Blue Planet Studio/iStock via Getty Images

Welcome to the June 2022 edition of Electric Vehicle [EV] company news. June saw reports of a recovery in China May global electric car sales. We also heard the big news in late June that EU nations approve the end to combustion engine sales by 2035.

Global Electric Car Sales As Of End May 2022

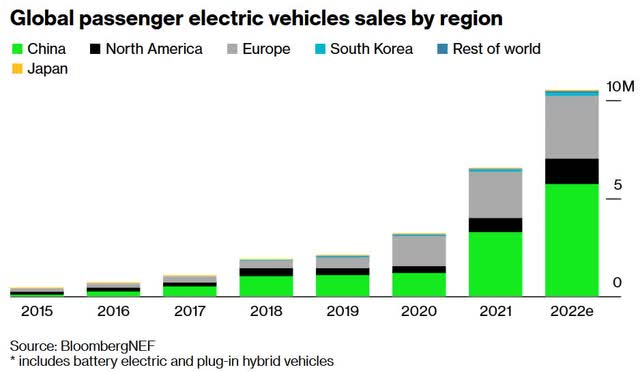

Global electric car sales finished May 2022 with 699,000 sales for the month, up 55% on May 2021, with market share of 12% for May 2022, and 11% YTD.

Note: 72% (not updated this month) of electric car sales YTD were 100% battery electric vehicles (BEVs), the balance being hybrids.

China electric car sales were 403,000 in May 2022, up 109% on May 2021 sales. Electric car market share in China for May was 31%, and 25% YTD.

Europe electric car sales were 183,000 in May 2022, up 3% YoY, reaching 19% market share and 20% YTD. Norway reached 85.1% share, Sweden 47.5%, Netherlands 32%, Germany 25%, France 21%, and 18.3% share in the UK in May 2022.

U.S electric car sales were not available from CleanTechnica. However, the Driven reported on June 3:

EVs grab 6 per cent of US car market, as Tesla dominates and Ford flags price war…Electric vehicles have grabbed a bigger share of the US car market, reaching a record high of 6.1 per cent of new car sales in May, according to the latest data. The new data represents a 70 per cent jump in EV sales over the same month a year earlier…And once again it was Tesla that dominated the field, accounting for 70 per cent of total EV sales – up from 63 per cent a year earlier – mostly through the Model 3 and Model Y.

Note: The above sales include light commercial vehicles.

Note: An acknowledgement to Jose Pontes and the team at CleanTechnica Sales for their work compiling all the electric car sales quoted above and charts below.

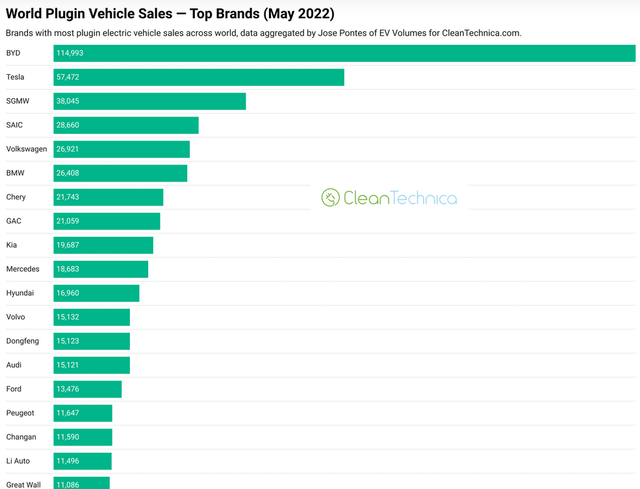

Global plugin electric car sales by brand for May 2022

Source: CleanTechnica

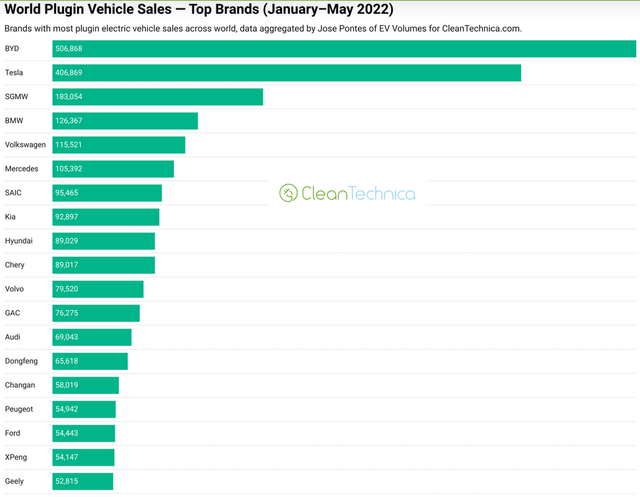

Global plugin electric car sales by brand YTD in 2022

Source: CleanTechnica

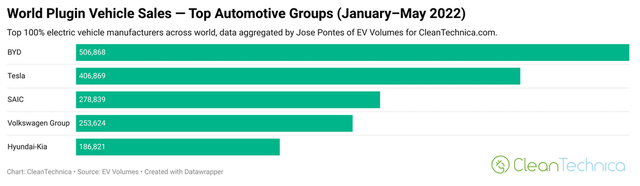

Top 100% electric car sales YTD by auto group

Source: CleanTechnica

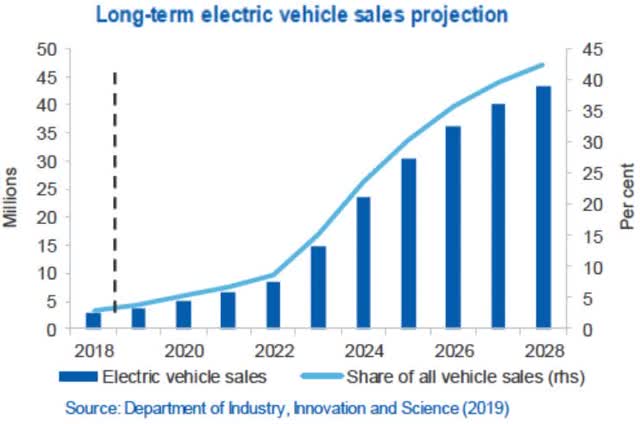

EV sales forecast to really take off from 2022 as affordability kicks in

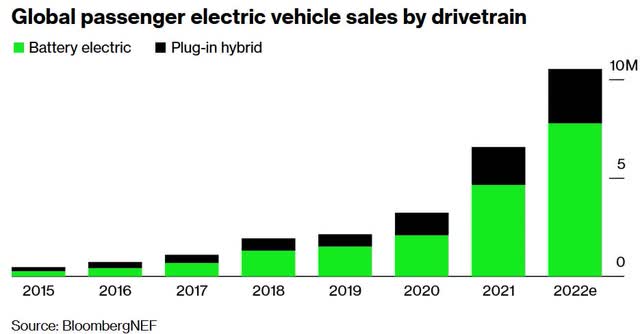

The chart below aligns with my research that electric car sales will really take off after 2022. It now looks like electric car sales already took off in 2021 with ~6.5m sales and 9% market share.

Source: BloombergNEF

Bloomberg Electric Vehicle Outlook 2022 (published May 2022)

BloombergNEF now forecasts “plug-in electric vehicles sales rise from 6.6 million in 2021 to 20.6 million in 2025” and “by 2025, plug-in electric vehicles represent 23% of new passenger vehicles sales globally, up from just under 10% in 2021”.

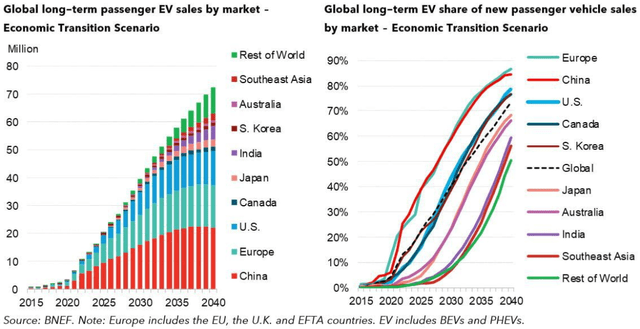

BloombergNEF long term EV forecast (global EV share to exceed 70% by 2040)

Source: BloombergNEF

EV Market News

On June 1 Bloomberg reported:

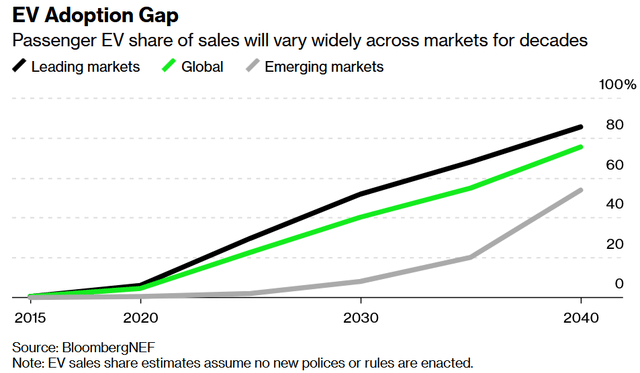

EV sales will triple by 2025 and still need more oomph to reach net zero…The research firm lays out the stakes and calls for action in its seventh annual Long-Term Electric Vehicle Outlook, released Wednesday. BNEF’s analysts deem EVs “a remarkable success story,” predicting plug-in passenger vehicle sales will soar to 20.6 million in 2025, much higher than its 14 million forecast just a year ago, mainly due to faster uptake in China.

BloombergNEF forecasts ~40.4% global passenger EV market share in 2030 and 75.3% in 2040

Source: BloombergNEF

On June 6 Nikkei Asia reported:

Sony eyes ‘independent’ EV joint venture with Honda…The head of Sony Group has said the company’s planned joint venture with Honda Motor may hold a public share offering as the two companies prepare to develop electric vehicles together.

On June 6 Electrek reported: “Aptera raises $40 million to bring solar electric car with up to 1,000 miles of range to production.”

On June 8 the Politico.eu reported:

European Parliament votes to ban combustion engine cars from 2035. Lawmakers in the European Parliament plenary voted Wednesday to mandate that all new car and van sales should be zero emissions from 2035 as part of efforts to clean up road transport…The legislation is a key part of the Fit for 55 package and mandates that carmakers should reduce their fleetwide emission averages by 100 percent from 2035, with interim steps in 2025 and 2030…The final legal text now needs to be worked out in talks with the Council. Environment ministers are set to sign off on their version of the legislation at a summit in Luxembourg on June 28.

On June 8 Reuters reported:

Walmart expands transportation partnerships with electric, hydrogen vehicle pilots…including Cummins Inc (CMI) and Daimler Truck’s (OTC:DTRUY) Freightliner. The partnerships, which are in addition to previously announced transportation tie-ups, are part of Walmart’s 2040 goal to achieve zero emissions across its global operations, including its fleet of roughly 10,000 tractors and 80,000 trailers.

On June 9 The U.S Department of Transportation reported:

Biden-Harris administration takes key step forward in building a national network of user-friendly, reliable, and accessible electric vehicle chargers. In keeping with President Biden’s commitment to jumpstart the construction of a national network of 500,000 electric vehicle (EV) chargers by 2030, the U.S. Department of Transportation’s Federal Highway Administration today announced a Notice of Proposed Rulemaking (NPRM) on proposed minimum standards and requirements for projects funded under the National Electric Vehicle Infrastructure (NEVI) Formula Program.

On June 9 NewAtlas reported:

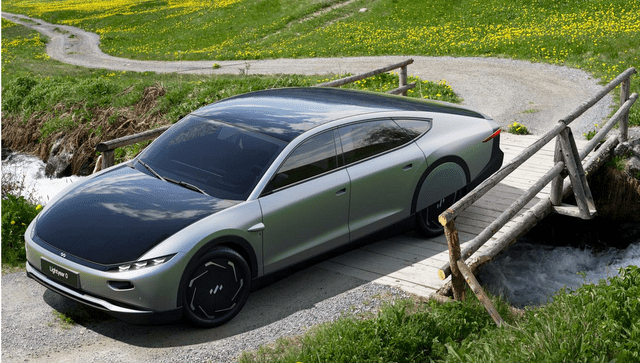

Lightyear 0 production solar car could run for months without charging. Dutch company Lightyear has unveiled what it claims is the world’s first production-ready solar car. The Lightyear 0 is a family sedan with 5 sq m (53.8 sq ft) of solar panels built in, capable of generating up to 70 km (44 miles) of charge-free driving a day…in WLTP testing, the Lightyear 0 delivers 625 km (388 miles) of range, or nearly 4 percent more than Tesla’s Model 3 Long Range AWD. Lightyear says it’s developed the most efficient electric drivetrain ever, and that these range figures come from a battery pack holding just 60 kWh.

Lightyear 0 production solar car

Source: Lightyear.one website

On June 10 Bloomberg reported:

Transcript: Foxconn has a plan to upend the electric vehicle industry… Foxconn is also unhealthily addicted to Apple. 50% of their revenue comes from Apple. And it’s been that way for more than a decade. They bought in about 215 billion of revenue last year Foxconn. And half of that came from Apple. So they can’t do without Apple, unless they get into the EV business. The hottest gadget, or one of the hottest gadgets in the world right now is the electric vehicle…Now what’s interesting is how about the existing legacy carmakers, like the Europeans and the Japanese, the Koreans, and of the Americans? Do they still want to make their own cars, or will they, at some point say, you know what, we’re going to outsource a couple of models of our cars to somebody else, like a Foxconn?

On June 10 The Driven reported:

BYD says shift to electric vehicles moving “much faster” than expected… “We feel that the process of electrification is accelerating, much faster than we imagined. Whoever has more resources, healthy supply chain and product advantages can win more market.”

On June 13 InsideEVs reported:

This Fiat 500 EV is charging wirelessly through the road as it drives… According to Stellantis, the outer lane of the circle has an embedded Dynamic Wireless Power Transfer (DWPT) system implemented and it allows a vehicle like the electric Fiat 500 they used as a test car to actually drive at highway speeds without actually draining its battery. The company says it is committed to offering “cutting-edge freedom of mobility” and this is one way to achieve that without overburdening cars with huge, heavy batteries.

On June 14 Bloomberg Green reported:

UK ends subsidies for electric cars on surging demand. The UK said it would scrap the last remaining subsidies for electric cars, saying the move would free up cash to expand the charging network and encourage sales of other battery-powered vehicles, such as vans, taxis and motorcycles. The £300 million ($349 million) grant-funding program is closing to new orders on Tuesday, the Department for Transport said in a statement. The scheme “has succeeded in creating a mature market for ultra-low emission vehicles…”

On June 14 Electrek reported:

Here’s why Bloomberg thinks Volkswagen’s EV sales will overtake Tesla’s by 2024. According to a comprehensive report published this morning by research firm Bloomberg Intelligence, Tesla will hold its global crown for EV sales for the next 18 months but will then be usurped by Volkswagen electric vehicles. The full BEV outlook report predicts that many legacy automakers will lag in sales through 2025, but Volkswagen is on track to overtake Tesla’s production volume by 2024.

On June 16 Bloomberg Green reported (Re: Ferrari N.V. (RACE)):

Ferrari sees profit jump as Italian carmaker goes electric. Ferrari NV will embark on a major shift toward electrification by turning its historic factory in northern Italy into a hub for battery-powered cars, underscoring how even the most pure-bred makers of combustion engines are embracing an electric future. The Italian manufacturer will invest about 4.4 billion euros ($4.6 billion) to develop fully electric and plug-in hybrid models that will make up 60% of its portfolio by 2026, Ferrari said on Thursday.

On June 17 Reuters reported:

VW U.S. chief warns of industry challenges with EV battery shift…the move to EVs is the single biggest “industrial transformation in America.”…Volkswagen AG’s top U.S. executive said on Thursday the United States faces major challenges in ramping up battery production to facilitate a shift to electric vehicles including attracting skilled workers, mining for key metals and supply chain issues…Automakers and battery companies are committing tens of billions of dollars to building new battery plants and EV assembly plants throughout North America as they scale up electric vehicle production. Keogh estimated that the United States is making 150,000-200,000 batteries a year and that seven years from now “we need to be making 8.5 million batteries” annually. “This is a scale of investment that honestly is going to make the industrial revolution look like a cake walk. It’s massive,” Keogh said.

On June 17 Bloomberg Hyperdrive reported:

EVs now average over $60,000 as Tesla, Rivian, Ford Raise Prices. Gasoline-price shock spurs demand while material costs mount. EVs shoppers tend to have higher incomes to absorb price bumps.

On June 22 Electrek reported:

Here’s where US electric school bus adoption currently stands. As of this month, US school districts and fleet operators have committed to 12,275 electric school buses in 38 states…The number of electric school buses jumped by more than 10,000 since the release of WRI’s January 2022 dataset, and there has been almost a 10-fold increase since WRI began tracking adoption in August 2021…Only about 5% of these buses are currently delivered or operational.

On June 22 aastocks.com reported:

Citi foresees NEV penetration in CN to leap to 60% by 2025; TPs of NEV makers broadly lifted…Citigroup lifted the sales volume forecasts for China’s leading NEV makers and subsequently raised the 2022-2025E/ -2030E China’s NEV penetration rates to 60% and 90%, respectively, compared to the 2022E penetration rate of 29%. Citigroup ramped up the target price for BYD COMPANY from HKD587 to HKD640, with its rating kept at Buy. The target prices for LI AUTO-W and XPENG-W were likewise added from HKD104 and HKD142.6, to HKD225.3 and HKD198.38, respectively, both rated at Buy. The broker selected BYD COMPANY and NIO-SW as the sector top picks, followed by LI AUTO-W and XPENG-W.

On June 22 Bloomberg reported:

Manchin says EV tax credit bonus is gone from spending bill. Senate Democrats have scrapped a $4,500 bonus tax credit for electric vehicles made with domestic union labor… “At this point, what we are left with is the base credit,” Joe Britton, the head of the Zero Emission Transportation Association, said in an interview. Conversations about lifting an existing 200,000 vehicle-per-manufacturer cap on the credit remain on going.

On June 23 Reuters reported:

Electric vehicles could take 33% of global sales by 2028…and 54% by 2035, as demand accelerates in most major markets, consultant AlixPartners said on Wednesday. EVs accounted for less than 8% of global sales last year, and just under 10% in the first quarter of 2022.

On June 29 Euractiv reported:

EU nations approve end to combustion engine sales by 2035. Environment ministers from the EU’s 27 member states approved to end the sale of vehicles with combustion engines by 2035 in Europe, officials announced early Wednesday (29 June), marking a major victory in the EU’s bid to reduce CO2 emissions to net-zero by 2050. As of 20305, new vehicles put on the EU market will need to reduce their CO2 emissions by 100%. An intermediate objective of 55% for cars and 50% for vans was agreed for 2030.

EV Company News

BYD Co. [SHE: 002594][HK:1211](OTCPK:BYDDY) (OTCPK:OTCPK:BYDDF)

BYD is currently ranked the number 1 globally with 15.6% market share YTD. BYD is ranked number 1 in China with 27.9% market share in YTD.

On June 2 Inside EVs reported:

UK: BYD ADL celebrates delivery Of 1,000th electric bus. In Europe, the Chinese manufacturer already delivered or has on order 2,600 electric buses…According to the press release, sales of the British-built and BYD-powered buses accelerated recently. It took five years to reach the 500th electric bus, while another 500 were sold just one year later… But all those numbers are just a shadow of what BYD has achieved in China. The company’s global sales (mostly China plus a few thousand outside of China) already stand at roughly 70,000 units in 70 countries and more than 400 cities.

On June 7 The Driven reported:

BYD sets new production record as Atto 3 arrival approaches. In April this year, BYD sold over 106,000 cars, which was a new record for the company. That was despite the lockdowns that many of the EV makers in China faced. May sales data has just been released and it shows another record month with 114,943 sales for the month.

On June 8 CNBC reported:

Shares of Chinese EV maker BYD jump after exec says company is set to supply batteries to Tesla. A senior executive at China’s BYD said during a Chinese state media interview that the firm is poised to supply Tesla with batteries “very soon.”

On June 13 CNBC reported: “BYD is selling so many electric cars it’s become one of the top three automakers in China.”

On June 16 BYD reported:

1200 units of BYD YUAN PRO EVs hit the Market in Costa Rica. Shenzhen, China – 1200 units of BYD YUAN Pro EVs (known locally as S1 PRO) are exported to Costa Rica this year. This batch of BEVs sets a new sales record in Latin America for BYD.

Tesla Inc. (NASDAQ:TSLA)

Tesla is currently ranked the number 2 globally with 12.6% global market share YTD. Tesla is number 3 in China with 6.6% market share YTD. Tesla is still the number 1 electric car seller in the US by far.

On May 18 CleanTechnica reported: “Tesla Model 3 & Model Y outsell all new cars in California in Q1 2022 – Even gas cars – CleanTechnica.”

On June 8 Teslarati reported: “Elon Musk says the Cybertruck will be Tesla’s ‘best product ever’.”

On June 9 Bloomberg reported:

Tesla’s China production roars back with output tripling. Tesla Inc. has staged a remarkable comeback in terms of its production in China, with May output more than tripling despite the electric carmaker only recently getting its Shanghai factory back up to speed after the city’s punishing lockdowns. The US-headquartered electric vehicle maker produced 33,544 cars from its Shanghai plant last month, versus 10,757 in April, China Passenger Car Association data released Thursday showed. Shipments came in at 32,165 units, with 22,340 of those cars exported to markets in Europe and the rest of Asia, and 9,825 of the vehicles going to domestic buyers…Even so, EVs produced in May were still only about 50% of what Tesla’s China plant does in a regular month when operations are running as normal. March shipments were 65,814, for instance, and as high as almost 71,000 in December.

On June 9 Seeking Alpha reported:

Tesla gains after UBS upgrades and points to attractive entry point. UBS upgraded Tesla to a Buy rating after having the electric vehicle stock slotted at Hold.

On June 10 Teslarati reported:

Tesla is the most preferable brand for prospective EV buyers…According to Kelley Blue Book, 25% of new car buyers considered an EV in January, February, and March 2022…The survey results showed Tesla was still the dominant brand among EV shoppers, with most preferring either the Tesla Model 3 or Tesla Model Y…Today, the national average price of a gallon of gas in the U.S. has reached $4.98, up nearly $2 from a year ago, according to AAA. In March, Tesla said it was experiencing an increased volume of orders in several regions of the U.S., especially those that had experienced a drastic increase in the price of gas per gallon.

On June 11 Bloomberg reported:

Tesla files to split shares 3-for-1 as investors bail on stock. Tesla Inc. said it will ask shareholders to approve a 3-for-1 stock split at their August annual meeting, according to a proxy statement filed Friday after the market close…

On June 12 Teslarati reported: “Tesla gets proposal from Indonesia for EV plant with an annual production capacity of 500k.”

On June 13 Teslarati reported: “Tesla is considering sites for new factory in Canada and Mexico, along with the US.”

On June 15 Electrek reported: “Tesla tops the list of most satisfied customers in the entire auto industry.”

On June 16 Seeking Alpha reported:

Elon Musk’s Tesla raises prices across car models in the U.S…as costs of raw materials have surged, including aluminum used in cars amid ongoing global supply-chain issues. The company raised its Model Y long-range price to $65,990 from $62,990…

On June 17 Seeking Alpha reported: “Tesla raises Model Y long-range price in China, following the hike across all car models in the U.S.”

On June 21 Seeking Alpha reported:

Tesla supply chain problems are paramount concern – Musk…He explained that production has been hindered by raw material shortages and shutdowns of assembly lines in China.

On June 22 Electrek reported: “Tesla Cybertruck design is ‘finally locked’ and gets an updated timeline…to production for mid-2023.”

On June 23 CleanTechnica reported: “Tesla Model Y = 1 out of every 3 new EVs registered in US in 2022.”

On June 23 Reuters reported:

Tesla plans 2-week suspension for most Shanghai production for upgrade – memo. Tesla Inc plans to suspend most production at its Shanghai plant in the first two weeks of July to work on an upgrade of the site, according to an internal memo seen by Reuters. After the upgrade, the U.S. automaker aims to boost the plant’s output to a new record high by the end of July to get closer to its goal of producing 22,000 cars per week in Shanghai, according to the memo.

Investors can read a past article: “Tesla – A Look At The Positives And The Negatives“, where we rated the stock a buy. It was trading at USD 250 (post 5:1 stock split is equivalent to USD 50). Investors can also read the latest Tesla Trend Investing article here.

Wuling Automobile JV (SAIC 51%, GM 44%, Guangxi 5.9%), SAIC Motor Corporation Limited [SAIC] [CH:600104] (SAIC includes Roewe, MG, Baojun, Maxus)

SGMW (SAIC-GM-Wuling Automobile) is number 3 globally with 8.6% market share YTD. SAIC/GM/Wuling JV (SGMW) is 2nd in China with 13.7% share YTD.

On June 5 Piston.My reported:

SAIC-GM-Wuling Air EV has global debut in Indonesia. Wuling Motors, through its SAIC-GM-Wuling (SGMW) joint-venture with General Motors, is aiming to do just that and develop Indonesia into a major overseas market. Over the past 15 years, it has gained experience in export sales, having sold one of the most popular small vans in Asia. In 2021, SGMW exported over 140,000 units from China to more than 40 countries and regions…

Wuling Air EV

Source: Wuling website

Volkswagen Group [Xetra:VOW](OTCPK:VWAGY) (OTCPK:VLKAF)/ Audi (OTCPK:AUDVF)/ Lamborghini/ Porsche (OTCPK:POAHF)/ Skoda/ Bentley

‘Volkswagen Group’ is currently ranked the number 4 top-selling global electric car manufacturer with 7.8% market share YTD, and 1st in Europe with 18.1% market share YTD.

On June 1 Porsche reported: “Porsche participates in further Rimac funding round.”

On June 8 Porsche reported:

Porsche and UP.Labs plan to build tailormade start-ups. Porsche is expanding its venturing network by collaborating with UP.Labs, a new model for fostering innovative start-ups. The Stuttgart-based sports car manufacturer has agreed with the US company on a three-year cooperation aimed at establishing six companies from 2023 to 2025 with new business models in various areas of mobility.

On June 8 Volkswagen Group reported: “Volkswagen-led research team to recycle batteries multiple times for the first time.”

On June 21 Volkswagen Group reported: “Elli and MITNETZ STROM publish concept for smart grid integration of EVs.”

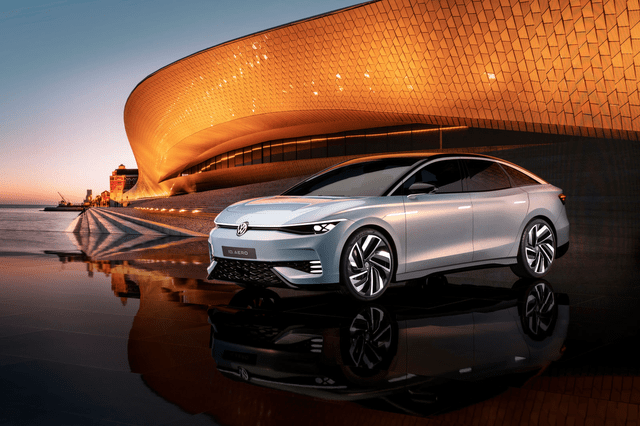

On June 27 Volkswagen Group reported: “Volkswagen’s first fully-electric sedan: World premiere of the ID. AERO.” Highlights include:

- “Volkswagen reveals concept car as a preview of the ID. family flagship.

- Flowing design combines optimised aerodynamics and elegant lines.

- Fully-electric four-door production model will be offered worldwide in the future in the premium mid-size segment.

- Sixth member of the ID. family after the models ID.3, ID.4, ID.5 and ID.6 as well as the iconic ID. Buzz.”

Volkswagen ID. AERO

Source: Volkswagen Group

On June 28 Volkswagen reported:

Volkswagen and Siemens invest in Electrify America’s ambitious growth plans. $450 million equity investment supports Electrify America’s expansion plans in U.S. and Canada.

Hyundai (OTC:HYMTF), Kia (OTC:KIMTF)

Hyundai-Kia Group is currently ranked number 5 in the global electric car manufacturer’s sales ranking with 5.8% market share YTD. Hyundai-Kia Group is ranked 3rd in Europe with 11.7% market share YTD.

On June 1 Hyundai reported: “Hyundai Motor America reports May 2022 sales.” Highlights include:

- “New EV Plant: Hyundai Motor Group announced it would establish its first dedicated EV Plant and Battery Manufacturing facility in the U.S. with an investment of approximately $5.54 billion. Commercial production to begin 1H 2025 with an annual capacity of 300,000 units.

- Hyundai IONIQ 5 added to Consumer Guide’s® 2022 Best Buy Awards…”

On June 2 Kia reported:

Kia announces May 2022 global sales results. Kia to continue creating sales momentum and enhancing profitability through new models, such as the Kia EV6.

On June 20 Hyundai reported: “Hyundai Motor Group and Michelin join hands to develop next-gen tires for premium EVs to foster clean mobility.”

On June 22 Reuters reported:

S.Korea’s Kia picks batteries from China’s CATL for EV sold at home – media report. South Korean automaker Kia Corp will use batteries from China’s CATL in an electric vehicle (EV) to be sold domestically.

On June 28 Hyundai reported: “Hyundai Motor unveils design of all-electric IONIQ 6, electrified streamliner with mindful interior design.”

Hyundai Motor all-electric IONIQ 6

Hyundai website

Source: Hyundai website

Geely Automobile Holdings Ltd (OTCPK:GELYY, HK:0175), Volvo Cars, Kandi Technologies Group (NASDAQ:KNDI), Proton, Lotus,

Geely/Volvo is currently ranked number 6 in the global electric car manufacturer’s sales ranking with 5.7% global market share YTD.

On May 30 Geely Automobile Holdings Ltd reported:

Geely Automobile Holdings Limited sets 5-year carbon reduction target of more than 25% and carbon neutrality target by 2045 aiming to become an ESG leader in China’s automotive industry.

On June 2 Volvo Cars reported: “Volvo Cars reports sales of 45,952 cars in May, share of fully electric cars stands at 7.9%…”

Stellantis N.V. (NYSE:STLA) (merger Fiat Chrysler Group (FCA) and the Peugeot Group (PSA)) Ferrari

Stellantis Group is currently ranked the number 7 in the global electric car manufacturer’s sales with 5.5% global market share YTD. Stellantis is ranked 2nd in Europe with 16.1% market share YTD.

On June 2 Stellantis reported: “Stellantis secures low emissions lithium supply for North American electric vehicle production from controlled thermal resources.” Highlights include:

- “…Sustainable lithium hydroxide to support Stellantis U.S. product offensive of over 25 all-new battery electric vehicle (BEV) launches and 50% BEV sales planned by 2030…”

On June 20 Stellantis reported: “Stellantis invests €33 million in global testing hubs for cutting-edge engineering.”

On June 24 Stellantis reported: “Stellantis expands relationship with Vulcan Energy becoming shareholder in decarbonized lithium company.”

On June 29 Stellantis reported: “Transformation in Action: Trémery-Metz Powertrain Plants in France Support Stellantis’ Electrified Portfolio.” Highlights include:

- “More than €2 billion has been invested in the French manufacturing footprint since 2018…

- Engines and transmissions from Trémery-Metz will power Company’s commitment to clean, safe and affordable mobility.”

BMW (OTCPK:BMWYY), Mini, Rolls-Royce

BMW Group is currently ranked the number 8 global electric car manufacturer with 3.9% global market share YTD. BMW Group is ranked 4th in Europe with 11.5% market share YTD.

On June 1 The Driven reported: “BMW says iX1, its first fully electric small EV, to land in Australia in 2023.”

On June 1 BMW Group reported: “Foundation stone laid for state-of-the-art plant in Debrecen.” Highlights include:

- “Series production of fully electric Neue Klasse will launch in 2025.

- CO2-free car plant – a world first…

- BMW iFACTORY will be fully implemented.”

On June 14 Electrek reported: “BMW is testing iX electric SUV with 600 miles of range thanks to new battery chemistry.”

On June 20 BMW Group reported: “BMW Group brings e-drives to Austria: Expansion of production and development at Steyr engine plant.” Highlights include:

- “Production of next-generation e-drives at BMW Group Plant Steyr from 2025.

- Annual production capacity of over 600,000 units.

- Investment of around one billion euros by 2030.

- BMW iFACTORY also in Steyr: electric drive trains from carbon neutral plant.”

On June 22 U.S news reported:

BMW starts production at new $2.2 billion China plant to ramp up EV output…The Lydia plant, BMW’s third car assembly facility in China, located in the northeastern city of Shenyang, Liaoning province, will increase BMW’s annual output in the world’s biggest auto market to 830,000 vehicles from 700,0000 in 2021, the company said. The plant is designed to be capable of producing battery-powered electric cars only according to market demand on its flexible manufacturing lines, BMW said.

Daimler-Mercedes (OTCPK:DDAIF, OTCPK:DDAIY) (Smart – 50% JV between Daimler & Geely) (NB: A proposal to rename Daimler to Mercedes Benz)

Daimler-Mercedes is ranked number 9 globally with 3.3% market share.

On June 15 Mercedes Blog reported:

Mercedes supports the 2035 ICE ban, claims it can come up with all-electric lineup earlier. The European Commission voted to uphold the ban of ICE new passenger cars starting in 2035 proposed last year. Mercedes claims it can come up with an all-electric lineup even earlier. The premium carmaker has already started its own electric revolution with the EQ-branded models.

GAC Group (Guangzhou Automobile Group Co. Ltd.)

GAC Group is ranked number 10 globally with 2.4% market share YTD.

Refer to Honda news below.

XPeng Inc. (Xiaopeng Motors) (XPEV) [HK:9868]

On June 1 Businesswire reported:

XPeng announces vehicle delivery results for May 2022. 10,125 vehicles delivered in May 2022, a 78% increase year-over-year.

Great Wall Motors [HK:2333] (OTCPK:GWLLF) (OTCPK:GWLLY) [ORA]

On May 5 Autovista 24 reported:

Great Wall Motor’s ORA Cats set to become a challenger in Europe… Created as a dedicated battery-electric vehicle (BEV) brand by Great Wall Motor Co. of China, ORA, which stands for “Open, Reliable and Alternative”, started out in 2018 with two distinct models, the R1 city car and the larger iQ5 crossover…Europe is also in ORA’s sights, with the Good Cat, or simply 01 Cat, as it will be known in Europe, set to land during the summer 2022 in top specification (171hp electric motor, 63kWh battery). With prices expected to start at around €30,000…

Ford (NYSE:F)

On June 15 Bloomberg Hyperdrive reported:

Ford recalls 48,924 Mustang Mach-Es in setback for EV Plans. Carmaker cites potential safety defect in the crossover SUV. Dealers cannot deliver vehicle until issue fixed via update.

On June 22 Ford reported: “Ford speeds toward all-electric, connected future in Europe; Chooses Valencia Plant, Spain, for Next-Gen EV Architecture.” Highlights include:

- “Ford takes next step in its transformation; selects Valencia plant as best positioned to produce vehicles based on a next-generation electric vehicle architecture.

- Ford reiterates its commitment to Germany with a $2 billion investment in a state-of-the-art electric vehicle center in Cologne, where production will start in late 2023.

- Advances Ford’s goal to achieve zero emissions for all vehicle sales in Europe and carbon neutrality across its European footprint of facilities, logistics and suppliers by 2035.”

Li-Auto (LI) [HK:2015]

On June 1 Li-Auto reported:

Li Auto Inc. May 2022 delivery update. Li Auto Inc. (“Li Auto” or the “Company”) (Nasdaq: LI; HKEX: 2015), a leader in China’s new energy vehicle market, today announced that the Company delivered 11,496 Li ONEs in May 2022, up 165.9% year over year. The cumulative deliveries of Li ONE have reached 171,467 since the vehicle’s market debut in 2019.

On June 21 Li-Auto reported:

Li Auto Inc. unveils Li L9, its flagship Smart SUV. Li Auto Inc. (“Li Auto” or the “Company”) (Nasdaq: LI; HKEX: 2015), a leader in China’s new energy vehicle market, today unveiled Li L9, the Company’s flagship smart SUV for families. Li L9is a six-seat, full-size flagship SUV, offering superior space and comfort for family users…Li L9 comes standard with over 100 flagship features at a retail price of RMB459,800.

Li-Auto Li L9 flagship Smart SUV

Li-Auto website

Source: Li-Auto website

On June 24 Li-Auto reported: “Li Auto Inc. takes in over 30,000 Li L9 orders.”

On June 28 Li-Auto reported:

Li Auto Inc. announces at-the-market offering of American depositary shares. Li Auto Inc. (“Li Auto” or the “Company”) (Nasdaq: LI; HKEX: 2015), a leader in China’s new energy vehicle market, today announced that it has filed a prospectus supplement to sell up to an aggregate of US$2,000,000,000 of American depositary shares (“ADSs”), each representing two Class A ordinary shares of the Company, through an at-the-market equity offering program (the “ATM Offering”) on the Nasdaq Global Select Market…

NIO Inc. (NIO)

On June 1 NIO reported: “NIO Inc. provides May 2022 delivery update.” Highlights include:

- “NIO delivered 7,024 vehicles in May 2022.

- NIO delivered 37,866 vehicles year-to-date in 2022, increasing by 11.8% year-over-year.

- Cumulative deliveries of vehicles as of May 31, 2022 reached 204,936.”

On June 9 NIO reported:

NIO Inc. reports unaudited first quarter 2022 financial results. Quarterly Total Revenues reached RMB9,910.6 million (US$1,563.4 million). Quarterly Deliveries of the ES8, the ES6, the EC6 and the ET7 were 25,768 vehicles.

On June 15 NIO reported:

NIO launched smart electric mid-large SUV ES7…With a 75kWh battery, the ES7 starts from RMB 468,000 before subsidies. With a 100kWh battery, the price is RMB 526,000 before subsidies. For the ES7 Premier Edition, the price is RMB 528,000 before subsidies.

NIO smart electric mid-large SUV ES7

Source: NIO Inc.

Renault [FR:RNO] (OTC:RNSDF)/ Nissan (OTCPK:NSANY)/ Mitsubishi (OTCPK:MSBHY, OTCPK:MMTOF)

On June 2 Reuters reported:

Morocco’s Managem to supply Renault with cobalt for EV batteries… Under this seven-year supply deal, Managem will supply Renault with 5,000 tonnes of cobalt sulfate annually starting from 2025.

On June 17 Renault reported: “Renault reveals ZOE Model Year 2022. ZOE evolution is available in France from €29,800 inc. VAT and government incentive.”

Renault ZOE Model Year 2022

Renault

Source: Renault website

General Motors/Chevrolet (NYSE:GM)

On May 31 General Motors reported: “GM defense strengthens global offerings by expanding into Canada…”

On June 1 General Motors reported:

Buick commits to all-electric portfolio by end of decade. Buick is set to embark on a brand transformation that will fully electrify its lineup in North America, led by a new badge and brand identity. In support of General Motors’ vision of a zero-emissions, all-electric future, Buick will bring its first electric vehicle to market for North America in 2024. Buick’s future EV products will carry the Electra name, drawing inspiration from the brand’s history.

On June 3 Reuters reported: “GM draws target on Tesla with EV price cut.”

On June 15 General Motors reported: “Cadillac CELESTIQ to be built at GM’s Global Technical Center.”

On June 21 General Motors reported: “BrightDrop accelerates EV production with first 150 electric delivery vans integrated into FedEx Fleet.”

Toyota (NYSE:TM)/ Lexus

On June 1 Toyota reported: “World premiere of the all-new Lexus RX. The rebirth of a global core model symbolizes the challenge of the Lexus brand.” Highlights include:

- “…Powertrain lineup that includes the introduction of PHEVs to meet diverse customer needs, while contributing to the realization of a carbon-neutral society.”

On June 2 Toyota reported: “Toyota releases storage battery system for residential use based on electrified vehicle battery technology.”

On June 24 Toyota reported: “Toyota and Suzuki to deepen collaboration in the fields of development and production in India.”

On June 24 Reuters reported:

Toyota recalls first mass-produced EVs less than 2 months after launch. Toyota Motor Corp said on Thursday it would recall 2,700 of its first mass-produced electric vehicles (EVs) for the global market because of a risk the wheels could come loose.

Beijing Automotive Group Co. (BAIC)(includes Arcfox) [HK:1958) (OTC:BCCMY)

On June 23 BAIC Group reported: “BAIC Group released ‘BLUE Plan’: aiming to achieve complete decarbonization on all products by 2050.”

Rivian Automotive (RIVN)

On June 17 Rivian Automotive reported: “Wind turbine planned for Rivian’s Normal plant to deliver vehicles charged with on-site renewables…”

On June 27 Rivian Automotive reported: “Rivian adventure network fast charging launches in Colorado, California…”

Lucid Group (LCID)

On June 15 Lucid Group reported: “Lucid announces $1.0B revolving credit facility.”

On June 21 Lucid Group reported: “Lucid Air Grand Touring Performance to make public debut during Goodwood Festival of Speed on June 23, 2022.”

On June 23 Lucid Group reported: “Lucid set to join Russell 3000® Index.”

Polestar Automotive Holding UK Limited (PSNY)

On June 7 The Driven reported:

Polestar 3 electric SUV orders to open in October, images leaked of sleek Polestar 5. Polestar says it is aiming for a 600kms range for the Polestar 3 delivered by a “large” but as yet unspecified battery and a dual-motor drivetrain.

Polestar 3 electric SUV

Source: Polestar

On June 24 Polestar reported: “The end of the beginning. As of today, June 24th, Polestar is listed on the Nasdaq in New York under the ticker PSNY.”

Tata Motors (TTM) group (Jaguar, Land Rover)

On June 6 Tata Motors reported:

Tata Motors bags an order for delivering the biggest EV fleet in India. Signs an agreement with BluSmart Electric Mobility for 10,000 XPRES T EVs.

GreenPower Motor Company Inc. [TSXV:GPV] (GP)

On June 2 GreenPower Motor Company Inc. reported: “GreenPower to take possession of West Virginia Manufacturing Facility in August 2022.”

Investors can also read my Trend Investing article on GreenPower here.

Workhorse Group Inc. (WKHS)

No news for the month.

Lion Electric (LEV)

On June 17 Lion Electric reported: “Lion Electric establishes cross-border US$125,000,000 ATM Equity Program.”

Nikola Corporation (NKLA)

On June 9 Nikola Corporation reported:

Nikola Tre BEV approved for the New York truck voucher incentive program as zero-emission vehicle. Nikola’s New York-based customers eligible for up to $185,000 incentive per truck.

Honda [TYO:7267] (HMC) (OTCPK:HNDAF)

On June 17 The Japan Times reported:

Sony and Honda agree to joint venture to sell electric cars by 2025… The car maker, which only offers one EV, Honda e, has said it plans to roll out 30 EV models and make some 2 million EVs annually by 2030. To the joint venture, first announced in March and named Sony Honda Mobility, Honda will bring its expertise in building and selling cars and Sony will add its software and technology chops, the companies said in a statement on Thursday. Each company will invest ¥5 billion ($37.52 million) in the venture.

On June 21 Honda reported:

GAC Honda begins construction of new EV production plant. Honda Motor (CHINA) Investment Co., Ltd., a wholly-owned Honda subsidiary in China, announced that GAC Honda Automobile Co., Ltd. (GAC Honda), a Honda automobile production and sales joint venture in China, began construction of its new EV plant, taking a forward step in establishing a suitable EV production system and capability in preparation for an increase in the number of EV models in its product lineup.

Near Term Potential EV Producing Companies

Faraday Future Intelligent Electric Inc. (FFIE)

On June 9 TechCrunch reported:

Faraday Future says it plans to open a Chinese factory by mid-decade. Faraday Future said Wednesday during an investor presentation that it plans to open a factory in China as early as 2025, even as it faces a shortage of capital and an SEC investigation.

On June 10 Bloomberg reported:

EV startup Faraday Future receives DOJ request amid SEC probe. Faraday Future Intelligent Electric Inc. said it has received a “preliminary request for information” from the US Department of Justice, several months after securities regulators opened an investigation of the electric-vehicle startup.

Lordstown Motors (RIDE)

No news for the month.

Arrival (ARVL)

On June 17 Arrival reported: “Enel X and Arrival partner to launch bus trials in Italy.”

On June 21 Arrival reported:

Arrival Van achieves EU certification milestone. Arrival successfully completed all the required functional and safety testing to achieve EUWVTA, which is a critical step towards starting trials with customers in the coming months. The company is expected to start production of the Van in Bicester, UK in Q3 2022.

Fisker Inc. (FSR)

On June 7 Electrek reported: “Fisker says Ocean still coming in 2022, cites Magna delivering ‘out of this world’ product.”

On June 8 Fisker Inc. reported: “Fisker surpasses 50,000 reservations for Fisker Ocean SUV and reveals additional details about its second vehicle, the Fisker PEAR.” Highlights include:

- “Reservations for the Fisker Ocean SUV surpass 50,000.

- Fisker reveals further details about its second vehicle, the Fisker PEAR.

- Fisker PEAR has over 3,200 reservations, with production expected to begin in 2024 and prototype testing slated for late 2022.”

On June 14 Reuters reported: “Fisker says it is nearing end of supply chain crisis.”

On June 15 Fisker Inc. reported: “All-electric Fisker Ocean will make its United Kingdom debut at 2022 Goodwood Festival of Speed Electric avenue.”

Note: A 2020 Reuters article quoted: “Fisker is targeting initial sales of 8,000 SUVs in 2022, 51,000 in 2023 and 175,000 in 2024.”

You can read a Trend Investing article on Fisker Inc. here, or the European reveal of Fisker Ocean video here.

Three Wheel EV Companies

Arcimoto Inc. (FUV)

On June 15 GlobeNewswire reported: “Arcimoto announces electric vehicle financing now available through FreedomRoad Financial.”

Electrameccanica Vehicles Corp. (SOLO)

No news for the month.

EV & battery ETF

- The Amplify Lithium & Battery Technology ETF (BATT) is a broad based EV related fund worth considering. It is currently a trading on a PE of 22.35. On their website they state: “BATT is a portfolio of companies generating significant revenue from the development, production and use of lithium battery technology, including: 1) battery storage solutions, 2) battery metals & materials, and 3) electric vehicles.

Other EV Or EV Related Companies

Other EV companies I am following include Envirotech Vehicles (EVTV) (formerly ADOMANI Inc., Atlis Motors, Ayro, Inc. (AYRO), Blue Bird Corporation (BLBD), Blink Charging (BLNK), Byton (private), Canoo Holdings (GOEV), China Evergrande New Energy Vehicle Group [HK:3333], Chery Automobile Co. Ltd. (private), Didi Chuxing, Dyson (private), Electric Last Mile Solutions Inc. (“ELMS”) (ELMS), Ferrari NV (RACE), Guangzhou Automobile Group Co., Hyliion Holdings (HYLN), Ideanomics Inc. (IDEX), Mahindra & Mahindra (OTC:MAHDY), Mazda (OTCPK:MZDAY), Niu Technologies (NIU), Proterra (PTRA), Qiantu Motor, Sono Group N.V (SEV), (Subaru (OTCPK:FUJHY), Suzuki Motor Corp. [TYO: 7269] (OTCPK:SZKMY) (OTCPK:SZKMF), Tata Motors (TTM) group (Jaguar, Land Rover), WM Motor, and Zhi Dou (private).

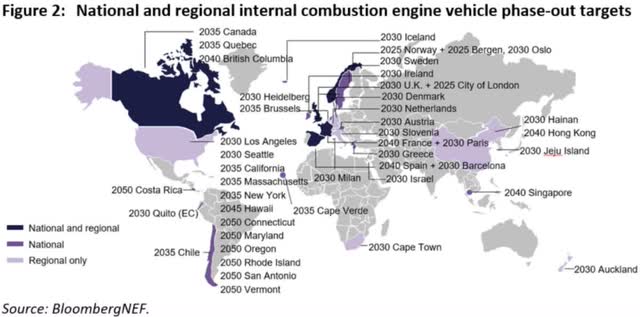

The list of countries and cities banning (or planning to ban) petrol and diesel vehicles include at least:

- Norway (2025); UK, Netherlands, Denmark, Sweden, Iceland, Greece, Ireland, Israel (2030); Scotland (2032); Hong Kong (2030-40); EU, Germany, Japan, Canada (2035); France, Spain, Egypt, Taiwan, Singapore, India, New Zealand and Poland (2040).

- Rome (2024); Athens, Paris, London, Stuttgart, Mexico City, Madrid (2025); Amsterdam, Brussels, Hainan (2030); California, New York, Quebec Province (2035); Sao Paolo, Seoul (2040).

Note: Wikipedia has an excellent list showing the phase out of fossil fuels in various cities and countries.

ICE vehicle phase out target dates

Source: Lake Resources newsletter courtesy BloombergNEF

Autonomous Driving/Connectivity/Onboard Entertainment/Ride Sharing [TaaS]/EV Leasing/Renting

On June 3 Seeking Alpha reported:

Cruise granted permit to carry paying riders in San Francisco. General Motors’ Cruise has become the “first and only company to operate a commercial, driverless ride-hail service in a major U.S. city” after inking the appropriate permits in San Francisco. The green light was granted by the California Public Utilities Commission, allowing the GM subsidiary to charge a fare for its driverless rides. Cruise’s cars are also fully electric and battery-powered, a big win for reducing emissions in the climate conscious San Francisco.

On June 9 Asia Financial reported:

Baidu and Geely’s JV Jidu unwraps first robot car. The car, which doesn’t have door handles and can be controlled by voice recognition, was launched at an online press conference held on Baidu’s metaverse-themed app Xirang.

On June 23 Electrek reported: “Einride gets NHTSA approval to operate its autonomous electric trucks on US roads.”

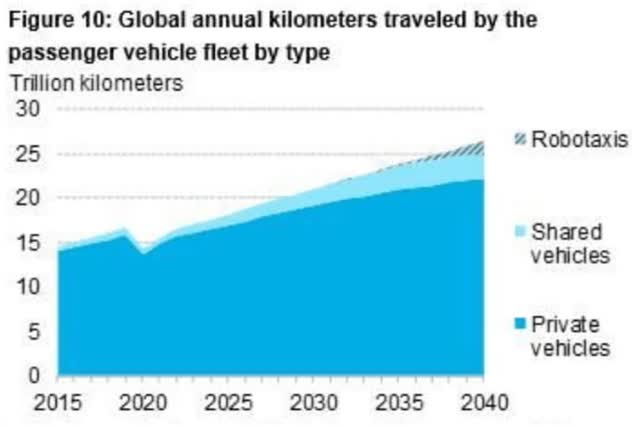

BNEF 2020 forecasts by fleet type

Source: BloombergNEF 2020 EV report

Conclusion

May 2022 global electric car sales were up 55% YoY and reached 12% global market share; 31% share in China, 19% in Europe, and a record 6.1% for the USA.

Highlights for the month were:

- BloombergNEF: EV sales will triple by 2025. Plug-in passenger vehicle sales will soar to 20.6 million in 2025. BloombergNEF forecasts ~40.4% market share in 2030 and 75.3% in 2040.

- EVs grab 6% of US car market in May as Tesla dominates with 70% share of sales.

- European Parliament votes to ban combustion engine cars from 2035.

- Walmart expands transportation partnerships with electric, hydrogen vehicle pilots.

- Biden-Harris administration takes key step forward in building a national network of user-friendly, reliable, and accessible electric vehicle chargers.

- Lightyear 0 production solar car could run for months without charging.

- BYD says shift to electric vehicles moving “much faster” than expected.

- UK ends subsidies for electric cars on surging demand.

- Ferrari sees profit jump as Italian carmaker goes electric.

- VW U.S. chief warns of industry challenges with EV battery shift.

- There has been almost a 10-fold increase in U.S electric school bus orders since WRI began tracking adoption in August 2021.

- Citi foresees NEV penetration in China to leap to 60% by 2025 and 90% by 2030 from an estimated 29% in 2022.

- AlixPartners forecasts EVs could take 33% of global sales by 2028 and 54% by 2035.

- EU nations approve end to combustion engine sales by 2035.

- BYD has now sold 70,000 electric buses in 70 countries (mostly China) and more than 400 cities. BYD’s electric car sales soar with several record months above 100,000. BYD set to supply batteries to Tesla.

- Tesla’s May China production roars back with output tripling, still 50% below normal operations. Tesla is the most preferable brand for prospective BEV buyers. Tesla files to split shares 3-for-1. Tesla tops the list of most satisfied customers in the entire auto industry. Tesla Model Y = 1 out of every 3 new EVs registered in US in 2022. Cybertruck design is ‘finally locked’ and gets an updated timeline to production for mid-2023. Shanghai upgrade to get closer to its goal of producing 22,000 cars per week.

- SAIC-GM-Wuling Air EV has global debut in Indonesia.

- Volkswagen’s first fully-electric sedan: World premiere of the ID. AERO.

- Hyundai to establish its first dedicated EV plant and battery manufacturing facility in the U.S. with an investment of approximately $5.54b. Production to begin 1H 2025 with an annual capacity of 300,000 units. Hyundai unveils design of all-electric IONIQ 6.

- Baidu and Geely’s JV Jidu unwraps first robot car.

- BMW is testing iX electric SUV with 600 miles of range thanks to new battery chemistry. BMW starts production at new $2.2 billion China plant to ramp up EV output.

- Mercedes supports the 2035 EU ICE ban.

- Ford recalls 48,924 Mustang Mach-Es in setback for EV Plans.

- Li Auto Inc. unveils Li L9, its flagship Smart SUV, takes in over 30,000 Li L9 orders.

- NIO launched smart electric mid-large SUV ES7.

- Toyota recalls first mass-produced EVs less than 2 months after launch.

- Sony and Honda agree to joint venture to sell electric cars by 2025.

- GM Buick commits to all-electric portfolio by end of decade.

- Toyota recalls first mass-produced EVs less than 2 months after launch.

- Polestar 3 electric SUV orders to open in October. Polestar lists on the NASDAQ under ticker ‘PSNY’.

- Nikola Tre BEV approved for the New York truck voucher incentive program as zero-emission vehicle.

- Sony and Honda agree to joint venture to sell electric cars by 2025.

- Faraday Future says it plans to open a Chinese factory by mid-decade.

- Fisker surpasses 50,000 reservations for Fisker Ocean SUV and reveals additional details about its second vehicle, the Fisker PEAR.

- GM’s Cruise has become the “first and only company to operate a commercial, driverless ride-hail service in a major U.S. city.

- Baidu and Geely’s JV Jidu unwraps first robot car.

As usual, all comments are welcome.

Be the first to comment