robertprzybysz/iStock via Getty Images

A Quick Take On European Wax Center

European Wax Center, Inc. (NASDAQ:EWCZ) went public in May 2021, raising approximately $97 million in gross proceeds from an IPO that was priced at $21.50 per share.

The firm operates a mostly franchised network of waxing service providers in 44 states in the United States.

Management appears to be executing well in a challenging economic environment, but I’m pessimistic on the U.S. economy through the next twelve months and am concerned this economic softness or recession will slow same-store sales results.

This macroeconomic concern combined with a potentially fully valued stock price means that I’m on Hold for EWCZ in the near term.

European Wax Center Overview

Plano, Texas-based EWC was founded to develop a franchised and corporate-owned network of waxing services by licensed estheticians in the U.S.

Management is headed by Chief Executive Officer, David Berg, who has been with the firm since October 2018 and was previously CEO of the Carlson Hospitality Group (global hotel business).

The firm seeks business relationships with franchise owners and assists them in various aspects of site selection, financing and store construction.

Management says the company is the largest franchisor of out-of-the-home waxing service locations in the U.S.

European Wax Center’s Market & Competition

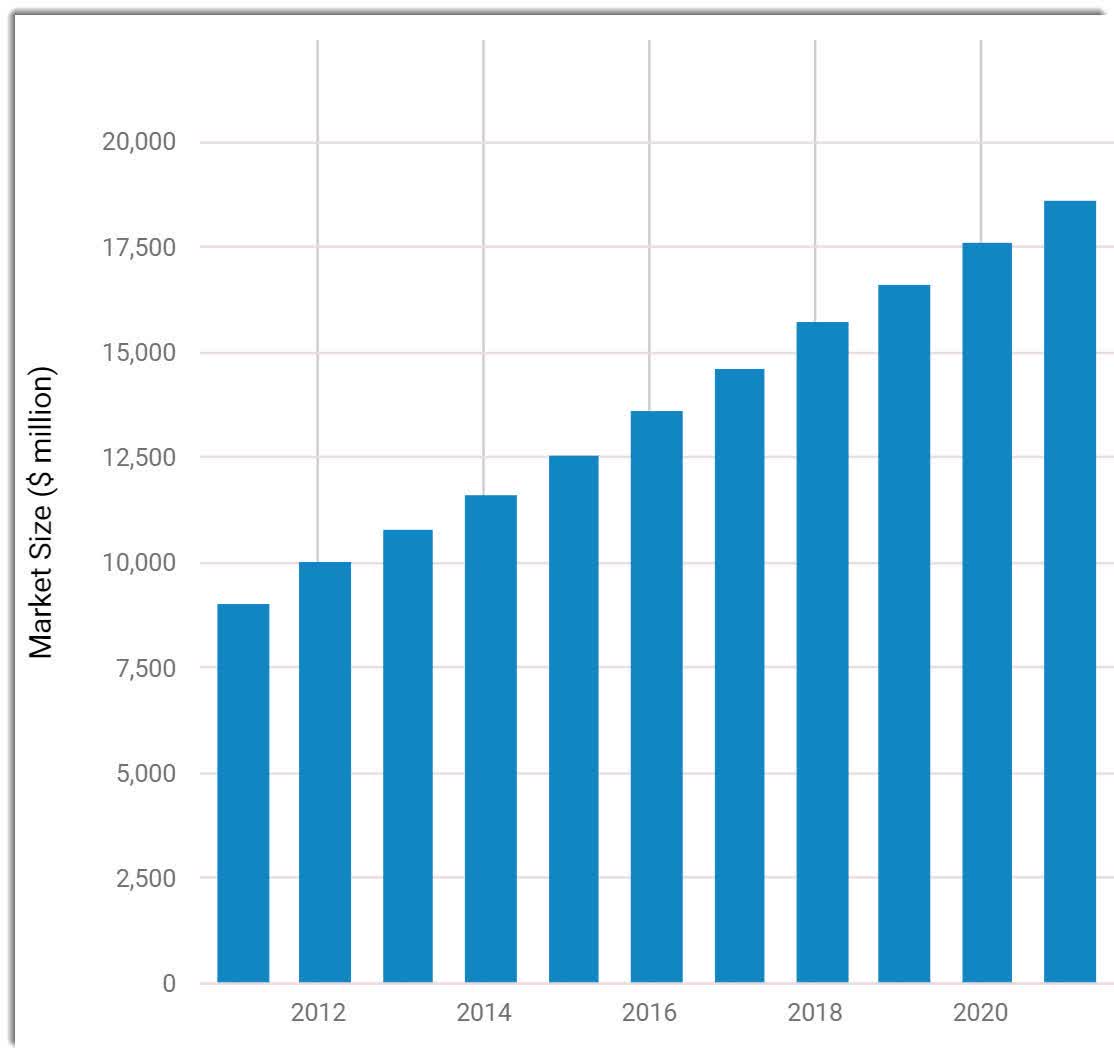

According to a 2020 market research report by IBISWorld, the U.S. personal waxing and nail salon market is an estimated $18.7 billion market.

The estimated average annual growth rate of the market from 2016 to 2021 was 6.4%.

The market is expected to grow by 5.8% in 2021.

The main drivers for this expected growth are available consumer discretionary spending on personal care services and products after a market slowdown in 2020 due to the COVID-19 pandemic.

Also, below is a historical and current year chart showing the industry growth in recent years:

U.S. Personal Waxing & Nail Salon Market (IBISWorld)

The waxing services market is highly fragmented, with at least 10,000 independent waxing operators and nearly 100,000 beauty salons that include waxing services in their offerings.

European Wax Center’s Recent Financial Performance

-

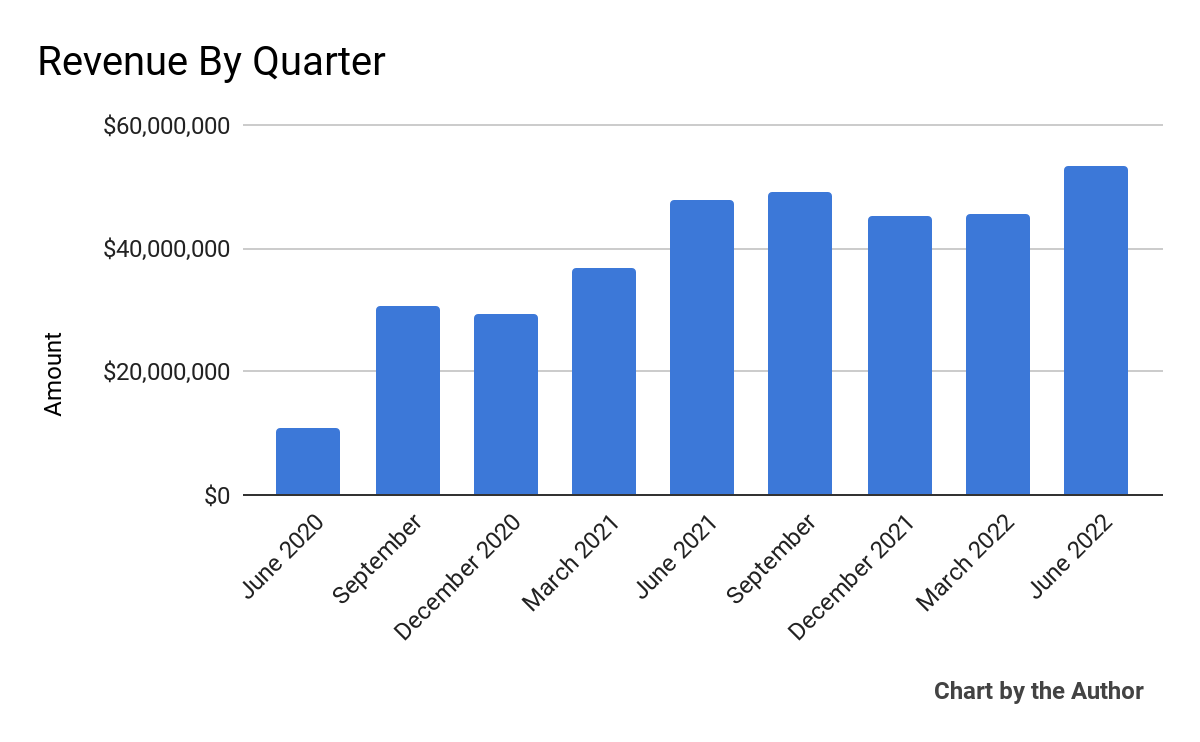

Total revenue by quarter has risen per the following chart:

Total Revenue History (Seeking Alpha)

-

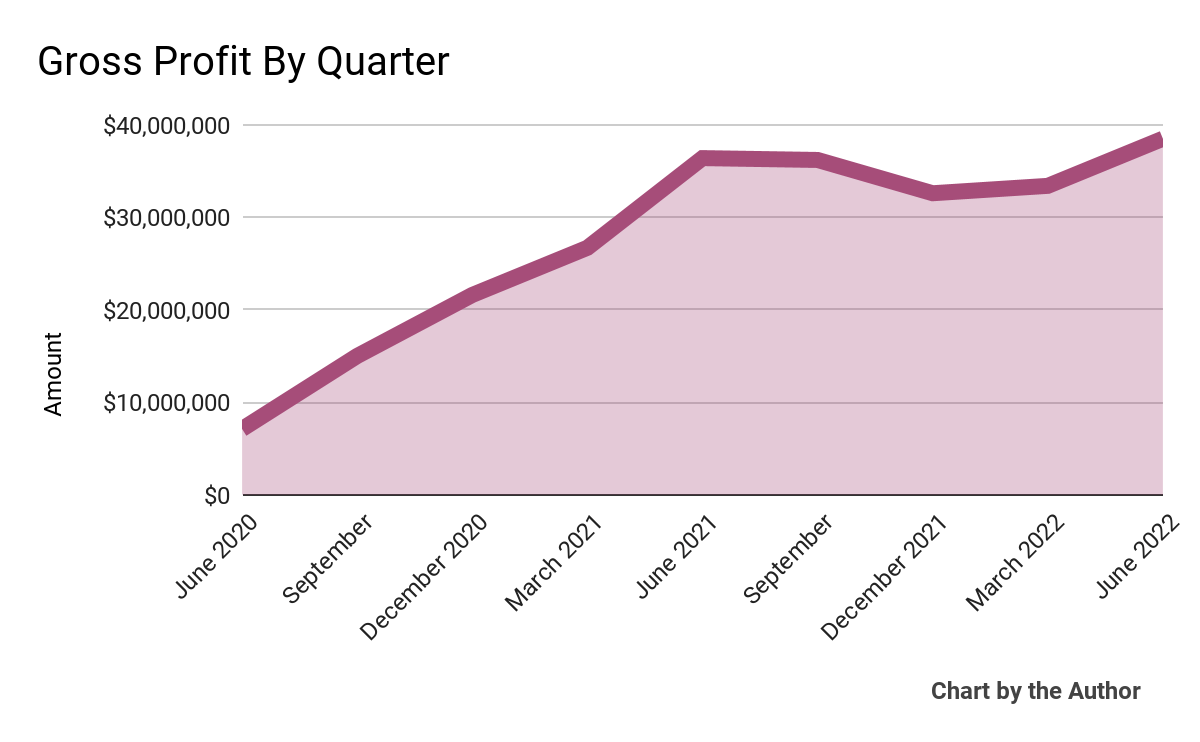

Gross profit by quarter has followed a similar path as that of total revenue:

Gross Profit History (Seeking Alpha)

-

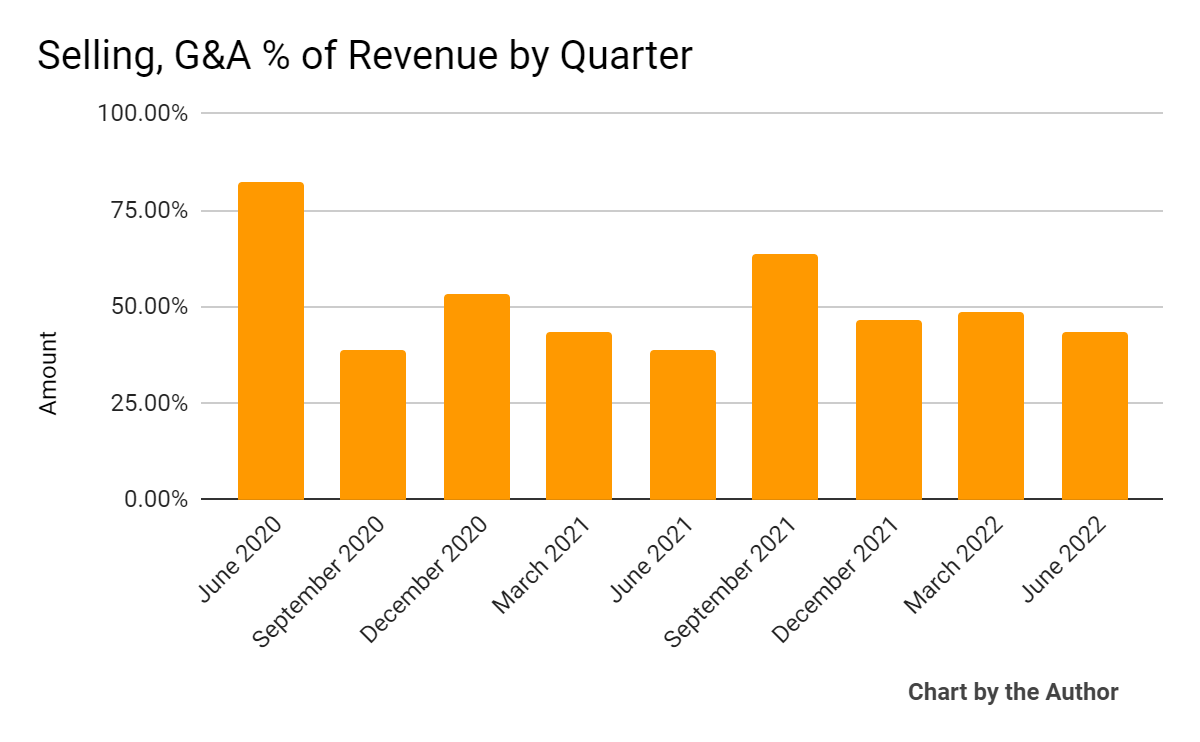

Selling, G&A expenses as a percentage of total revenue by quarter have produced the result shown below:

Selling, G&A % Of Revenue History (Seeking Alpha)

-

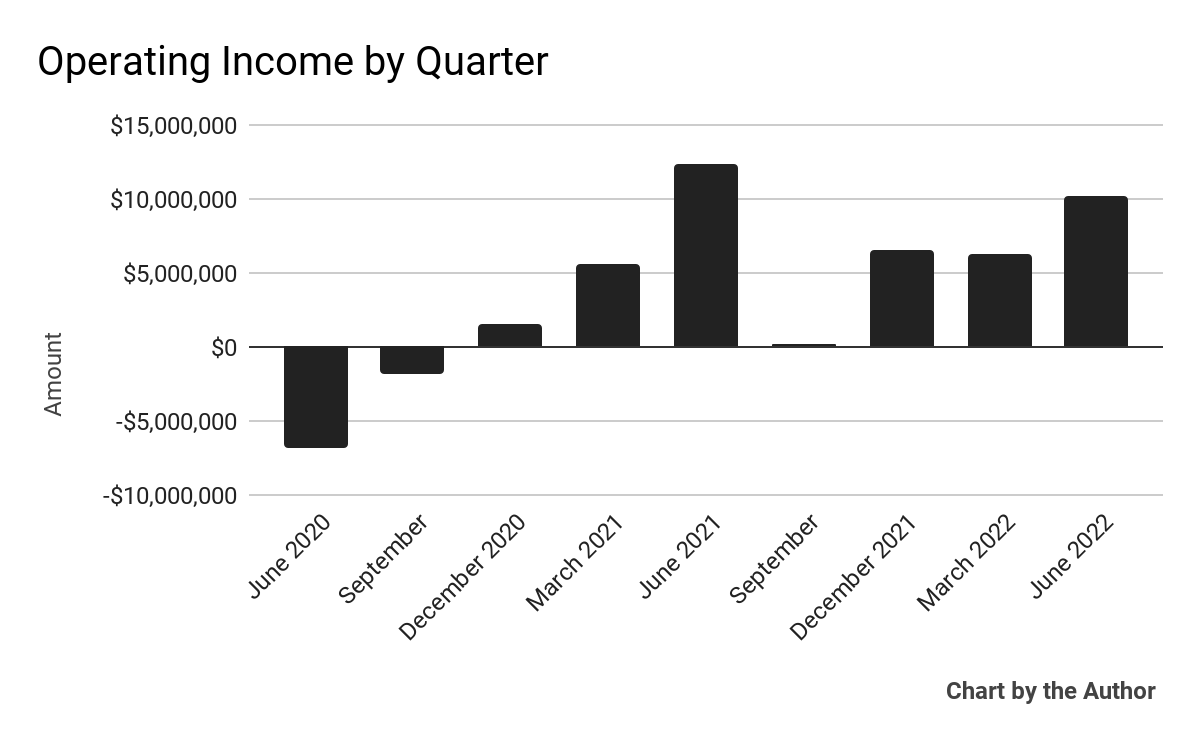

Operating income by quarter has trended higher recently:

Operating Income History (Seeking Alpha)

-

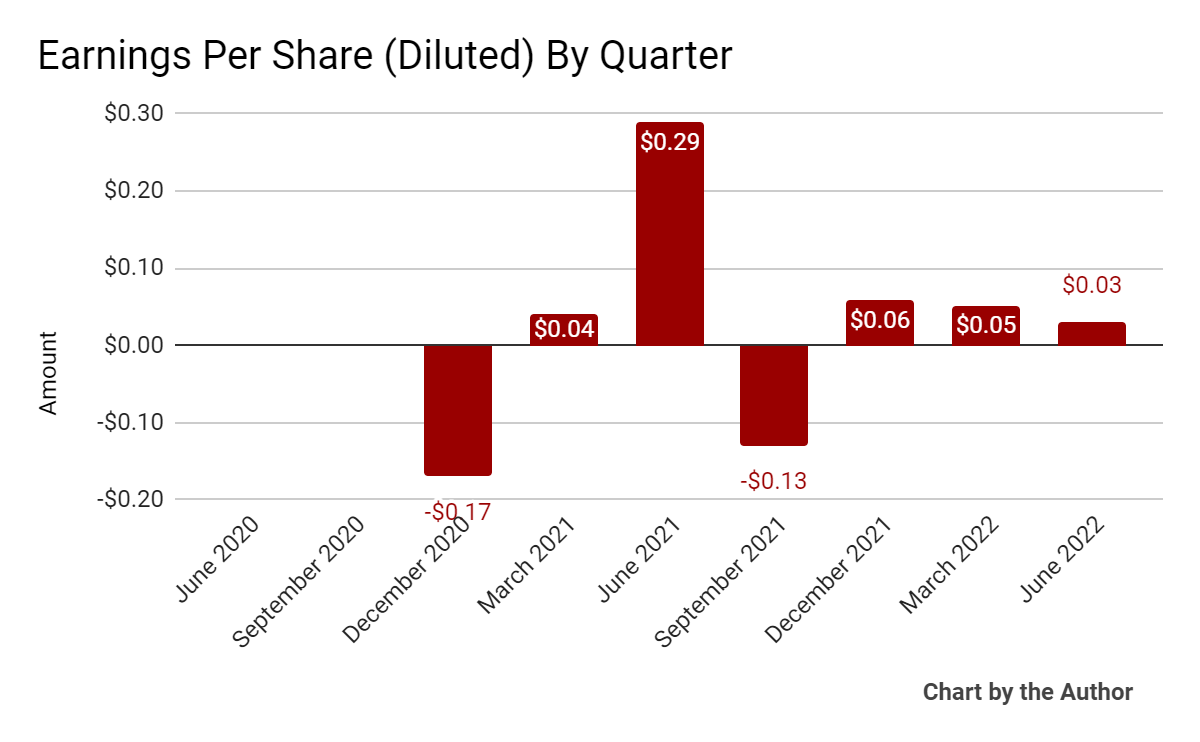

Earnings per share (Diluted) have varied materially:

Earnings Per Share History (Seeking Alpha)

(All data in above charts is GAAP.)

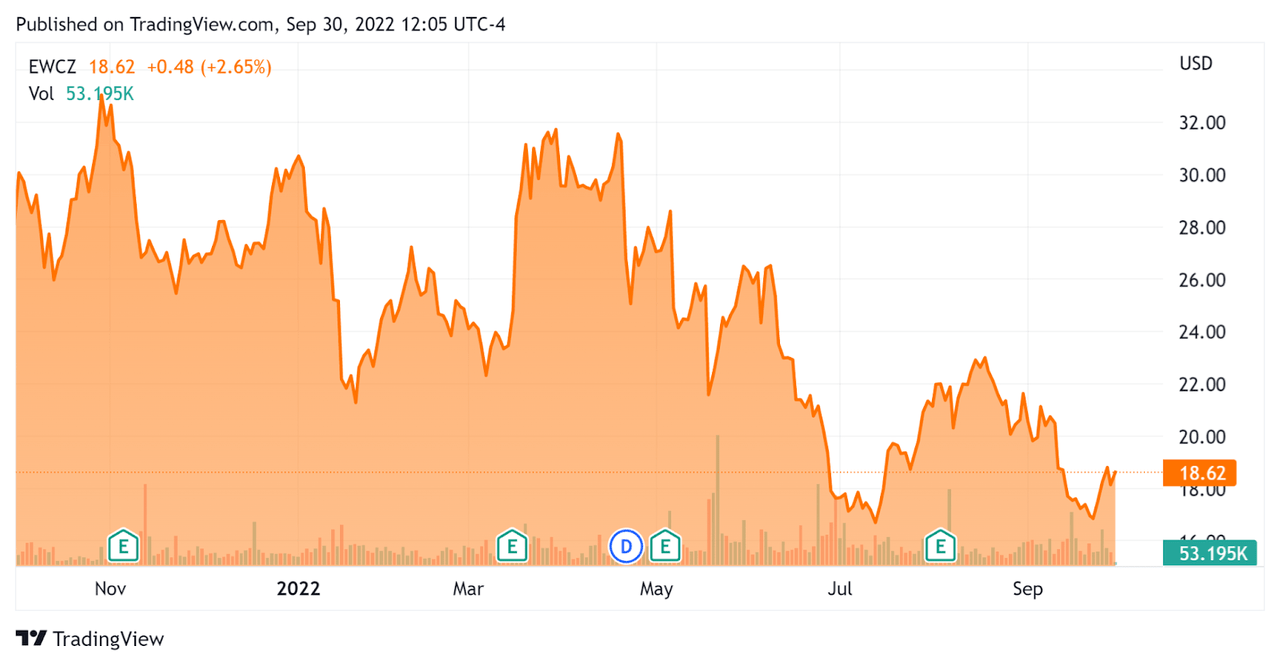

In the past 12 months, EWCZ’s stock price has fallen 25.7% vs. the U.S. S&P 500 Index’s drop of around 16.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For European Wax Center

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

6.03 |

|

Revenue Growth Rate |

33.7% |

|

Net Income Margin |

0.5% |

|

GAAP EBITDA % |

22.4% |

|

Market Capitalization |

$1,190,000,000 |

|

Enterprise Value |

$1,160,000,000 |

|

Operating Cash Flow |

$51,090,000 |

|

Earnings Per Share (Fully Diluted) |

$0.01 |

(Source – Seeking Alpha)

Commentary On European Wax Center

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its resilient business model due to its high-earning customer demographic, which may be less affected by recent inflation.

Secondly, the firm is seeing growth in its Wax Pass offering, which allows customers to pre-pay for a set of services and receive a discount for doing so.

Also, due to the recurring nature of the firm’s services, it becomes part of customer personal beauty care routines.

As to its financial results, same-store sales grew by 6.7% and the company opened 19 new centers, finishing the quarter with a total of 893.

However, management has begun to see an increase in the average time between visits, indicating customers are slowing their visit cadence, likely due to inflation or economic pressures.

Also, costs have begun to increase on its proprietary product line, which accounts for 6% of total sales, although management has begun pushing through price increases.

Adjusted EBITDA dropped partially due to an annual marketing shift into the second quarter. Earnings also dropped sequentially.

For the balance sheet, the firm finished the quarter with $42.1 million in cash and restricted cash and $400 million in debt, which management recently refinanced to a fixed rate structure.

Over the trailing twelve months, free cash flow was an impressive $50.8 million.

Looking ahead, management increased its expected new center openings for fiscal 2022 from 83 to 85 and reiterated its previous full year outlook.

Regarding valuation, the market is valuing EWCZ at an EV/Revenue multiple of around 6x, which is not unreasonable for a company growing at a trailing twelve rate of nearly 34%.

A potential risk to the company’s outlook is a reduction in franchise growth due to financing constraints as the cost of capital has increased. If these increases continue, it could crimp the ability of franchise operators to obtain capital needed to launch new stores.

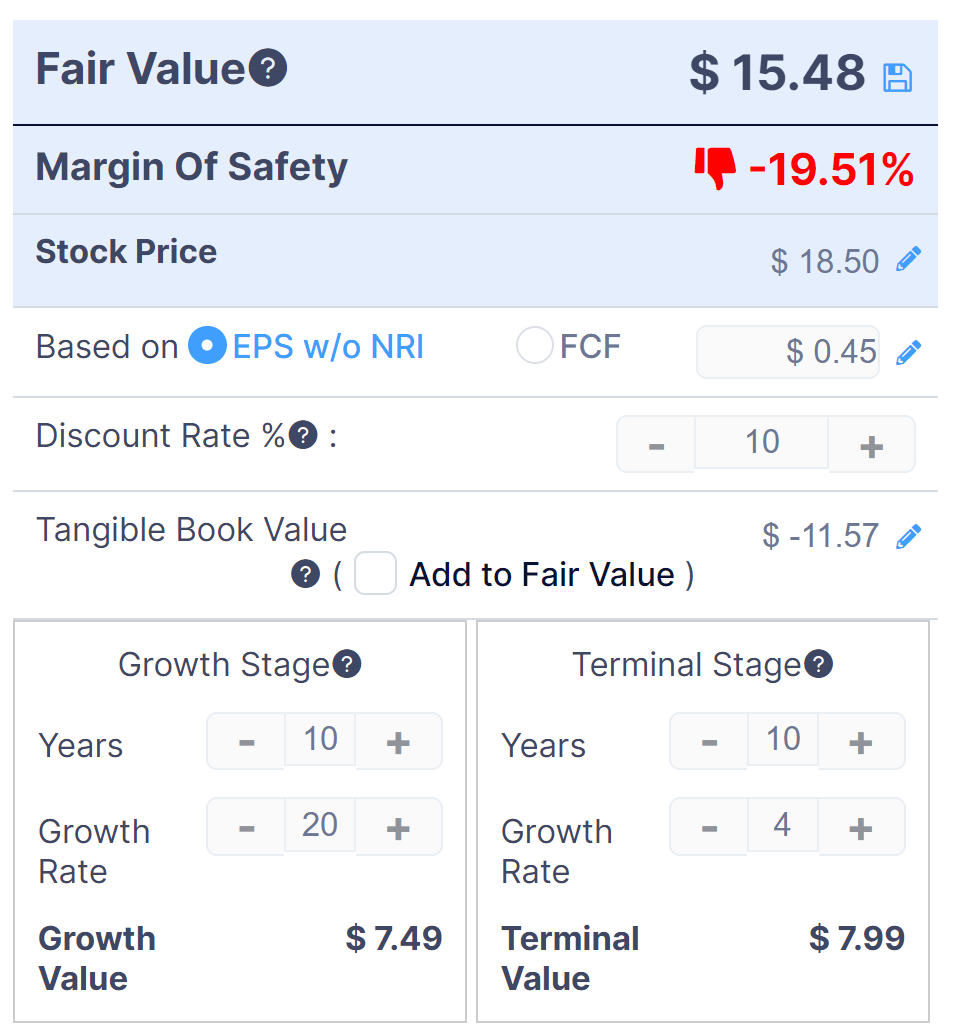

Also, a discounted cash flow analysis of EWCZ with generous growth assumptions is shown here:

EWCZ – Discounted Cash Flow (GuruFocus)

Even with strong growth assumptions, the discounted cash flow (“DCF”) shows the stock is more than fully valued at its current level.

While management appears to be executing well in a challenging economic environment, I’m pessimistic on the U.S. economy through the next twelve months and am concerned this economic softness or recession will slow same-store sales results.

This macroeconomic concern combined with a potentially fully valued stock price means that I’m Neutral on EWCZ in the near term.

Be the first to comment