Dragon Claws/iStock via Getty Images

Nine Energy Service, Inc. (NYSE:NINE) saw an increase in its shares in the open market after the company delivered a recent quarterly report. The company seems to benefit from the increase in the price of oil and gas, and stock market analysts recently noted very beneficial expectations about NINE’s business model. Under my own discounted free cash flow models, I obtained a valuation of close to $13.69 per share, which is higher than the current stock price. The total amount of debt appears substantial. However, with sufficient free cash flow generation, I believe that the debt does not seem to be a problem.

Nine Energy Has Ties With Many Actors In The Oil And Gas Industry

Nine Energy Service, Inc. is a service provider for the unconventional oil and gas industry in North America and abroad. Nine’s specialization includes horizontal, multistage wells for production, cementing, wireline, and coiled tubing services among many other applications.

Let’s note that the Board of Directors includes personnel that are sitting on the Board of Directors of large companies. It means that the directors of Nine Energy will be able to bring contracts with relevant actors in the industry.

Mr. Baldwin has served as a Director of the Company since February 28, 2017, and served on Beckman Production Services, Inc.’s board of directors prior to its merger with and into the Company on that date. He currently serves on the Board of Directors of Select Energy Services, Inc. (WTTR) and Oil Patch Group, Inc. Source: Board of Directors – Corporate Governance | Nine Energy Service

Mark Baldwin has served as a Director of the Company since May 10, 2013. Mr. Baldwin has been a Director of KBR, Inc. (KBR), since October 3, 2014, and Director of TETRA Technologies, Inc. (TTI), since January 16, 2014. Source: Board of Directors – Corporate Governance | Nine Energy Service

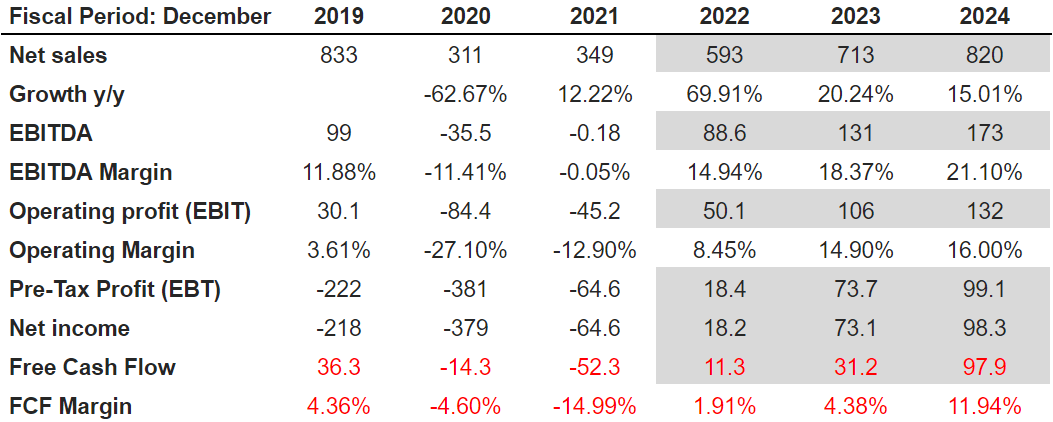

Analysts Expect Sales Growth Of 69% In 2022 and 20% In 2023

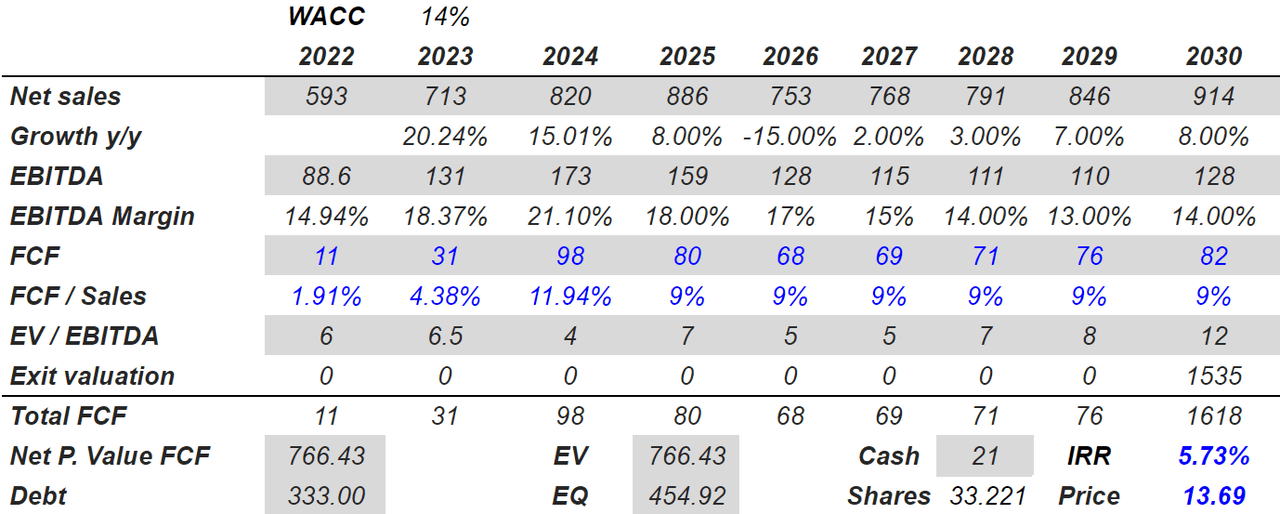

I believe that the expectations from analysts are quite beneficial. For 2024, analysts forecasted that with 2024 net sales of $820 million and a growth of 15.01%, EBITDA would stand at $173 million with an EBITDA margin of 21.10%.

Source: Marketscreener.com

2024 operating profit would be close to $132 million with an operating margin of 16% and a pre tax profit of $99.1 million. Finally, net income would be close to $98 million with a free cash flow of $97.9 million and FCF margin of 11.94%.

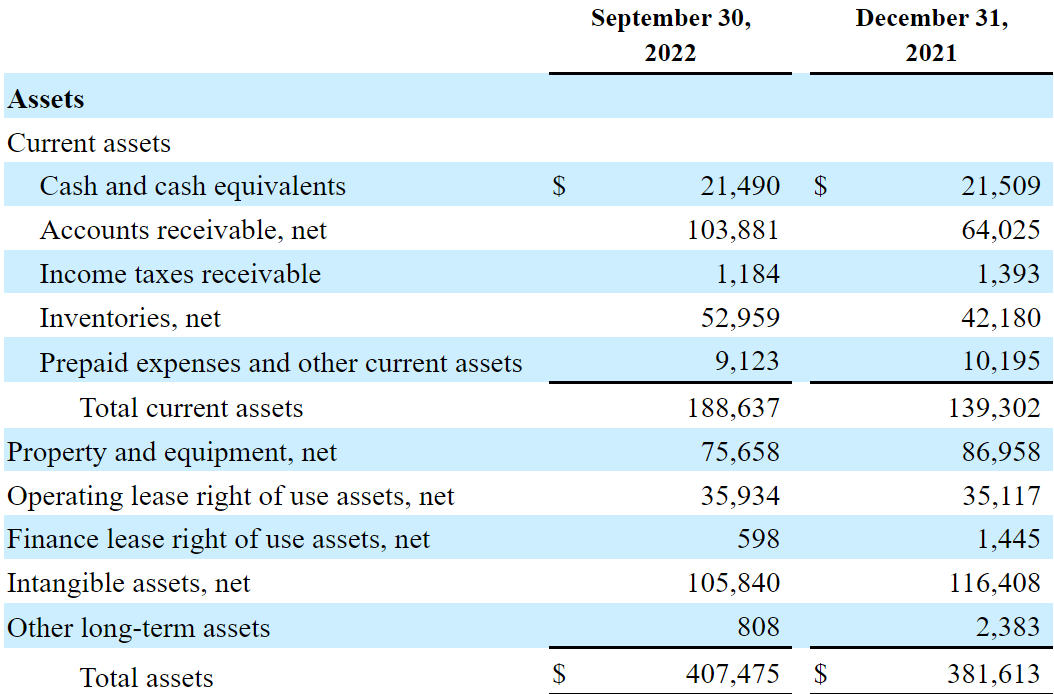

Balance Sheet

As of September 30, 2022, with cash and cash equivalents of $21.490 million in addition to accounts receivable of $103.881 million, Nine Energy’s inventories were $52.959 million. Besides, total current assets were equal to almost $189 million. Considering that the amount of current liabilities is close to $102 million, I believe that Nine Energy will likely not face any liquidity crisis any time soon.

Non-current assets include property and equipment worth $75.6 million, operating lease right of use assets of $35.934 million, and intangible assets of $105.840 million. Finally, the total assets are worth $407 million. Let’s note that the asset/liability ratio is under one, which most investors may not appreciate.

Source: 10-Q

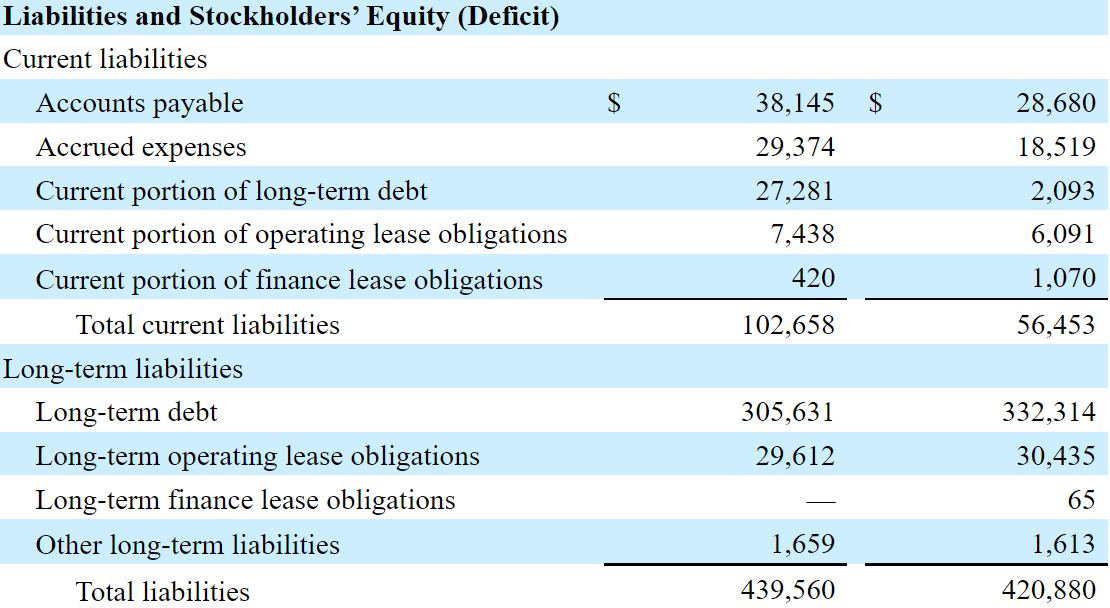

The liabilities include accounts payable of $38.145 million, accrued expenses of $29.374 million, and a current portion of long term debt worth $27.281 million. With a current portion of operating lease obligations of $7.438 million, the total current liabilities were equal to $102.658 million.

Long term debt stands at $305 million with long term operating lease obligations of $29.612 and total liabilities of $439.560 million. If we keep in mind that the company’s 2024 EBITDA is expected to be close to $173 million, the debt close to $333 million does not seem that significant.

Source: 10-Q

My Conservative Case Scenario Implies A Fair Price Of $13.69 Per Share

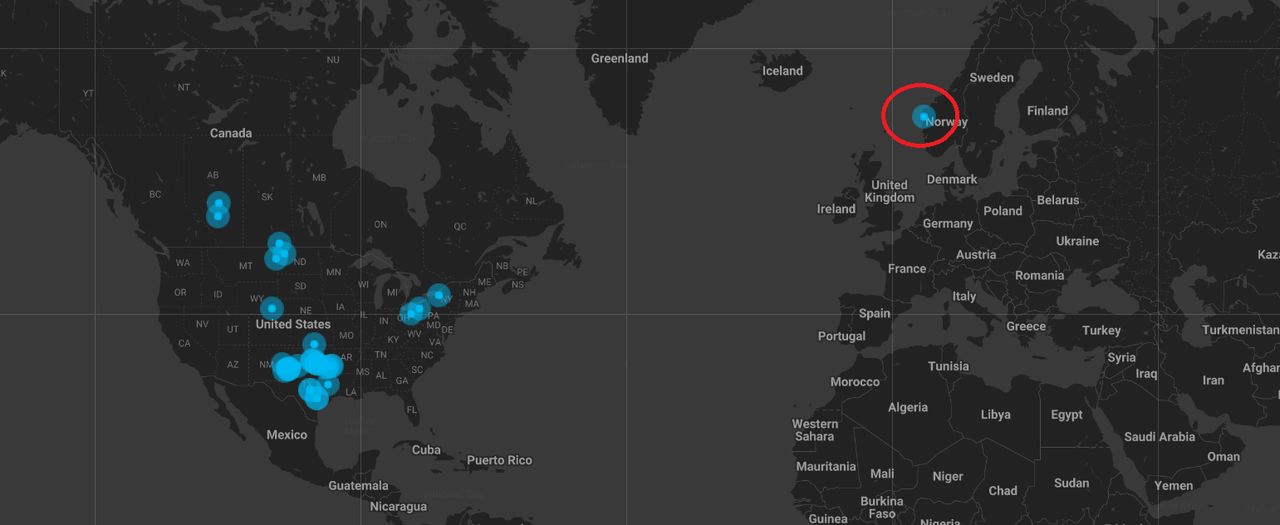

With clients in Norway, I believe that most clients are located in the United States. With this in mind, in my view, internationalization may bring significant revenue growth in the coming years.

Source: Company’s Website

According to the most recent quarterly report, Nine Energy usually signs Master Service Agreements with customers. With this in mind, I believe that the level of customization and service to each client requires a lot of attention. It means that Nine Energy will likely develop great connections with many clients in the industry.

We typically enter into a Master Service Agreement with each customer that provides a framework of general terms and conditions of our services that will govern any future transactions or jobs awarded to us. Each specific job is obtained through competitive bidding or as a result of negotiations with customers. The rate we charge is determined by location, complexity of the job, operating conditions, duration of the contract, and market conditions. Source: 10-Q

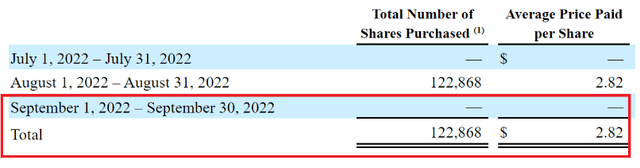

Under normal circumstances, I believe that the repurchase program that Nine Energy is running will likely bring demand for the stock. Keep in mind that the company acquired 0.122 million shares only in September 2022. More shares repurchased will likely reduce the cost of equity, which may enhance Nine’s fair price.

Under the previous conditions, I designed the following discounted model. 2030 net sales are expected to be close to $914 million with sales growth of 8%, in addition to an EBITDA of $128 million and an EBITDA margin of 14%.

I foresee FCF of $82 million with an FCF/sales of 9%. If we also include an EV/EBITDA of 12x, the exit term would be $1.53 billion. The sum of free cash flow discounted with a WACC of 14% implied $766.43 million. If we also include debt of $333 million and cash of $21 million, the equity would be $454.92 million. Finally, the internal rate of return would stand at 5.73% with a fair price of $13.69 per share.

Source: Bersit’s DCF Model

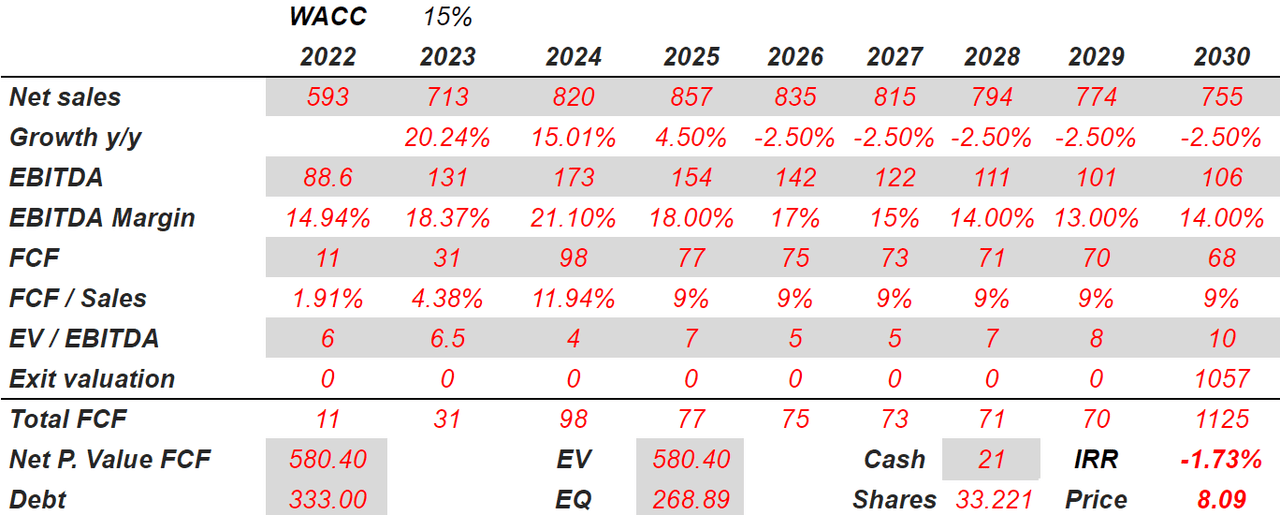

Under Very Bearish Conditions, I Believe That The Fair Price May Reach $8.095 Per Share

Nine Energy could suffer significantly from a decrease in the price of oil and gas or a decrease in the capex expectations in the industry. As a result, management may sign less Master Service Agreements, which will likely lower company’s sales growth and the free cash flow margins.

Even with supportive oil and natural gas prices, E&P operator activity may not materially increase, as they remain focused on operating within their capital plans. Moreover, any substantial and unexpected drop in commodity prices in the future could result in a material adverse effect on our business, financial condition, results of operations, cash flows, and prospects. Source: 10-k

I also expect lower demand for the stock if Nine Energy continues to receive written notifications from the NYSE about compliance standards. Keep in mind that not trading in the NYSE would reduce the visibility of the stock, and may make the cost of equity increase. In sum, the fair price would likely decrease.

Our common stock is currently listed on the NYSE. On January 5, 2022, we received written notification from the NYSE that we no longer satisfy the continued listing compliance standards set forth under Section 802.01B of the NYSE Listed Company Manual. Source: 10-Q

I also believe that new rules announced by Biden to regulate the oil and gas industry and the emissions of methane would affect the company:

The Environmental Protection Agency said the proposed standards would reduce methane from the oil and gas sector by 87% below 2005 levels. Source: Biden takes aim at methane emissions with new rules on oil and gas industry.

Under very bearish conditions, I believe that Nine Energy may struggle to pay its total outstanding debt. In the last annual report, the company noted that future free cash flow may not be sufficient to pay the company’s total financial obligations.

Our ability to make scheduled payments with respect to our indebtedness depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and certain financial, business, and other factors beyond our control. If our cash flows and capital resources are insufficient to fund debt service obligations, we may be forced to sell assets, seek additional capital, or restructure or refinance indebtedness. Source: 10-k

Under this scenario, I used 2030 net sales of $755 million with sales growth of -2.50%, EBITDA of $106 million, and an EBITDA margin of 14.5%. In addition, I expect FCF close to $68.5 million with 9.5% FCF/sales.

If we use an EV/EBITDA of 10x, the 2030 exit value would be $1.057 billion. The results using a discount of 15% include an enterprise value of $580.40 million and equity valuation of $268.89 million. Finally, with a share count of 33.221 million, the internal rate of return would be -1.73%, and the fair price would be $8.09 per share.

Source: Bersit’s DCF Model

Conclusion

Nine Energy benefited from the recent increase in the oil and gas price. Most analysts are expecting very decent sales growth and double digit EBITDA margin for the next two years. Considering the repurchase of stock enacted by Nine Energy, I believe that the stock price will likely trend north soon. Under my own discounted cash flow models, the fair price appears higher than the market price. Even considering the words from Biden about the new rules of the oil and gas industry, the company’s total amount of debt, and other risks, Nine Energy appears quite undervalued.

Be the first to comment