EUR/USD TALKING POINTS

- U.S. 10-year Treasury yield looks to test 3%.

- U.S. jobs data in focus.

- IG client sentiment points to short-term hesitancy.

EURO FUNDAMENTAL BACKDROP

The euro opened slightly firmer this morning against the U.S. dollar after yesterday’s surge in U.S. Treasury yields. The 10-year is remains elevated just shy of the 3% level (see chart below). Thus far, U.S. economic data has been strong which has given markets more confidence around the hiking cycle. This is in complete contrast to last week’s notion of an overexuberant Federal Reserve.

Source: Refinitiv

The eurozone continues to have the Russian oil embargo held over its head with regard to the potential for Russia to retaliate by potentially cutting off gas from the region, exacerbating an already bad inflation situation and leaving the euro vulnerable to further downside.

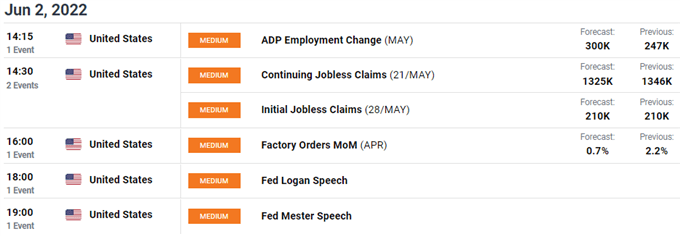

At the end of the day, the battle between the two regions (U.S. and eurozone) favors the U.S. (dollar) under current circumstances but upcoming U.S. jobs data could set the tone as we close off the week. Later today, U.S. employment via the ADP and jobless claims releases will serve as a precursor (although contentious) to tomorrow’s NFP print.

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

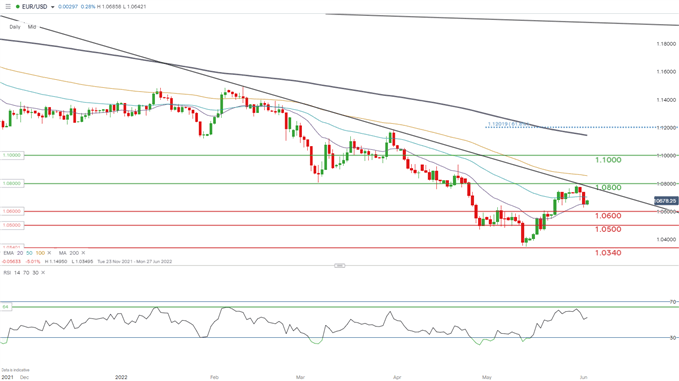

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

EUR/USD price action found support at the 20-day EMA (purple), leaving the euro bid this morning. The rest of the day is unlikely to produce significant market moves leading up to the U.S. jobs and Fed speeches respectively, while markets await tomorrow’s NFP. This being said, my bias remains skewed to the downside towards the key 1.0500 support zone.

Resistance levels:

Support levels:

- 20-day EMA (purple)

- 1.0600

- 1.0500

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on EUR/USD, with 61% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, recent changes in long and short positioning result in a mixed disposition.

Contact and follow Warren on Twitter: @WVenketas

Be the first to comment