ugurhan

NEW YORK (July 21) – The European Central Bank (ECB) governing council’s decision to raise rates by 50 bps this morning came as somewhat of a surprise for two reasons: First, it diverted from the ECB’s forward guidance. Second, it came when most analysts anticipate a recession and downturn in Europe. The higher rates are just one more issue that trouble the economy of the European Union (EU). EU inflation ran at 9.6% year-over-year in June, while inflation in the Eurozone (a/k/a the “Euroarea”), those countries in the EU that use the euro as currency, was 8.6%.

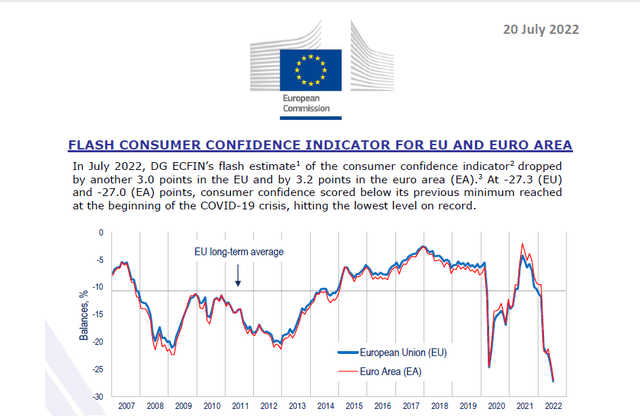

Consumer confidence in the Euro printed at the lowest level on record.

European Consumer Confidence (European Commission)

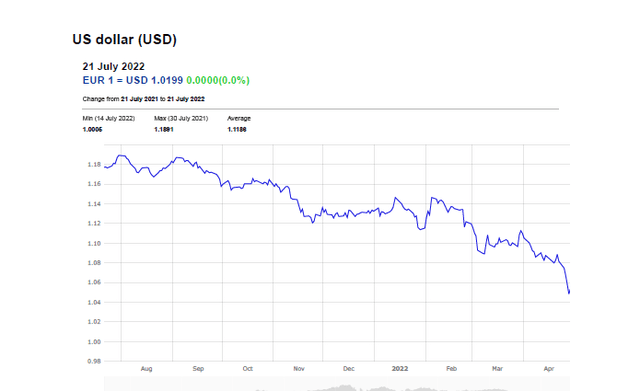

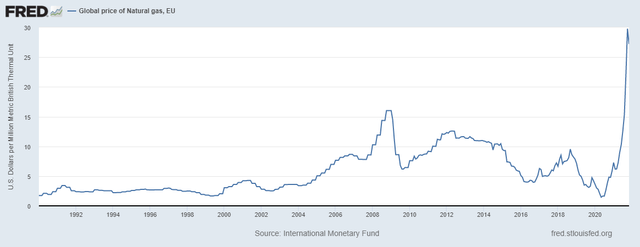

At the same time, natural gas prices in Europe have spiked, largely because of Russia’s retaliatory sanctions for the West’s sanctions over Ukraine, but also the because the electrical grid (powered in many instances by natural gas) is under enormous pressure from the European heat wave. All of this is amidst a soaring dollar (or, as someone once said of a relatively strong US economy in an overall weak global economy, the currency of “The Tallest Pygmy.”)

The EUR/USD currency pairs are particularly stressed, as seen in this chart from the ECB:

EUR:USD Currency Pair 7/2121 to 7/21/22 (European Central Bank)

What This Means for the USA

Perhaps the biggest effect for the USA will come from the currency pairs of the GBP/USD and EUR/USD. As US multinationals with large European operations like McDonald’s (MCD), Walmart (WMT), Pfizer (PFE) translate earnings back to USD, the year-on-year quarterly earnings comparables will obviously be stressed by the decline in the EUR. (The GBP has similarly declined, year-on-year.) While multinationals typically hedge their earnings, they only rarely completely hedge 100%.

Also stressed will be the US export market, with companies like Boeing (BA) and Caterpillar (CAT) facing a more challenging pricing environment vis-à-vis European competitors like Airbus SE (OTCPK:EADSY) as well as various Japanese and Indian heavy equipment sellers.

An Opportunity in Peace?

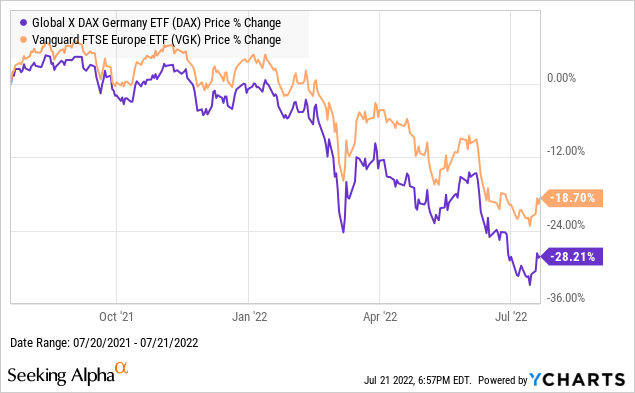

Two of the leading European market indexes, shown above, have fallen precipitously since Russia’s invasion of Ukraine in February. The Ukraine War is one of the leading pressures on the European markets at present. Russia’s President Putin clearly seems to be using his natural gas supplies to retaliate against the sanctions the EU imposed on Russia after its February invasion, sending prices for European natural gas soaring, as illustrated here:

European Natural Gas Prices (FRED)

The International Monetary Fund projected that:

[a]lternative sources could replace up to 70 percent of Russian gas, allowing Europe to avoid shortages during a temporary disruption of around 6 months. However, a longer full shut-off of Russian gas to the whole of Europe would likely interact with infrastructure bottlenecks to produce very high prices and significant shortages in some countries…With natural gas an important input in production, the capacity of the economy would shrink.

In other words, Europe can “Stand with Ukraine” for a limited time, but it’s not clear what happens after that. We are all troubled by the war and by humongous cost in blood and treasure that has been forced on Ukraine. But it has become a war of attrition which Ukraine has little chance of winning and which Russia will clearly not abandon. Neither side of the war has a clear strategy to achieve its goals or the means to achieve its war objectives and neither European nor American leaders have defined the war aims or the means to achieve them. In this war, there is no presentation to the media, “First, we’re going to cut it off, and then we’re going to kill it,” as Colin Powell made at the start of the Gulf War.

An article in Foreign Affairs earlier this month suggested the broad outlines of a peace settlement. As I wrote at length elsewhere, I believe that a peace, however achieved, would benefit all parties, including Russia, even if it meant appeasing Putin and even if that appeasement meant surrendering the entirety of Ukraine to Russian dominance. (I am of the view that Putin would not risk direct engagement with NATO and can be contained. Nor do I believe that Putin would attempt the kind of ethnic cleansing that was Holodomor; not with NATO forces over the border in Poland.) For now, it also seems clear that European support for continuing the war is eroding. Only 24% of Germans believe Ukraine can drive Russia from the Donbas. About 42% of Germans oppose giving Ukraine heavy weapons. It’s no surprise, then, that German Chancellor Olaf Scholz is reportedly reneging on his promise of additional Ukraine aid. Similarly, the Italians, who have traditionally had close ties to Russia, also seem to be readily influenced to step away from the war. Premier Mario Draghi, who had supported Ukrainian President Zelensky, resigned today and snap elections have been called. His resignation came after Draghi lost the support of a handful of center-right and populist parties, all with ties to Russia.

Shortly after Draghi’s resignation, Gazprom – the Russian natural gas distributor – announced it would increase gas distribution to Italy. (Correlation is not necessarily causal. Nord Stream 1 came back on line today, too.)

Draghi, who led Europe’s third largest economy, was the preeminent supporter of Ukraine in Europe. His counterpart in the UK, Boris Johnson, resigned earlier. So, for the time being, there is no European national leader to rally the other members of the EU in support of Ukraine’s war aims.

Anyone who has read Clausewitz knows that warfare, even as a non-belligerent ally, depends on morale. Once you have defeated the enemy’s will to fight, you have defeated the enemy. (See, for example the American experiences in Vietnam and Afghanistan, as well as Russia’s there.)

While there is little doubt that Ukraine’s leaders are willing to stand and fight Russia, the willingness of Europe and the UK to do so seems questionable. There is also a question about the United States’ popular support for Ukraine’s ability to push Russia out of its territory.

Investment Thesis

In Europe, there does not seem to be strong support for escalating the Ukraine War. NATO countries have coalesced more closely, and Norway and Sweden have signaled they will join alliance, but that is largely in their own defense more than in sympathy for Ukraine’s woes.

Just how long can EU and NATO’s European members suffer the economic consequences of the war – and how long will they risk a war themselves – in support of a nebulous notion of “freedom” for a country other than their own? I don’t believe for long.

But I think Russia may be at similar loggerheads.

Sergey Lavrov, the Russian Foreign Minister, said this morning that Russia was revising its war aims and would continue to do so so long as the United States kept arming Ukraine.

While, at first impression, that seems belligerent, on closer consideration it actually sounds more like an oblique opening position of a man who wants to negotiate (i.e., “If you agree to stop sending weapons, we will agree to freeze our position where we are.”)

I think that a third party mediator – the UN Secretary General, the Papal Nuncio, or some other substantive and respected figure – could successfully call for an armistice and peace talks. Properly constructed, those talks could bring about a lasting peace.

Investors willing to get into European equities now could benefit tremendously if that scenario were to play out. Investing now, and substantially, into a high quality European ETF or select European stocks carries the possibility of high returns, albeit obviously with commensurate risk. We believe there is a 7-in-10 chance the war will be resolved by the end of September and that investors positioning now could realize substantive gains by the autumn of 2023. It might also help avoid the recession that we are predicting will be called in the first or second quarter of 2023.

Be the first to comment