EUR/USD Rate Talking Points

EUR/USD extends the rebound from the weekly low (1.1280) after showing a limited reaction to the larger-than-expected uptick in the US Producer Price Index (PPI), and the exchange rate may stage a larger rebound over the remainder of the week as it halts the series of lower highs and lows from the monthly high (1.1495).

EUR/USD Halts Bearish Price Series Ahead of US Retail Sales Report

The recent rebound in EUR/USD appears to driven by an improvement in risk appetite amid easing tensions between Russia and Ukraine, and swings in investor confidence may ultimately shape the near-term outlook for the exchange rate as it appears to be stuck in a defined range.

It remains to be seen if fresh developments coming out of the US will influence EUR/USD as Retail Sales are expected to increase 2.0% in January after contracting 1.9% the month prior, and a positive development may play a greater role in driving the monetary policy outlook as the Federal Reserve prepares to normalize monetary policy.

As a result, the Federal Open Market Committee (FOMC) Minutes may provide a more detailed exit strategy as the central bank emphasizes that “the federal funds rate is our primary means of adjusting monetary policy and that reducing our balance sheet will occur after the process of raising interest rates has begun,” and indications of a rate-hike cycle may generate a bullish reaction in the US Dollar as market participants brace for an imminent change in regime.

In turn, the advance from the January low (1.1121) may turn out to be a correction in the broader trend as the FOMC appears to be on track to winddown the balance sheet in 2022, and a renewed decline in the exchange rate may fuel the recent flip in retail sentiment like the behavior seen during the previous year.

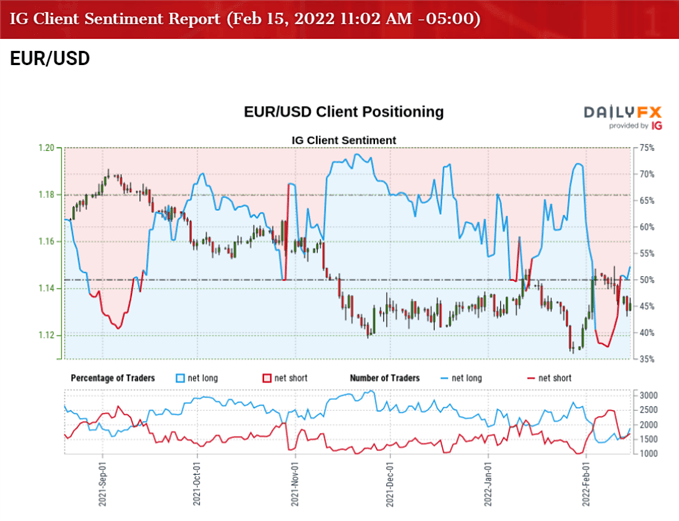

The IG Client Sentiment report shows 50.22% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 1.01 to 1.

The number of traders net-long is 2.50% lower than yesterday and 12.83% higher from last week, while the number of traders net-short is 4.77% higher than yesterday and 28.34% lower from last week. The rise in net-long interest has fueled the shift in retail sentiment as 40.61% of traders were net-long EUR/USD last week, while the decline in net-short position comes as the exchange rate halts the series of lower highs and lows from the monthly high (1.1495).

With that said, EUR/USD may continue to track the February range as there appears to be an improvement in investor confidence, but developments coming out of the US may undermine the recent rebound in the exchange rate with the FOMC on track to normalize monetary policy ahead of the European Central Bank (ECB).

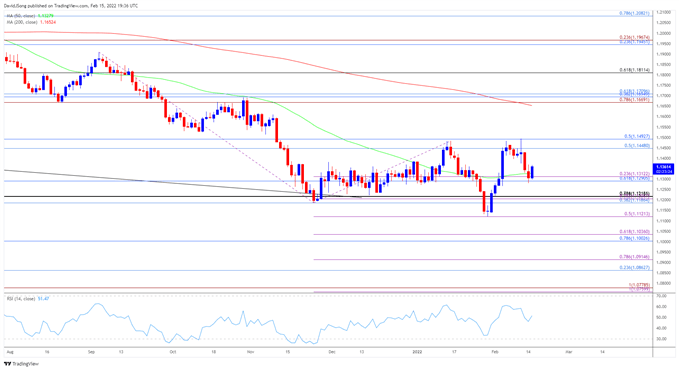

EUR/USD Rate Daily Chart

Source: Trading View

- The broader outlook for EUR/USD remains tilted to the downside as the 200-Day SMA (1.1652) continues to reflect a negative slope, and the recovery from the January low (1.1121) may turn out to be a correction in the broader trend amid the failed attempts to break/close above the Fibonacci overlap around 1.1450 (50% retracement) to 1.1490 (50% retracement).

- However, EUR/USD may trade within a defined range as it halts the series of lower highs and lows from the monthly high (1.1495), with lack of momentum to close below the 1.1290 (61.8% retracement) to 1.1310 (23.6% expansion) region raises the scope for another run at the overlap around 1.1450 (50% retracement) to 1.1490 (50% retracement).

- Need a break/close above the overlap around 1.1450 (50% retracement) to 1.1490 (50% retracement) to bring the November high (1.1616) on the radar, with the next area of interest coming in around 1.1670 (78.6% expansion) to 1.1710 (61.8% retracement), which lines up with the October high (1.1692).

- At the same time, failure to hold above the 1.1290 (61.8% retracement) to 1.1310 (23.6% expansion) region opens up the 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) zone, with the next area of interest coming in around 1.1120 (50% expansion), which lines up with the January low (1.1121).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment