EUR/USD Rate Talking Points

EUR/USD trades to a fresh monthly low (1.1752) as it extends the series of lower highs and lows from the start of the week, and the European Central Bank (ECB) interest rate decision may keep the exchange rate under pressure if the Governing Council retains the current course for monetary policy.

EUR/USD Outlook Hinges on ECB Guidance Following Strategy Review

EUR/USD continues to approach the March low (1.1704) on the back of US Dollar strength, and the Euro may continue to depreciate against the Greenback as the ECB is widely expected to keep the main refinance rate, the benchmark for borrowing costs, at zero.

As a result, market participants are likely to pay increased attention to the forward guidance following the ECB Strategy Review as the Governing Council plans to achieve a symmetric 2% inflation target over the medium term, and the central bank may signal a looming shift in monetary policy as President Christine Lagarde pledges to “redefine our forward guidance to align it with the strategy review.”

The recent remarks from President Lagarde suggest the ECB is on track to shift gears as the June 2021 Eurosystem staff macroeconomic projections showed an upward revision in the inflation outlook for 2021 and 2022, and a material change in the forward guidance for monetary policy may spark a bullish reaction in EUR/USD if the central bank lays out a tentative exit strategy.

However, more of the same from the ECB may drag on the Euro if the Governing Council continues to expect “net purchases under the PEPP (pandemic emergency purchase programme) over the coming quarter to continue to be conducted at a significantly higher pace than during the first months of the year,” and a further decline in EUR/USD may continue to fuel the shift in retail sentiment to largely mimic the behavior from earlier this year.

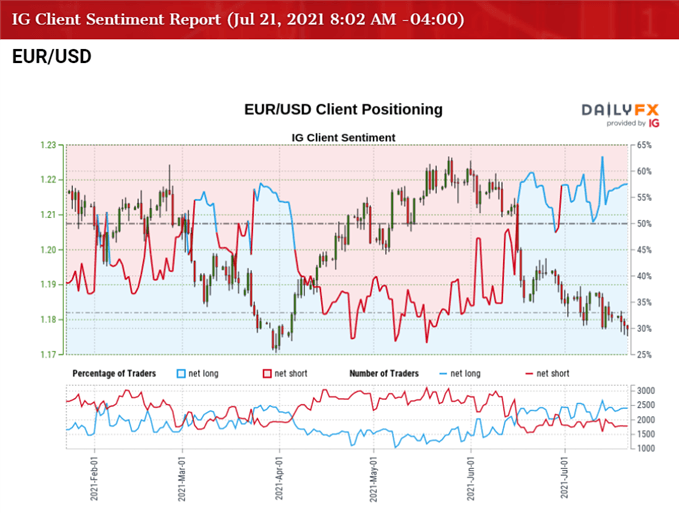

The IG Client Sentiment report shows 58.06% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 1.38 to 1.

The number of traders net-long is 3.08% higher than yesterday and 10.66% lower from last week, while the number of traders net-short is 2.00% lower than yesterday and 5.72% higher from last week. The decline in net-long position comes as EUR/USD trades to a fresh monthly low (1.1752), while the rise in net-short interest has done little to alleviate the crowding behavior as 53.08% of traders were net-long the pair last week.

With that said, the yearly low (1.1704) may continue to unravel if the ECB retains the current course for monetary policy, and a move below 30 in the Relative Strength Index (RSI) is likely to be accompanied by a further decline in EUR/USD like the price action from earlier this month.

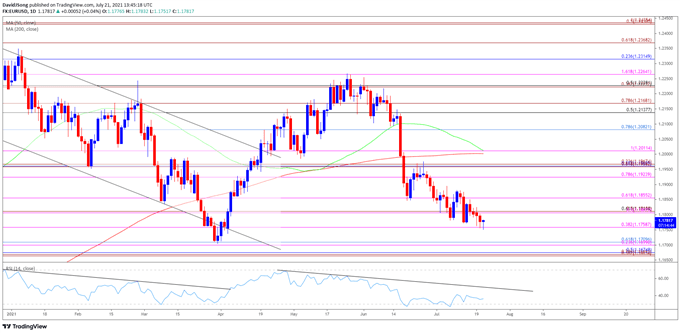

EUR/USD Rate Daily Chart

Source: Trading View

- EUR/USD trades below the 200-Day SMA (1.2002) for the first time since April as the advance from the March low (1.1704) failed to produce a test of the January high (1.2350), with the Relative Strength Index (RSI) still tracking the downward trend from earlier this year.

- A move below 30 in the RSI is likely to be accompanied by a further decline in EUR/USD like the price action from earlier this month, but need a close below the 1.1760 (38.2% expansion) zone to bring the 1.1700 (23.6% expansion) to 1.1710 (61.8% expansion) region on the radar, which lines up with the March low (1.1704).

- Will keep a close eye on the 50-Day SMA (1.2039) as it develops a negative slope and approaches the 200-Day SMA (1.2002), and looming developments may further highlighting a change in EUR/USD trend especially if the 50-Day pushes below the 200-Day moving average for the first time in over a year.

- However, lack of momentum to close below 1.1760 (38.2% expansion) may push EUR/USD back towards the 1.1810 (61.8% retracement) region, with the next area of interest coming in around 1.1860 (78.6% expansion).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment