Eurozone CPI Talking Points:

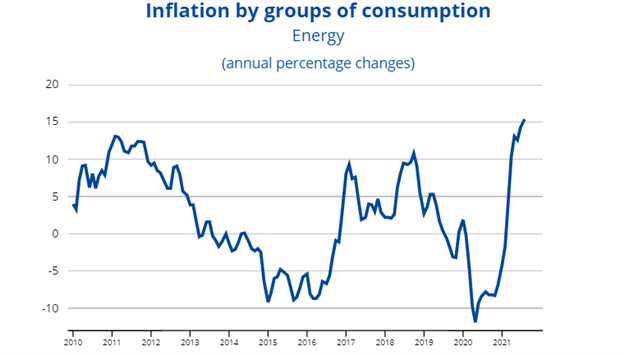

- Eurozone inflation highlights concerns over the energy sector

- Eurozone CPI in line with expectations while the inflation rate (YoY) edges higher

- EUR/USD remains under pressure as sentiment dampens

Eurozone Core Inflation Rate (YoY) for the Eurozone came in at 1.9%, with the inflation rate (YoY) rising to 3.4%

Visit the DailyFX Educational Center to discover how CPI data affects currency pairs

DailyFX Economic Calendar

With rising energy prices and supply shortages weighing heavily on sentiment, policymakers continue to face pressure to tackle the surge in prices that is expected to reduce the purchasing power of consumers.

Following on from last month’s ECB meeting, the European Central Bank (ECB) has suggested that a reduction in the Pandemic Emergency Purchase Program (PEPP) may be expected in the foreseeable future. As the ECB prepares for the next meeting on 6 October 2021, focus on rising energy prices is likely to remain a key focal point for both consumers and investors alike.

As Europe prepares for winter, supply constraints in the oil and gas industry combined with rising commodity prices continue to dampen sentiment, impacting consumer spending despite low interest rates.

Source: ECB Eurostats

EUR/USD Unfazed by CPI data

Following the release of the data, EUR/USD price action continued to trade within a well-defined range, showing little reaction to the economic data.

Over the next few weeks, price action will likely remain closely linked to the actions undertaken by both the Federal reserve and the European Central Bank in the fight against inflation.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

Be the first to comment