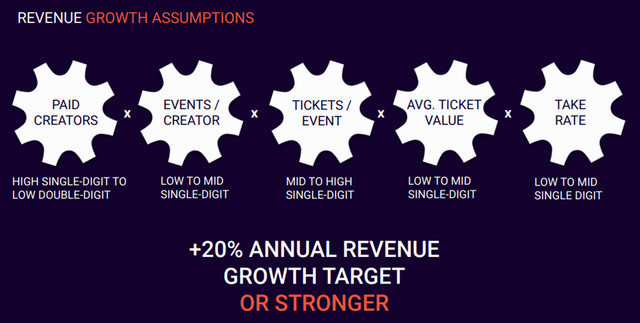

In contrast with the ongoing macro uncertainty, EB outlined an impressive new revenue growth target of >20% at its investor day. Future growth will depend on the following key drivers – paid creators (high-single-digit to low-double-digit growth), events per creator (low single-digit to mid-single-digit growth), tickets per event (mid to high single-digit growth), average ticket value (low to mid-single-digit growth), and take-rates (low to mid-single-digit growth). Per the guidance range, revenue could grow 20% if each driver grows at the lower end of the targeted range, but growth at the higher end would push revenue growth to ~40%.

Source: Eventbrite Investor Day 2022 Deck

Given revenue remains below pre-COVID highs, this seems like a fairly high bar, in my view. Plus, the stock already trades at >2x EV/Revenue and ~22x EV/EBITDA, so a fair bit of optimism has likely been baked into the valuation. This isn’t a knock on management’s efforts, as its product pipeline and growth drivers are impressive. With expectations already high, though, the company has little room for error to drive stock performance. What could change my mind is the success of its two new initiatives (Boost and the yet-to-be-launched Eventbrite Ads product). The contribution here remains small, but early progress has been positive and further momentum here adds long-term optionality to the EB case, in my view.

Balancing Growth And Expenses Could Prove Challenging

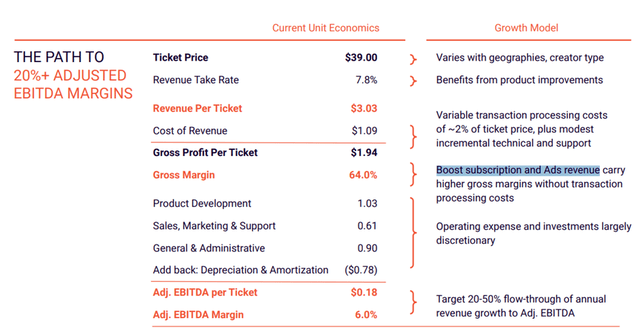

Alongside the strong growth projections, EB is also targeting >20% adjusted EBITDA margins on operating leverage benefits as well as an increased contribution from the higher-margin Boost and Eventbrite Ads businesses. This builds on near-term guidance for another quarter of adjusted EBITDA profitability in Q2 2022 as well, which, if achieved, would represent its fourth consecutive quarter of positive adjusted EBITDA.

Source: Eventbrite Investor Day 2022 Deck

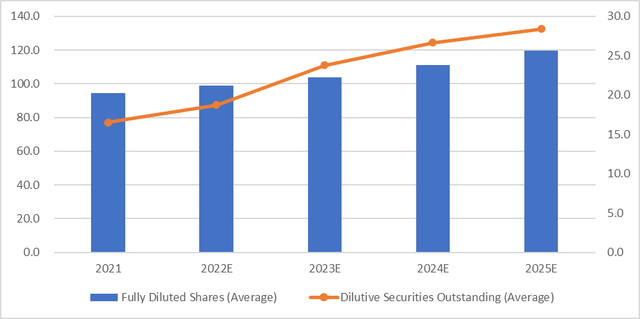

That said, I found the reliance on the nascent Boost/Eventbrite Ads for its long-term numbers a surprise, with management guiding to a 20-50% flow-through to adjusted EBITDA. Also concerning to me is the potential dilution impact from stock-based compensation expenses going forward. At a double-digit % of revenue, EB’s dependence on stock comp is already concerning, and with the significant drop in stock price over the past year, EB may have to lean on additional restricted stock units (RSUs)/option issuances going forward. Thus, relative to the ~17m dilutive securities outstanding (options and RSUs) in 2021, I am penciling in a step up to ~28m through 2025 (implying ~30% dilution).

Source: Author, Eventbrite Financial Disclosures

Building Out The Boost/Eventbrite Ads Growth Engine

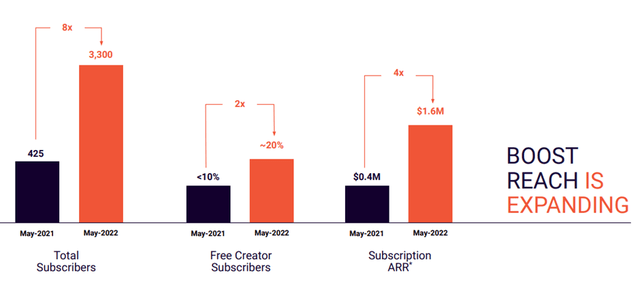

Backed by ~$390m of cash on its balance sheet, EB is investing heavily in demand creation for its creators with Boost, a revamped marketing program to help creators manage events and attendance through distribution across social media and other platforms. While Boost is only about a year old, EB has reported seeing positive results already, with total subscribers up 8x YoY to ~3.3k as of May 2022. More positively, the subscription annualized run-rate revenue has increased ~4x YoY – outpacing the doubling of free subs over the same time frame. Within the Boost creator base, ~66% are new to Facebook (META) paid ad campaigns as well, highlighting its role as an on-ramp into the EB ecosystem. I see a clear growth runway in the coming years given the value add – Boost creators sold ~16% more tickets when using Boost for Facebook Ads, while its email program drove an ~60% improvement in open rates relative to the industry average. EB also plans to make Boost a core part of new creator onboarding later this year, so expect an acceleration in the creator base sooner rather than later.

Source: Eventbrite Investor Day 2022 Deck

Given the results creators have seen thus far with Boost and the incremental growth potential of Eventbrite Ads, which will support marketing campaigns once it moves out of beta, the push into these new businesses makes a lot of sense. Here, EB has a clear path to monetizing free creators, which currently make up ~20% of subscribers (up from <10% in the prior year) and stretching the EB funnel. Through the pandemic, EB continues to carry a lot of weight as a consumer brand, with ~70m of paid ticket sales in 2021, of which ~30% came from its consumer funnel. Progress here will be key to making the stock work, as it not only boosts revenue growth through the take rate (unit economics are 20-25% pts higher than the core ticket) but also allows for operating leverage benefits to kick in down the line.

Growth Story Intact but Premium Valuation Raises Downside Risk

Net, I like the long-term EB growth opportunity – its robust product pipeline around monetizing demand creation adds interesting optionality to the post-COVID recovery prospects in the core business. That said, the current market environment has been less favorable to unprofitable growth stories and pending operating leverage benefits flowing through to the P&L, I would be cautious on the outlook. Plus, questions about EB’s reliance on stock-based compensation and required marketing intensity remain, as it looks to balance demand creation and margin expansion. With the stock still priced at a premium ~22x EBITDA multiple, I remain on the sidelines pending more concrete signs of a post-COVID recovery and sustained margin expansion.

Be the first to comment