Dzmitry Skazau/iStock via Getty Images

Investment thesis: A recent report on Europe’s car industry suggests that next year, as much as 40% of the EU’s auto manufacturing capacity may be shut down, due to high energy prices. It is just the latest hit taken by a car industry that has already been battered by decades of extreme pressures to cut emissions, which led to the diesel emissions scandal. Assuming that eventually, sometime this decade the EU energy crisis will subside, EU automakers or at least the ones that will be left standing will have to grapple with a whole new challenge, namely end all production of ICE-powered cars by 2034, since by 2035, they will no longer be allowed to sell any of them on the European market. What will be left of the EU’s domestic auto industry by that time will take one final hit, as I predict the ban will be swiftly reversed under immense public pressure, leaving domestic car manufacturers with an all-EV manufacturing capacity, as well as the related supply chains, even as many consumers will go back to ICE-powered options. By that time, the EU car industry will become a shell of its current self. As is always the case, some manufacturers are better adapted to the challenge than others.

The proposed ban and its likely effects before 2035:

The agreement, which all member states signed on to, and was also approved by the EU parliament, and the commission, meaning it is a done deal, with no further roadblocks ahead, aims to ban all sales of ICE-powered personal vehicles by 2035. Given that it is only 12 years away, it means that all EU automakers have to start actively preparing for it now. It means that they will all have to push for increased EV sales in order to ramp up EV production capacities, including related supply chains, even as the current ICE-centered manufacturing capacities, as well as related supply chains, will have to be shut down, or in some cases repurposed.

It should be clear to everyone that we are talking about a transition towards that final point in 2035 that will set the wheels into motion for the EU car industry to end production of all ICE-powered passenger cars by around 2033, with the final batch of conventional cars that will be produced that year sold the following year, meaning that they will not want to have any left in inventory by the end of 2034.

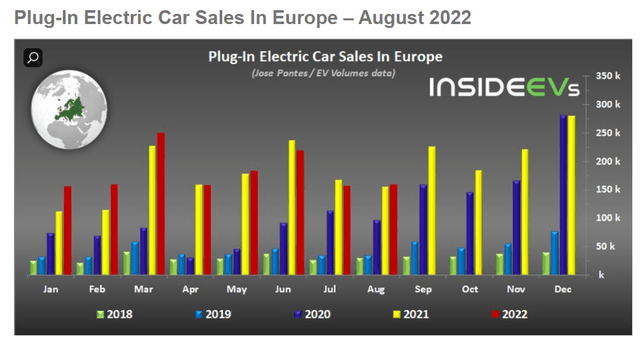

It should be noted that the EU car industry is already selling a lot of EVs, so it is not like they have to start from zero.

About one in five passenger vehicles sold in Europe currently are EVs. Incidentally, the average sale price of an EV in Europe currently is about $55,000. It is far more than most EU consumers can afford to spend on a car. There are of course some cheaper offers, but most of those are purely urban travel vehicles, with limited range and other drawbacks, while many people have a tendency to travel, whether for vacation, to see family, or to get out in nature. This is by far the main challenge that the industry needs to tackle or otherwise adjust to in the next decade.

In parallel with this dramatic forced shift of an entire major industry in Europe, infrastructure, ranging from changes to the power grid to charging stations as well as other issues need to be addressed. Automakers will also have to spend a significant amount of money on retooling, redesigning cars, and so on. The wider industrial base will have to adjust to being able to provide new components and new materials. It is unclear how much this will all cost, but my guess is that it will amount to trillions of dollars.

It goes without saying that in order to have the desired effect on emissions, Europe’s recent fling with an old love, namely coal will have to be broken up and trillions of dollars will have to be spent on enhancing electricity production from green sources like wind & solar. Based on the lesson that should have been learned in 2021, when a massive shortfall in wind power generation occurred throughout the year due to weather patterns, it means that parallel with more wind & solar capacity, green hydrogen production will have to be ramped up. Massive amounts of hydrogen will be needed as a means to store a significant part of that green wind & solar energy for when the weather will cease to provide favorable power generation conditions for a prolonged period.

Bottom line is that between now and 2035 private industry and governments will have to spend trillions of dollars in order to make this green energy transition a reality. It is a daunting task, especially within the context of an EU economy that, as I pointed out in a recent article may have shrunk by about $1 trillion this year in USD terms and more of the same may occur next year and beyond, given the severe energy crisis that is gripping the continent. Perhaps it is an impossible task, and even though European car manufacturers mostly publicly welcomed the EU decision, in practical terms we may see the beginning of a process of a hollowing out of one of the continent’s most important industries.

German automakers and luxury sports car makers may give up on their European home base, while French & Italian firms may just lay down and die.

The increasingly struggling EU consumer base.

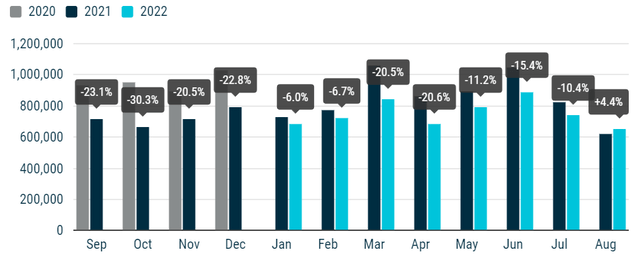

Incidentally, not long before the agreement to ban ICE-powered car sales in Europe was announced, a report came out highlighting a possible decline in EU car production of as much as 40% due to the energy crisis. It is currently unclear whether we are talking about temporary shutdowns, with companies eagerly awaiting for the supposedly temporary energy crisis to dissipate, or whether we are talking about more permanent shutdowns and or the relocation of some production capacities. My guess is that it is the beginning of the latter.

As we can see, it is not like demand for cars is particularly strong this year. It may be hard to comprehend from a North American perspective, but for perhaps most urban dwellers in Europe, a car is more of a luxury than a necessity. Public transport plays a much larger role in urban mobility than it does in most American or Canadian cities. One can get around with far more ease by using public transport in large as well as small urban settings on the old continent. For this reason, if EU consumers feel financially squeezed, as they do right now due to high energy prices, or if the auto industry will fail to provide the right level of consumer utility for the right price, people will be very likely to just give up on car ownership. It is simply a much easier decision in Europe than it is in North America.

Some production will be shut down in order to reflect declining EU demand, which is unlikely to be temporary, just like the energy crisis that is the main cause of the demand decline is not likely to be temporary. Some of that 40% decline in capacity will be transferred over to current export markets. In other words, the EU will export far fewer cars, with the production of existing facilities being moved to where the market happens to be. Some of it might be closed only temporarily, at least for now, in the hope that there will be at least a partial rebound in domestic demand. This will be a one-time industry contraction event, that will probably be followed by further cuts in supply as the industry will march towards that 2035 deadline.

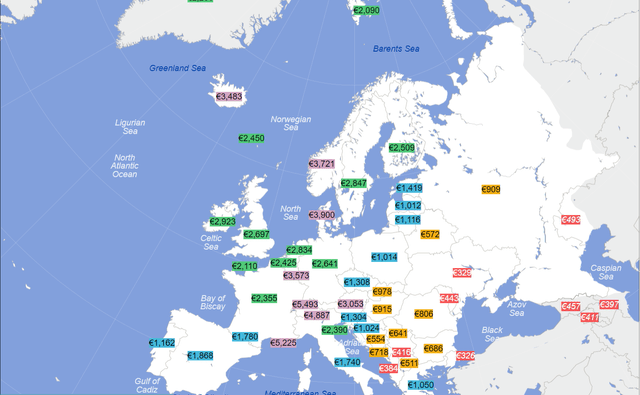

Going back to the average price for an EV in Europe, namely about $55,000, one needs to purchase an EV at that average price level or higher in order to get the full utility that one gets from an ICE-powered car, like range and space, and so on. At the same time, we should keep in mind that currently, monthly net wages in Europe are about half of what they are in the United States. Given the dire economic situation that the EU is facing, I expect to see further deterioration in this regard in the coming years.

Europe average net monthly wages (Wikipedia)

As European car producers will start to move away from producing and selling conventional cars, the pure EV market will gradually emerge, with three different distinct categories in place. The first will be the core EV buyers, namely the top affluent class. They will buy fully compatible EVs that will be just as useful for their overall lifestyle as an ICE-powered car is right now for most people.

The second category will be urban EV buyers. In other words, people will buy a cheaper EV that they will use only to get around town, with little long-range mobility available to them. This cohort will in all likelihood be much smaller in size than the affluent cohort.

The third category will be those who will continue to buy ICE-powered cars for as long as they can and are still available, because they cannot afford the fully useful EVs, nor do they have much desire or need for an urban-only vehicle. Car manufacturers will probably raise prices for the ICE option while keeping profits on EVs in negative territory for the time being because they need to re-tool their entire operation and supply chains to produce only EVs within a decade. For that reason, they will need as many people as possible to switch to EVs, since they will produce more and more of them, and fewer and fewer ICE-powered cars with every year that passes. When the ICE option will become too pricey or simply unavailable, most of this group will drop out of the car ownership lifestyle altogether. This cohort might in fact be the largest of the three, even if it does not represent the majority of potential EU car buyers. I should also note that with the overall EU economic situation turning ever grimmer, the overall potential car-buyer pool of consumers is set to continue to shrink as it does right now, regardless of the EV issue.

The car industry’s most likely response to EU market pressures.

In response to this bleak outlook for the EU car market, it is very likely that most of the EU car industry is ready to give up on its own domestic market altogether. In other words, they will give up on it as a major market, since it cannot remain a major market as long as the buying power of Europeans keeps shrinking, while EVs will simply fail to meet the needs of a large number of mostly middle-class potential car buyers.

Mostly German companies like Mercedes (OTCPK:MBGYY), BMW (OTCPK:BMWYY), and Volkswagen (OTCPK:VWAPY) all of which already have a very significant market and manufacturing footprint outside of Europe will probably cease all ICE-powered car manufacturing in Europe. The same goes for the likes of Ferrari (RACE). The supply chains for the ICE industry will simply disappear in the EU by the beginning of the next decade. Their overall unit output will not match current levels once they will only produce EVs. At best they may produce half as many cars in Europe as they currently do on average currently. Their primary EV market will be the affluent class, or what will be left of it in a decade. They will have stiff competition to contend with, in the form of Tesla (TSLA), as well as possibly some of the Chinese EV producers.

Companies like Renault (OTCPK:RNLSY), or Fiat which are more dependent on the domestic European middle-class market may disappear altogether. Given their current profile of mostly producing low-cost cars for the European middle class, they will probably try to reinvent themselves as mostly city EV producers. As I pointed out, however, that market is not likely to be overly robust, and it will have competition from other domestic producers like Volkswagen, as well as some Chinese EV producers that may enter the EU EV market. My take is that these brands are set to die under the current circumstances.

Ferrari may or may not end up producing EVs. It is said to try its hand at it in the next few years. It will probably gauge the consumer response and take it from there. My bet is that the bulk of its business will remain with the ICE technology and thus it will leave Europe, maybe for the US, but also possibly for Asia.

The final act:

A few years back I wrote an article entitled: “In Age Of EVs, Income-Based Range Inequality Will Become The Norm“. The article was meant to highlight the social issues that will arise as people will be pushed into buying EVs. Range, or in other words, physical mobility will become a function of whether one can afford an EV that has enough battery capacity to allow people to enjoy having a car as much as they do with their current conventional ICE-powered cars. It is an issue that I believe most of the world remains largely oblivious to. It is also an issue that the people of the EU are about to become brutally acquainted with.

In response to the 2035 deadline, most European car producers will start to actively push potential customers towards EVs, using pricing mechanisms and so on. In other words, for the first time, potential car buyers in Europe who until now have not really seriously considered an EV will find themselves faced with the reality of the price/range relationship and they will have to contemplate how this will affect them personally. Within the next decade, most potential car buyers in Europe will become well-acquainted with the reality, namely that the full utility of an EV that will be comparable to an ICE-powered car will only exist outside the price range that the overwhelming majority of EU citizens will be able to afford. My best guess is that public anger on this issue will boil over just around the time when car makers will be done dismantling their ICE business. The ban will be overturned and aside from the luxury sector customers, most people will probably want to go back to purchasing a conventional car. Unfortunately, the EU car industry will not have the capacity to meet that demand, so the market will probably be flooded with imports for most of the next decade.

Contrary to most expectations of EV enthusiasts, technological breakthroughs will not provide typical potential car buyers in Eastern Europe for instance, where most new cars sell in the $10,000 to $20,000 price range, with comparable EVs in terms of utility for that same price. Most people obsessively dwell over battery prices, but in reality, most EVs with a range of 300 miles or more sell for a minimum of $40,000 to $50,000, even without factoring in the cost of the battery. Some of the added costs that go into EVs include the need to source lighter-weight materials needed to keep the overall weight of cars down, given the heavy weight of the battery, which they need to compensate for. There is simply no technological fix on the horizon to provide Europe’s middle class with the EVs they need for the price that they can afford to pay.

Just to provide a sample of what is currently available on the European EV market for around $20,000, the Dacia Spring has a winter highway range of only 110 kilometers. The Renault Zoe ZE50, has a cold weather highway range of 220 kilometers and it is available for about $35,000, which is already out of the price range of all but very thin strata of potential car buyers in much of the Eastern part of the EU and it is even out of the financial coping capacity of a sizable portion of the potential Western EU car buyers. It should be noted that with a winter range of only 220 kilometers drivers would have to realistically stop every 180 kilometers or so to recharge, and on a second fast recharge, that range will drop about 20%, so the second time they would have to stop after about 140 kilometers of driving. It would be a very frustrating drive for most people attempting a longer-range road trip. I picked Renault (OTCPK:RNLSY) EVs because from my understanding it is a company that strives to at least break even on its EV sales, therefore it is a decent indication of where we stand in terms of the price/range issue.

Investment implications:

Assuming that the range/price issues will persist, a social equality crisis will inevitably occur as European consumers will increasingly be obliged to opt for an EV or for no vehicle at all, given no viable products will be available for a price that they will be able to afford. For European automakers, a crisis of a different kind is set to gradually develop and intensify with every year that will pass, bringing us closer to the ICE ban. Not all companies will be affected to the same extent, however, with some companies arguably facing a death sentence, while others might barely feel any negative effects along the way, as long as they will be able to provide consumers with some credible EV options on the high-end.

-

Most likely losers:

- Renault, which caters to the lower end of the consumer market price-wise is the obvious example, where it is questionable whether it will be able to survive the decade. City EVs will most likely be a niche within the overall EV market. Urban living in Europe makes vehicle ownership a choice rather than a necessity. It is questionable whether Renault will be able to sell enough of those low-end EVs to remain in business. It does not have a very significant market presence outside of the EU. Russia was its largest non-EU market, but it exited this year. It also lacks any brand credibility in the high-end auto market. It is currently suffering financially, so it is questionable whether it has the financial resources to invest in new production facilities, and new model developments, and survive what will likely be a major drop in sales volumes going forward.

- Volkswagen is also a company that caters mostly to the middle-class masses, as the name itself suggests. It does have the Audi brand which can be a good platform to represent the company on the higher end of the EV market. The Volkswagen brand itself may be an alright platform to build some competitors to the likes of Tesla’s Model 3, which currently dominates the EU market in that price and specifications range. Having said that, many of its EU customers tend to shop many of its under 30,000 euro models. Its low-cost Skoda brand may also struggle. Perhaps it could become its platform for low-cost, low-performance city EVs. Volkswagen also has a robust presence outside of Europe, where it might continue selling ICE-powered cars beyond 2035, which could help with its survival. Unlike Renault, I do see Volkswagen surviving this, albeit it will likely be a much smaller company within a decade.

-

Likely survivors:

- Mercedes is perhaps the best example of a European company that can potentially fully execute a pivot to EVs largely unscathed, as long as they can produce some EV concepts that will capture the fancy of Mercedes buyers of the past, as well as perhaps some new EV consumers. It is already a company that mostly sells into the high-end luxury part of the auto market, so selling EVs with enough range and other features that will entice future EV buyers looking for a comparable replacement to their ICE-powered cars should not be much of a stretch.

- BMW is similarly well-adapted to selling high-end cars, so selling higher-priced EVs should not affect its European market. It just has to achieve a high conversion rate from its current ICE-powered customers to its new EV models, which it can sell for a similar price while maintaining a similar level of utility.

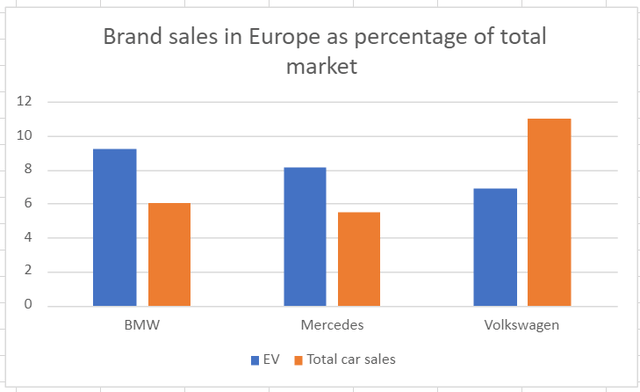

There are some early indications that luxury brands are making greater inroads in the surging EV market in Europe.

Car Sales Statistics, Inside EVs

As we can see, BMW and Mercedes brands are both capturing a much higher portion of the EV market than they do in the overall European car market, while the opposite is the case with Volkswagen. I think it may be an early sign of how low-cost brands will fail to convert a large portion of their existing customer base from ICE to EV.

The case of Ferrari:

Ferrari stands apart from the rest because it simply doesn’t fit the EV story. It is all about the roar of that ICE engine. Ferrari intends to release an EV version by the middle of the decade. Perhaps it is testing the waters in order to see the market response. I personally do not see Ferrari giving up on its ICE-powered cars. At the same time, Europe might no longer be a viable place to produce those cars, because the change of the whole continent to EV production could leave Ferrari lacking local supplies for certain inputs. My best guess is that it will move and reorient its sales primarily to North America and Asia. It may sell EVs into the EU market, but even those EVs might not be produced in Europe. What all this means for the Ferrari brand and for its stock is a big question mark.

There is no denying the fact that the EU decision to ban ICE-powered cars by 2035 is set to create a lot of upheaval within the domestic EU car industry. It should also have some effect on non-European car makers such as Ford (F), since it has a sizable presence in the EU. It will have an overall effect on the global auto market since ICE-powered car production in Europe is likely to cease, although it is unlikely that European car brands will stop making ICE-powered cars in different regions around the world. It is still unclear what net effect this will have on most non-European carmakers. Based on what we know about the current profile of domestic European car makers we can make a reasonable assumption in regard to who the survivors will be versus which companies have a strong chance of going under. One thing that is clear is that there are unlikely to be any net winners in all of it. It is therefore hard to make the case for investing in any European car makers at this point. However, if one wants to have exposure to the domestic EU car manufacturers, clearly the luxury brands are the better bet.

Be the first to comment