janiecbros/E+ via Getty Images

“Pain and suffering are the soil of strength and courage.” – Lurlene McDaniel

Today, we post our first look at Evelo Biosciences (NASDAQ:EVLO). The company recently did a significant capital raise and has numerous potential catalysts on the horizon. A full analysis follows below.

Company Overview:

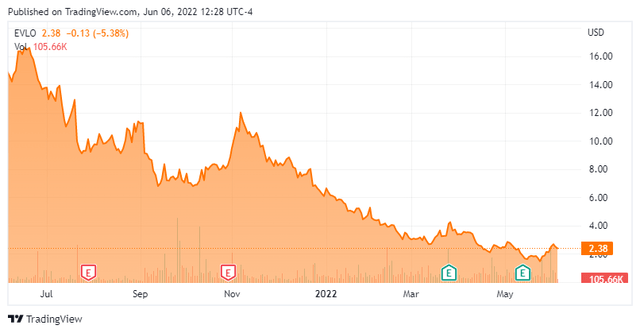

Evelo Biosciences is a small clinical-stage biotech concern based in Cambridge, MA. The company is focused on developing oral biologics for the treatment of inflammatory diseases and cancer. The stock trades just under $2.50 a share and sports an approximate $270 million market capitalization.

March Company Presentation

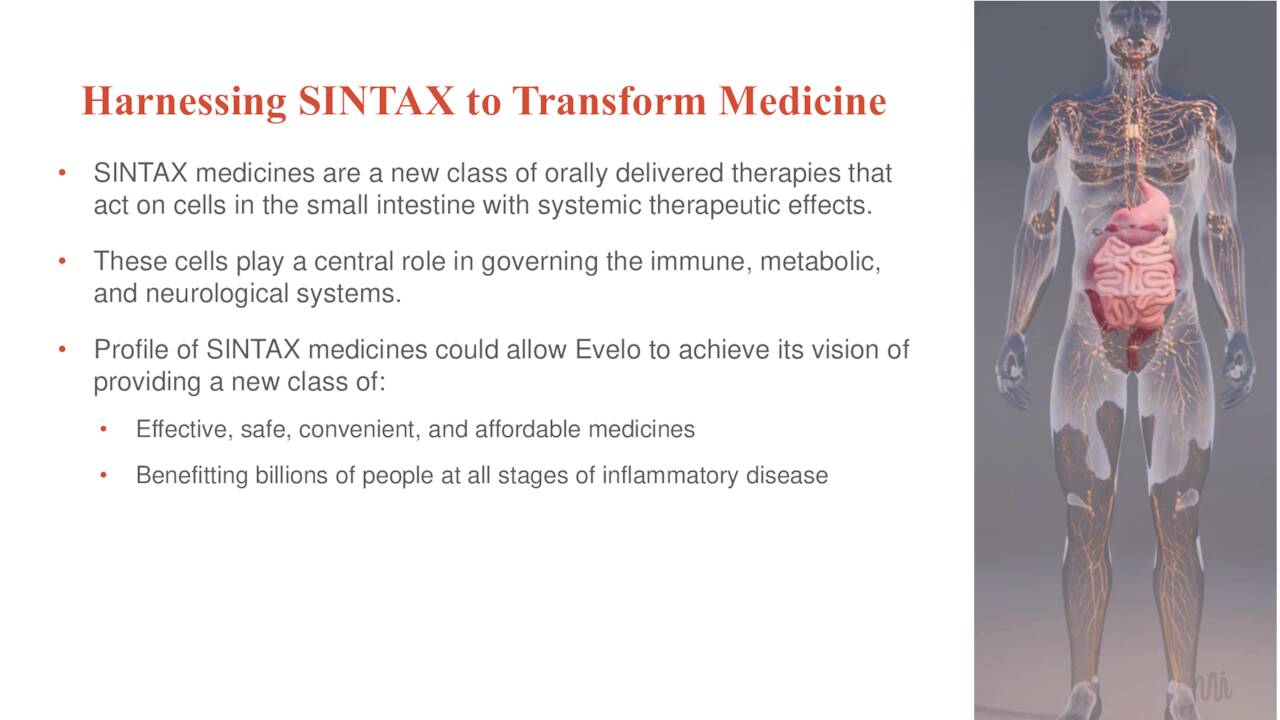

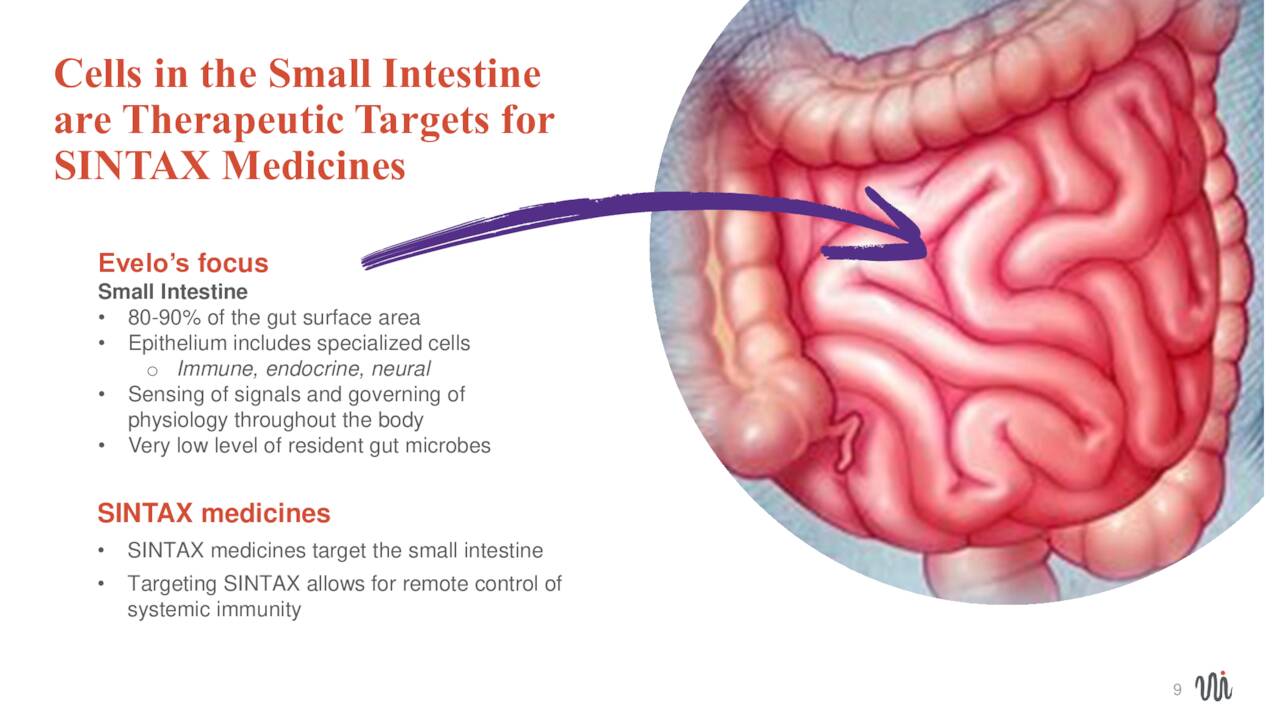

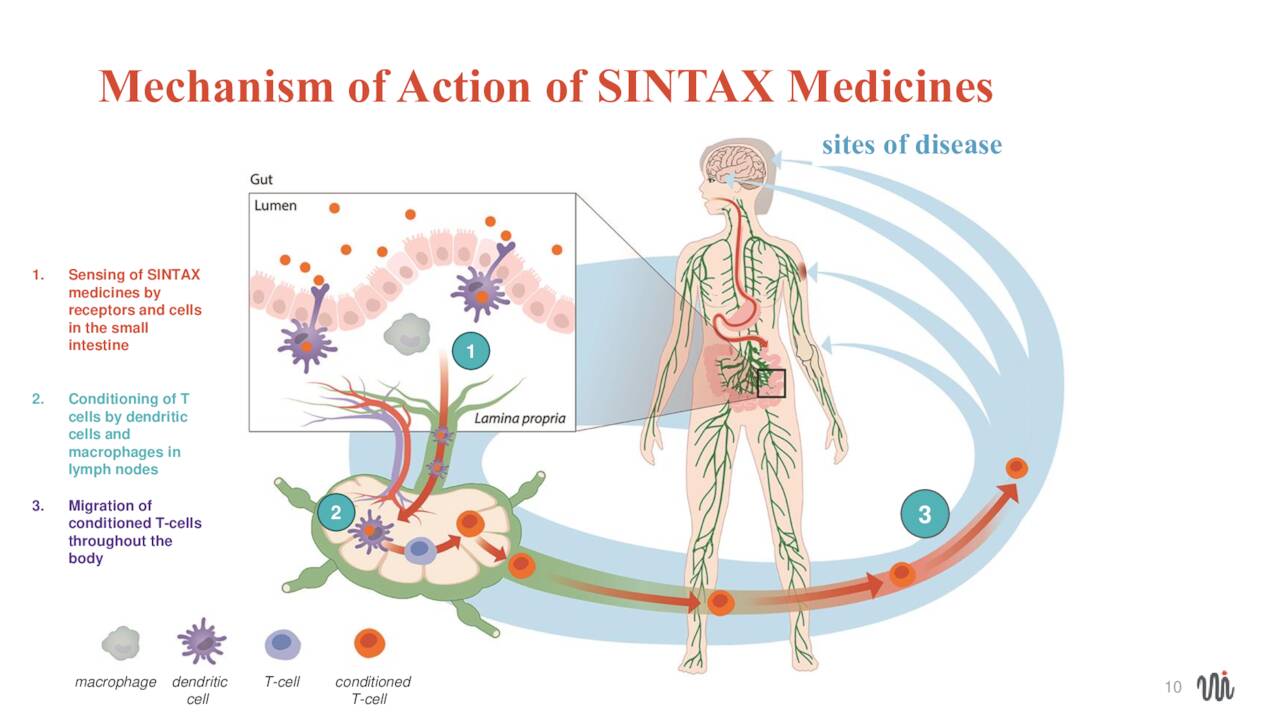

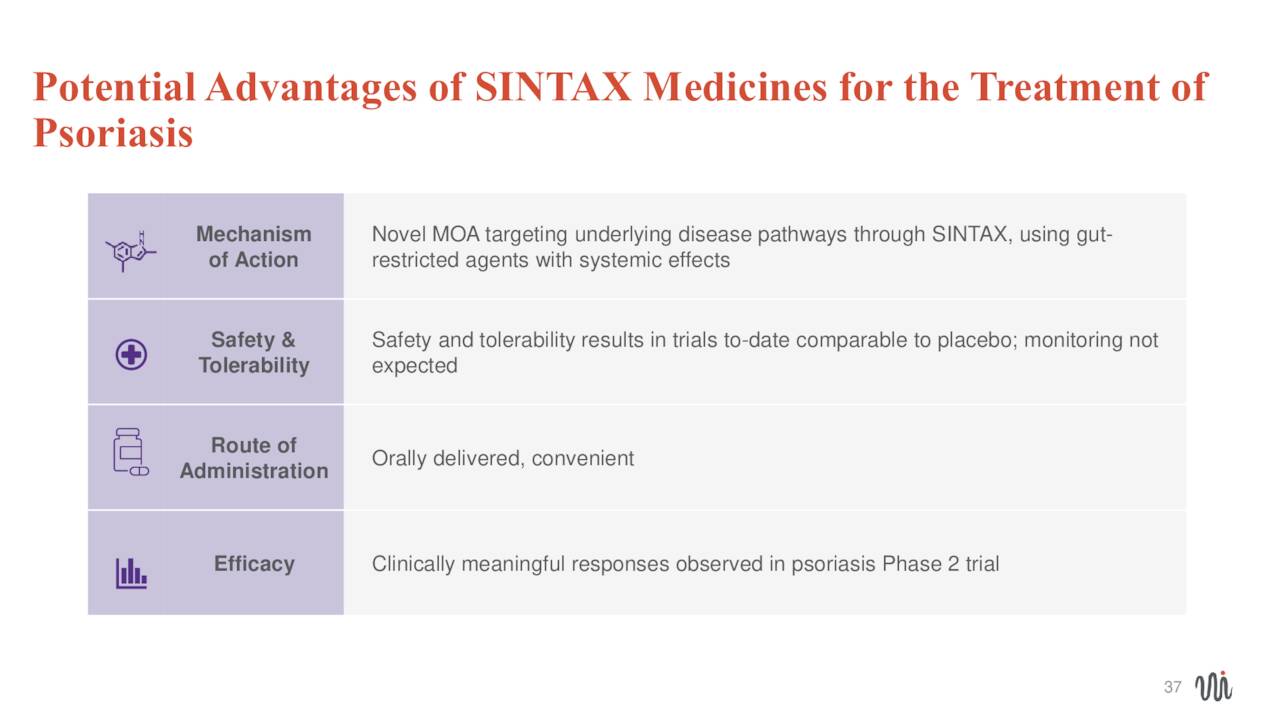

The company is focusing on a new class of therapies targeting the cells in the small intestine to produce what it hopes will be several cheap, safe and effective medicines that target the gut.

March Company Presentation

March Company Presentation

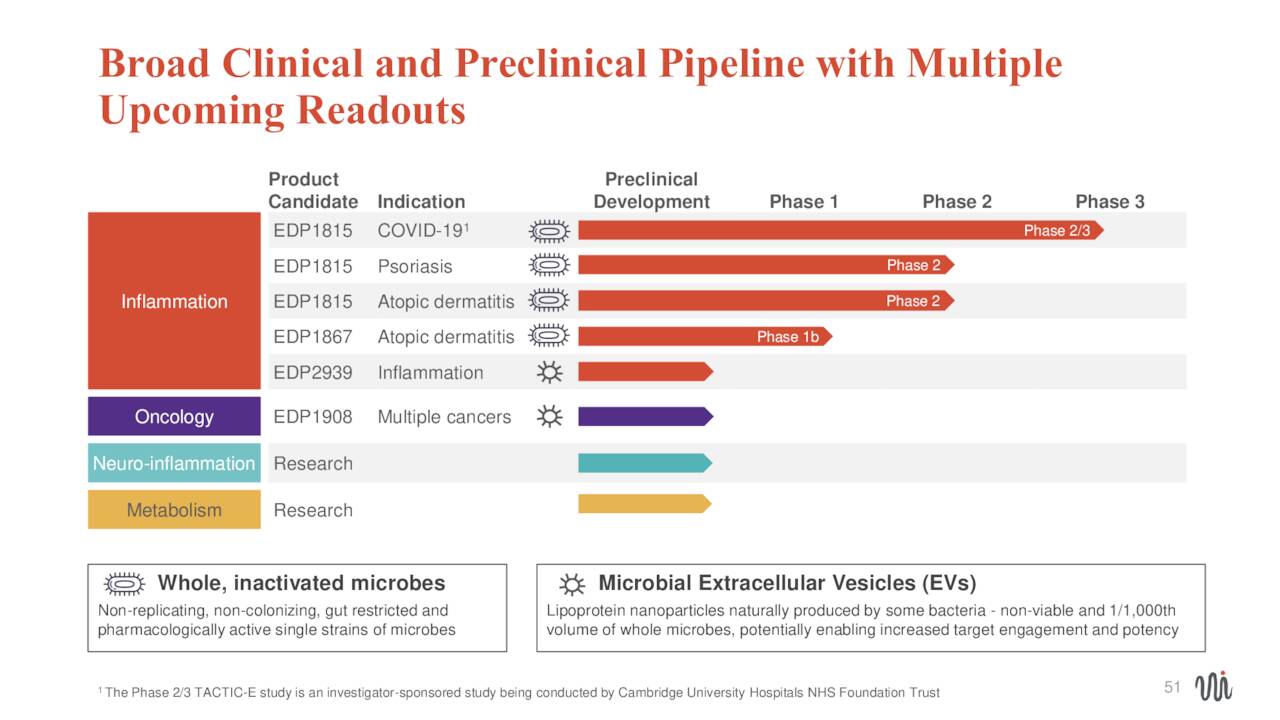

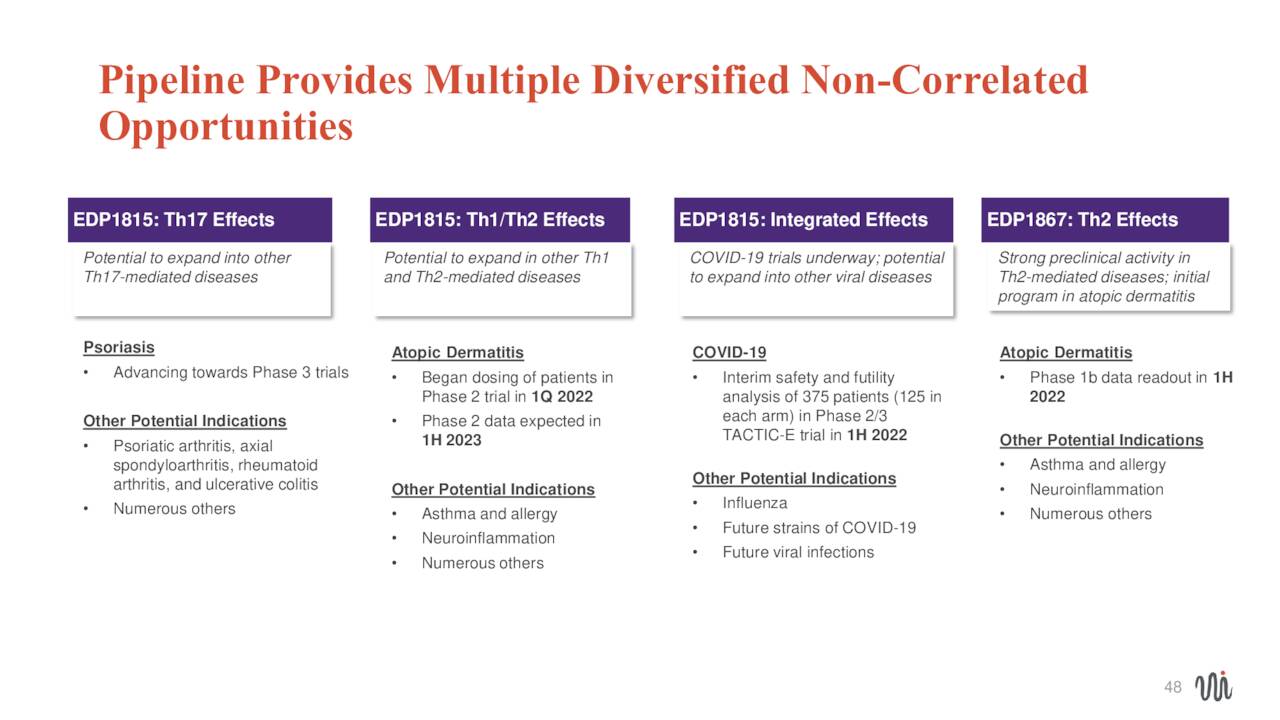

Evelo has several compounds in various stages of development. The most advance of these is a candidate called EDP1815, which you can see below is in studies as a potential treatment for Covid-19, Psoriasis and Atopic Dermatitis.

March Company Presentation

The company’s other pipeline candidates are in much earlier stages of development, so we will concentrate on EDP1815 as far as this analysis goes.

March Company Presentation

The firm’s efforts to target Psoriasis are the most advanced of its current studies, and this candidate saw solid results in Phase two development. The company is currently working with the FDA on the design of Phase 3 registrational study that, if successful, will result in an NDA being filed for this indication.

March Company Presentation

Recent Events:

On May 25th, the company announced that it had entered into a securities purchase agreement with investors over a direct offering. This offering consisted of almost 55 million shares offered at $1.46 apiece and raised nearly $80 million, which was approximately half the company’s market cap at that price.

Six weeks prior to this news, Evelo announced it had put its EDP1867 program for eczema on hold after no clinical benefit was seen in a phase 1 trial. Trying to cushion that blow, management did also say that an ongoing recruitment effort for a phase 2 trial of EDP1815 to treat atopic dermatitis is ahead of plan. A week later, Alnylam Pharmaceuticals (ALNY) founding CEO and the former head of MyoKardia joined the Evelo team as ‘strategic advisors’, which briefly gave the stock a brief bump. MyoKardia, it should be noted, was bought out by Bristol-Myers Squibb in 2020.

Analyst Commentary & Balance Sheet:

So far in 2022, four analyst firms including Cowen & Co. and Cantor Fitzgerald have reiterated Buy ratings on the stock. Price targets proffered range from $12 to $28 a share. Morgan Stanley maintained its Equal Weight rating and $6 price target on March 15th.

A beneficial owner bought over $20 million of the recent direct offering while three officers/directors of the company purchased just over $550,000 of it in aggregate. The company ended the first quarter of 2022 with just under $40 million of cash and marketable securities on the balance sheet after posting a net loss of $29.9 million for the quarter. Approximately 14% of the outstanding float in the share is currently held short.

Verdict:

Evelo Biosciences has some ‘shots on goal‘, has potential upcoming catalysts and just addressed its immediate funding needs. The company has an interesting approach to candidate development as well that may hold considerable promise and is targeting potentially large markets.

That said, I have several concerns around EVLO as a possible investment.

- While the recent capital raise was large in comparison to the company’s market cap, it provided fewer than three-quarters of a runway at current burn rates.

- To this point, the stock has destroyed a ton of shareholder value.

- I put little value in Evelo’s Covid-19 efforts. Scores of companies are working on potential Covid treatments, and the pandemic seems to be rapidly ebbing at this point….or at least it is mostly out of headlines.

- The percent of the offering bought by insiders is somewhat encouraging. However, they made some significant purchases in 2021 when the stock was in the mid-teens and those buys did not turn out to be ‘directional‘.

Therefore, discretion seems the better part of valor here given how miserable sentiment has been on the biotech space since the start of 2021 (the SPDR S&P Biotech ETF (XBI) has lost approximately 60% of its value over that time), we have no investment recommendation around Evelo Biosciences at this time.

“Time is an illusion that passes way too fast!” – Ana Claudia Antunes

Be the first to comment