Darren415

Cannabis stocks soared briefly after President Biden stated intentions to pardon federal convictions related to possession of cannabis and seek a rescheduling of the plant. Those gains have faded – offering investors another chance to buy cannabis stocks before a potential near term catalyst takes place. Curaleaf (OTCPK:CURLF) reported second quarter earnings results which reflected ongoing macro headwinds. The company did pull some levers to drive higher margins and remains well positioned to benefit from future long term growth. The stock is trading at a notable premium to peers on account of its wide footprint, though it is not clear if that premium is warranted. The stock is nonetheless cheap here, and the company’s European footprint may help distinguish it from other US operators.

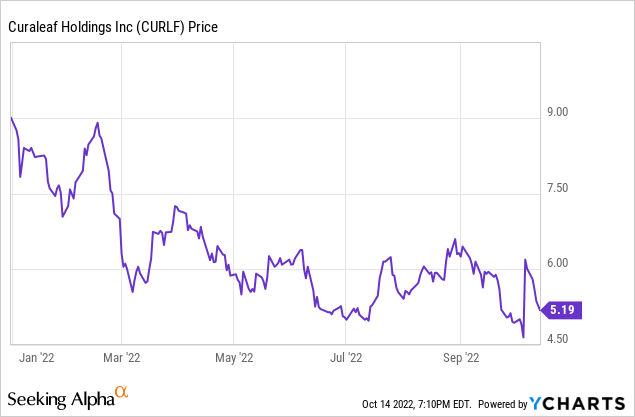

CURLF Stock Price

After peaking at around $17 per share in early 2021, CURLF has since fallen nearly 70% to present day – giving up most of its gains following Biden’s announcements.

I last covered CURLF in May, where I compared it to Canadian producer Tilray (TLRY). While the fundamentals are facing near term headwinds, the stock continues to trade cheaply as compared to the long term opportunity.

Is Federal Cannabis Legalization Coming in 2022?

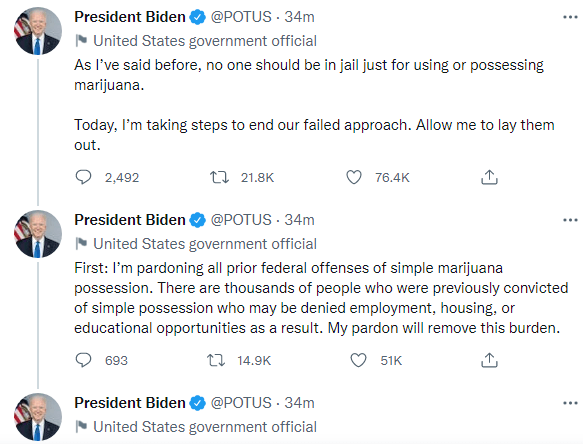

On Thursday, October 6th, President Biden announced that he was pardoning all prior federal offenses of cannabis possession.

Twitter

In addition, he also immediately called the Attorney General to reschedule the plant. That sent cannabis stocks soaring briefly though they have since given up most of those gains.

Legislative reform can have a huge impact on cannabis stock prices. Besides the general build-up of investment hype, decriminalization could allow institutional capital to enter the sector, leading to a long-anticipated run-up in stock prices. From a fundamental perspective, investors are hopeful for a resolution of 280e taxes, which forces US cannabis companies to pay unusually high tax rates due to being unable to deduct normal operating expenses from taxable income. Even if legislative reform stops short of legalization, a lesser SAFE Banking reform bill would decrease cost of capital by enabling institutional investment to lend in the sector. Now that President Biden has officially made clear his intention to begin cannabis reform, the future is finally looking up for a sector in desperate need for good news.

What is Curaleaf?

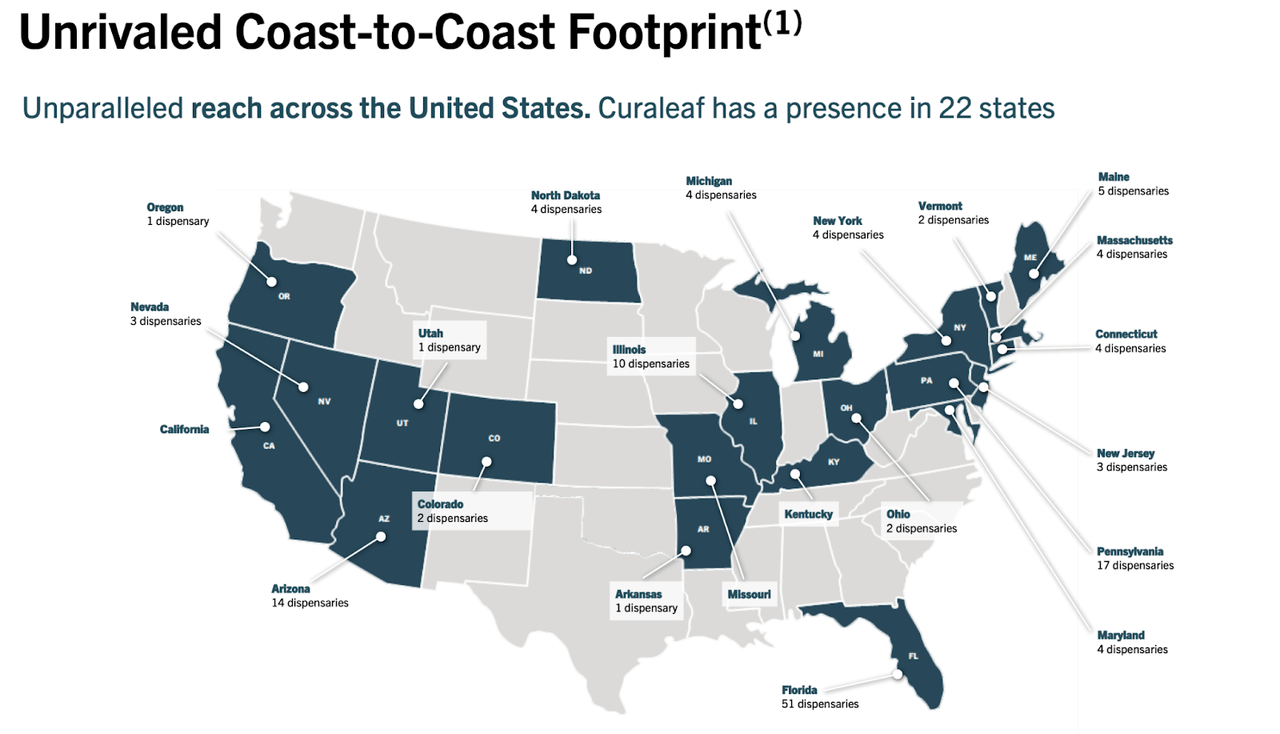

CURLF is a US-based cannabis operator with 136 retail locations and 26 cultivation sites spread across 22 states.

August Presentation

As of the latest quarter, the company had a 75%/25% retail/wholesale split in its operations.

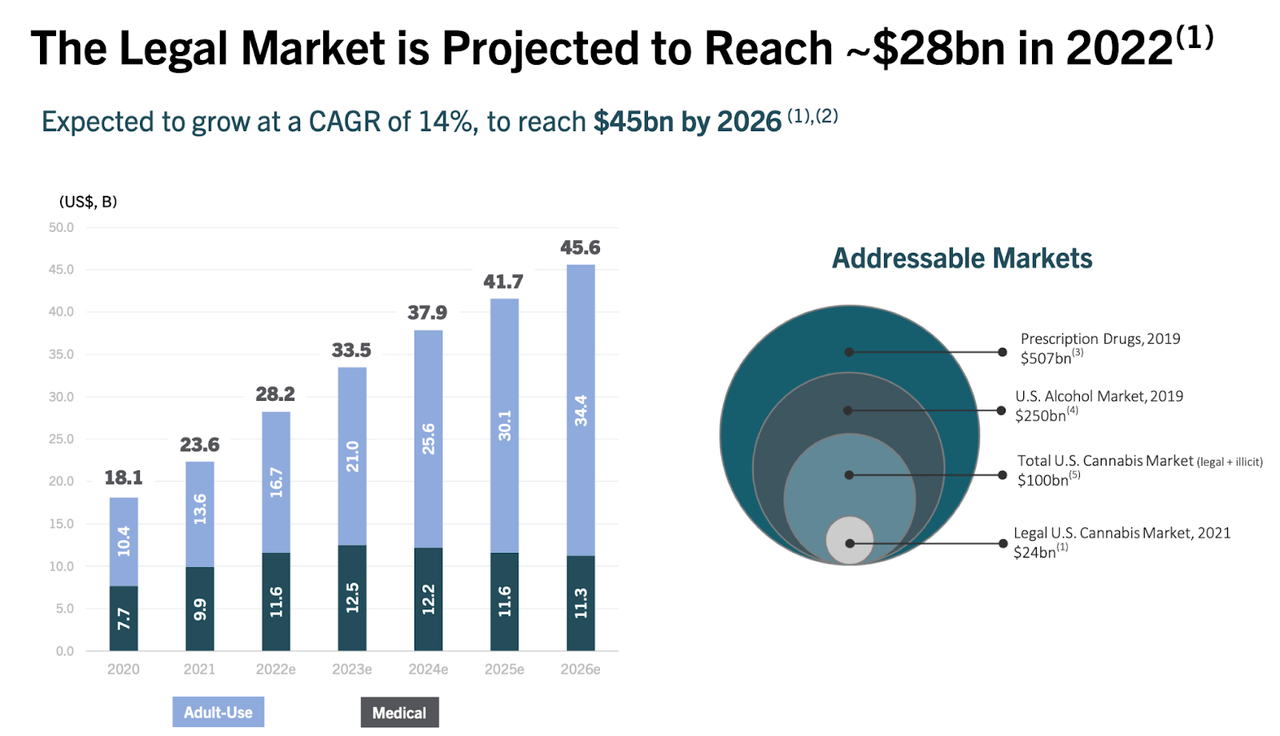

The US cannabis market is a high-growing sector that most investors might not know about. This is because cannabis remains federally illegal, keeping most investment institutions away from investing in the sector – in spite of the huge potential. Retail investors are not faced with the same restrictive mandates, though they need to confirm which brokerage firms allow the purchase of US cannabis stocks. The US legal market is projected to grow at a 14% pace to reach $45 billion by 2026.

August Presentation

Much of that growth will come from ongoing legalization of cannabis at the state level. Multi-state operators (‘MSOs’) like CURLF continue to position themselves for such growth by winning licenses or acquiring operators ahead of such legalization.

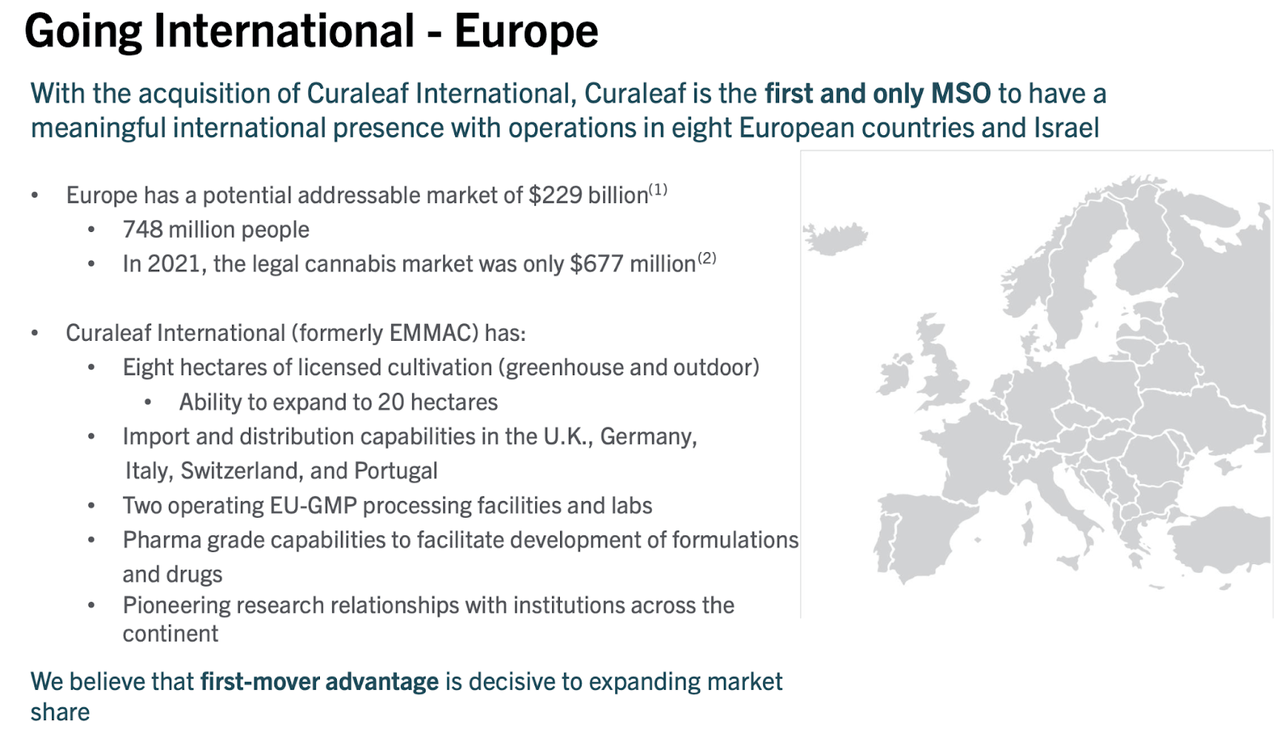

Unlike other US operators which have in general focused on domestic operations, CURLF has looked abroad in Europe through its previous acquisition of EMMAC. CURLF is optimistic that it will have a first-mover advantage in Europe when countries there inevitably legalize cannabis.

August Presentation

Right after releasing earnings, CURLF also announced that it had acquired a majority stake in Four 20 Pharma GmbH, a medical cannabis operator in Germany. Germany is expected to legalize adult-use sales soon, making this partnership a potential way for CURLF to earn a preliminary footprint in the country.

CURLF Stock Key Metrics

Historically, CURLF has been viewed as one of the largest operators in US cannabis, one with the widest footprint and respectable but not the highest profit margins. This latest quarter continued that trend, with revenues growing 8% sequentially and 8% year over year. Gross margin stood at 51.9%, a notable increase from the 49% that it has typically operated at. Gross margins increased due to the company focusing more on vertical integration as well as emphasizing more wholesale in higher margin states.

CURLF also showed some EBITDA margin expansion, generating 25.5% adjusted EBITDA margins in the quarter – up over the 23.3% quarter sequentially but down from the 27% level year over year.

The company generated $12 million of positive operating cash flow in the first half of this year. In the quarter, CURLF operated at breakeven operating income before taxes, but recorded $45.1 million in income taxes. US cannabis operators are unable to deduct operating expenses from taxable income in the calculation of income taxes, leading to income taxes being effectively calculated based on gross profits (this is again due to the fact that cannabis is federally illegal).

CURLF ended the quarter with $187 million of cash versus $587 million of debt.

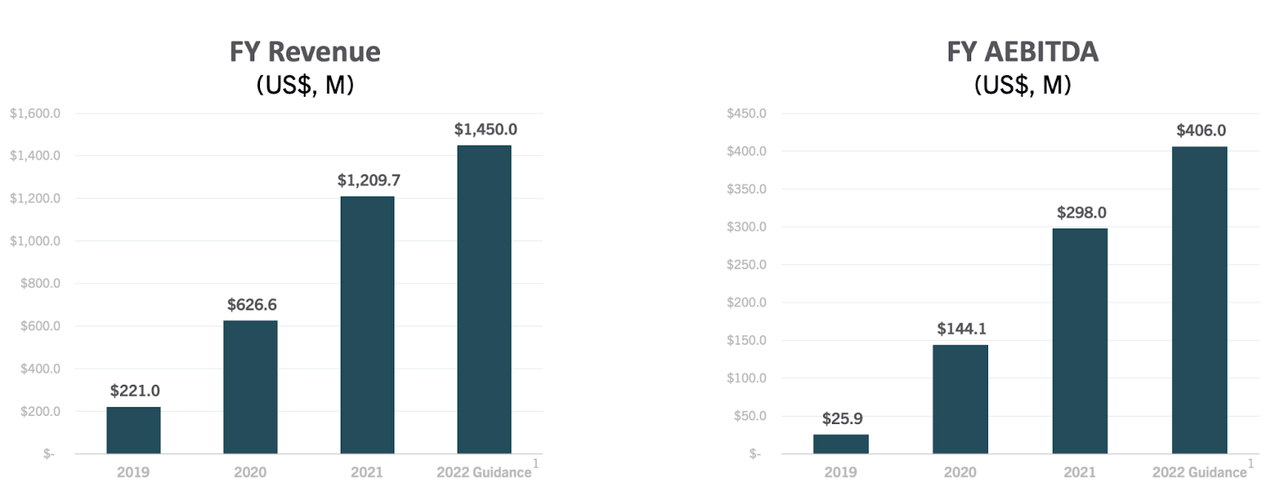

Looking ahead, CURLF has guided to around $1.45 billion in revenues and $406 million in adjusted EBITDA for this year.

August Presentation

On the conference call, CURLF hinted that it may come at the low end of guidance – I would not be surprised if the company ends up missing guidance, considering the slew of misses across the sector. CURLF management also stated on the conference call that they intend to convert to US GAAP financial reporting no later than the first quarter of next year. Currently, Verano (OTCQX:VRNOF), Trulieve (OTCQX:TCNNF), and Green Thumb Industries (OTCQX:GTBIF) of the “Big 5” already report US GAAP financial statements (Cresco Labs (OTCQX:CRLBF) is the final member of the Big 5).

Is CURLF Stock A Buy, Sell, or Hold?

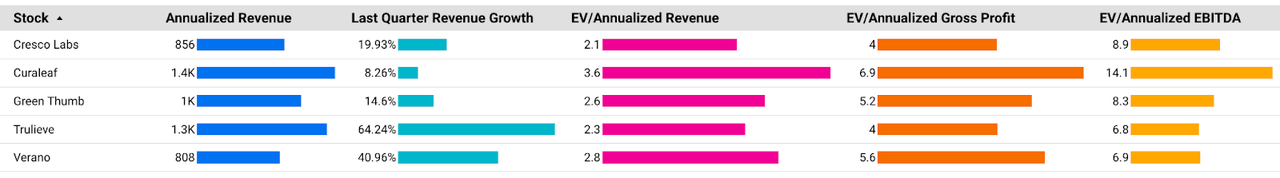

At recent prices, CURLF trades at a sizable premium to peers.

Cannabis Growth Portfolio

That premium is large on the basis of price to sales, and even larger on the basis of EBITDA multiples. Based on 2023 estimates, CURLF trades at 3x sales and 11x EBITDA. Those multiples are significantly higher than Tier 1 peers, as even Green Thumb is trading at around 9.5x EBITDA. Yet, CURLF’s valuation stands at a clear discount to the 15x to 18x EBITDA multiple of alcohol companies like Constellation Brands (STZ) and Boston Beer (SAM), even though US cannabis companies hold far stronger growth prospects. While growth should be expected to be lumpy in the near term due to the heavy reliance on state-level legalization, the long term thesis remains intact. It is inevitable for more states to continue legalizing cannabis for adult-use sales, as more and more people begin appreciating the plant for its recreational and medical applications. There are two main risks to consider here. First, US cannabis operators face immense financial difficulty due to strict regulations. I have already discussed the difficult taxation, but these operators also have limited access to capital markets, though that element has improved dramatically in recent years alongside the rapid growth rates. An operator-specific risk with respect to CURLF is the possibility that the management team is more focused on growing revenues without enough attention to per-share long term profits. Their presentations and commentary have frequently shown admiration of their wide footprint and large revenue base – it remains to be seen if the company can eventually ramp up profit margins or if it will be left burdened with an expensive footprint and not enough capital to invest in it. I still rate CURLF a strong buy on account of the deep undervaluation, but emphasize my preference for higher margin peers. That said, given the promising outlook sprung about by Biden’s announcement, it may make sense to own a diversified allocation to the higher quality operators in the sectors.

Be the first to comment