Kristin Mitchell/iStock via Getty Images

Ideally, when you make an investment, you would expect to see the value of that investment rise. But during turbulent times, it can be considered a win if your investment holds steady when the broader market declines significantly. A great example of this playing out in recent months can be seen by looking at Ethan Allen Interiors (NYSE:NYSE:ETD). This company, which focuses on the production and sale of interior design products such as home furnishings and accents, as well as casegoods, and other related offerings, has done really well for itself lately. Although it’s always possible that the firm could experience some downside because of the state of the economy, shares do look cheap enough, both on an absolute basis and relative to similar firms, to warrant some nice upside from here. Because of this, I have decided to retain my ‘buy’ rating on the company for now.

A good spot to be in

The last time I wrote an article about Ethan Allen Interiors was in the middle of November 2021. Up to that point, the company had experienced a rather bumpy ride from a fundamental performance perspective. However, its most recent financial performance was encouraging and shares were trading at very low levels. Add on top of this that the company had cash in excess of debt, and I couldn’t help but to rate it a ‘buy’, reflecting my belief that it should outperform the market for the foreseeable future. Since then, the company has not generated upside for shareholders, but considering my benchmark is the S&P 500, I would consider what has transpired to be a win. You see, while the market is down by 13.5% since the publication of that article, shares of Ethan Allen Interiors have dropped by just 1.2% as of this rating. That’s inclusive of distributions received.

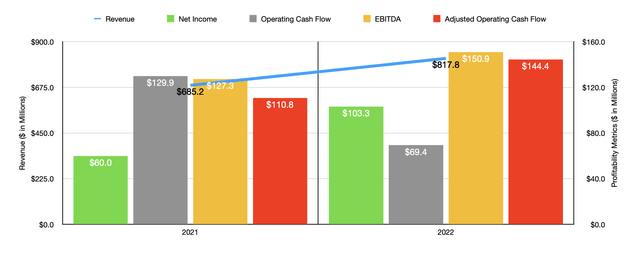

Sometimes, there’s a disconnect between fundamental performance and share price performance. But in this case, the company held up well because fundamental performance remains robust. Consider how the company ended its 2022 fiscal year that it just reported for. Sales for the year came in at $817.8 million. That’s 19.4% higher than the $685.2 million generated in the 2021 fiscal year. This surge in revenue came even as the number of locations the business has in operation dropped from 300 in the 2021 fiscal year to 296 the same time this year. Even with this decline, retail net sales for the company jumped by 24.3% year over year, climbing from $555 million to $689.9 million. This, in turn, can be chalked up to higher order volume, as well as an increase in pricing. Compared to the 2019 fiscal year, which was the last year we had before the pandemic struck, retail written orders received by the company were 14.9% higher in 2022. The company also experienced a 17.1% rise in wholesale net revenue, driven in large part by strong demand for its products. Compared to the 2019 fiscal year, wholesale orders were up 7.6%.

When it comes to profitability, the picture also looks quite nice. Net income for the 2022 fiscal year came in at $103.3 million. That’s nearly double the $60 million generated one year earlier. Operating cash flow, on the other hand, fell from $129.9 million to $69.4 million. But if we were to adjust for changes in working capital, it would have risen from $110.8 million to $144.4 million. Meanwhile, EBITDA for the company was also on the rise, climbing from $127.3 million in 2022 to $150.9 million last year.

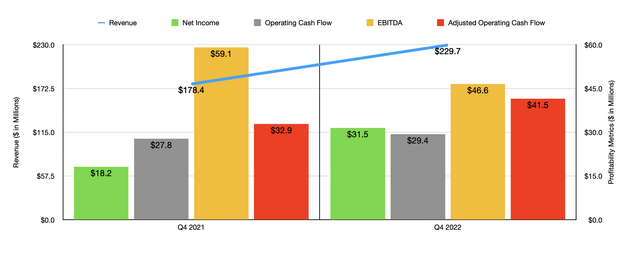

Investors or those looking to invest would be wise to ask whether or not a demand for the company has shown any signs of weakening. Fortunately, it has not. To see what I mean, we need only look at the results from the latest fiscal quarter. For the final quarter of 2022, sales came in at $229.7 million. That’s up nicely from the $178.4 million generated in the final quarter of 2021. Profits have also followed a similar trajectory, with net income shooting up from $18.2 million to $31.5 million. Operating cash flow inched up from $27.8 million to $29.4 million. But if we adjust for changes in working capital, it would have risen from $32.9 million to $41.5 million. And finally, we arrive at EBITDA. For the latest quarter, that came in at $46.6 million. That’s the only metric to show weakening year over year, coming in lower than the $59.1 million reported for the final quarter of 2021.

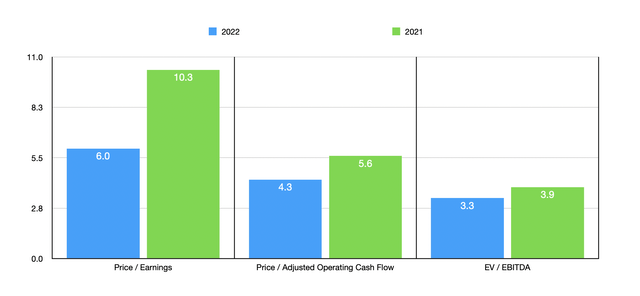

Management has not really provided any guidance for the current fiscal year. But given that we just saw the company report results for the 2022 fiscal year, we should probably price it based on that. At present, the company is trading at a price-to-earnings multiple of 6. That stacks up against the 10.3 of multiple we get using data from 2021. The price to adjusted operating cash flow multiple should come in at roughly 4.3. That’s down from the 5.6 reading that we would get using results from 2021. Meanwhile, the EV to EBITDA multiple of the company should drop from 3.9 using data from 2021 to 3.3 using the 2022 figures. As part of my analysis, I also decided to price the company against five similar firms. On a price-to-earnings basis, these companies ranged from a low of 3 to a high of 65.9. And when it comes to the EV to EBITDA approach, the range is between 2.1 and 11.1. In both of these cases, only one of the five companies was cheaper than Ethan Allen Interiors. Using, instead, the price to operating cash flow approach, we get a range of between 10.5 and 21. In this case, our target is the cheapest of the group.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Ethan Allen Interiors | 6.0 | 4.3 | 3.3 |

| The Lovesac Co. (LOVE) | 10.0 | 21.0 | 7.8 |

| Bassett Furniture Industries (BSET) | 3.0 | 13.1 | 2.1 |

| Hooker Furnishings (HOFT) | 33.9 | 10.5 | 11.1 |

| Flexsteel Industries (FLXS) | 65.9 | 13.3 | 10.3 |

| Tempur Sealy International (TPX) | 9.4 | 11.2 | 7.9 |

Takeaway

All the data that’s available right now suggests to me that Ethan Allen Interiors is sitting in a pretty solid position. Management was confident enough to recently, in August, pay out a special dividend of $0.50 per share. It helps, of course, that the company has no debt on its books but $121.1 million in cash and cash equivalents. Even if financial performance were to revert back to what the company achieved in 2021, shares would still look cheap. Because of this affordability and the continued growth of both its top and bottom lines that has been demonstrated, I have decided to retain my ‘buy’ rating on the company for now.

Be the first to comment