Euro Price, News, and Analysis:

- Multi-week support breaks, opening the way for lower prices.

- Retail trader data shows customers buying EUR/USD

Discover what kind of forex trader you are

For all market-moving economic data and events, see the DailyFX Calendar.

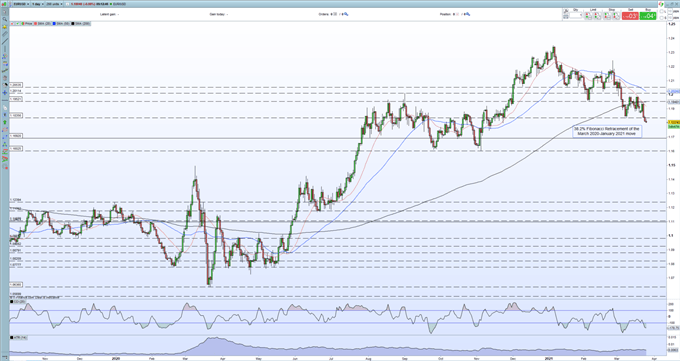

EUR/USD continues its slow move lower and after breaking multi-week support at 1.1836, the pair look set to trade sub-1.1800 in the near future. Any rebound back to the old support level may be an opportunity to position for lower prices.

The European Council starts a two-day meeting today with the EU vaccination program the main topic of conversation. The EU has struggled to date to get their vaccination program fully operational and they lag both the US and UK by a considerable margin. This is causing friction in Brussels with the EU saying recently that they have the power to prevent any vaccines from leaving the EU if their own quotas have not been met. That the EU was behind the UK and US in ordering the vaccines, and it seems has a weaker legal contract, has not stopped the EU’s heavy-handed action.

The daily EUR/USD chart highlights the ongoing weakness of the pair with little in the way of support until Fibonacci retracement support at 1.1692 heaves into view. The chart is showing a series of lower lows off the January 6 high, while the break and open below the 200-day simple moving average adds to the negative outlook. Retail traders have also been buying EUR/USD over the last week (see below) a negative contrarian signal.

EUR/USD Daily Price Chart (October 2019 – March 25, 2021)

| Change in | Longs | Shorts | OI |

| Daily | 2% | 7% | 4% |

| Weekly | 25% | -1% | 11% |

IG Retail trader data show 54.00% of traders are net-long with the ratio of traders long to short at 1.17 to 1. The number of traders net-long is 2.86% lower than yesterday and 32.36% higher from last week, while the number of traders net-short is 9.63% higher than yesterday and 11.13% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment