EUR/USD Analysis

ECB REMAINS ACCOMODATIVE AND KICKS CAN DOWN THE ROAD TO DECEMBER MEETING

The European Central Bank (ECB) expectedly kept rates at 0% as forecasted, keeping the current outlook consistent from the previous meeting. The December meeting will now be the likely placeholder set to give markets guidance around stimulus. The ECB is being slowly divided between hawkish and dovish camps as the transitory outlook on inflation is being challenged.

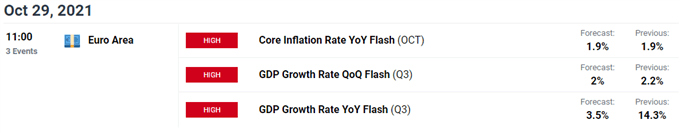

Source: DailyFX Economic Calendar

EURO FUNDAMENTAL BACKDROP

The ECB has been far more dovish relative to the Federal Reserve this year and has reflected in a downward Euro trajectory since May 2021. Tomorrow seesEU inflation data and GDP ( see economic calendar below) being the focus which could add further tightening pressure on the ECB should actual inflation data come in above expectations. High European energy prices may push the print higher than estimates suggest which could add to the a bullish bias on the EUR/USD pair.

Source: DailyFX Economic Calendar

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

After the rectangle breakout (blue) in late September, EUR/USD has found support at 1.1524 which is likely to be retested leading up to December’s meeting particularly if the Fed announces more specifics around QE tapering before then. Post-announcement today price action reflected the fundamentals and ticked marginally lower giving bulls a probable target at the 1.1524 swing low.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT DATA POINTS TO A MIXED SHORT-TERM OUTLOOK

IGCS shows retail traders are currently prominently long on EUR/USD, with 54% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment, and the fact traders are net-long is suggestive of a sustained bearish outlook however, with a higher net change in short positions relative to long positions by retail traders, the outlook is of a neutral bias.

— Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas

Be the first to comment